Super Micro Computer (SMCI) shares whipsawed in after-hours trading on Tuesday, initially dropping but then jumping 8% after the troubled server and data center manufacturer assured investors it will meet Nasdaq’s critical Feb. 25 deadline to submit its delinquent 2024 financial reports.

🚨 Why This Matters:

- Avoiding Nasdaq delisting → This restores confidence and keeps SMCI publicly traded.

- Accounting & SEC investigations still ongoing → Investors remain cautious.

- Stock broke key technical levels → Potential for a bullish breakout.

SMCI’s Accounting Troubles & Regulatory Scrutiny

Super Micro has faced intense scrutiny due to its failure to file quarterly (10-Q) and annual (10-K) reports, leading to:

✅ SEC & DOJ subpoenas over financial reporting concerns.

✅ Investor lawsuits tied to past accounting mismanagement.

✅ Audit firm EY’s resignation in October 2024, with BDO USA stepping in as a new auditor.

CEO Charles Liang insists that Super Micro will not need to restate its financials, and that cash flow issues will soon be resolved. However, investors are still awaiting clarity on the company’s internal accounting reforms.

Stock Movement & Technical Breakout

Super Micro’s wild price swings reflect investor uncertainty but also renewed optimism:

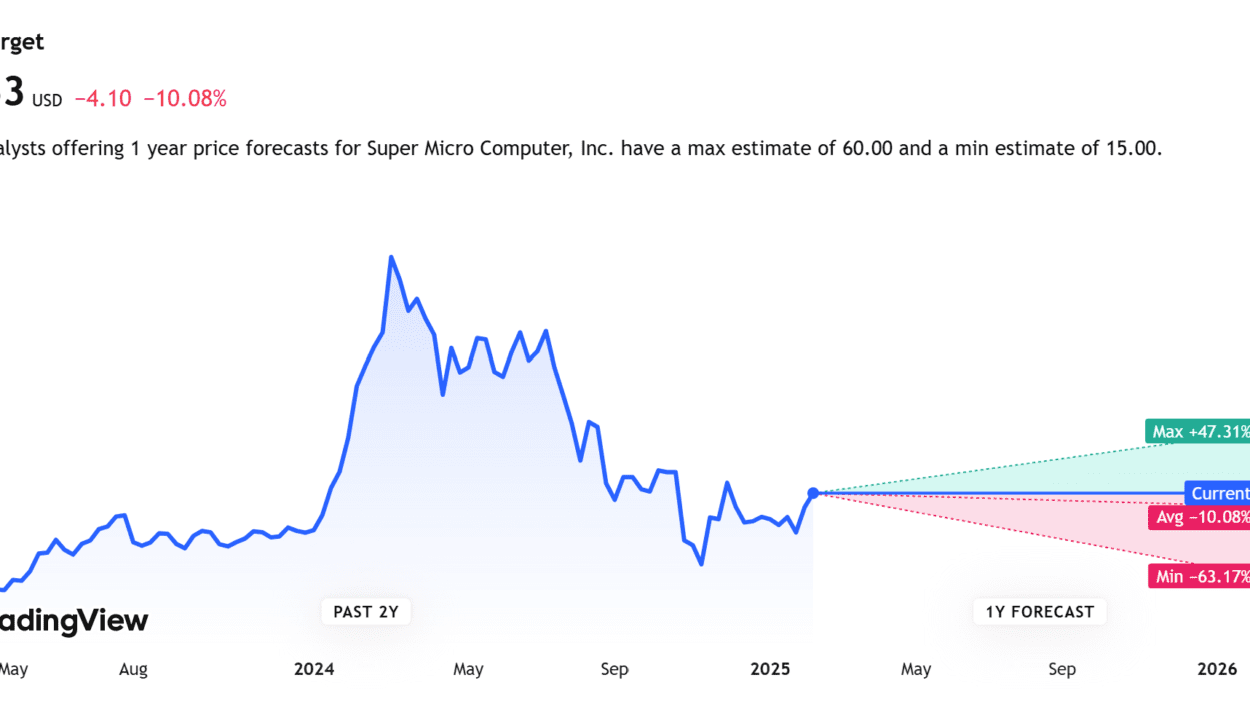

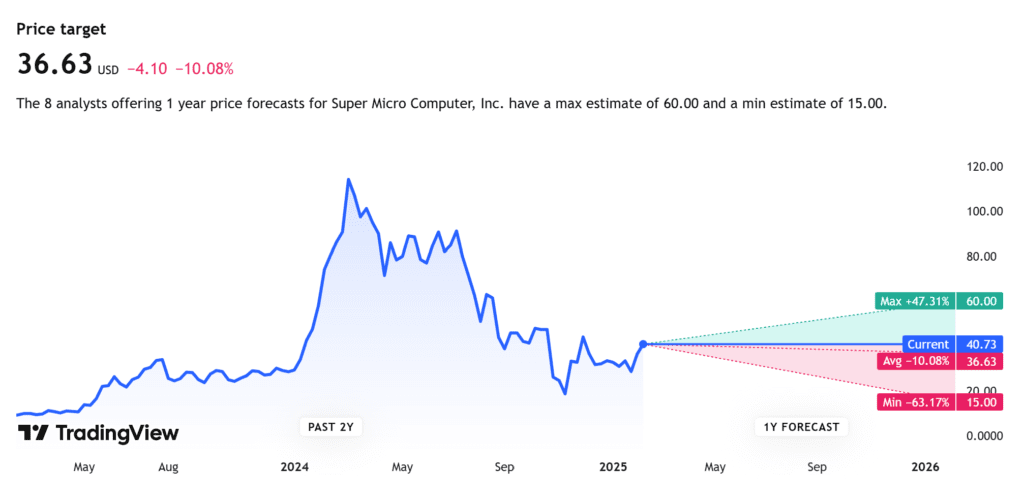

📉 Stock fell 10% in regular trading Tuesday before rebounding 8% after-hours.

📈 SMCI is up 35% in February, despite losing nearly half its value over the past year.

Key Chart Patterns & Price Levels to Watch

- Bullish breakout: Stock broke above a descending broadening wedge last Friday.

- Potential inverse head and shoulders pattern forming → Bullish signal.

- Highest trading volume since December suggests big institutional moves.

🔍 Key Resistance Levels:

- $50: Psychological level near the inverse head & shoulders neckline and 200-day moving average.

- $70: Near February 2024 pullback low & April trough—potential take-profit zone.

- $96: Major resistance near 2023’s peak trendline—breakout target.

📉 Support Levels:

- $26 & $18: Key pullback zones where buyers may step in.

Financial Performance & 2026 Growth Outlook

Despite accounting concerns, Super Micro reported strong earnings growth:

✔ Q2 Revenue: $5.7 billion (+54% YoY).

✔ 2026 Revenue Projection: $40 billion (CEO calls it a “conservative estimate”).

❌ 2025 Revenue Guidance Cut: Lowered to $23.5B – $25B (from $26B – $30B).

Investor Takeaway: SMCI—A Rebound Play or a Risky Bet?

✔ Bullish Case:

- AI-driven data center boom continues to fuel server demand.

- Meeting Nasdaq’s Feb. 25 deadline restores investor confidence.

- Chart shows bullish breakout potential—could push toward $70+.

❌ Bearish Case:

- SEC, DOJ, and investor lawsuits still pose long-term risks.

- Prior delisting history (2018 Nasdaq removal) raises credibility concerns.

- Accounting mismanagement & leadership turnover leave uncertainty.

With volatile price action and regulatory concerns, Super Micro remains a high-risk, high-reward play. Traders should watch the $50 resistance closely—a breakout could fuel a run toward $70-$96, while failure to sustain momentum could see a pullback to $26-$18 levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Hottest CPI inflation report: What does this mean for FED rate cut?

Rocket Labs (RKLB) vs Intuitive Machines (LUNR): The Likely Winner in 2025?

Physical Gold BUYING Went Apocalyptic: What to Expect

Short positioning in Ethereum is now up +40% in ONE WEEK: What do hedge funds know is coming?

Elon Musk and Coinbase’s CEO proposed putting ALL US spending on blockchain. What does this mean?

Trump’s 25% Tariffs on Steel & Aluminum: What It Means for Stocks

Top Funds Absolutely Adore These 6 Stocks — And Love Tesla, Too

Trump to Announce Reciprocal Tariffs: Is a New Stock Dip Coming?

Key Events to Watch in [Week] & Their Market Impact

Bullish Momentum vs. Financial Reality in Palantir

Here Are 10 Most Polarizing Stocks in Market Right Now & Why Critics Might Be Wrong