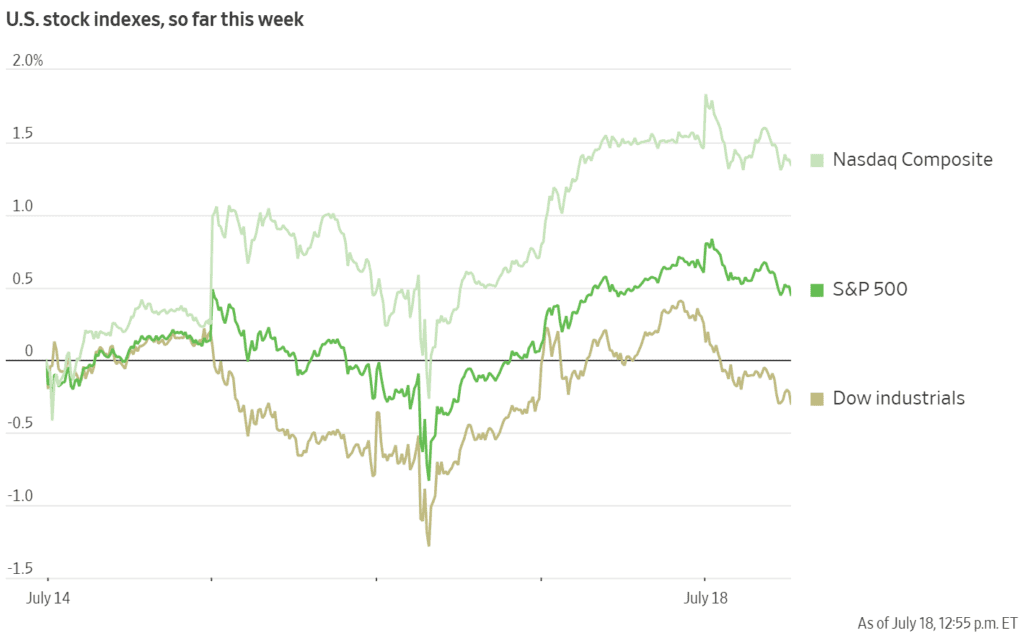

Wall Street opened in record‑chasing mode, but news that President Trump wants a 15‑20 % blanket tariff on all EU imports—and won’t budge on the existing 25 % duty for European cars—knocked the wind out of the rally. A softer‑than‑expected earnings reaction and fresh Fed chatter made the tape even choppier.

Tariff headline flips the script

The Financial Times scoop hit screens just after noon ET. Within minutes:

- Dow fell more than 240 points (‑0.5 %).

- S&P 500 slipped off its intraday high, down 0.1 %.

- Nasdaq gave back early gains, down 0.07 %.

Investors had been betting a US‑EU deal could land before the Aug 1 tariff‑pause expiry. A blanket levy would be the toughest broad duty on Europe in decades and could spark immediate retaliation—hence the knee‑jerk risk‑off move.

Fed noise keeps rates center stage

Fed Governor Christopher Waller doubled down on his call for a 25 bp cut at the July meeting and said he’d accept the chair role if offered when Jerome Powell’s term ends next year. Treasury yields edged lower (10‑yr at 4.42 %), but futures still price only a 10 % chance of a July cut and ~60 % odds for September.

Earnings: beats, but not much love

Early results looked strong on paper, yet price action was muted or negative:

| Company | Beat? | Stock move* | Key takeaways |

|---|---|---|---|

| Netflix | Yes (rev, EPS) | –5.2 % | FX‑boosted beat, but FY FCF guide underwhelmed. |

| American Express | Top & bottom line | –2.7 % | High‑end spending solid; guidance simply in line. |

| 3M | Beat | –4.7 % | Margins squeezed; guidance unchanged. |

| Schlumberger (SLB) | Beat | +1.2 % | Upbeat offshore outlook held. |

| Schwab | Beat | +0.3 % | Deposits stabilized; NII still under pressure. |

| Ally Financial | Miss (EPS) | –3.1 % | Auto‑loan loss provisions ran hot. |

*mid‑day moves

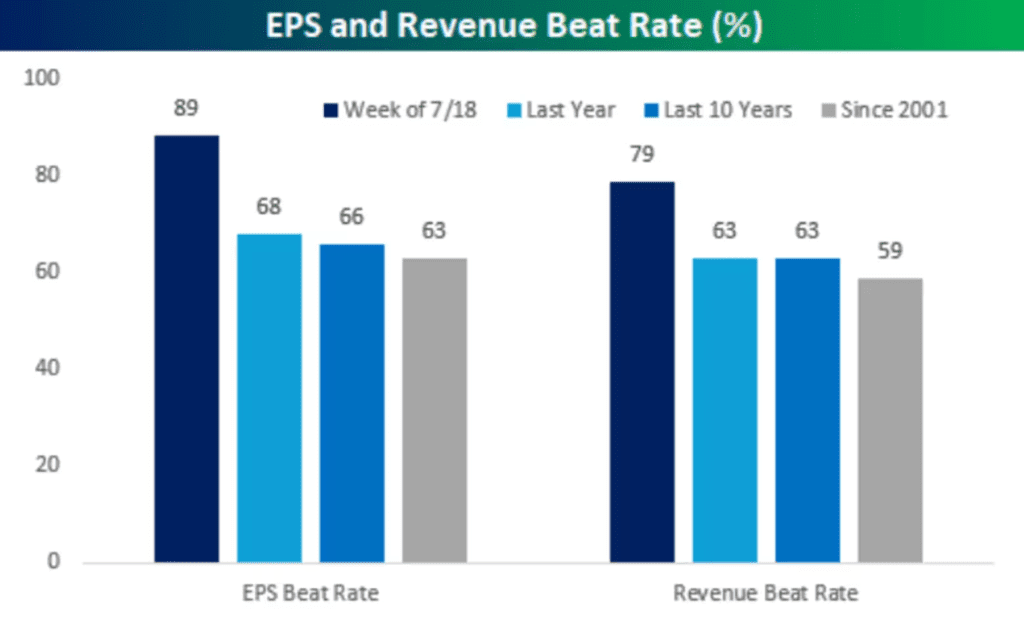

This earnings season is statistically stellar—about 9 in 10 reporters have beaten EPS and 4 in 5 have topped on revenue, the strongest beat‑rate combo since early‑2000s records. Yet share‑price reactions have been muted or negative. Netflix slipped 5 % on a clean beat and raise; Bank of America is up less than 1 % on the week, while Goldman and Morgan Stanley are flat to down.

The takeaway: with indexes at record highs, “better than expected” was already expected—investors now want guidance upgrades or surprise margin traction to justify fresh upside.

Macro data: sentiment inching higher

On the data front, Friday’s releases paint a familiar “slow but steady” picture. Preliminary July numbers from the University of Michigan put consumer sentiment at 67.5—its best read in five months, and a sign households are shaking off tariff headlines for now. Housing, meanwhile, showed a gentle downshift: June starts slipped to 1.43 million (annualised), a modest pullback from May’s pop and just shy of consensus. Taken together with a 2.1 % reading from the Atlanta Fed’s GDPNow tracker for Q3, the figures fit the soft‑landing script—growth still positive, inflation pressures easing, but no snapback that would force the Fed to rethink a gradual rate‑cut path.

- Michigan Consumer Sentiment (Jul prelim): 67.5 vs 66.9 prior, a five‑month high.

- Housing Starts (Jun): 1.43 M vs 1.48 M est., moderating after May’s surge.

- Atlanta Fed GDPNow: ticked up to 2.1 % for Q3.

The consumer mood is recovering, but housing cooled a touch—consistent with a soft‑landing narrative rather than outright re‑acceleration.

Cross‑asset snapshot

| Asset | Level | Move |

|---|---|---|

| S&P 500 | 6,290 | ‑0.1 % |

| Dow | 44,243 | ‑0.5 % |

| Nasdaq | 20,870 | ‑0.07 % |

| 10‑yr UST | 4.42 % | ‑3 bp |

| DXY Dollar Index | 98.1 | ‑0.2 % |

| Gold | $3,338 | +0.4 % |

| Brent crude | $69 | ‑0.6 % |

| Bitcoin | $117.8 K | ‑1 % |

Utilities led the S&P sectors (+1.7 %), a classic defensive rotation on tariff jitters. Tech and small caps swung between green and red.

What to watch into the close

- Any White House clarification on the EU tariff plan.

- Late‑day flow in defensives versus cyclicals as traders square for the weekend.

- Ongoing Fed speak; markets will parse every hint on July vs. September cuts.

Unless sentiment stabilizes, the Dow looks set for its worst day in two weeks, while the S&P and Nasdaq still eye a modest gain for the week. The summer rally isn’t broken—but it just hit its first serious speed bump.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans