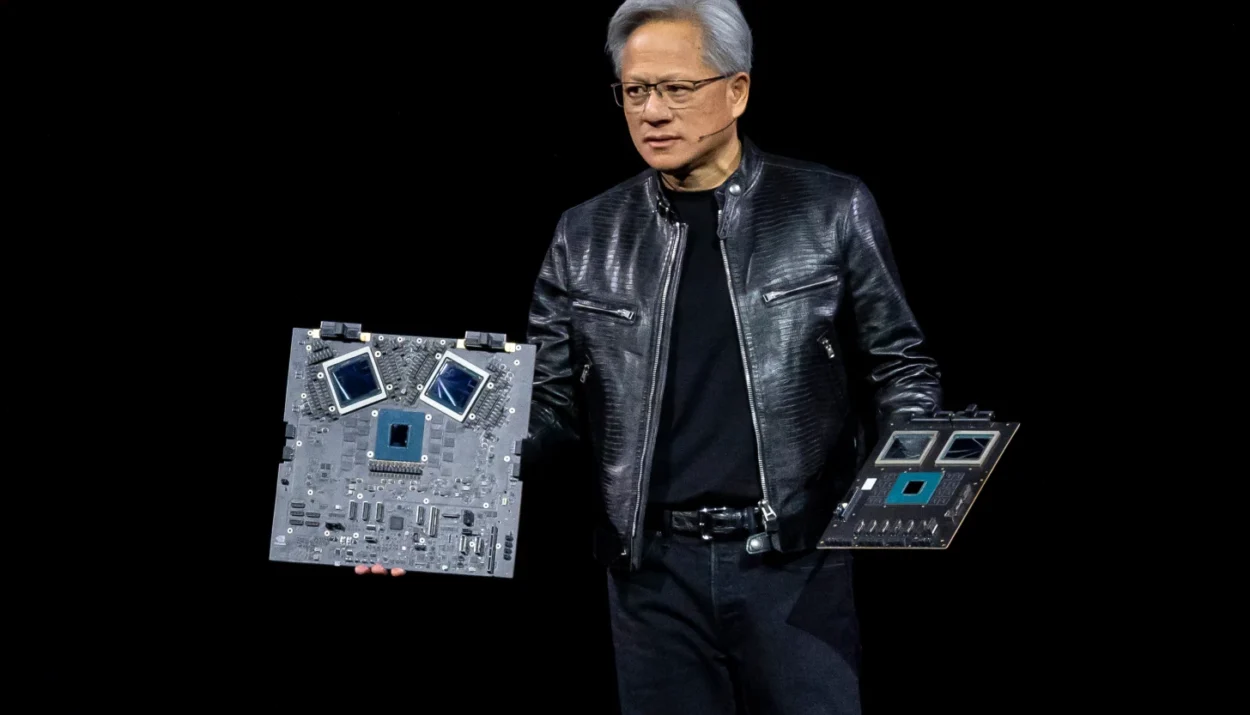

Nvidia (NASDAQ: NVDA) shares are climbing as investors eagerly anticipate more information on the company’s next-generation AI chip, named after famed astronomer Vera Rubin. The details are expected to be unveiled at Nvidia’s annual GTC conference on Tuesday, with CEO Jensen Huang set to provide key insights into the chip’s capabilities and release timeline.

The Vera Rubin AI platform is Nvidia’s latest move in its strategy to maintain leadership in the AI chip market. Following the success of its Hopper and Blackwell chips, the Rubin chips are projected to be an essential part of Nvidia’s product lineup, with a release scheduled for 2026.

Why Vera Rubin?

Vera Rubin was a trailblazer in astronomy whose work confirmed the existence of dark matter. Nvidia’s decision to name its newest chip platform after her not only honors her contributions but also signals the company’s ambition to push the boundaries of AI technology, just as Rubin did in astrophysics.

Nvidia Stock Gains Momentum

Nvidia’s stock is reflecting growing investor excitement:

- Opened today at $118.62, up from $115.58

- Currently trading at $120.33 as of 10:50 EDT

- Intraday high of $120.68, low of $118.15

Over the past year, Nvidia’s stock has ranged from a low of $75.61 to a high of $153.13. Despite volatility, it remains one of the most closely watched and actively traded stocks in the tech sector.

Strong Fundamentals Drive Confidence

With a market cap of $2.94 trillion, Nvidia is a tech giant supported by impressive financial metrics:

- Trailing P/E ratio: 40.93

- Forward P/E ratio: 29.21

- Revenue: $130.50 billion

- Quick ratio: 3.672

Analysts remain optimistic, with price targets ranging from $130.00 to $220.00, and an average target of $172.50. Many rate Nvidia as a strong buy, thanks to its leadership in AI, strong cash flow, and innovative chip designs.

What’s at Stake with Rubin?

The Rubin chip platform is expected to deepen Nvidia’s relationships with major tech clients like Google (GOOGL), Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA). Analysts expect these chips to power next-generation AI systems, keeping Nvidia at the forefront of AI hardware innovation.

The upcoming GTC conference will be closely watched, as Nvidia’s announcements may influence investor sentiment and further impact the stock’s performance.

Final Thoughts

Nvidia’s strategy of annual chip releases has positioned it as the dominant player in the AI chip space. With the Vera Rubin platform, the company aims to strengthen its lead, capitalizing on the AI boom.

Investors will be watching Tuesday’s GTC presentation for critical updates on the Rubin chip’s performance specs, market applications, and release timeline.

Source:

🔗 CNBC: Nvidia to Detail Vera Rubin Chips at GTC Conference

🔗 The Tokenist: Nvidia’s Stock Climbs as Market Awaits Details on New Rubin AI Chip

Related:

Bitcoin panic selling costs new investors $100M in 6 weeks — Research

Oracle: How Project Stargate and OCI will fuel growth

Why China Isn’t Worried About Trump’s New Trade War Like It Was in 2018

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?