The S&P 500 has officially entered a correction, down more than 10% from its recent peak. Market pullbacks like this are par for the course—what Morgan Housel calls “a feature, not a bug.” Since 1980, the index has averaged a correction every 12 months, and most don’t turn into prolonged bear markets.

Is this just a reset or the start of something worse? Nobody knows.

While investors debate what’s next, Oracle is charting its own course. The company just posted record-breaking bookings for its Q3 FY25 (February quarter) and expects accelerating AI-driven cloud growth. Yet, a revenue and EPS miss raised questions about execution.

One critical catalyst ahead?

Project Stargate—Oracle’s massive cloud initiative with OpenAI, NVIDIA, and SoftBank. With demand for AI compute surging, Oracle is positioning itself as a major force in AI infrastructure.

Oracle is reportedly the leading candidate to serve as TikTok’s US cloud partner. With ByteDance under pressure to divest or restructure operations amid regulatory scrutiny, Oracle’s role could expand from handling TikTok’s US data to managing critical cloud infrastructure for the platform.

1. Oracle Q3 FY25

Oracle operates across multiple layers of the tech stack:

- 🏢 Industry Applications: Specialized solutions for healthcare, financial services, and utilities.

- 📊 Fusion / NetSuite: Cloud-based ERP, HCM, and CRM solutions.

- 🔧 3rd Party Applications: Integration with ISVs for flexibility.

- ☁️ Oracle Cloud Infrastructure (OCI): Compute, networking, storage, and AI-driven cloud services.

Key metrics:

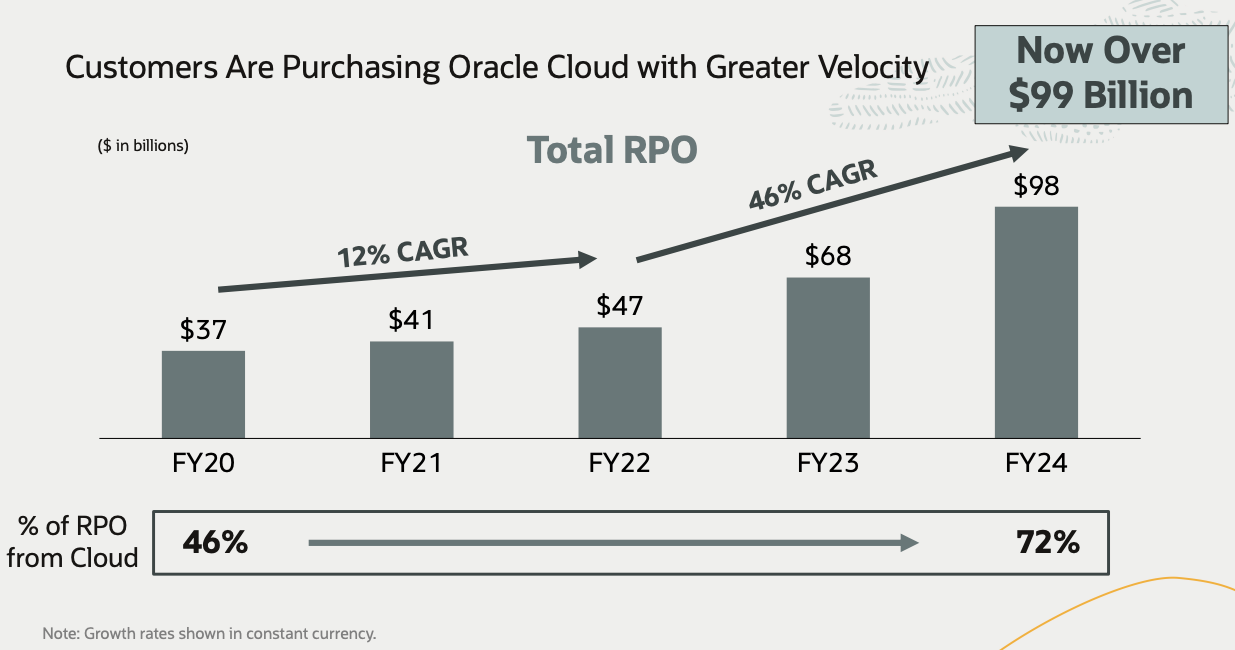

- RPO (Remaining Performance Obligations): RPO (future revenue from om existing contracts signed) is a critical leading indicator of cloud revenue growth. It accelerated to 63% Y/Y in constant currency (from 50% Y/Y in the prior quarter), reaching $130 billion. This figure does not include any impact from Project Stargate. Conversion from RPO to revenue primarily depends on the live data center count and power capacity.

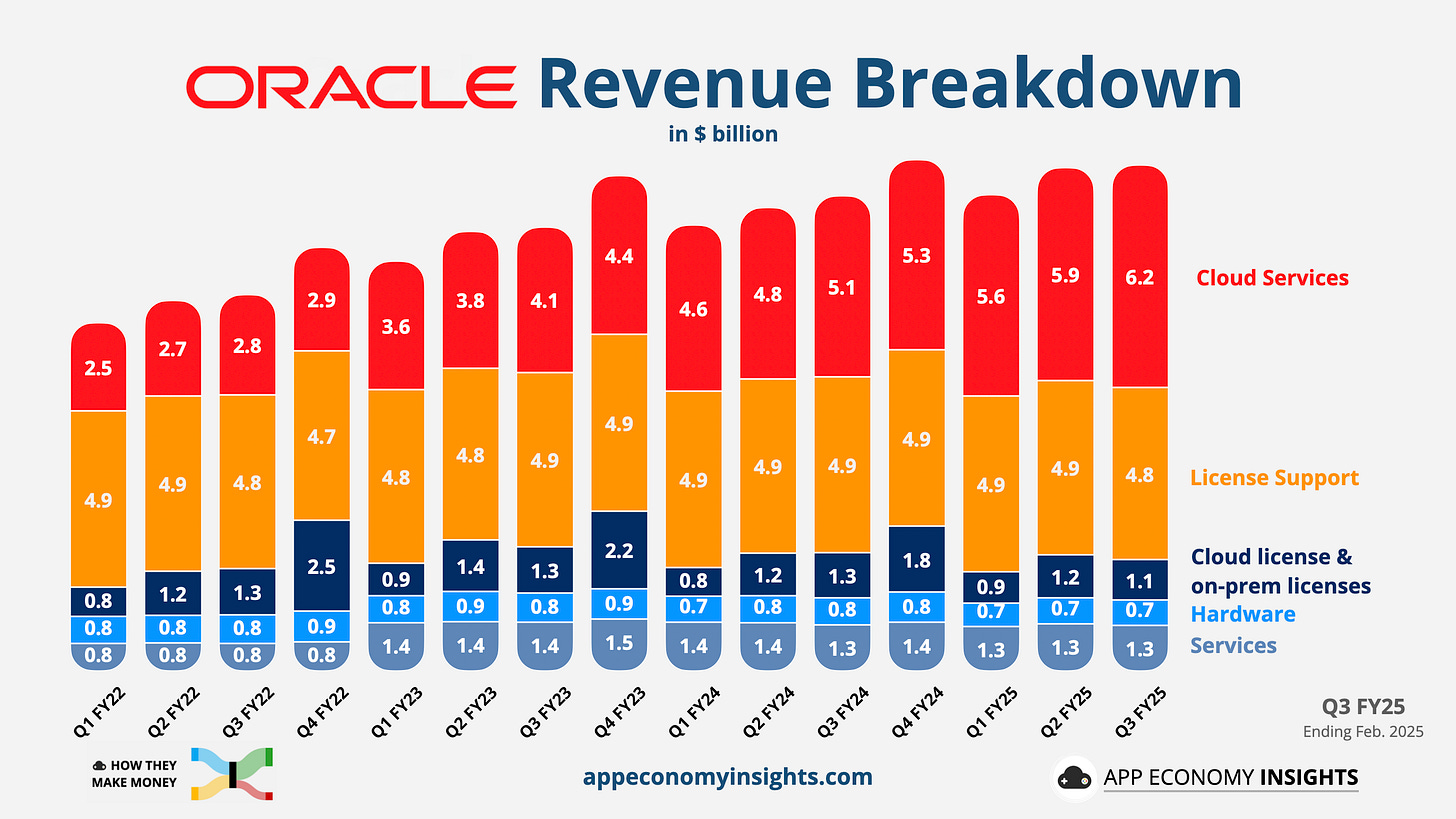

- Cloud services: The company’s growth engine was up 23% Y/Y to $6.2 billion.

- IaaS (Cloud Infrastructure) focuses on providing compute, storage, and networking services. It grew +49% Y/Y to $2.7 billion, driven by increased adoption of OCI for high-performance workloads and multi-cloud deployments.

- SaaS (Cloud Application) focuses on delivering Oracle’s suite of enterprise applications. It grew 19% Y/Y to $3.6 billion, driven by demand for cloud-based ERP, HCM, and CRM solutions.

- Fusion Cloud ERP grew +16% Y/Y to $0.9 billion.

- NetSuite Cloud ERP grew +16% Y/Y to $0.9 billion.

Income statement:

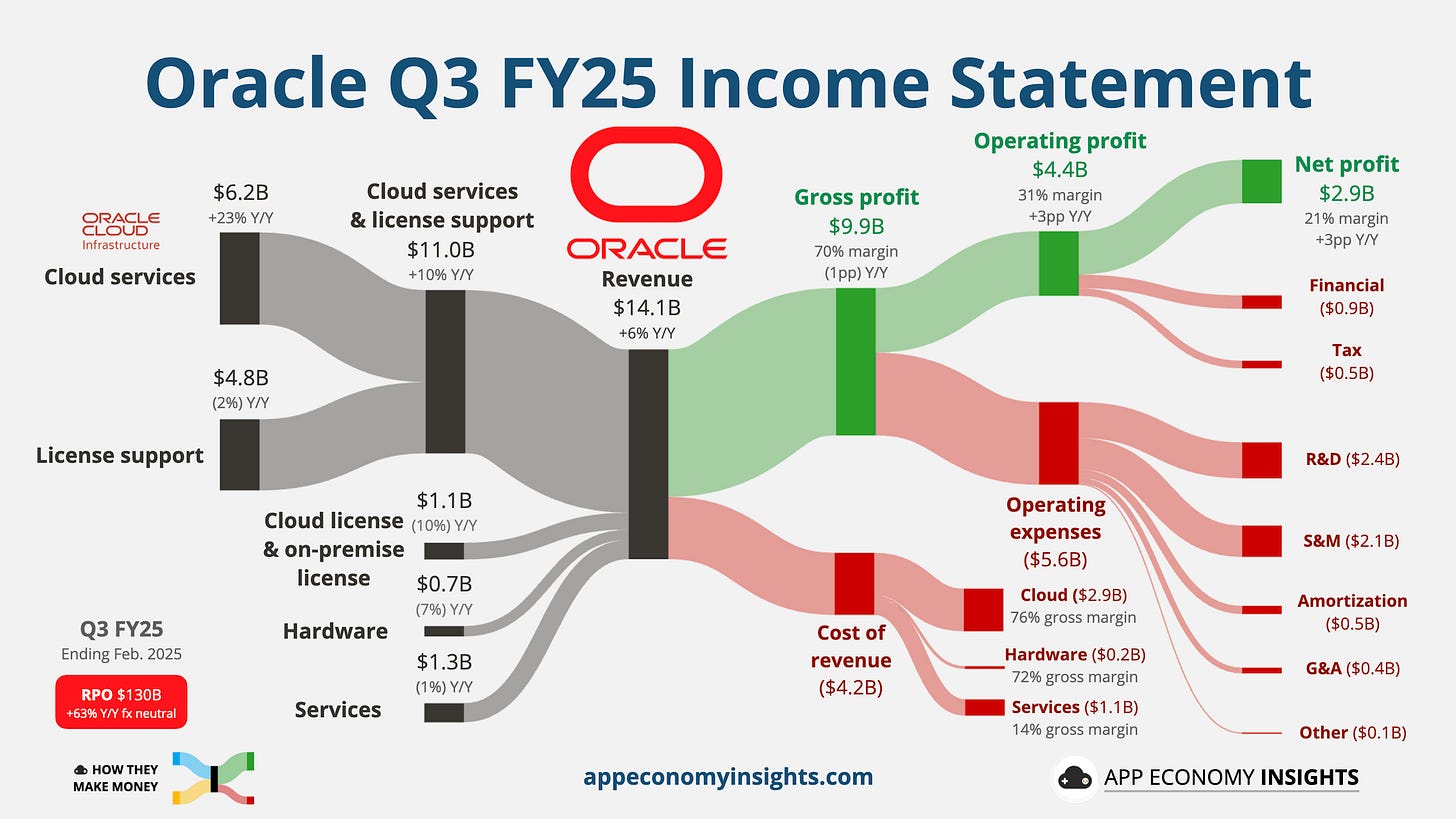

- Revenue grew +6% year-over-year to $14.1 billion ($260 million miss).

- ☁️ Cloud services & license support grew +10% Y/Y to $11.0 billion.

- Cloud services grew +23% Y/Y to $6.2 billion.

- License support declined by 2% Y/Y to $4.8 billion.

- 🌐 Cloud license & on-prem declined by 10% Y/Y to $1.1 billion.

- 🖥️ Hardware declined by 7% Y/Y to $0.7 billion.

- 💼 Services declined by 1% Y/Y to $1.3 billion.

- ☁️ Cloud services & license support grew +10% Y/Y to $11.0 billion.

- Gross margin was 70% (-1pp Y/Y).

- Operating margin was 31% (+3pp Y/Y).

- Non-GAAP EPS $1.47 ($0.02 beat).

- Dividend increased by 25% to $0.50/share.

Cash flow:

- Operating cash flow TTM was $20.7 billion (+14% Y/Y).

- Free cash flow TTM was $5.8 billion (-53% Y/Y), impacted by rising CapEx.

Balance sheet:

- Cash and cash equivalent: $17.8 billion.

- Debt: $88.1 billion.

Q4 FY25 Guidance (in constant currency):

- Overall revenue to grow by 10% Y/Y.

- Cloud revenue to grow by 24% to 28% Y/Y.

So what to make of all this?

- 📈 Record bookings, but execution is key: Oracle added $48 billion to its backlog, bringing RPO to $130 billion (+63% Y/Y), excluding Project Stargate, signaling strong demand. The challenge? Converting backlog into revenue faster.

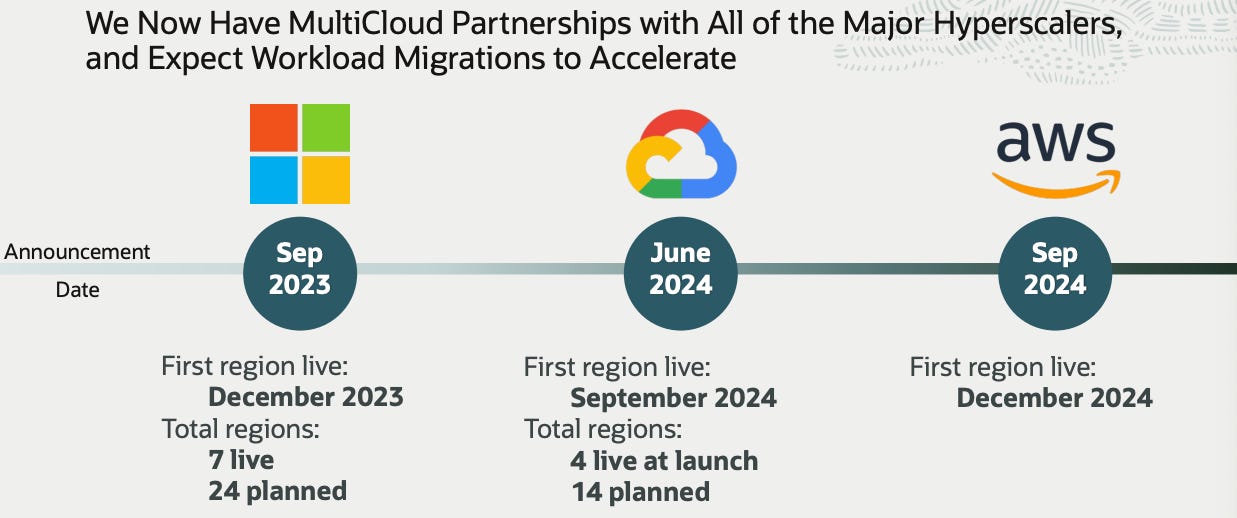

- ☁️ Cloud expansion & capacity growth: Oracle’s 101 cloud regions now outnumber competitors and power capacity will triple by FY25’s end. Multi-cloud partnerships with AWS, Microsoft, and Google are rapidly scaling, with 40 more regions planned.

🤖 AI boom driving OCI: Oracle Cloud Infrastructure grew 51% Y/Y in constant currency, barely slowing from 52% Y/Y last quarter. GPU consumption revenue tripled, fueled by AI training workloads.

📊 Database strength & AI integration: Cloud database services grew 28% Y/Y to an annualized $2.3 billion as enterprises adopt Oracle’s AI-powered database platform. Unlike rivals, Oracle’s AI models can infer on private customer data—a key differentiator.

🌍 Multi-cloud surge: Oracle’s multi-cloud database business grew 200% in three months as enterprises deploy Oracle databases across AWS, Azure, and Google Cloud. This strategy keeps Oracle relevant, even on competitors’ clouds.

💰 Profitability & shareholder returns: Despite a Q3 revenue miss, Oracle’s operating margins expanded to 31%. It raised its dividend by 25% and is pushing CapEx past $16 billion in FY25 (up from $7 billion in FY24) to support AI and cloud expansion.

🤖 AI-powered Enterprise growth: AI agents are now embedded across Oracle’s SaaS applications, driving automation in healthcare, finance, and supply chain.

🔮 Rising outlook: Management projects 9%-11% total revenue growth and 24%-28% cloud revenue growth in Q4, reinforcing expectations of acceleration ahead.

2. Project Stargate

What is it?

Project Stargate is a multi-billion-dollar AI infrastructure initiative to build some of the largest AI data centers in history. The project will supercharge AI compute capacity with an initial $100 billion investment, potentially scaling to $500 billion over four years.

The goal? Reinforce the US as a global AI leader while providing the compute power needed for next-generation AI models.

How does this impact Oracle?

Oracle is providing the cloud infrastructure and high-speed networking, making it a core player in the project. However, Stargate contracts have not yet been signed, meaning it hasn’t contributed to Oracle’s $130 billion RPO yet.

Once formalized, Stargate could significantly boost Oracle’s cloud revenue, strengthening its position against hyperscalers AWS, Microsoft, and Google Cloud in the AI race.

Project Stargate key players

- 🧠 OpenAI: Using Oracle’s cloud for AI model training.

- 💰 SoftBank: Major financial backer scaling AI compute infrastructure.

- ☁️ Oracle: Providing cloud and high-speed networking.

- 🤖 NVIDIA: Supplying GPUs for AI workloads.

- 🏗️ MGX: Acting as an equity partner in the project.

Strength in numbers

- 64,000 NVIDIA GB200 GPUs: One of the largest AI clusters ever built.

- 30,000 AMD MI355x GPUs: Secured in a multi-billion-dollar deal.

- Texas Data Centers: The first sites are being developed, with more to come.

- Massive job creation: It aims to create “over 100,000” US jobs.

Key takeaways

- ✅ A major AI play: Stargate is Oracle’s biggest AI bet, reinforcing its cloud ambitions.

✅ Unmatched cloud demand: AI-driven GPU consumption tripled Y/Y, fueling record OCI growth.

✅ Future RPO and revenue catalyst: While not included in RPO yet, Oracle expects faster cloud revenue growth in FY26 and FY27, including Stargate.

Bottom line

Is Project Stargate Oracle’s moonshot? If executed successfully, it could boost its position as a dominant AI cloud provider. But until the first contracts are signed, investors are watching closely.

3. Key quotes from the earnings call

CEO Safra Catz

On AI cloud leadership:

“What we are seeing in the market is that we are the destination of choice for both AI training and inferencing. This is due to the fact that our Gen 2 cloud is faster and therefore, cheaper than our competitors and also due to our ultra high-speed networking engineering that we started decades ago and that is now highly relevant for AI.”

Oracle is betting on speed and cost to win AI workloads. The claim that Gen 2 Cloud is faster and cheaper than competitors isn’t just marketing—AI demand is outpacing supply, with GPU consumption revenue tripling Y/Y. With component delays easing, Oracle sees stronger AI-driven cloud growth ahead.

On database growth acceleration:

“Cloud database revenues, which were up 28%, will be the third driver of revenue growth alongside OCI and strategic SaaS. As on-premise databases migrate to the cloud—whether on OCI, multi-cloud with AWS, Azure, and Google, or cloud-to-customer deployments—we expect this trend to accelerate. We are currently live in 18 multi-cloud regions and have another 40 planned with our partners.“

Oracle isn’t just competing on cloud infrastructure—its database business is a massive growth pillar. With billions of dollars in on-premise workloads still needing to migrate, Oracle’s multi-cloud flexibility (OCI, AWS, Azure, Google, on-prem cloud) ensures it captures demand no matter where enterprises move their data.

Chairman and CTO Larry Ellison

On multi-cloud momentum:

“Our multi-cloud business at Amazon, Google, and Microsoft grew 200% in the last three months alone. Customers can now get Oracle databases everywhere—on their premises, from OCI, or embedded inside AWS, Google, and Azure. And as AI models become more deeply integrated with enterprise data, the demand for Oracle’s multi-cloud solutions will only increase.”

Enterprise AI is driving multi-cloud adoption. Instead of forcing vendor lock-in, Oracle integrates its database services inside rival hyperscalers, making it indispensable even on competitors’ clouds. The 200% growth in just three months proves that strategy is working.

On AI compute expansion:

“In Q3, we signed a multibillion-dollar contract with AMD to build a cluster of 30,000 of their latest MI355x GPUs. At the same time, all four of the leading cloud security companies—CrowdStrike, Cyber Reason, Newfold Digital, and Palo Alto—chose Oracle Cloud. AI and cybersecurity workloads require high-speed, high-performance computing, and OCI is the only hyperscale cloud offering this level of capability.“

Oracle is landing massive AI and cybersecurity workloads. Securing major GPU contracts alongside NVIDIA and winning all four of the leading cloud security firms shows OCI’s networking and AI performance are becoming harder for enterprises to ignore.

On AI-Ready Databases:

“The AI models have to understand your products, your customers, your service requests, your financials. That’s the missing piece—most enterprise data is not available on the internet, so AI models can’t train on it. But with Oracle Database 23ai’s vector capabilities, customers can instantly convert all their existing data into a format that AI models can learn from—while keeping their data private and secure.“

Oracle is solving a key AI problem—access to proprietary enterprise data. Unlike public AI models trained on internet data, Oracle Database 23ai lets businesses train models on their private datasets without exposing them to the public cloud—a major competitive edge over AWS, Azure, and Google.

4. What to watch looking forward

Closing the gap with Hyperscalers

Oracle still lags behind AWS, Azure, and Google Cloud in the cloud infrastructure market, but it’s growing faster. Synergy Research Group ranks Oracle ahead of Salesforce and IBM, and if OCI maintains its momentum, it could soon leapfrog Alibaba Cloud to become the fourth hyperscaler.

Long-term growth targets

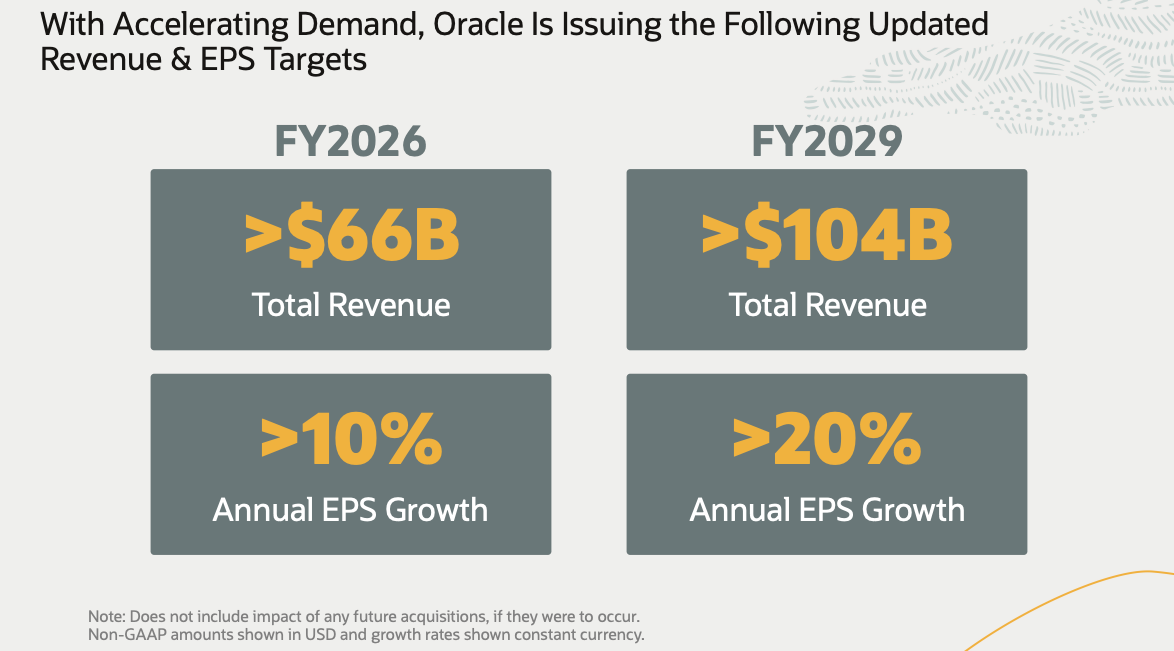

Last year, Oracle set a revenue target of $66 billion for FY26, implying 15% Y/Y growth. But the company now sees an even bigger opportunity ahead.

Fueled by AI infrastructure, multi-cloud expansion, and database modernization, Oracle expects 20% growth in FY27, putting it ahead of its original forecast.

And the long-term vision? Oracle is now projecting $104 billion in revenue by FY29, implying a sustained 16% annual revenue growth beyond FY26.

With a $130 billion backlog, Oracle is scaling multi-cloud adoption, securing massive AI infrastructure contracts, and turning AI-ready databases into a competitive edge. The company plans to double data center capacity this year, positioning itself at the center of AI computing’s next wave.

If execution matches ambition, Oracle won’t just be a fast-growing cloud provider—it could become a defining force in AI infrastructure.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: App Economy Insights

Related:

Why China Isn’t Worried About Trump’s New Trade War Like It Was in 2018

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?