Alphabet will report fiscal Q2 2025 results on Wednesday, July 23, after market close. Analysts expect revenue of $93.8–94.0 billion (up ~11% YoY) and EPS of $2.17–2.18, compared to $1.89 in Q2 last year. Operating margin is projected to rise to 34%, from 32.4% in Q2 2024.

Options imply a 5–6% post-earnings stock move, roughly in line with Alphabet’s historical average of 4.4%. Shares are currently near $190, flat year-to-date, and about 10% off their early-2025 high of $209. Wall Street maintains a cautiously optimistic view, with ~80% Buy ratings and a 12-month consensus target of $201–205.

Recent Financial Performance

Alphabet has recovered from the 2022 ad slump, returning to double-digit growth in 2024. Q1 FY2025 revenue rose 12% YoY to $90.2 billion, and EPS surged 49% to $2.81, aided by cost cuts and a one-time gain. The operating margin reached 34%, up from 32% the year prior.

Alphabet also declared a $0.21 quarterly dividend, signaling confidence in sustained cash flows. In Q2 2024, revenue was $84.7 billion (+14%), net income $23.6B, and EPS $1.89. That marked a sharp jump from Q2 2023, which saw $74.6B in revenue and $1.44 EPS.

Q2 FY2025 Forecasts: Segment Breakdown

- Revenue: $93.8–94.0B (+10.7–11% YoY)

- EPS: $2.17–2.18 (+15% YoY)

- Net income: ~$26.5B

- Operating margin: ~34%

- Google Cloud margin: ~17% (up from 11% a year ago)

By Segment:

- Google Search & Other: ~$52.9B (+~9% YoY)

- YouTube Ads: ~$9.6B (+10–11% YoY)

- Google Cloud: ~$13.1B (+26% YoY), op. profit ~$2.2B

- Other Bets: Revenue still minimal, losses ~$1B+

- Google Services (Play Store, hardware): ~$9.3B in Q2 last year; expected ~10–15% growth

Advertising: Still the Core Engine

Ads remain ~80% of Alphabet’s total revenue. Q2 benefits from easier YoY comps and strong advertiser demand.

- Search ads remain resilient despite AI disruption fears. Growth of ~9% suggests Google’s integration of AI features (SGE) hasn’t dented ad monetization. No material search traffic shift to Bing or ChatGPT has been observed.

- YouTube shows momentum via Shorts and connected TV. Q2 expected growth: ~10–11%. NFL Sunday Ticket and brand/direct-response ads are helping drive engagement.

- Network ads (AdSense) may stabilize after 2024’s 5% YoY decline. Even flat growth would remove a drag.

- Macro: Ad spend in e-commerce, retail, and travel is holding up well. Any guidance on Q3 spending trends will be critical.

Google Cloud: Sustaining High Growth, Margin Expansion

Cloud revenue is forecast at $13.1B, up 26% YoY, on par with Microsoft Azure and ahead of AWS. Cloud operating margin could rise to ~17%, more than doubling from Q2 2024’s 11%. Analysts expect Cloud to contribute disproportionately to overall profit growth.

Recent wins:

- OpenAI is now a Google Cloud client.

- Adoption of Vertex AI and Duet AI in Workspace is growing.

- Enterprise demand for AI infrastructure is fueling bookings across healthcare, finance, and retail sectors.

Longer term, Cloud margins are projected to rise to ~21% by 2027. Watch for any signals of new enterprise deals or margin compression due to price competition.

AI Strategy and Capex

Alphabet is investing aggressively in AI infrastructure, committing $25B over 2 years to expand data centers, including clean energy sourcing. It signed a $3B hydropower deal with Brookfield to power AI workloads.

Key initiatives:

- AI integration into Search (SGE), Gmail, Maps, and YouTube.

- Monetization of AI via Google Cloud (Vertex AI) and Workspace tools.

- AI features are compute-heavy but Alphabet is developing custom TPUs to improve efficiency.

Risks:

- Higher compute costs from AI queries could pressure margins.

- Investors want to see clear ROI from these investments. Management commentary on AI revenue contribution will be closely scrutinized.

Antitrust and Regulatory Risk

The DOJ’s antitrust remedy ruling could land as early as August. Potential outcomes include fines, behavioral changes, or—in a worst-case scenario—forced separation of assets like Chrome.

The market isn’t pricing in a breakup, but management may address contingency planning. Alphabet also faces scrutiny under the EU’s Digital Markets Act, plus regulatory risks tied to AI privacy and competition rules.

Analyst Ratings and Price Targets

Alphabet is widely rated a Buy. Highlights include:

- J.P. Morgan: $200, Overweight

- Morgan Stanley: $205, cites strong AI innovation

- BofA: $210, expects Q2 beat

- Jefferies: $210 base, Bull case $255

- Goldman Sachs: $220, Buy

- Oppenheimer: $220, highlights margin expansion

- UBS: $192, Buy with caution on ad trends

- Cantor: $196, Neutral (DOJ uncertainty)

- Scotiabank: $240, Sector Outperform (most bullish)

Consensus target: $205, implying ~7% upside. Some see re-rating potential if regulatory concerns fade and AI monetization accelerates.

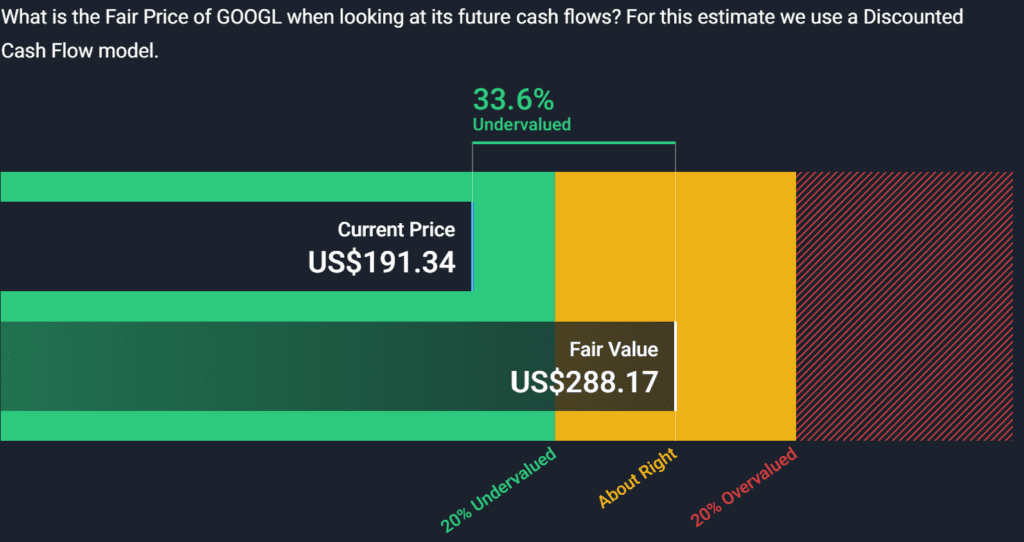

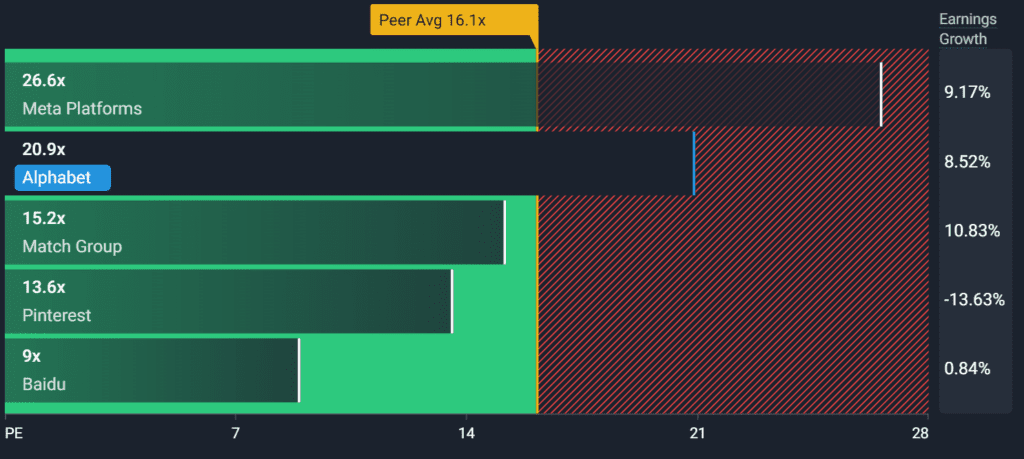

Valuation vs Peers

- Forward P/E: ~20–21x (vs MSFT ~33x, AAPL ~30x, META ~28x)

- PEG ratio: ~1.3 (considered fair to cheap)

- Price/Sales: ~6.5x

- Net margin: ~30%, ROE ~34%

- Cash: ~$115B, minimal debt

Compared to peers, Alphabet trades at a discount, despite similar growth. Analysts argue this reflects caution around AI disruption and regulatory overhang.

Investor Sentiment

- Institutions: Mixed activity; Vanguard, JPMorgan increased holdings. Some trimming after February highs.

- Retail investors: Generally bullish, tracking AI updates closely. Dividend now attracts long-term holders.

- Hedge funds: See GOOGL as a defensive value tech play.

- Short interest: Low (<1% float), suggesting little bearish conviction.

Sentiment is constructive but not euphoric—Q2 results and commentary could reignite bullish positioning if AI monetization and ad trends beat expectations.

Risks and Wildcards to Watch

- DOJ ruling on Chrome or Search

- Guidance on Q3 ad spending or Cloud pipeline

- AI query cost pressure or monetization success

- FX headwinds, one-off gains/losses (e.g., investments)

- Shift in buybacks or dividend signals

Alphabet enters Q2 with momentum and high expectations. The Street is looking for sustained growth, margin expansion, and signs that AI is enhancing—not cannibalizing—core businesses. If Alphabet delivers solid ads growth, stronger Cloud margins, and clarity on AI strategy, the stock could break toward the $200–210 range and reclaim leadership among megacaps.

But any softness in ads, a cautious tone on AI costs, or regulatory uncertainty could hold it back. Investors will tune in not just for results—but for confidence, clarity, and vision.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources: This article is based on comprehensive reporting and analysis from multiple leading financial outlets, including detailed previews and forecasts from Ainvest, TastyLive, Forbes, Investing.com, and Techi. Additional insights were sourced from Investopedia, Seeking Alpha, Yahoo Finance, Barron’s, CNBC, and Morningstar. Supplementary reporting came from MSN, Saxo Bank, MarketWatch, Investor’s Business Daily, Schwab Network, Zacks, MarketBeat, Inkl, AskTraders, and GuruFocus.

Related:

Trump’s Tariffs Are Hitting US Companies Hard — and Consumers Is Next

BYD Global EV Price War Reshapes Auto Markets, but at a Cost

Wall Street Is Stubbornly Bullish on Downtrodden Energy Stocks

As the Dollar Slides, the Euro Is Picking Up Speed

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead