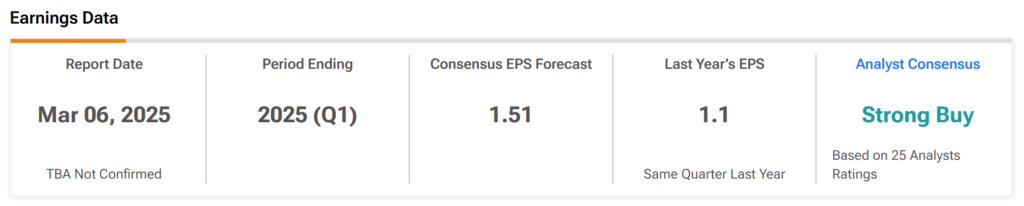

Broadcom (NASDAQ: AVGO) is set to release its Q1 FY2025 earnings today, March 6, 2025, after market close. As one of the leading semiconductor and AI infrastructure companies, Broadcom’s earnings report will be a key event for tech investors, AI chipmakers, and the broader semiconductor sector.

With AI-driven demand surging, Wall Street is watching Broadcom’s earnings closely, especially after recent stock declines and growing competition in the semiconductor space. Here’s what analysts predict for AVGO’s earnings and how the stock could react.

Market Reactions and Volatility

Broadcom’s stock has been under heavy selling pressure, with shares dropping nearly 6% in the past week and down 25% since December highs.

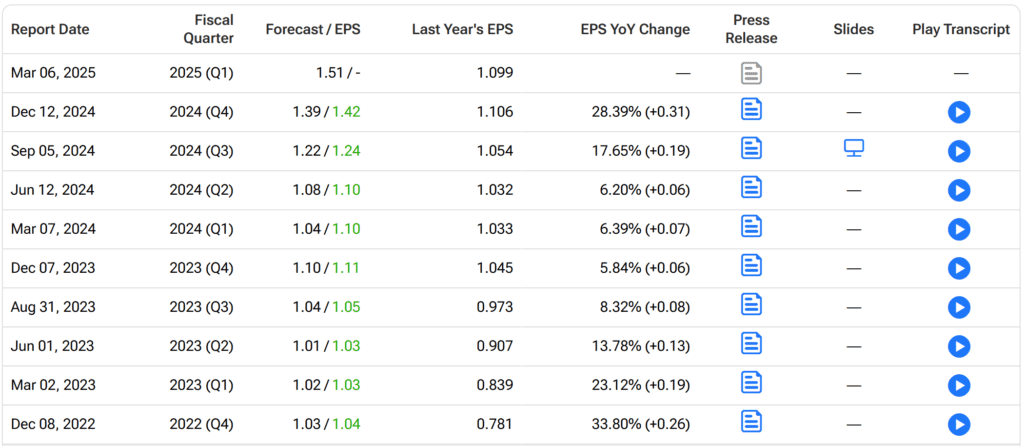

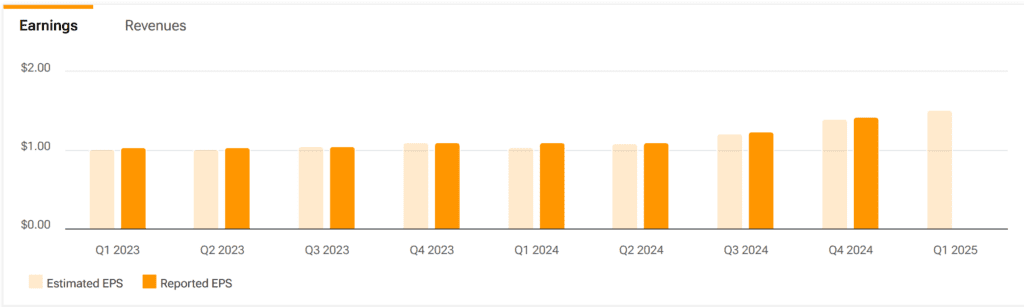

📉 Over the past 8 quarters, Broadcom has:

✔ Beaten EPS estimates 7 times

✔ Beaten revenue estimates 8 times

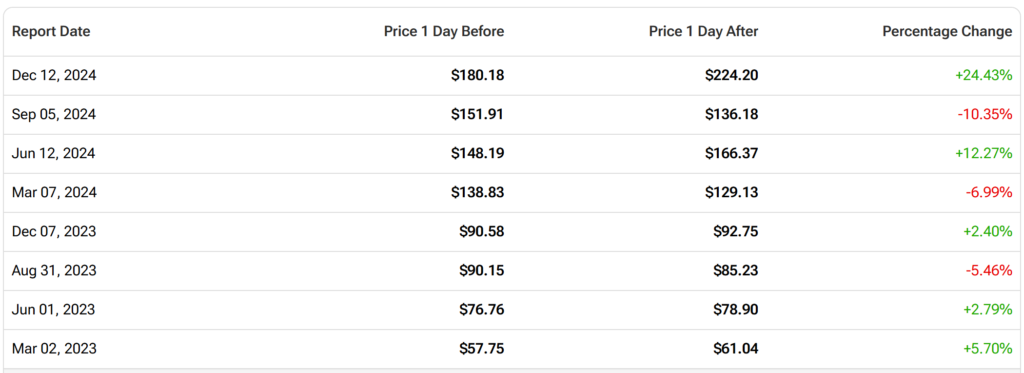

✔ Seen an average 4.8% stock move post-earnings

Some analysts believe expectations may already be priced in, limiting the potential for a sharp rally unless the company delivers a major earnings beat and strong guidance.

Key Predictions on Broadcom’s Q1 Performance

1. Strong Revenue and EPS Growth Expected

Broadcom is expected to post strong Q1 revenue and earnings growth, fueled by:

✅ Enterprise AI and cloud computing demand

✅ Increased adoption of AI networking chips

✅ Ongoing software and infrastructure expansion

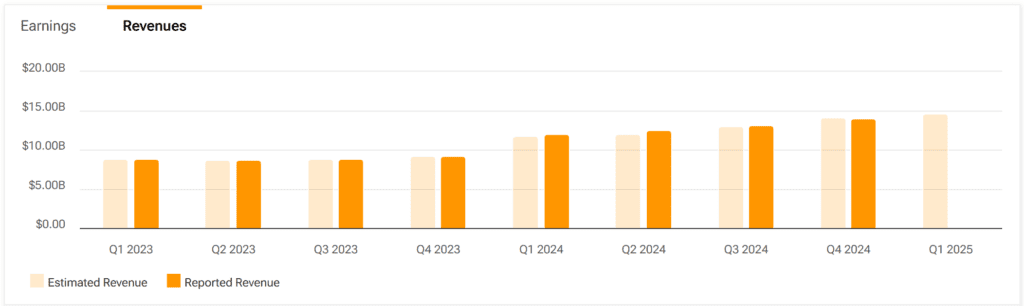

📌 Revenue Estimate: $14.61 billion (+22% YoY)

📌 Net Income: $7.39 billion (+40.8% YoY)

📌 EPS (Earnings Per Share): $10.47

📌 Gross Margin: 78% (up from 74% last year)

Data center and AI infrastructure investments by companies like Google, Microsoft, and Amazon continue to drive growth in Broadcom’s AI chip business.

📌 AI Revenue Contribution: Expected to double YoY, exceeding $6 billion in sales.

📌 Networking and Cloud Infrastructure: Projected 15% growth YoY, driven by hyperscaler adoption.

📌 Acquired VMware Integration: Analysts are watching how Broadcom integrates VMware into its software segment, as this could significantly boost recurring revenue.

Sources: Nasdaq, MarketBeat, TipRanks

2. Bullish Case: More Growth Potential Ahead?

Many analysts remain bullish on Broadcom, citing multiple growth catalysts beyond Q1 earnings.

✅ AI Expansion: Broadcom expects AI chip revenue to jump from $15B in FY2024 to $60B+ by FY2027.

✅ Strong Enterprise Demand: Major cloud providers continue increasing Broadcom chip orders, ensuring sustained demand.

✅ Software Strength: The VMware acquisition boosts Broadcom’s high-margin enterprise software business, providing more stable revenue streams.

📌 Susquehanna: $250 (up from $225) – Maintains Positive Rating (Feb 26)

📌 HSBC: $235 (up from $175) – Maintains Hold Rating (Feb 10)

📌 Morgan Stanley: $246 (down from $265) – Maintains Overweight Rating (Jan 28)

📌 Barclays: $260 (up from $205) – Maintains Overweight Rating (Jan 17)

📌 TD Cowen: $265 (up from $240) – Maintains Buy Rating (Jan 13)

📌 Mizuho: $260 (up from $245) – Keeps Outperform Rating (Jan 13)

📌 Goldman Sachs: $255 (up from $240) – Maintains Buy Rating (Jan 13)

Sources: Business Insider, MarketWatch

3. Bearish Case: Risks and Challenges

While Broadcom’s fundamentals remain strong, some analysts warn of potential downside risks, especially given the stock’s recent decline and AI market uncertainties.

🚨 Stock Valuation Concerns: Broadcom’s P/E ratio of 32x remains elevated compared to historical semiconductor industry averages.

🚨 Post-Earnings Volatility: AVGO has a history of sharp post-earnings price swings, making short-term movements unpredictable.

🚨 Marvell’s Earnings Impact: Marvell Technology missed expectations last week, triggering a 20% stock drop and raising concerns about AI chip demand.

Bearish Analyst Views:

📌 Morningstar: $1,100 fair value estimate – “AVGO’s valuation is high, and AI demand may not grow as fast as expected.”

📌 JPMorgan: Neutral rating – “The VMware deal adds complexity, and AI revenue is still in its early stages.”

📌 Bank of America: $1,200 price target – “AVGO remains strong, but semiconductor cyclicality remains a risk.”

Final Take: Buy, Sell, or Hold?

With high expectations for AI-driven growth, Broadcom’s Q1 earnings will be a key catalyst for semiconductor stocks in 2025.

✔ Bullish Scenario: If Broadcom beats estimates and provides strong AI-driven guidance, the stock could rebound above $250-$265, aligning with recent analyst price targets. Continued AI infrastructure demand and VMware integration could fuel further long-term gains.

❌ Bearish Scenario: If earnings miss expectations or guidance signals slowing AI demand, AVGO could decline toward $175-$200 in the near term. Weakness in cloud spending or broader semiconductor headwinds could weigh on the stock.

📌 Final Analyst Consensus: Cautiously bullish, with AI growth as a key driver but potential post-earnings volatility.

Broadcom reports after market close today—how the stock reacts could shape AI sentiment and semiconductor trends for the rest of 2025. 🚀

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?

After Trump announced the US Strategic Crypto Reserve, What’s coming next?

Market Debate: Economic Slowdown or Sector Rotation?

Methods for More Consistent Gains in Penny Stocks

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors