A battered blue-chip becomes Wall Street’s hottest contrarian play. Buffett, Burry, and Tepper see opportunity in chaos.

From Out-of-Favor to Wall Street Darling

UnitedHealth Group (NYSE: UNH) went from a stock everyone wanted to dump to one suddenly commanding the attention of the world’s most famous investors.

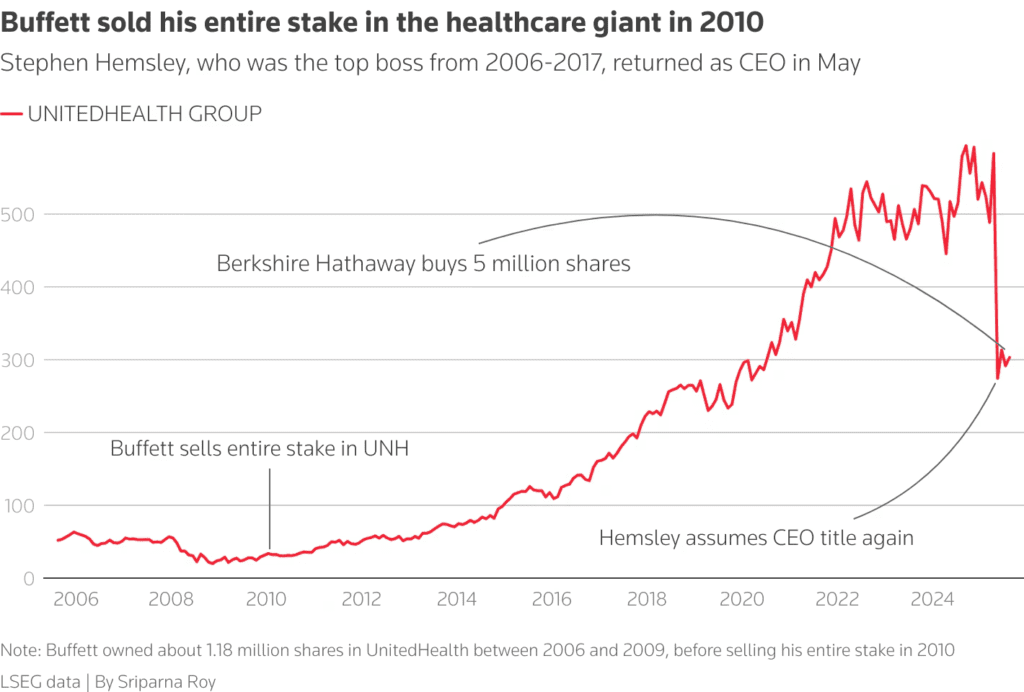

In August 2025, Warren Buffett’s Berkshire Hathaway disclosed in its SEC 13F filing that it quietly scooped up roughly 5 million UnitedHealth shares — a new $1.57 billion position. The news sent shockwaves through markets: UNH stock surged 11% in after-hours trading and closed nearly 12% higher the next day.

Buffett wasn’t alone. Hedge fund titans Michael Burry and David Tepper also loaded up on UnitedHealth in Q2, signaling they see enormous rebound potential.

This flood of high-profile money came after a brutal collapse: UnitedHealth’s stock had been crushed, falling 45–50% year-to-date by mid-August. Once a Dow stalwart, it had become the single largest drag on the index.

The burning question: why are the world’s savviest investors piling into UnitedHealth now?

A Year of Pain: UnitedHealth’s Perfect Storm

By mid-2025, UnitedHealth was reeling from setbacks that would have crippled lesser companies.

- Surging medical costs: In Q2, UnitedHealth said 2025 expenses would come in $6.5 billion higher than expected, slashing EPS to ~$4.70 from $6.80 a year earlier. Its medical care ratio jumped 430 basis points — a sign premiums hadn’t kept up with inflation or healthcare usage.

- DOJ investigation: The Justice Department launched a criminal probe into UnitedHealth’s Medicare Advantage billing practices, questioning whether it inflated diagnoses to boost payouts. UNH insists it has “full confidence in its practices” and is cooperating.

- Cyberattack fallout: In 2024, Change Healthcare — a UnitedHealth subsidiary — was hacked, paralyzing payments nationwide. Months of disruption dented credibility and cost millions to repair.

- CEO assassination: In December 2024, Brian Thompson, CEO of UnitedHealthcare, was murdered in New York City. The shocking tragedy intensified public anger at insurers, fueling online outrage about denied claims and high costs.

- Leadership upheaval: CEO Andrew Witty resigned abruptly in mid-2025. Stephen Hemsley, UnitedHealth’s former long-time chief, returned, admitting the company underpriced policies and failed to adjust quickly.

The stock collapsed more than 50% from highs. By May, UnitedHealth alone accounted for 88% of the Dow Jones Industrial Average’s YTD decline. Once untouchable, the giant looked broken.

This, of course, is exactly when Warren Buffett tends to pounce.

Buffett’s Contrarian Play

Buffett’s $1.6 billion bet fits his classic pattern: buy a high-quality franchise when fear peaks.

- Timing: Berkshire built its 5 million-share stake quietly under confidential SEC treatment in Q2, revealed only in mid-August. Shares popped 11% immediately on the “Buffett effect.”

- Insurance DNA: Buffett knows insurance models better than anyone. From Geico to Gen Re, he has thrived by exploiting the “float” — collecting premiums now, paying claims later, and investing the spread. Health insurance is different but shares the same DNA.

- Valuation dislocation: Before Buffett’s buy was public, UNH traded at ~14× forward earnings — a 26% discount to its five-year average. At ~$300/share, the company was valued below 1× sales despite projected 2025 revenue above $360 billion. For Buffett, this was “a great company on sale.”

- Circle of competence: Though UNH is a healthcare name, Buffett likely views it as an insurance/finance play — firmly in his comfort zone.

As Charlie Munger once said, Buffett “likes a business with no surprises.” By stepping in after the bad news was priced in, Buffett may believe the worst is over.

Hedge Funds Double Down

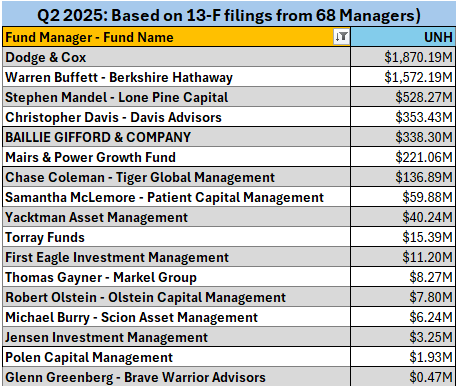

Buffett isn’t the only one. Hedge funds piled into UNH in Q2 2025:

- Michael Burry (Scion Asset Management): Took call options on 350,000 shares and 20,000 shares outright. UNH made up 19% of Scion’s portfolio — a bold bet from the “Big Short” pessimist.

- David Tepper (Appaloosa Management): Boosted his UNH stake by 1,300% to 2.45 million shares (~$760 million), now his second-largest holding.

- Other funds: Renaissance Technologies, Naya Capital, Solel Partners, and Bluefin Capital all added UNH.

Not everyone agreed: Viking Global (Andreas Halvorsen) dumped its 3.5% UNH stake. But the weight of names like Buffett, Burry, and Tepper shifted the narrative.

As one report quipped: these investors are “doubling down while execution troubles turn friendly skies into turbulence.”

Why UnitedHealth Still Looks Attractive

Buffett and hedge funds likely see what the market missed:

- Cheap valuation: P/E of ~14 vs. high-teens historical average, ~3% dividend yield, and >10% free cash flow yield.

- Dominant franchise: 52 million health plan members, plus Optum’s fast-growing services arm (pharmacy, clinics, analytics) — which grew revenue 13% in Q2 despite earnings pressure.

- Pricing reset: Premiums reset annually. For 2026, CMS raised Medicare Advantage reimbursement by >5% — a big relief for the largest provider (UNH). Employer and individual premiums are also rising.

- Financial resilience: $14.3B H1 operating earnings, $7.2B Q2 operating cash flow, manageable debt, and continued buybacks/dividends ($4.5B in Q2).

- Growth runway: Aging demographics = more Medicare Advantage enrollment. Optum expansion, AI-driven healthcare efficiency, and diversified revenue streams provide long-term growth.

In Wall Street consensus, 2025 is the trough. Analysts forecast recovery into 2026, with average price targets ranging $312–$400+. That implies 20–50% upside from current levels.

Market Reaction: The “Buffett Bump”

The reaction was immediate.

- Biggest single-day gain in 16 years: UNH surged 12% on Aug. 15, 2025 — the largest daily jump since the pandemic rebound in March 2020.

- Best week since 2009: Shares rose 20% in a week, lifting the Dow Jones to a new all-time high.

- Sector sympathy rally: Peers Humana and Elevance Health gained in response.

Analysts dubbed UNH the “Buffett trade of 2025.” Investors now see his stake as a confidence buffer: retail and institutional buyers pile in rather than risk missing a bottom.

Risks Still Loom

The bullish case isn’t risk-free.

- Medical costs could remain stubbornly high.

- The DOJ probe could uncover damaging practices.

- Political pressure for stricter regulation remains intense after the CEO assassination and public outrage.

But Buffett and peers are betting those are temporary storms, not permanent impairments.

Conclusion: A Classic Contrarian Bet

UnitedHealth’s saga in 2025 is a case study in contrarian investing.

A blue-chip giant battered by cost spikes, investigations, a cyberattack, and even a CEO assassination scared investors away. Yet, Buffett, Burry, and Tepper saw a fortress franchise temporarily mispriced.

They are wagering that UnitedHealth’s moat — massive membership, Optum’s diversification, financial strength, and pricing power — will prove enduring. If so, today’s chaos will look like an extraordinary buying opportunity in hindsight.

Buffett’s mantra applies perfectly: “Be fearful when others are greedy, and greedy when others are fearful.”

Right now, much of Wall Street is still fearful about UnitedHealth. Buffett and the hedge funds? They’re very greedy.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana