As President Donald Trump reignites a trade war with China in his second term, Beijing’s leaders are striking a noticeably calmer and more confident tone. Unlike during the first trade conflict in 2018, China today appears better prepared, less reactive, and more strategic in its approach.

While Trump ramps up tariffs—already imposing a 20% duty on Chinese imports, with talk of further escalation—China is quietly countering. Its foreign ministry has issued a stark warning:

“If war is what the U.S. wants, be it a tariff war, a trade war, or any other type of war, we’re ready to fight till the end.”

But behind the rhetoric is a carefully calculated strategy that’s vastly different from Beijing’s response seven years ago.

What’s Changed Since 2018?

In Trump’s first term, Beijing was caught off guard by his aggressive tactics. Now, Xi Jinping’s government has learned valuable lessons and altered its playbook:

- China has diversified its trade partners, reducing reliance on U.S. exports and imports.

- It now buys key commodities, such as soybeans, from Brazil and Argentina rather than the U.S.

- The percentage of Chinese goods sold to the U.S. has fallen, reducing the impact of American tariffs on China’s economy.

Analysts say China’s leaders are not psychologically shocked by Trump’s tactics anymore.

“They’ve seen this before,” says Scott Kennedy of the Center for Strategic and International Studies.

“They are better prepared to absorb the effects of the shocks.”

China’s Stronger Economic Position

Despite economic slowdowns, China’s GDP is still growing at nearly 5% annually. The government has increased fiscal stimulus, raising local government debt quotas and issuing over $179 billion in treasury bonds.

- China’s advanced technology investments and growing self-reliance in key industries further shield its economy.

- The share of U.S.-China trade has declined on both sides, reducing mutual dependence.

Beijing has also insulated its economy by broadening its global partnerships, while Trump is increasingly isolating the U.S. with simultaneous tariff threats on Canada, Mexico, and others.

Strategic, Calculated Retaliation

China’s response to the new wave of tariffs has been measured but firm.

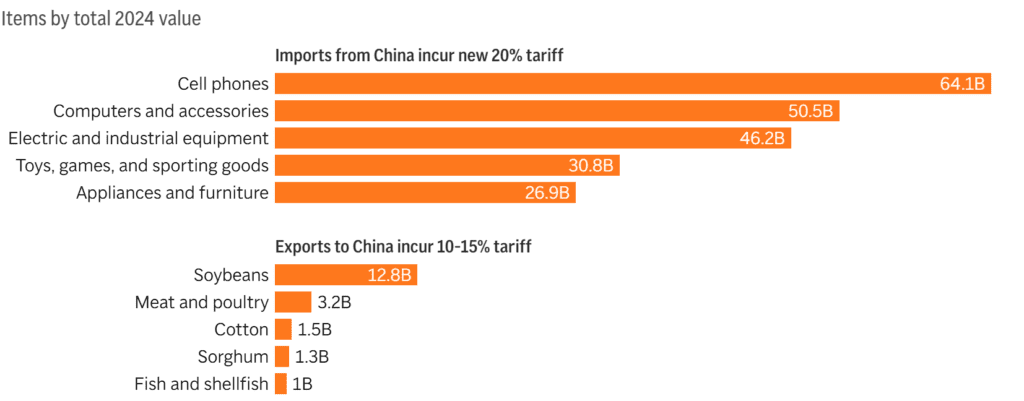

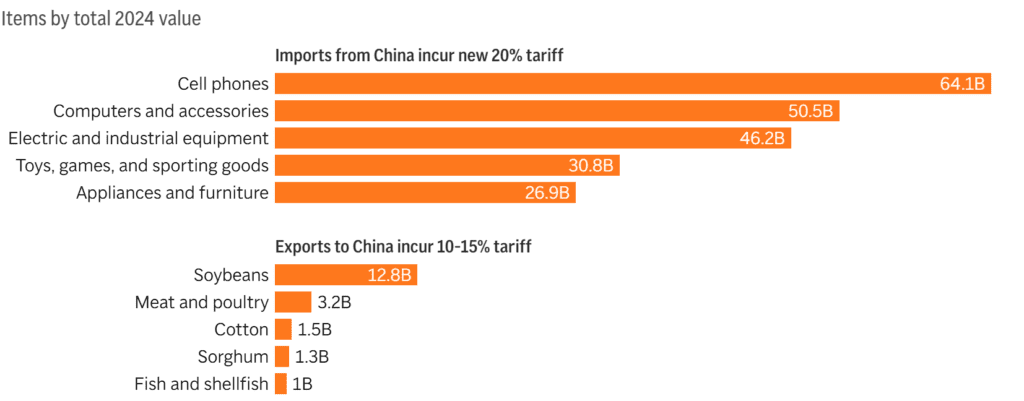

- 10-15% tariffs on U.S. agricultural goods have been rolled out.

- Additional duties have been imposed on crude oil, machinery, coal, and natural gas.

- Beijing has left room for negotiation, avoiding the kind of overreaction that could derail future talks.

“China won’t play the role of a supplicant,” says Daniel Russel, Vice President at Asia Society Policy Institute.

“Xi Jinping won’t engage if there’s a risk of humiliation.”

Why China Stands Confident

Beijing knows it has leverage. By targeting U.S. agricultural exports, China hopes to exert political pressure on key red states, potentially forcing Trump back to the negotiating table.

At the same time, Beijing’s domestic policies, including support for local industries and export diversification, offer a cushion against U.S. trade penalties.

“Appeasing Trump doesn’t work,” Russel explains.

“China’s leadership believes patience and resilience will ultimately pay off.”

Trump’s Gamble, China’s Advantage

While Trump escalates his “America First” trade crusade, analysts warn he may be overplaying his hand.

- Trump’s rapid-fire tariffs total over $1.4 trillion in goods, dwarfing his actions in his first term.

- He has already delayed tariffs on Canada and Mexico just days after imposing them, suggesting domestic economic fallout may force reversals.

“There’s a real risk Trump’s tariffs backfire,” says Christopher Beddor of Gavekal Dragonomics.

“China’s strategy is: wait and see, and apply more fiscal stimulus to mitigate the impact.”

Conclusion: China Has Learned, and It’s Ready

Beijing’s measured retaliation, diversified trade ties, and resilient economy give it greater confidence in facing Trump’s trade war.

As Xi Jinping’s government demonstrates strategic patience, China looks less like a vulnerable adversary and more like a carefully calculating power, prepared to endure the long game.

“If the U.S. wants a trade war, we’re ready,” China says.

But this time, China isn’t blinking first.

Sources:

🔗 AP News: Tariffs, China, Trump, Xi Trade War

🔗 Al Jazeera: Why China Isn’t as Worried About Trump’s Trade War as in 2018

Related:

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?