In his latest YouTube episode, Joseph Carlson candidly looks at his investment decisions, focusing on trimming two major positions and reinforcing his conviction in another. The episode covers his personal portfolio moves and dives into wider market uncertainties, YouTube’s emerging competition, Apple’s AI missteps, and Mark Mahaney’s top stock picks. Carlson, a long-term investor with over a decade of experience, manages a widely-followed passive income portfolio valued in the six figures, known for its focus on dividend growth and high-quality companies. Let’s break down everything Carlson discussed.

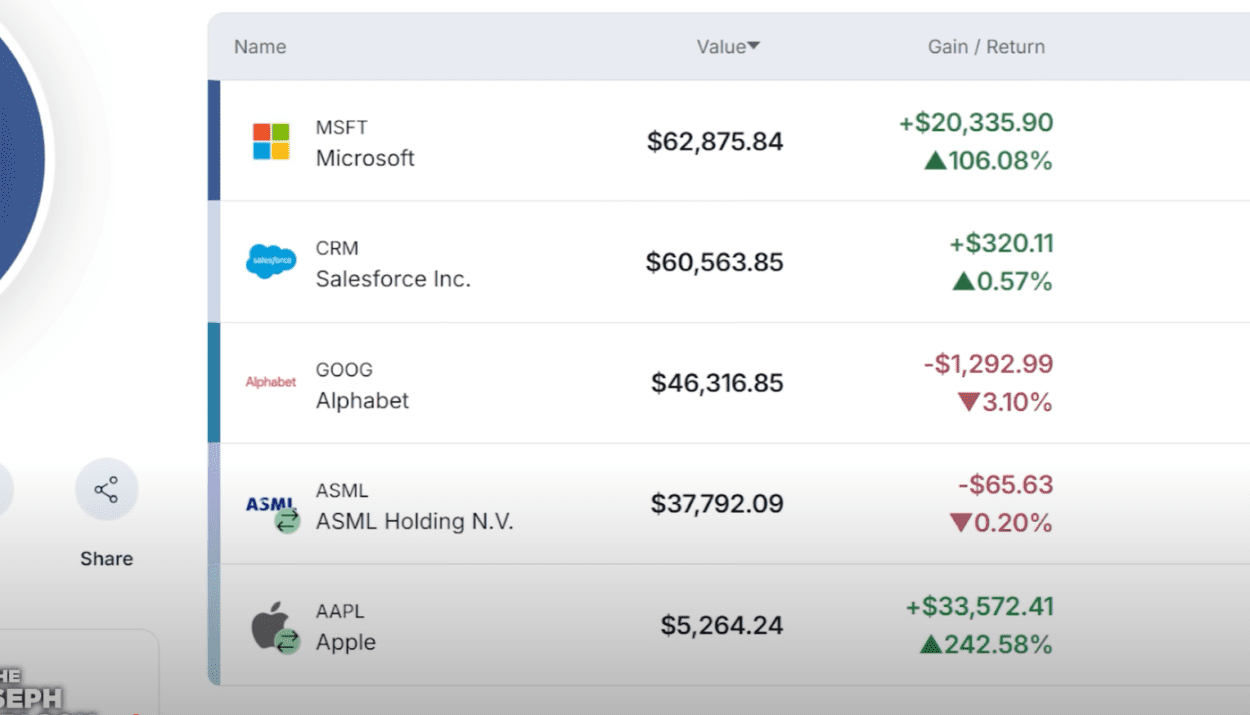

For the first time during this market downturn, Carlson is trimming some of his holdings. After months of holding steady, he’s taking profits on Vici Properties ($VICI) and Apple ($AAPL) to reallocate capital toward ASML ($ASML).

🔻 Vici Properties ($VICI)

- Trimmed by $3,000, reducing the position by one-third.

- Despite being a strong performer this year—up 10.8% year-to-date, outperforming the broader market by 21%—Carlson views this as an opportunity to lock in gains during a correction.

- Vici is still a company he likes, but he sees better risk/reward opportunities elsewhere at the moment.

🔻 Apple ($AAPL)

- Carlson has been heavily trimming his Apple holdings for months.

- He is selling an additional $4,000, reducing the position to what he describes as a “watcher” size.

- Reasons for the reduction include:

- Sluggish earnings growth.

- High valuation, with a 28-29 P/E ratio despite Apple being down 13.3% year-to-date.

- Ongoing concerns about Apple’s innovation and product pipeline, particularly around its delayed AI efforts (covered below).

- Carlson believes the future of Apple is uncertain and that the goodwill investors have toward the company isn’t enough to justify holding a large position anymore.

✅ ASML ($ASML)

- Carlson is increasing his ASML position by $8,000, bringing his total stake to $37,000.

- Carlson sees ASML as undervalued at its current 29 P/E ratio, with consistent earnings and free cash flow growth.

- Historically, ASML has shown 25.6% CAGR earnings growth over the past five years and 21.6% growth over the past decade.

- His projections: If ASML maintains a 22% EPS growth rate, it could deliver 15%+ annual returns.

- Carlson believes the current $700/share price could rapidly return to $1,000/share, as it has done in previous cycles.

- He’s bullish on ASML’s moat, especially as countries move toward self-sufficient semiconductor production, which should drive further demand for ASML’s lithography equipment.

Market Conditions: How Long Until Recovery?

Carlson also addressed the broader market volatility. Trump’s ongoing tariff threats and retaliatory measures have created uncertainty, prompting some to call this a “detox period.”

Historical Data on Market Corrections:

- Past 24 corrections (down at least 10%, avoiding a bear market) took an average of 8 months to reclaim previous all-time highs (source: CF data).

- If this correction began on February 19, history suggests a recovery by mid-October is plausible.

- The average drawdown during these instances was 14%, which aligns with today’s numbers.

Recession Risks:

- If the U.S. avoids a recession, a 16% drawdown from highs with a recovery within 8 months seems likely.

- However, recession scenarios could mean a 36% decline, dragging out recovery much longer.

- Investors like Doug Ramsey are warning that this downturn might be just beginning, citing the wealth effect where falling stock prices lead consumers to cut back on spending.

Upcoming Q1 Earnings Season (April):

- Carlson believes the next earnings season will be pivotal.

- Strong consumer spending and earnings growth could trigger a sharp rebound.

- Weak numbers, however, might result in another 10% market drop.

YouTube’s Moat Under Threat: Streaming Platforms Move in on Creators

Carlson points out an emerging challenge for YouTube (and its parent company Google): the migration of YouTube creators to major streaming platforms like Amazon Prime and Netflix.

MrBeast and Beast Games:

- MrBeast’s Beast Games series on Amazon Prime was a $100 million profit success for Amazon.

- Nearly 1 in 4 Prime Video viewers in the U.S. watched Beast Games in its first month; 60% watched at least three episodes.

- MrBeast chose Amazon over Netflix because Amazon allowed him full creative control.

- This has sparked a wave of interest from streamers eager to sign top YouTube talent.

Other Major Moves:

- Netflix signed Miss Rachel, who quickly landed a spot in Netflix’s Top 10 shows.

- Netflix is also courting Dude Perfect and Mark Rober, two of the biggest creators on YouTube.

- Carlson predicts more YouTubers will move to streaming platforms, drawn by money and creative freedom.

Apple’s AI Woes: Vaporware and Broken Promises

Carlson highlights John Gruber’s scathing critique of Apple Intelligence, the company’s suite of AI tools and features.

Key Points from Gruber’s Review:

- Apple’s WWDC AI demos were concept videos, not live demos.

- Features like personalized Siri, context awareness, and in-app actions have yet to materialize.

- Apple promoted these features as reasons to buy the iPhone 16, but later pulled ads and delayed features until next year.

- Gruber argues that this kind of vaporware marketing is a dangerous shift for Apple, a company historically known for only showcasing finished products.

- Carlson warns Apple risks breaking customer trust if it doesn’t course correct.

Mark Mahaney’s Top Picks: Amazon and Uber

On CNBC, analyst Mark Mahaney shared his top stock picks for this period of volatility:

✅ Amazon ($AMZN)

- Mahaney’s #1 pick.

- Trading at a 25x forward P/E, the lowest valuation in years.

- Historically, Amazon’s growth and profitability justify this valuation, and Mahaney believes now is the time to buy.

✅ Uber ($UBER)

- Mahaney’s other top pick, calling it “dislocated high-quality stock”.

- Mahaney (and Carlson) agree Uber is undervalued with significant upside potential.

Conclusion

Joseph Carlson’s latest episode offers an insightful breakdown of the current investing landscape:

- He’s trimming outperformers like Vici and Apple.

- He’s doubling down on ASML, believing it’s an undervalued growth opportunity.

- He highlights risks in market recovery timelines, Apple’s AI struggles, and YouTube’s eroding moat.

- And he agrees with Mark Mahaney’s bullish stance on Amazon and Uber.

For investors, Carlson’s message is clear: Stay disciplined, buy high-quality businesses, and be patient.

📺 Reference:

This article is based on Joseph Carlson’s YouTube episode, Watch it here.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Will Trump Use the Federal Reserve as Leverage in Global Finance?

Key Events and Earning Calendar to Watch This Week (17-21 March)

Quantum computing leader reveals historic breakthrough

Russia Turns to Cryptocurrencies to Bypass Sanctions and Sustain Oil Trade

Bitcoin panic selling costs new investors $100M in 6 weeks — Research

Oracle: How Project Stargate and OCI will fuel growth

Why China Isn’t Worried About Trump’s New Trade War Like It Was in 2018

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN