Rocket Lab USA (NASDAQ: RKLB), a leading space launch and aerospace systems company, is scheduled to report its Q1 2025 earnings on May 8 after market close. As a small-cap space disruptor competing against giants like SpaceX and Northrop Grumman, Rocket Lab is under intense scrutiny: can it turn booming space demand into sustainable financial results?

This article dives deep into what investors, beginners, and traders need to know.

What Wall Street Expects

Based on data from Yahoo Finance, MarketBeat, Zacks, and Nasdaq, here’s what analysts are forecasting for Q1:

- Revenue: $117M-$123M

- EPS (Adjusted): -$0.10 → narrower loss vs. -$0.14 YoY

- Gross Margin: ~25-27% → improving from ~12% last year

Notably, Rocket Lab has beaten revenue estimates in four of the last six quarters, but consistent profitability remains elusive.

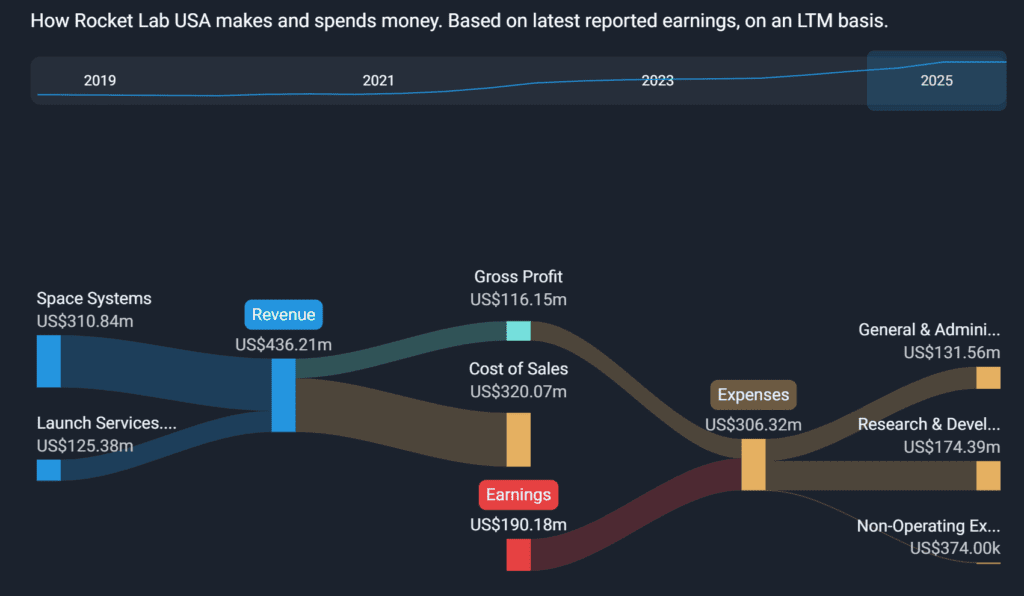

Core Business Drivers

✅ Launch Services (Electron Rocket Program)

Rocket Lab’s Electron rocket remains its flagship product, handling small satellite launches for commercial, government, and defense clients.

- Q1 launch cadence: 3 missions (MarketBeat), putting it on track for 15–20 launches in 2025, compared to 10 in 2024.

- Notable customers include NASA, BlackSky, Capella Space, and the National Reconnaissance Office.

Why it matters: Each Electron mission brings in ~$7–10M, but margins are tight due to high fixed costs. Investors will watch whether launch volumes scale efficiently.

✅ Space Systems (Photon, Solar, Components)

Rocket Lab’s shift into spacecraft manufacturing (Photon satellite buses, reaction wheels, solar panels) is key to long-term revenue diversification.

- Space systems accounted for ~35% of total revenue in Q4 2024, with strong backlog growth.

- Major wins include satellite manufacturing contracts for Varda Space, Globalstar, and MDA.

Why it matters: Hardware sales carry higher gross margins (~30–40%) than launch services, helping offset the capital-intensive nature of rockets.

✅ Neutron Rocket Development

Rocket Lab is investing heavily in its next-generation Neutron rocket, a medium-lift, reusable launcher designed to compete directly with SpaceX Falcon 9.

- Development costs are weighing on EBITDA margins but promise long-term upside if Rocket Lab captures larger payloads.

- Investors want updates on Neutron’s timeline, test milestones, and potential customer commitments.

✅ Government and Defense Contracts

Rocket Lab has increasingly become a critical national security partner, winning contracts from the U.S. Space Force, National Reconnaissance Office, and DARPA.

- MarketBeat reports the U.S. defense sector could eventually make up ~30% of Rocket Lab’s backlog.

- This gives Rocket Lab political tailwinds, but execution risk is high.

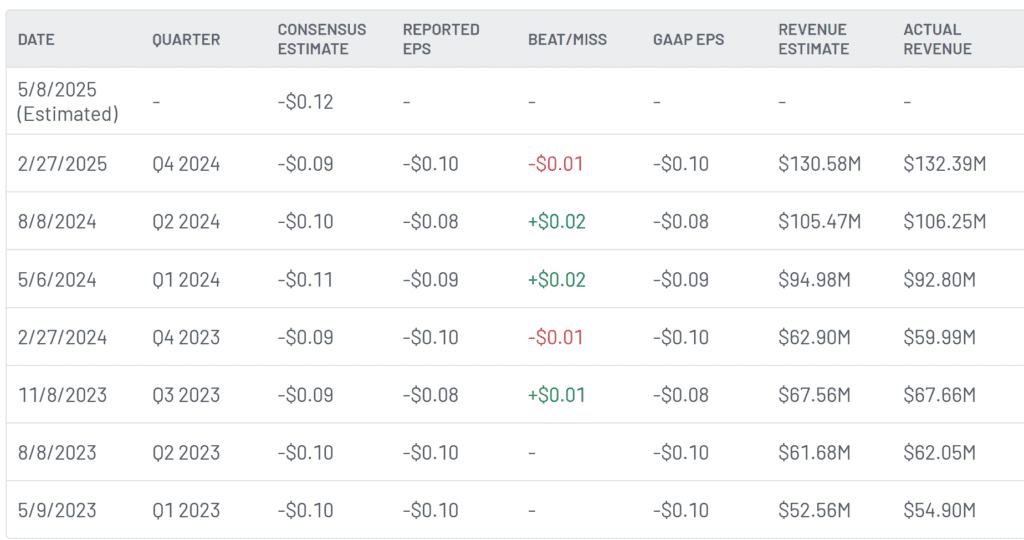

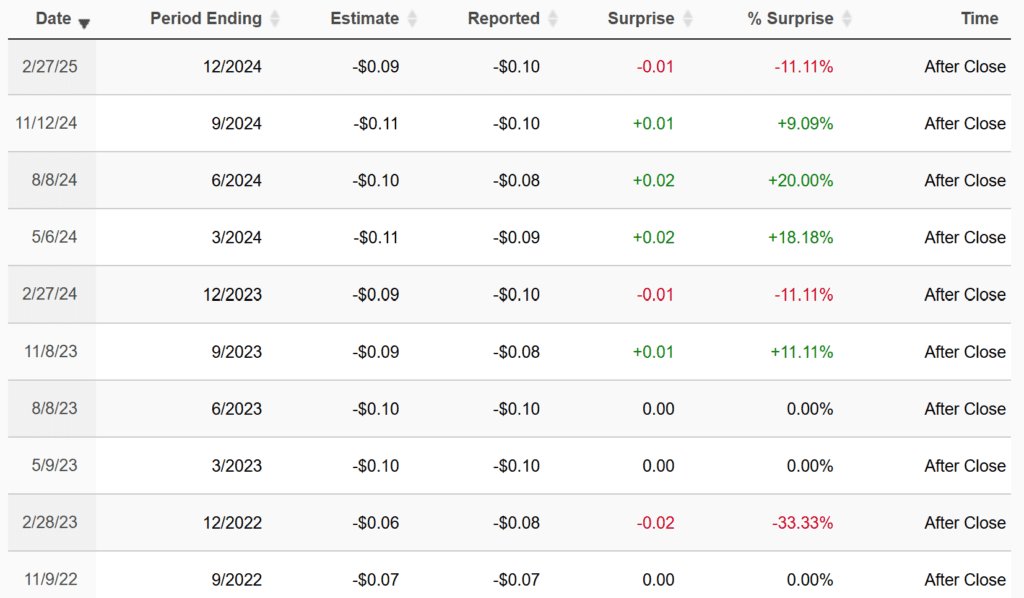

Historical Performance and Earnings Surprise Record

- Revenue beats: Rocket Lab exceeded top-line estimates in 4 of the last 6 quarters.

- EPS beats: Less consistent, as losses often come in wider than expected due to R&D and infrastructure spending.

Stock price reactions are volatile, with post-earnings moves averaging ±10–15%.

Bullish Case

Strong Backlog and Visibility: GuruFocus notes Rocket Lab ended FY2024 with a $600M+ contracted backlog, providing multiyear visibility.

Diversified Revenue Streams: Photon spacecraft, satellite components, and deep-space missions are increasingly driving revenue. In Q4, non-launch business made up ~35% of sales — a major shift.

Defense and Government Tailwinds: MarketBeat highlights that geopolitical tensions (Russia-Ukraine, China-Taiwan) have increased defense spending, creating fertile ground for Rocket Lab’s national security launches.

Neutron’s Disruptive Potential: While unproven, the Neutron rocket could unlock payload classes ~10x larger than Electron, moving Rocket Lab into the $5–10B medium-lift market.

Innovation and Execution: Rocket Lab has a ~96% launch success rate on Electron (Seeking Alpha), proving its technical chops.

Bearish Case

Unprofitable Core Business: Despite revenue growth, Rocket Lab continues to post quarterly losses (Yahoo Finance, Nasdaq). Gross margins are thin, and breakeven remains 1–2 years away.

Execution Risk on Neutron: The Neutron rocket is still under development, with no test flights yet. Analysts warn of delays, cost overruns, or market misfires (Nasdaq).

SpaceX Dominance: Elon Musk’s SpaceX controls ~70% of the commercial launch market. Competing head-to-head on price, cadence, or payloads is a steep uphill battle.

Valuation Premium: Rocket Lab trades at ~7x forward sales (GuruFocus), a hefty premium compared to traditional aerospace names like Lockheed or Northrop, making it vulnerable to sentiment swings.

Macroeconomic Pressures: Higher interest rates and tightening capital markets could crimp investor appetite for high-risk, capital-intensive space plays.

Prediction and Market Sentiment

Wall Street expects:

- Revenue beat: High chance, as Rocket Lab has consistently delivered top-line outperformance.

- EPS: Likely still negative, with losses narrowing but profitability elusive.

- Key catalyst: Updates on Neutron development, government contracts, and Photon order flow.

Stock reaction: Historically volatile, ±10–15% depending on guidance and commentary.

Valuation, Analyst Ratings, and Setup

- YTD stock performance: +35% (reflecting space sector optimism)

- Market cap: ~$3.7 billion

- Forward P/S ratio: ~7x (vs. ~3–5x for traditional aerospace peers)

- Analyst Ratings

- Average price target: ~$7.50 (vs. ~$7 current), implying limited short-term upside

Final Takeaways

For long-term investors: Rocket Lab is a promising play on the commercial space revolution, with technical expertise, diversified revenue streams, and defense backing. But profitability is years away, and execution risk on Neutron is high.

For traders: Expect sharp post-earnings moves, typically ±10–15%. Watch for updates on launch cadence, government wins, and Neutron timelines.

For beginners: Understand that Rocket Lab is an ambitious, capital-intensive company in a volatile sector. Success hinges on scaling operations efficiently and breaking into larger launch markets. While the growth story is exciting, the path is risky.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump expected to announce trade agreement with United Kingdom

What Jerome Powell said after Fed leaves key interest rate unchanged

US-China Trade Talks to Start This Week as Tariffs Start to Bite

India, UK successfully conclude mutually beneficial Free Trade Agreement

EU Eyes €100 Billion of US Goods With Tariffs If Talks Fail

China, Japan and South Korea will jointly respond to US tariffs

Supermicro Q3 Fiscal 2025 Earnings Preview and Prediction: What to Expect

Palantir Q1 2025 Earnings Report — Why the Stock Popped (Then Dropped)