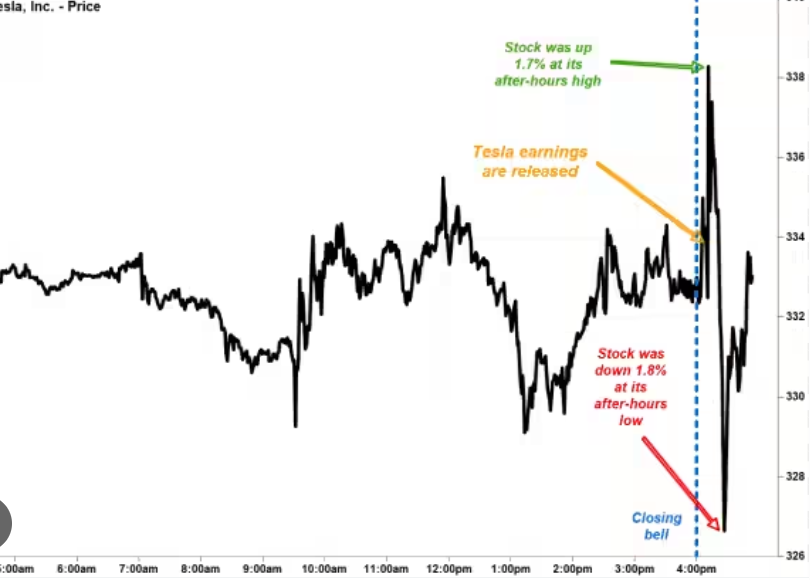

Tesla’s second-quarter 2025 earnings delivered a classic Tesla cocktail: a slight miss, big vision, volatile stock action—and Elon Musk’s trademark drama. After initially rising post-earnings, $TSLA stock tumbled more than 4.5% as the call concluded. Here’s what happened and why the market flipped.

Why did the Stock Fall After Initially Rising?: Markets reacted favorably at first to decent margins and AI growth plans. However, during the earnings call, Elon Musk’s remarks soured the mood. However, during the earnings call, Elon Musk’s remarks soured the mood.

Tesla’s year goes from bad to worse

What happened?!

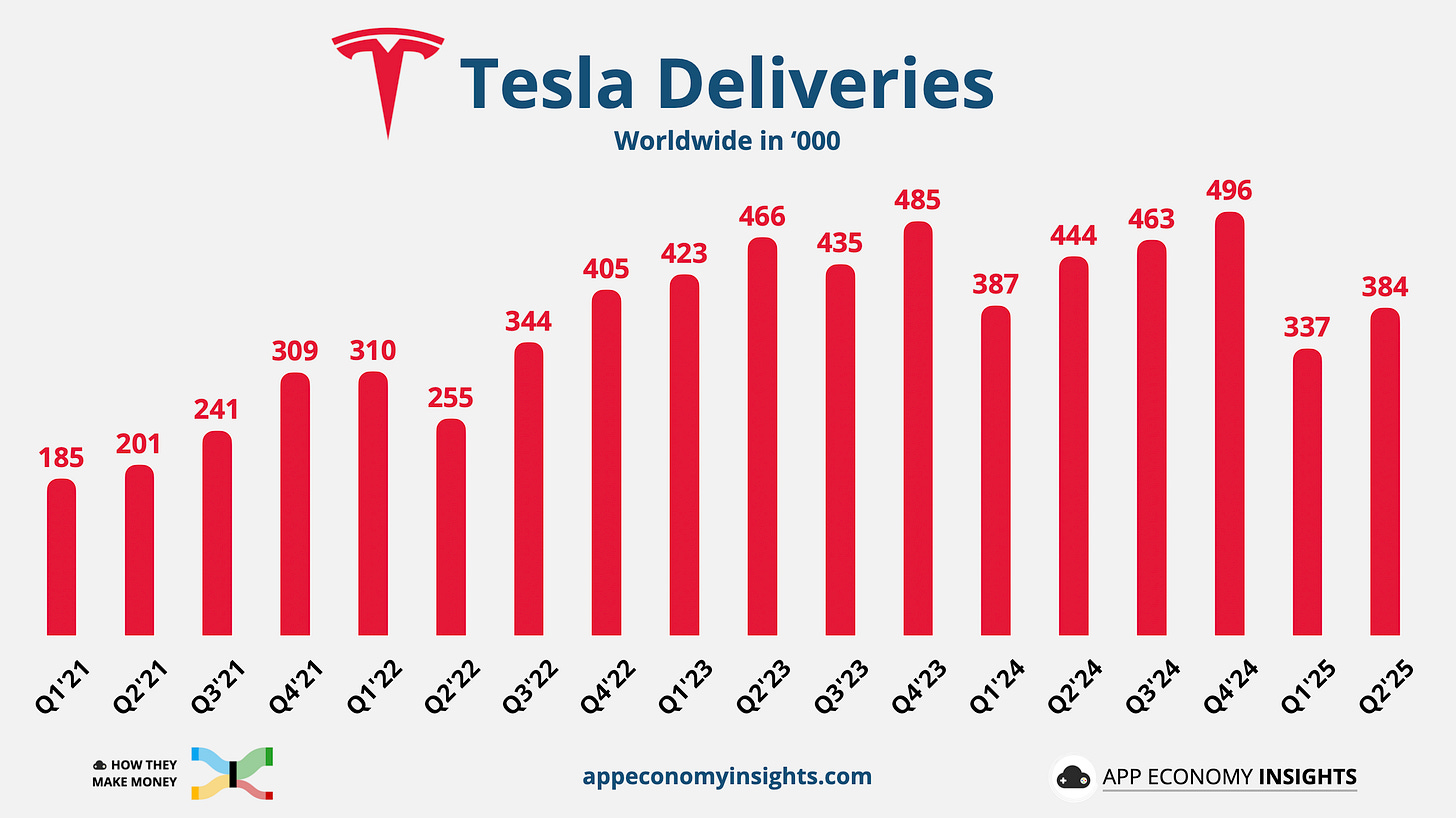

Global deliveries just fell 13%, their steepest quarterly drop ever.

Revenue is declining, margins are compressing, and cash flow has dried out.

Only weeks after promising to focus more on the company following his exit from DOGE (Department of Government Efficiency), Elon Musk announced a new political movement: the America Party. The move quickly escalated his feud with Trump, who called him “off the rails.” According to a Quinnipiac poll, 77% of Americans rejected the idea outright.

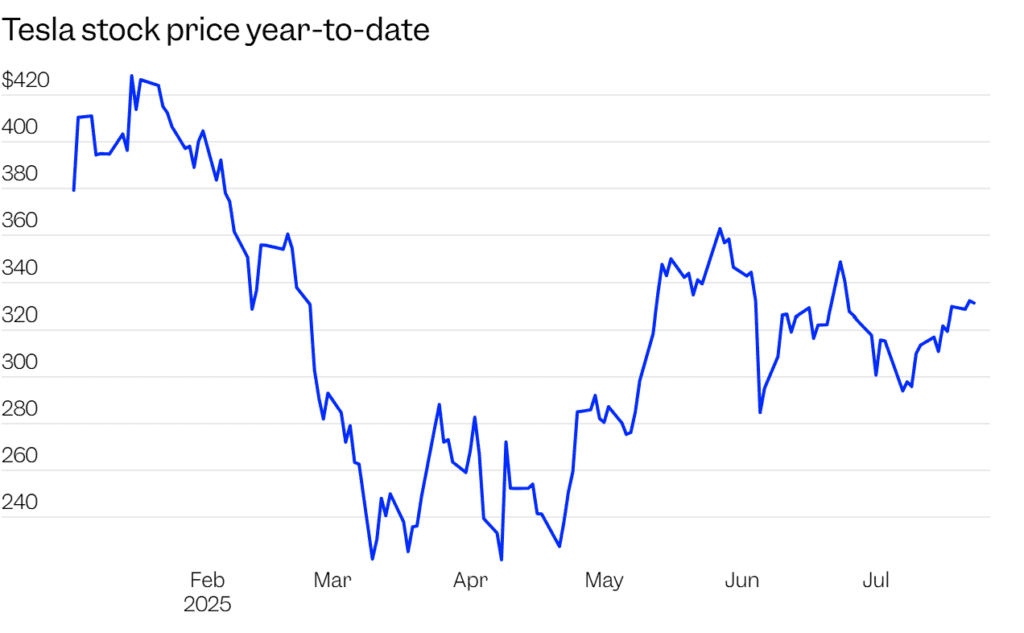

That’s not the pivot shareholders were hoping for. TSLA is now down over 30% from its December 2024 peak, while the broader market is hitting new all-time highs.

Of course, if you view Tesla purely as an auto business, Q2 results remain very poor. But if your focus is on its bets in energy, AI, and robotics, this quarter likely won’t change your thesis.

In Musk’s own terms during the call: “Autonomy is the story.” But even if the moonshots in robotaxi and robotics succeed, they’re years away from offsetting collapsing vehicle demand and face regulatory hurdles.

Yes, Tesla’s robotaxi program could unlock tremendous value. But at what point does mounting evidence of brand erosion start to undermine even the most ambitious upside?

1. Tesla Q2 FY25

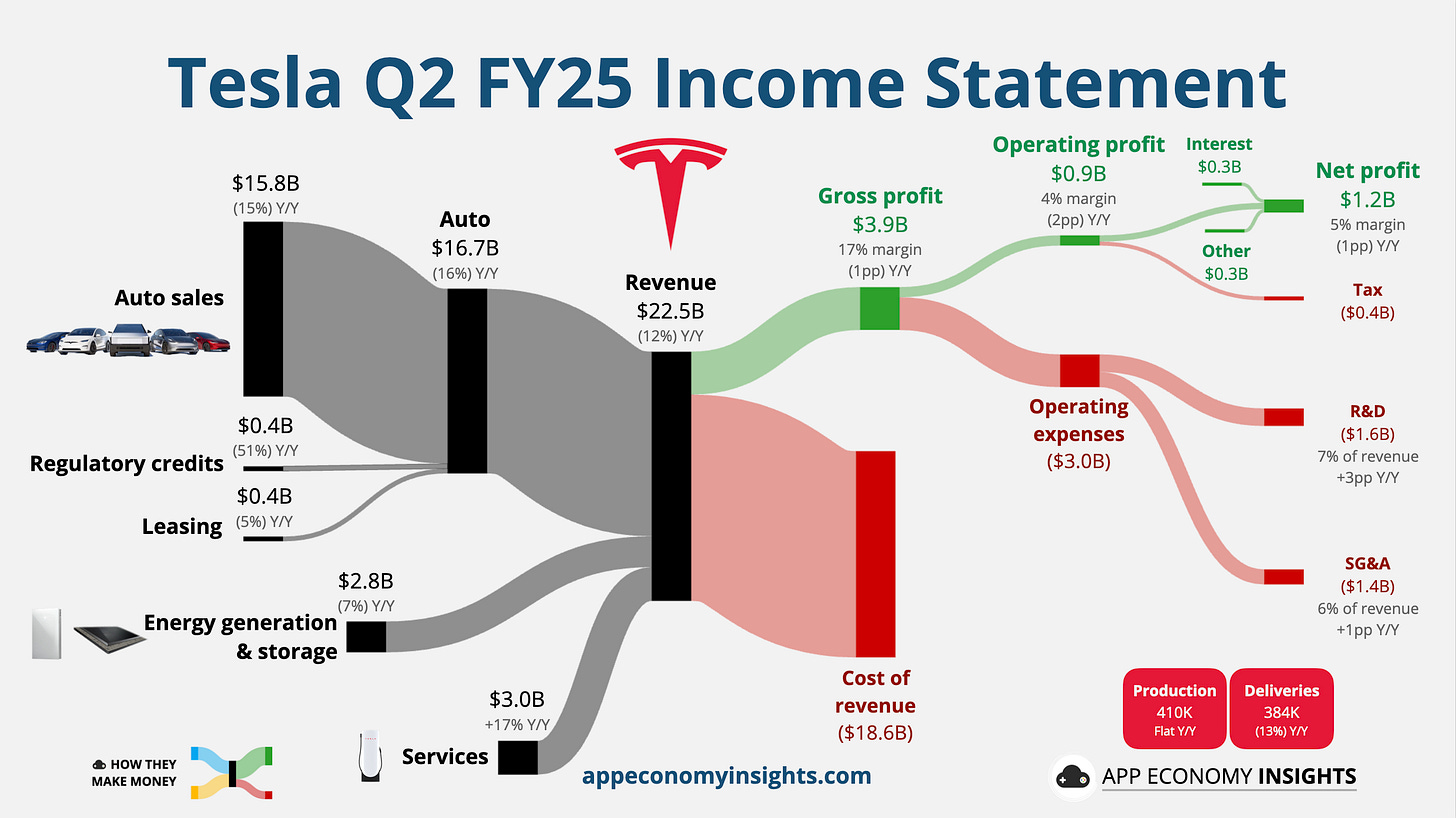

Tesla’s revenue comes from three primary sources:

- 🚗 Automotive: Revenue from selling electric vehicles, including models S, 3, X, Y, and the Cybertruck (74% of revenue).

- 🌞 Energy Generation and Storage: Revenue from solar products and energy storage solutions, like Solar Roof and Powerwall (12% of revenue).

- 🔌 Services and Other: Revenue from vehicle service, Supercharger network, and sales of automotive parts and accessories (14% of revenue).

- Deliveries -13% Y/Y to 384K vehicles, the worst quarterly slip ever.

- Production flat Y/Y at 410K vehicles.

Income statement:

- Revenue -12% Y/Y to $22.5 billion ($0.4 billion beat).

- Gross margin 17% (-1pp Y/Y).

- Operating margin 4% (-2pp Y/Y).

- Non-GAAP EPS $0.40 (in-line).

Auto revenue fell 16% Y/Y while the non-auto segments were up 4%, partially offsetting the decline. Energy alone is now 22% of Tesla’s gross profit.

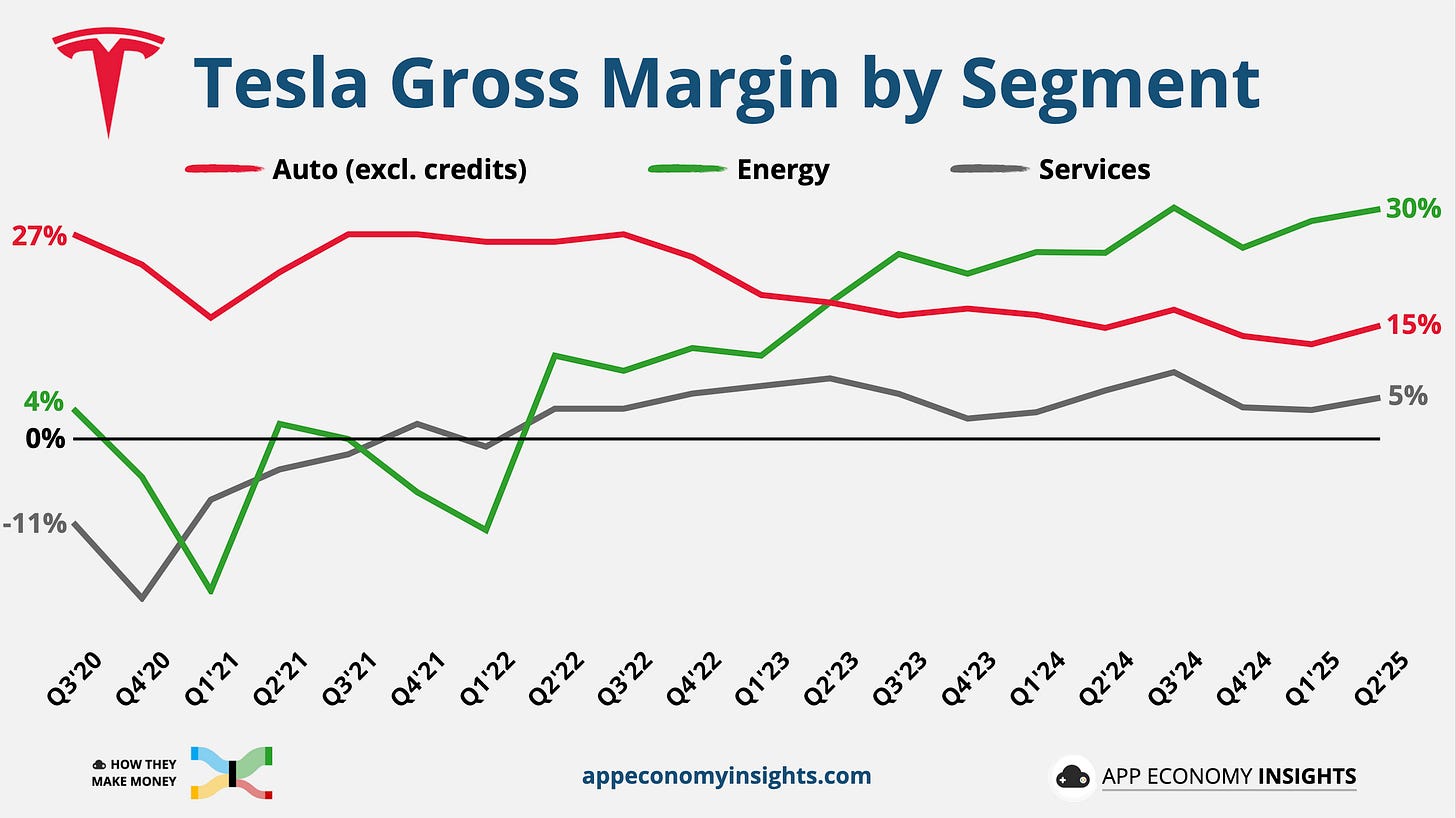

Gross margin trends:

- Auto: 15% (excluding credits), a rebound from 12.5% in Q1.

- Energy: 30%, the highest margin segment improving again.

- Services and Other: 5%, the 13th consecutive profitable quarter.

Tesla’s historically strong margins have been supported by gigafactory scale, direct-to-consumer sales, and minimal marketing costs. But those advantages are being eroded by price cuts and rising competition.

Cash flow:

- Operating cash flow: $2.5 billion, down 30% Y/Y, reflecting the revenue decline and margin compression.

- Free cash flow: $0.1 billion, a massive 89% drop from last year, due to lower operating cash flow combined with Capex growing 19% Q/Q to $2.4 billion. Still, the company is underspending compared to its previous $10 billion full-year target, and now expects only $9 billion in FY25.

Guidance: FY25 outlook: Tesla again withheld full-year guidance, citing trade policy and political backlash. A return to growth, predicted earlier this year, now looks unlikely. Commentary on tariffs only deepened the uncertainty. Remember: Musk predicted 20–30% growth for FY25 late last year.

Musk Warning: A “Weird Transition,” Incentive Loss, and Rough Quarters Ahead

“We’re in a weird transition period,” Musk told analysts, referring to the phase-out of federal EV tax credits and tightening regulations.

Musk made this comment multiple times, signalling that Tesla’s near-term results could worsen before improving.

Loss of EV tax incentives could cause a sharp demand drop starting in Q4. Tesla expects a pull-forward effect in Q3, but orders beyond August may not be fulfilled due to limited supply.

Musk added: “The economics [of Tesla] will be very compelling by end of next year. But we need to get through this transition first.”

He warned about macroeconomic unpredictability, tariff shifts, and a high-risk regulatory environment for autonomy.

But he remains confident in the long game:

“I expect Tesla’s economics to be very compelling by the end of next year.”

Musk also addressed his control over the company:

“I think my control over Tesla should be enough to ensure that it goes in a good direction, but not so much control that I can’t be thrown out if I go crazy.”

Musk’s Vision: Tesla as an AI + Robotics Powerhouse

Despite the short-term caution, Musk laid out an ambitious long-term vision—with Tesla becoming more than a carmaker:

Full Self-Driving (FSD):

- Unsupervised FSD rollout for personal use planned by year-end in several US cities.

- Musk said 50% of owners eligible for FSD haven’t even tried it once—a huge untapped opportunity.

Robotaxi Network:

- Robotaxi expansion from Austin to Bay Area in “a few weeks”, starting with drivers onboard.

- Musk hopes Tesla’s autonomous ride-hailing will reach half the US population by year-end—pending regulatory approval.

- The Cybercab—a purpose-built, steering wheel–free robotaxi—still on track for 2026 production.

Optimus Robot:

- Optimus v3 prototype coming by late 2025; production starts 2026.

- Musk said Tesla could sell 1 million humanoid robots per year within five years.

“Tesla is much better than Google in AI… better than anyone,” Musk said boldly

Musk’s Control Paranoia: A Governance Warning

Musk said he’s worried about losing influence at Tesla:

“I don’t want to be ousted by activist shareholders after building an army of robots.”

He reiterated his belief that he needs ~25% voting control to steer Tesla’s future, and hopes the November shareholder meeting will address that.

This comes amid rising tension between Musk and politically opposed investors, especially after his public feud with Donald Trump and growing xAI ambitions.

5 Key Takeaways for Investors

- “Rough Quarters” Ahead – The expiration of the $7,500 EV tax credit and macro risks will likely hurt Q3–Q4 performance.

- Tesla Is Shifting Identity – The company is leaning fully into being an AI and robotics firm, not just an EV maker.

- Robotaxis Still The Dream – Expansion plans are real, but still heavily dependent on regulatory green lights.

- Affordable EV Momentum – It’s finally happening—but 2026 mass scale is the more realistic timeline.

- Governance Risk Is Real – Musk’s discomfort about control adds uncertainty. The November vote could be pivotal.

Retro Diner + Supercharger: Tesla Opens in Hollywood

In classic Musk fashion, Tesla added a wild twist to the earnings news:

The company opened its long-awaited retro-futuristic diner and Supercharger station in Hollywood, blending neon nostalgia with EV innovation.

The diner is part of Tesla’s brand-building ecosystem, helping redefine how people view charging—and Tesla culture.

Political & Macro Risks: What Spooked the Market

Tesla acknowledged “a sustained uncertain macroeconomic environment” due to:

- Shifting tariffs

- Changes to fiscal policy

- Political sentiment

CFO Taneja added:

“Costs will increase in the near term… We are in an unpredictable environment.”

With Trump’s new bill ending the $7,500 EV credit on Sept 30, Tesla is scrambling to boost sales — offering 18 months of free Supercharging, 0% financing, and free FSD transfers.

Analyst Reactions

Wedbush: “We’re at a positive crossroads in the Tesla story… Investors now see more of a wartime CEO.” Reiterated Outperform, $500 PT.

Investing.com: “The worst is likely behind Tesla in terms of core auto business.”

Morgan Stanley: “Musk’s politics are a party crasher.” Still, Tesla remains a Top Pick, $410 PT.

Bank of America: “Q2 earnings challenged by tariffs and weak deliveries.” Raised PT to $341 (Neutral).

What’s Next

- Q3 will be the final quarter with US EV tax credit

- Volume production of the affordable EV starts H2 2025

- Cybercab and Semi still on track for 2026

- Musk says critics may “end up with egg on their face” as Tesla pushes deeper into AI, autonomy, and robotics

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Tariffs Are Hitting US Companies Hard — and Consumers Is Next

BYD Global EV Price War Reshapes Auto Markets, but at a Cost

Wall Street Is Stubbornly Bullish on Downtrodden Energy Stocks

As the Dollar Slides, the Euro Is Picking Up Speed

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China