Nvidia is preparing to launch a new AI chip for China as early as June, pricing it significantly lower than its previously restricted H20 model, according to sources familiar with the matter. The move marks Nvidia’s third attempt to navigate around US export controls, with the company now betting on a pared-down Blackwell-architecture GPU to maintain relevance in China’s $50 billion data center market.

New Chip, Lower Price, and Simpler Build

- The upcoming GPU—based on Nvidia’s Blackwell RTX Pro 6000D architecture—will cost between $6,500 and $8,000

- That’s a steep drop from the H20’s price tag of $10,000 to $12,000

- The lower cost reflects weaker specs and conventional GDDR7 memory, rather than advanced HBM

- It also skips TSMC’s high-end CoWoS packaging, further simplifying production

While final specs and the official name (possibly 6000D or B40) remain unconfirmed, production is expected to begin in June, with a second China-focused Blackwell chip targeting September rollout.

Nvidia’s Market Share in China Is Shrinking Fast

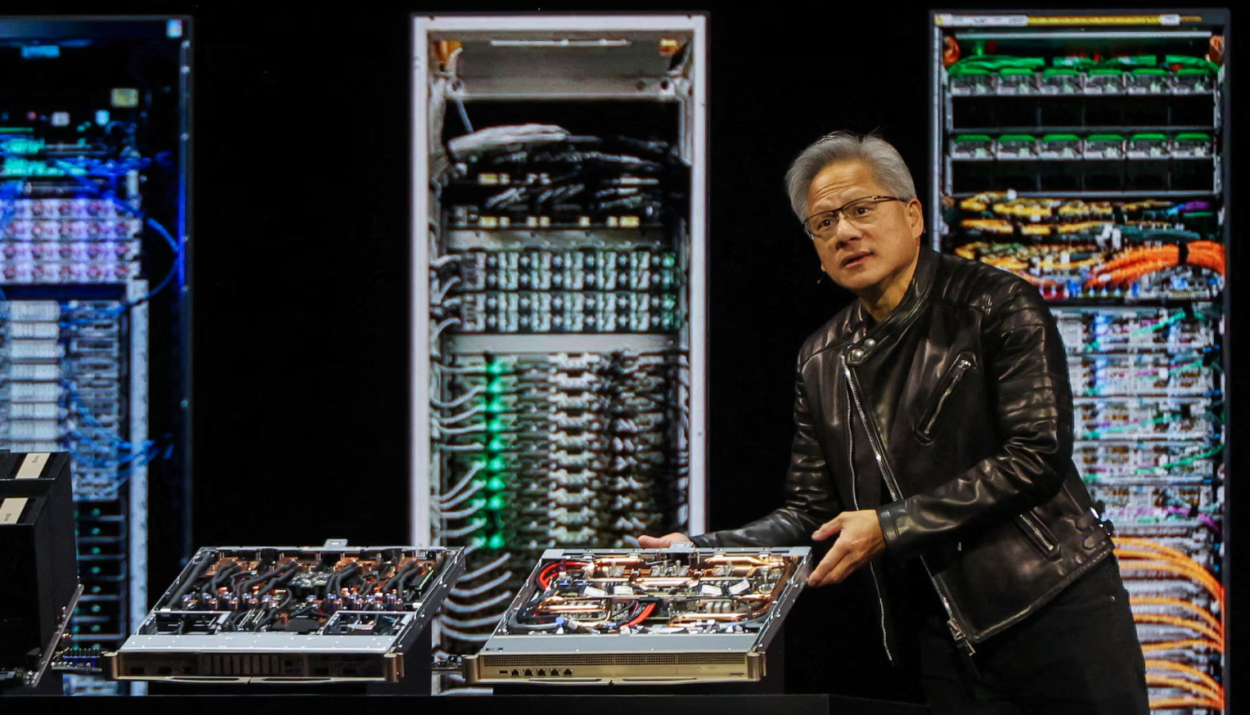

- Before US restrictions, Nvidia held 95% of the Chinese AI chip market

- That figure has since dropped to 50%, according to CEO Jensen Huang

- Huawei, with its Ascend 910B, has emerged as Nvidia’s primary local rival

The recent H20 ban, based on new memory bandwidth limits imposed by US regulators, forced Nvidia to write off $5.5 billion in inventory and walk away from $15 billion in potential sales, Huang told the Stratechery podcast earlier this week.

Meeting the Limit — But Just Barely

New US rules now cap GPU memory bandwidth at ~1.7-1.8 TB/s for products exported to China. The H20 previously operated at 4 TB/s, putting it far outside permitted thresholds.

Nvidia’s new chip will reportedly achieve ~1.7 TB/s using GDDR7, just within compliance. While this bandwidth reduction limits AI performance, it avoids the fate of being blacklisted — a tradeoff Nvidia seems willing to accept to remain in the market.

Strategic Pivot or Stopgap?

“We are effectively foreclosed from China’s data center market until a new product is approved,” an Nvidia spokesperson said, adding the company is still evaluating its “limited” options.

While TSMC declined comment, the shift to simpler designs and conventional packaging signals a broader recalibration of Nvidia’s China strategy — one focused less on cutting-edge performance, and more on regulatory survival.

With Huawei surging, and US restrictions tightening, Nvidia’s China playbook is being rewritten in real-time. Whether the new chips can keep market share afloat — or simply slow the bleed — remains to be seen.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Von der Leyen: EU needs until July 9th to reach trade deal with US

Angry Elon Is Back — And He’s Betting Big on Driverless Teslas and AI

Elon Musk’s Qatar Meltdown: “NPCs,” Jeffrey Epstein, Tesla Denial, and Prison Promises

Trump Escalates EU Trade Clash With 50% Tariff Threat: “The Deal Is Set”

Most Trump Crypto Dinner VIPs Have Moved or Dumped Their Coins: Inside of Dinner

US at risk of stagflation, Fed right to hold: Jamie Dimon

Why ‘Sell America’ is trending on Wall Street

Trump’s ‘Big, Beautiful Bill’ Moves Forward — But Sparks Backlash Over Debt and Benefit Cuts

Bloomberg Terminal Outage Disrupts Bond Auctions Across Europe

Weak 20-Year Treasury Auction Sends Yields Higher and Stocks Tumbling