Netflix turned in another blockbuster quarter on paper: revenue jumped 16 %, profit soared 47 %, and free cash flow nearly doubled, helped in no small part by a dollar that’s been sliding since May. Management even nudged its full‑year outlook higher. Yet when the numbers were released, the shares softened after hours, reminding investors that a record-high stock price sets a very high bar. Below are the key details behind the beat, the guidance lift, and why the market still wants more convincing before pushing $NFLX to fresh highs.

The numbers

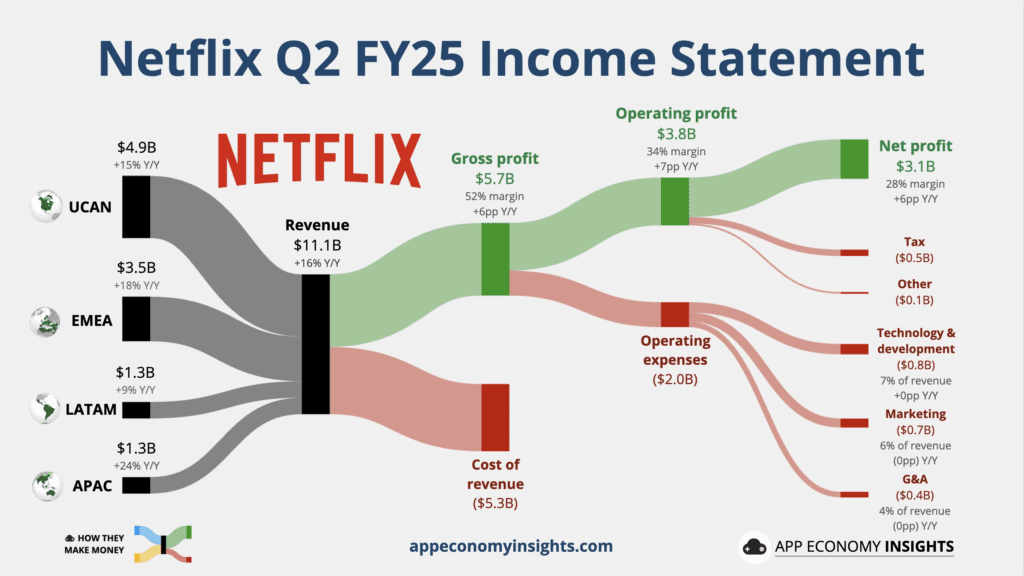

- Revenue: $11.08 B (+16 % YoY) vs. $11.07 B est.

- EPS: $7.19 (+47 % YoY) vs. $7.08 est.

- Free cash flow: $2.27 B (+87 % YoY) vs. $2.17 B est.

A softer U.S. dollar padded the top line and shaved costs abroad, helping operating margin expand nearly seven points to 34.1 %.

Guidance tweaks

| Metric | New FY‑25 range | Prior range | Street est. |

|---|---|---|---|

| Revenue | $44.8 B–$45.2 B | $43.5 B–$44.5 B | $44.56 B |

| Operating margin | 29.5 % | 29 % | 29.7 % |

| FCF | $8.0 B–$8.5 B | “~$8.0 B” | $8.91 B |

For Q3, Netflix guided to revenue of $11.53 B and EPS of $6.87, both ahead of consensus.

Segment highlights (YoY)

- U.S./Canada: $4.93 B (+15 %)

- EMEA: $3.54 B (+18 %)

- Latin America: $1.31 B (+8.6 %)

- APAC: $1.31 B (+24 %)

Growth remains broad‑based, though Latin America and APAC came in fractionally below Street targets.

Why the stock dipped

Netflix closed up 1.9 % ahead of the release but fell ~1 % after hours:

- Expectations bar was high. Shares touched an all‑time high ($1,341) in late June, pricing in aggressive goals—doubling revenue and hitting a $1 T market cap by 2030.

- Currency tailwind isn’t forever. Management credited much of the beat to FX; investors worry organic momentum may slow if the dollar rebounds.

- Cash‑flow guide missed. FY‑25 FCF of $8.0–$8.5 B trails the $8.9 B consensus, hinting at heavier content and live‑event spending.

- No more subscriber metric. Without quarterly membership data, bulls have less real‑time proof that ad‑tier and live‑events bets are delivering.

Management’s view

- “Healthy member growth and ad sales” plus FX gains drove the outlook boost.

- Ad‑supported tier is on track to double ad revenue in 2025.

- Price hikes landed “broadly in line with expectations.”

Big‑picture target

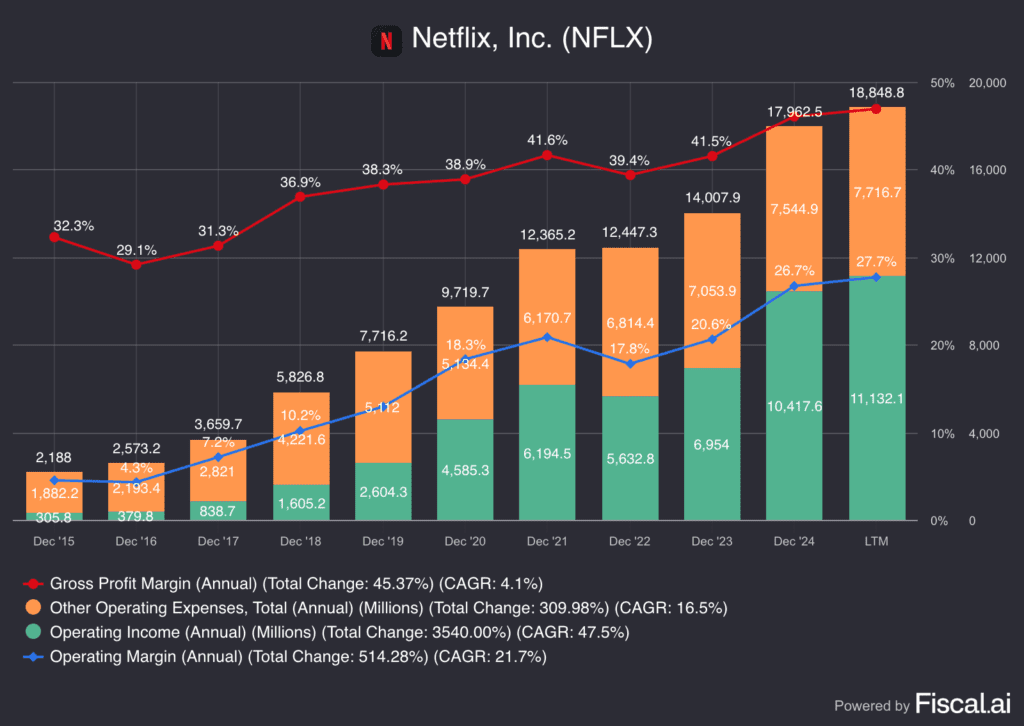

Netflix still aims for 400 M subscribers, $1 T market cap, and triple the operating income by 2030—but analysts like Seaport’s David Joyce warn the company “may need time to execute before another leg up.” Average Street target sits near $1,270, just above current levels.

Solid quarter, but with the stock near record highs and much of the FX boost considered one‑off, investors want to see sustained ad growth and content wins before pushing the shares higher.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?