Here is why the stock market continues to crush inflation over time, what China is really doing with its gold reserves, and why hedge funds might be sleepwalking into the next market rally.

Patience Pays: The Long-Term View

Every time we zoom out and study long-term charts—especially those spanning decades—we’re reminded of just how powerful patience and conviction truly are.

These aren’t just lines on a screen. They’re validation.

They prove that holding firm through volatility, crises, and euphoric rallies hasn’t just been the right choice—it might have been the single most important financial decision of my life.

Let’s start with inflation.

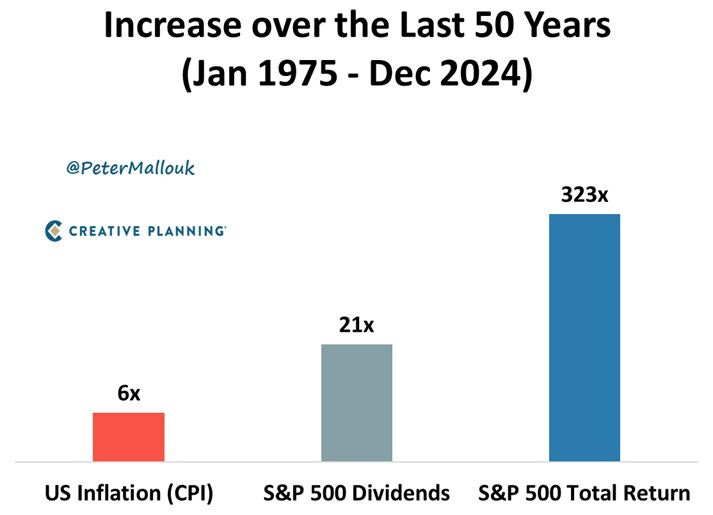

Since 1975, prices in the U.S. have increased roughly sixfold. Something that cost $10 back then now costs about $60. We feel it daily—from groceries and healthcare to education and a morning coffee. Inflation acts as a silent tax on savings.

But here’s the flip side: over that same stretch, dividends paid by S&P 500 companies grew 21-fold.

Not just price inflation—income inflation. That matters.

The S&P 500’s total return, including reinvested dividends, didn’t just outpace inflation—it obliterated it.

A 323x increase from 1975 to 2024. The index went from 90 to over 29,000. That’s an annualized return above 11%, while inflation averaged just 3.4%.

That spread isn’t just a gap—it’s the foundation of generational wealth.

In a world where purchasing power feels under constant threat, equities remain a relentless engine of wealth creation. They don’t just preserve value. They multiply it.

That’s why I stay in. Despite the noise. Despite the fear. Despite the media cycles.

What China Isn’t Telling You About Gold

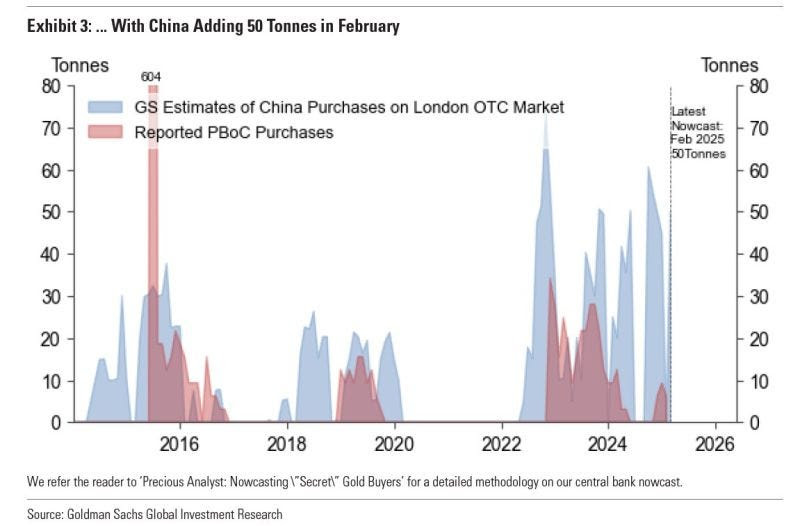

February 2025 was a perfect case study of macro moves that slip under the radar.

The People’s Bank of China officially reported buying just 5 tonnes of gold. But Goldman Sachs estimated the real figure was closer to 50 tonnes.

That kind of discrepancy isn’t accidental. It’s strategy. When nations like China enter financial markets, they move quietly and with purpose.

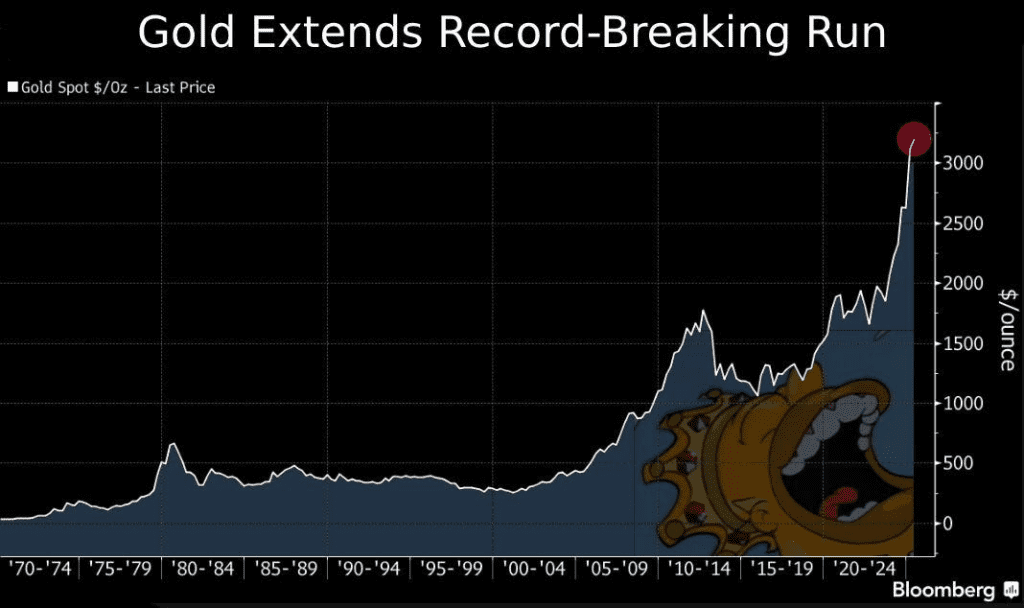

Gold has no counterparty risk. It’s a reserve, a hedge, and in today’s fractured geopolitical world—a strategic asset. Since 2015, gold has more than doubled, jumping from $1,050 to over $3,200 an ounce.

These moves tend to coincide with certain macro conditions: central bank accumulation, negative real rates, and rising uncertainty.

China’s gold buying patterns often align with:

- Yuan depreciation pressures

- Trade tensions with the U.S.

- De-dollarization of reserves

This isn’t just economics—it’s sovereignty.

Gold often says what central bankers won’t. When accumulation spikes, it’s usually where fear lives. China may be silent publicly, but its gold activity is deafening.

Hedge Funds: Missing the Move?

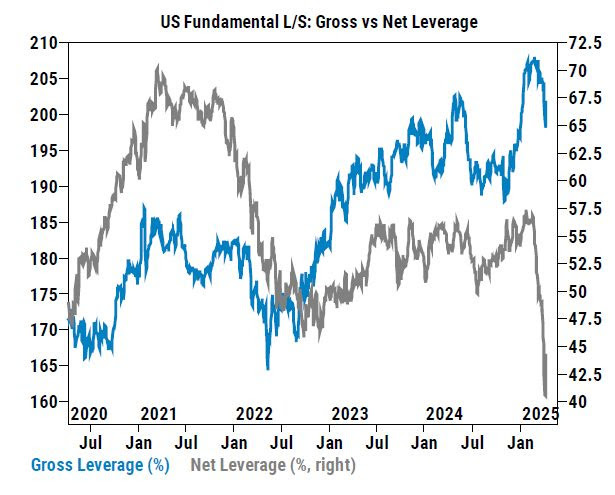

Hedge fund net exposure has dropped to around 41%, close to levels seen in March 2020—right before markets staged one of the fastest recoveries in history.

That month marked peak fear. Yet it launched a 60% rally in just six months.

Now, we’re seeing déjà vu.

Funds are de-risking, holding back, waiting. But markets don’t wait. When momentum returns, these same funds could be forced to chase performance—quickly.

This isn’t about fundamentals. It’s about positioning. Low exposure + rising market = forced buying.

That’s when things rip.

The Crowd Thinks the Fed Will Pause

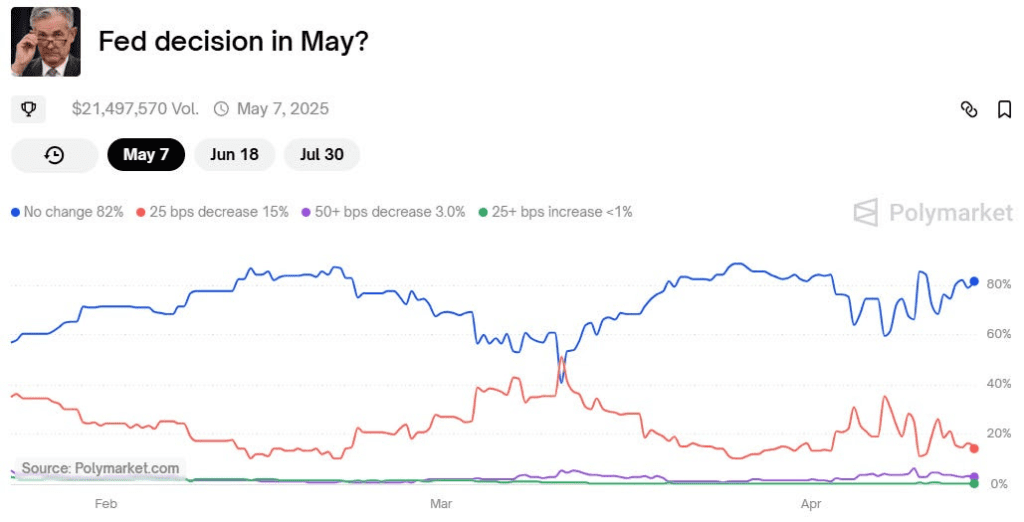

Polymarket has become a fascinating signal for Fed expectations. Over $21 million has flowed into the platform, with 82% betting that the Fed will hold rates steady at the May 7 meeting.

Only 15% expect a 25bps cut, and a tiny 3% anticipate anything more aggressive.

This is more than just speculation—it’s capital-backed consensus. The takeaway? Investors are preparing for a pause, and that positioning influences everything from yields to tech stocks.

Bond Yields: A Rare Move

In early April 2025, the 10-year Treasury yield spiked nearly 20 basis points in just one week. That might seem minor, but it was the largest weekly jump since 2001.

Historically, similar spikes (1998, 2016) signaled major macro resets. It’s not a slow grind up—it’s a violent repricing, driven by sticky inflation and strong economic data.

Typically, this leads to a stronger U.S. dollar, especially versus low-yielding currencies. And just as markets digested that shift, the U.S. announced tariff exemptions for smartphones and computers.

That sounds minor, but when something similar happened in 2019, the Nasdaq 100 rallied 10% in weeks.

We might be looking at a replay.

Despite the tension, the opportunity is building beneath the surface.

The headlines can blur the bigger picture. But when you zoom out and link the signals—gold, bonds, equities, positioning—you don’t just see the market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: Macro Mornings

Related:

Mark Zuckerberg defends Meta in social media monopoly trial

Top 10 Social Media Marketing stories this week

Netflix Aims to Join the $1 Trillion Club

Dark colors make products seem more effective

NATO Taps Palantir to Power AI-Driven Warfare Platform

A Decade Later, Meta Is Back on Trial

China Chokes Rare Earth Exports — US Supply Chains Face Major Shock

Tariffs on Phones and Microchips Will Return — Electronics Exemption Only Temporary

90 Deals in 90 Days?: Experts say good luck with that

China strikes back with 125% tariffs on U.S. goods, starting April 12

Tesla stops taking new orders in China

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts