The world’s most valuable company, Nvidia faces its toughest earnings test yet. Nvidia rides record AI demand into Q2, but US-China tensions, tariffs, and sky-high expectations raise the stakes.

Quick Snapshot: What You Need to Know

- Report Date: Wednesday, Aug. 27, after market close

- Street Consensus: ~$46.2B revenue, $1.01 EPS

- Policy Twist: Ban reversed, replaced with 15% China sales fee

- Stock Run: +35% YTD, +44% in 12 months, $4T market cap milestone

- Market Stakes: Options pricing in ~$260B swing in market cap

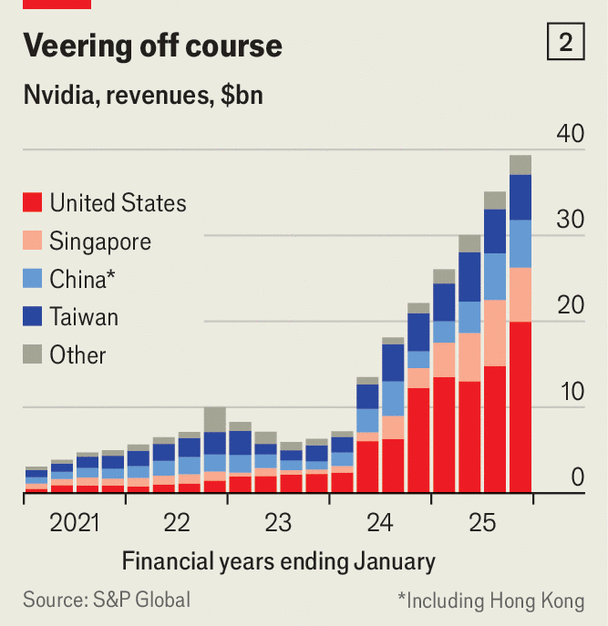

What Nvidia said last quarter about Q2 – Guided revenue: $45B ±2% for Q2 (fiscal Q2 ending July) after export restrictions; also warned of ~$8B hit from China H20 limits. In Q1, China was ~12.5% of revenue; Q1 included $4.6B H20 sales (pulled forward)

Latest Key Factors Influencing Q2

- China policy whiplash

In April, Trump banned Nvidia’s high-end chip exports to China, threatening an $8B hole in Q2 revenue. By July, the ban was reversed—but replaced with a 15% levy on all China sales, forcing Nvidia to funnel billions in revenue to Washington. Analysts warn that this cuts gross margins by 8–10%, setting a precedent no U.S. company has faced before.

Nvidia accepted the deal to regain access to its $17–18B China market, but Chinese regulators are warning domestic firms to avoid U.S. chips, dampening demand.

- China revenue & margin math: China was roughly ~13% of NVDA sales last year. Analysts expect the 15% fee to trim China margins and shave ~1ppt off company-wide gross margins near term.

- Roadmap for China: Nvidia is developing a Blackwell-based China chip more powerful than H20 (pending US approval). The White House indicated openness to scaled-down Blackwell exports.

- Hyperscaler capex still elevated: LSEG/Reuters tracking points to strong AI capex at major cloud players, key for NVDA data-centre demand continuity into 2H25.

- Supply Chain & New Product Ramp: Investors also want clarity on supply. Reports suggest Nvidia’s server rack yields improved to 85%, enabling ~30,000 Grace/Blackwell shipments this year. Next up: the GB300 superchip, a successor to GB200, could launch as soon as September. Meanwhile, the Blackwell ramp will test whether Nvidia can sustain leadership while scaling capacity under geopolitical pressure.

Anticipating Strong Growth – At a Slower Pace

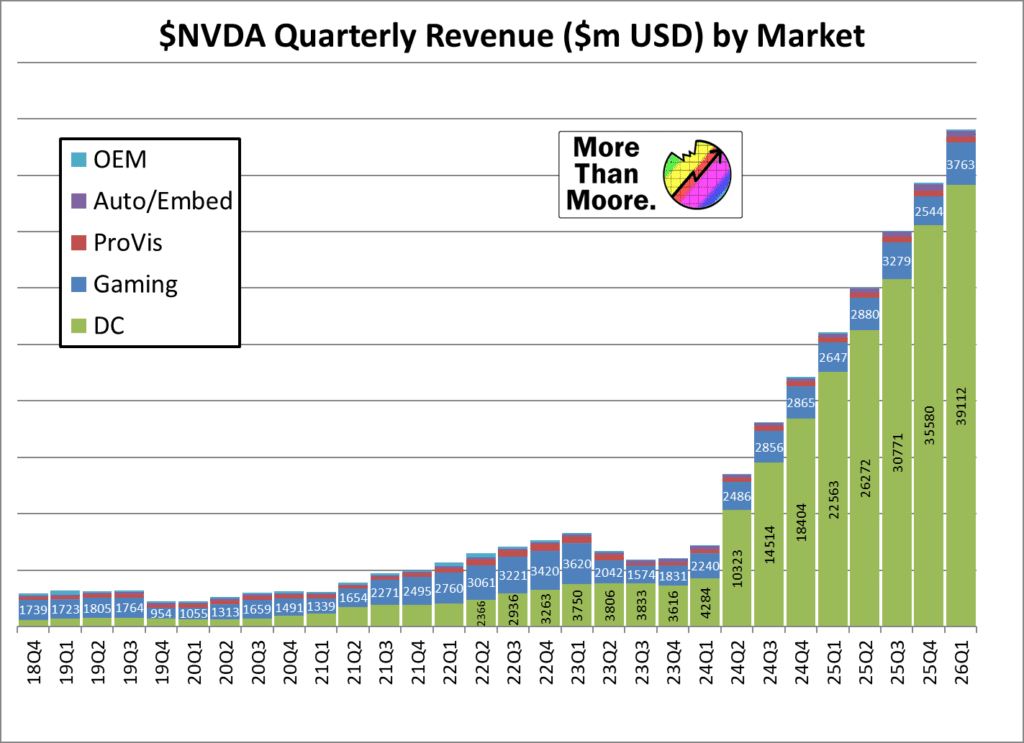

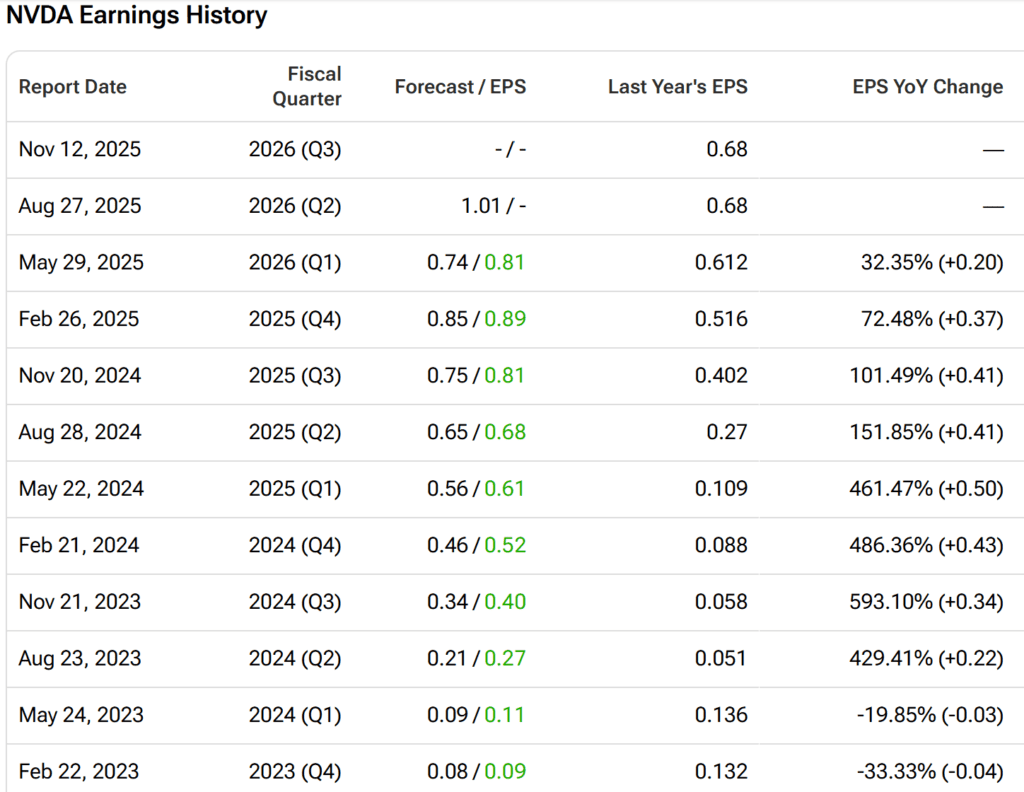

Wall Street expects $46.2B in revenue and $1.01 EPS, up ~50% year-over-year. That’s still blockbuster growth, but slower than last year’s triple-digit surge.

- Data Center Revenue: ~$41.2B (up from $26.2B a year ago)

- Gaming Segment: ~$3.8B

- Gross Margins: ~mid-70s% range, with slight compression from the China fee

The takeaway: growth remains extraordinary, but is normalizing. Nvidia’s data center segment dominates the story, driven by hyperscaler AI capex.

Tariff Threats and Exemptions

The Trump administration has floated a 100% tariff on imported semiconductors unless companies manufacture in America. Nvidia is likely exempt, thanks to its fabless model and limited U.S. operations. But the rhetoric highlights how geopolitics now shapes semiconductor valuations as much as technology.

On the other side, Beijing is doubling down on semiconductor self-reliance, accelerating GPU and chip alternatives. In the short term, Chinese firms still rely heavily on Nvidia’s accelerators, but the push for homegrown chips is a long-term headwind.

Bullish vs. Bearish Views on Nvidia

Bullish Case

- Demand > Supply in AI DC: Street models Data Center ~$41.2B this quarter (vs $26.2B YoY, +~57%); Gaming ~$3.8B. That mix implies AI remains the profit engine.

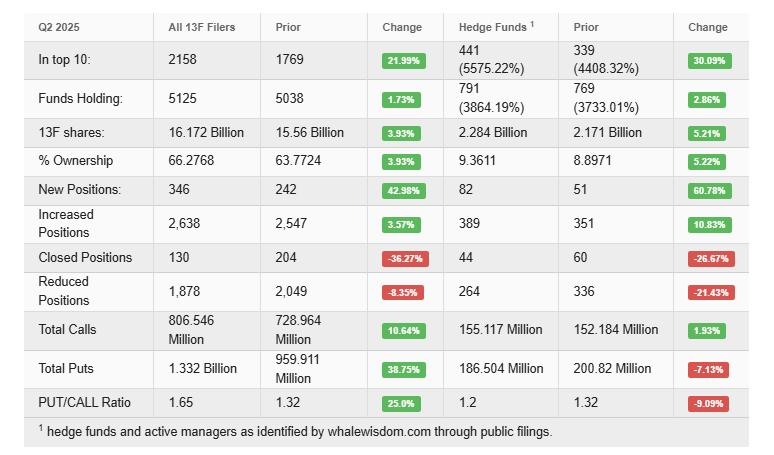

- Macro heft & leadership: NVDA is #1 by market cap (~$4.4T) and ~8% of S&P 500—the market is effectively pricing continued leadership in AI accelerators and systems.

- Guidance bar may be beatable ex-China: Even with China uncertainty, Street models ~$46B Q2. WSJ highlights buy-side scenarios where without China revenue could still track mid-50s ($54–$55B) if hyperscaler ramps hold—leaving room for positive surprises on commentary. (UBS scenario, not baseline)

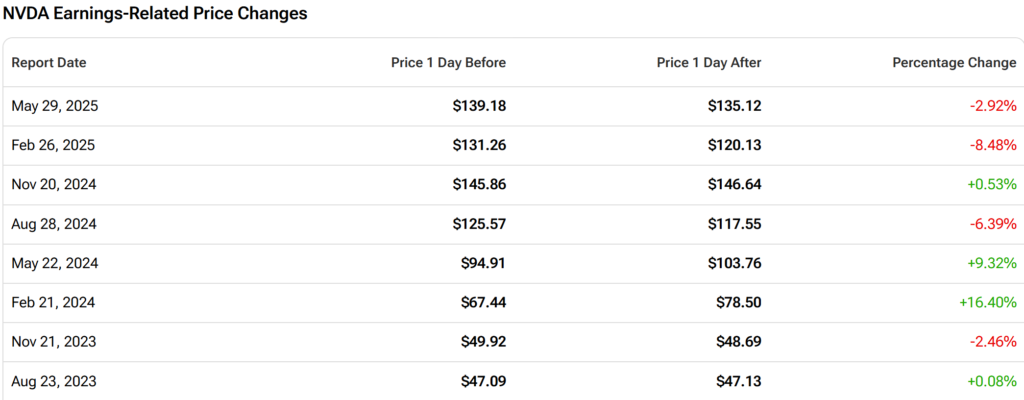

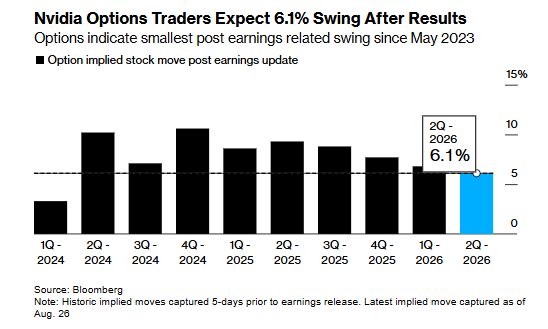

- Options setup & realized moves: Typical post-earnings move ~7.6–7.7% historically; current ~6% implied suggests asymmetric upside if print/guidance clears the bar.

- Pipeline for China (optionality): Blackwell-based new China chip (pending approval) offers a path to recapture part of the ~13% China contribution over time.

Bearish Case

- China drag + fees: The 15% revenue cut on China sales + regulatory chill led to reports of H20 production pauses; near-term China revenue could be near zero for Q2, removing a historical ~10–13% tailwind.

- Margins compressing: Consensus GM ~72.1% vs mid-70s last year; Reuters notes China fee could shave ~1ppt off overall GMs, raising sensitivity to any mix/price changes.

- Valuation loaded with perfection: With NVDA at multi-trillion cap and index-leading weight, even a meet-not-beat on revenue or cautious Q3 guide could trigger a >6% downside move (options market).

- “AI ROI” skepticism building: A 95% of firms see no bottom-line benefit (yet) MIT finding is feeding caution. If NVDA tone hints at slower orders/digestion, bears will press.

Market Expectations & Prediction Setup

Consensus:

- Rev: $45.9–46.5B

- EPS: ~$1.01

- Gross margin: ~72% (vs mid-70s in prior year)

- Segment: DC ~$41.2B, Gaming ~$3.8B

- Options implied move: ~6% (≈ $260B market cap swing)

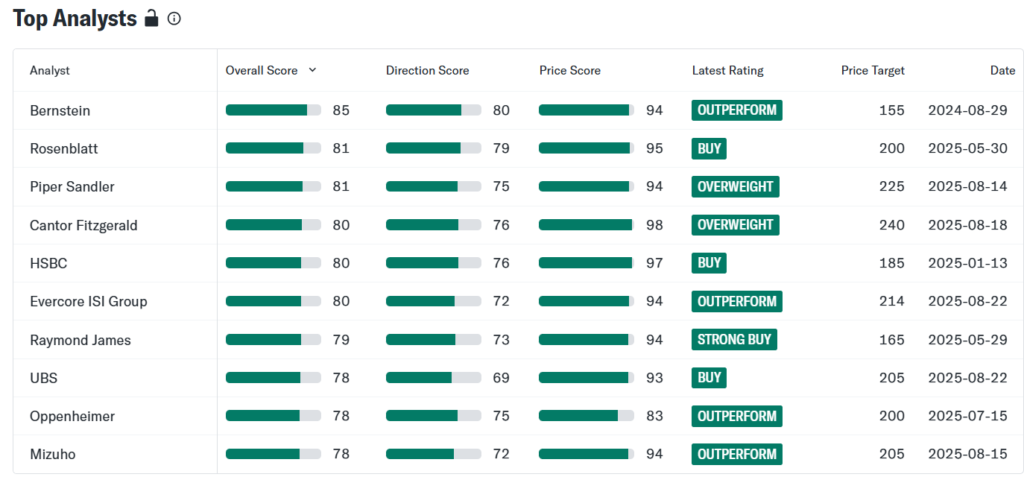

- Price Targets: $155–$225, most clustered above $200

Here is expectation cases :

- Base case: Inline-to-small beat on rev/EPS; GM ~72%; guide language cautious around China licensing timing, will cause knee-jerk volatility, but sustained direction depends on Q3 guide and Blackwell ramp commentary.

- Upside skew: If management signals ex-China demand strength remains “sold-out,” confirms smoother GB200/Blackwell supply, and frames China as incremental optionality, stonks up.

- Downside skew: Any light guide, GM below 71.5%, or hesitant hyperscaler capex tone, equivalent to quick de-risking in AI complex.

What to Watch on the Call

- Q3 revenue guide & GM bridge: Does GM path move back toward mid-70s later this year?

- China specifics: Timing/scale of license approvals, any H20 → Blackwell-for-China transition details.

- Hyperscaler capex signals: Any explicit commentary tied to MSFT/AMZN/GOOGL/META 2H25 spend cadence.

- Supply chain & racks: Update on GB200 rack yields (~85%) and shipment cadence into year-end. (Street chatter/analyst notes to date)

- Segment color: DC vs. Gaming mix, networking/software pull-through, and any Blackwell availability timeline.

If Nvidia beats and guides clean—especially if it frames China as upside optionality and shows Blackwell ramp clarity—the AI trade likely re-accelerates. If margins or guide wobble, the AI digestion thesis gains steam and the 6% implied move may break to the downside.

Nvidia’s Q2 earnings are no longer just a company update, they are a referendum on the AI supercycle and a stress test of U.S.–China policy. If Jensen Huang delivers strong numbers and bullish guidance, Nvidia could ignite another AI rally. But if growth slows, or management turns cautious on China, the “AI bubble” sceptics will find their moment.

Nvidia earnings tonight are Wall Street’s biggest event of the quarter, and could move not just one stock, but the direction of the entire market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana