Markets steadied Monday after last week’s wild swings, as traders brace for a packed week of Fed speak, inflation data, and Nvidia’s earnings.

Related: Nvidia Earnings, Fed Signals, and Inflation Data: A Pivotal Week for Markets

Last Week in Review

Markets churned through a volatile week of Fed signals, earnings, and trade jitters:

- Early week selloff — Tech and crypto led losses as investors rotated into defensive sectors, shedding over $1T in market cap.

- Earnings mixed — Retailers like Home Depot and Lowe’s beat expectations, while Target flagged leadership changes and Walmart warned of tariff-driven price hikes.

- Fed minutes revealed a divided committee: some members pushed for rate cuts to offset labor softness, while others cautioned that tariff inflation remains a risk.

- Thursday pain — Hurricane Erin headlines and trade tensions drove stocks into a fifth straight decline.

- Friday rebound — Jerome Powell’s Jackson Hole speech hinted at September cuts, sending the Dow to record highs and calming volatility. Traders now price in an 85% chance of a 25bps cut next month.

Intel grabbed attention late in the week by confirming the US government would take a 10% stake via CHIPS Act grants, marking an unprecedented public-private tie-up in semiconductors.

How We Opened This Week

Markets in Asia opened strong Monday, with China blue chips at three-year highs and Japan’s Nikkei edging higher. Industrial metals rallied after Powell’s dovish tilt, as a weaker dollar boosted demand.

But in Europe and US futures, the mood was more restrained. The Stoxx 600 slipped around 0.2% and S&P 500 futures edged lower, as traders weigh whether last week’s optimism was a temporary burst or the start of a new leg higher.

Powell, Trump, and the Stakes Ahead

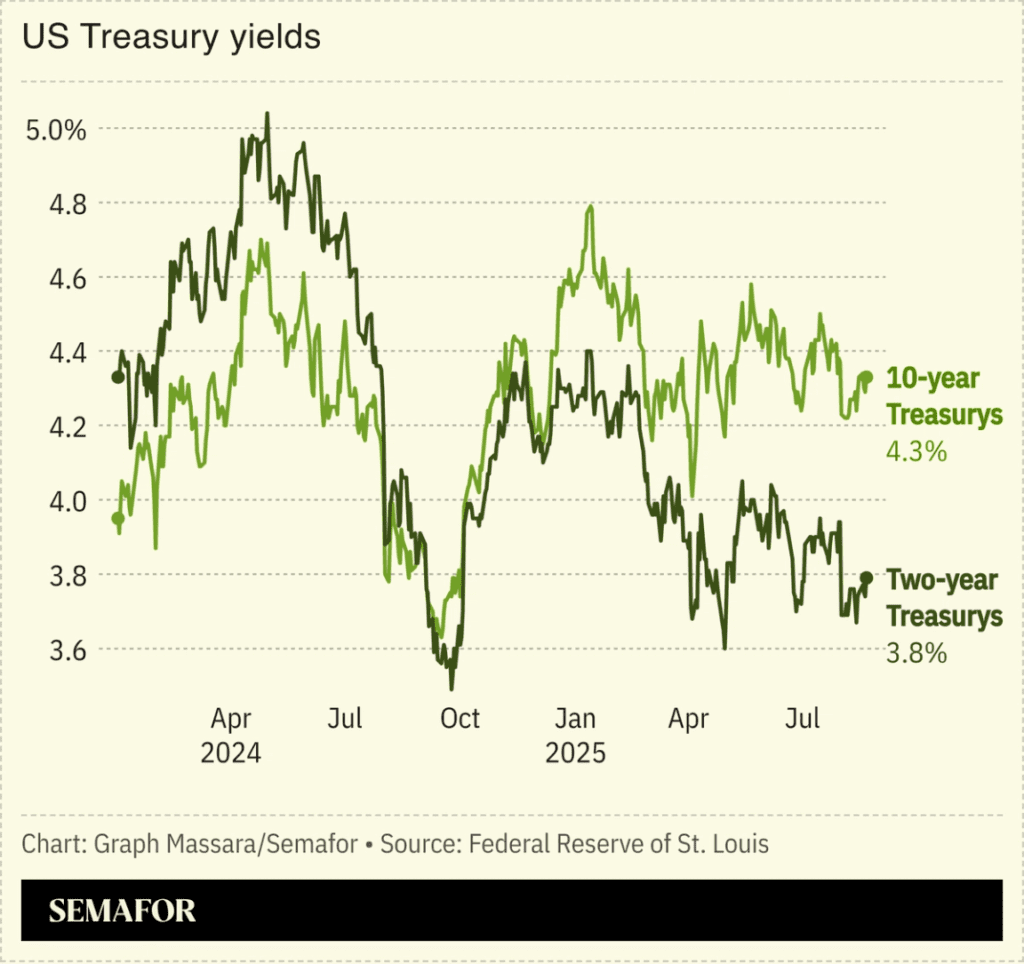

US Federal Reserve Chair Jerome Powell’s signal that the central bank will likely cut interest rates next month triggered last week’s market rally, but a dearth of clear data has investors on edge. Powell nodded to rising inflation as a result of President Trump’s tariffs, but made no mention of Trump’s pressure campaign to lower borrowing costs. While Trump may soon get his wish, it’s unclear how much rates might fall, especially if upcoming employment and inflation data are mixed.

Markets could be tested this week when chip giant Nvidia reports its earnings on Wednesday. As economist Paul Krugman warned, “If the AI boom goes bust, the odds are high that the US economy will be plunged into a recession.”

Fear & Greed Index

CNN’s Fear & Greed Index sits in Greed territory, showing investor sentiment has turned bullish — but also highlighting the risk of overconfidence as markets price in rate cuts.

Today’s Key Events

- 08:30 – Chicago National Activity Index

- 10:00 – US New Home Sales

- 10:30 – Dallas Fed Manufacturing Business Index

- 15:15 – Fed’s Logan speaks

- 19:15 – Fed’s Williams speaks

Earnings

- Before Open – Pinduoduo ($PDD)

- After Hours – Semtech ($SMTC), HEICO ($HEI)

After Powell’s dovish shift, the spotlight this week turns to Nvidia’s blockbuster earnings (Wed) and the Fed’s preferred inflation gauge, Core PCE (Fri). Both could reset the market tone after last week’s relief rally.

For now, sentiment is cautiously optimistic — but with tariffs, inflation risks, and an AI-driven market vulnerable to disappointment, Wall Street’s “Powell bounce” faces its first real stress test of the fall.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana