The Fed’s worst nightmare just got worse:

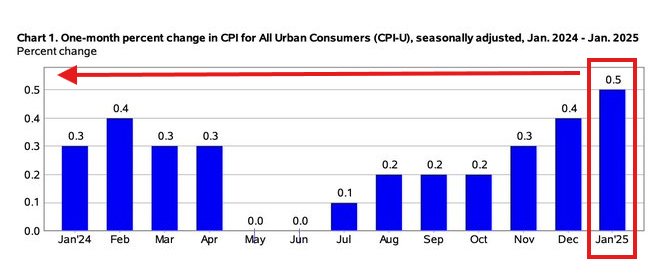

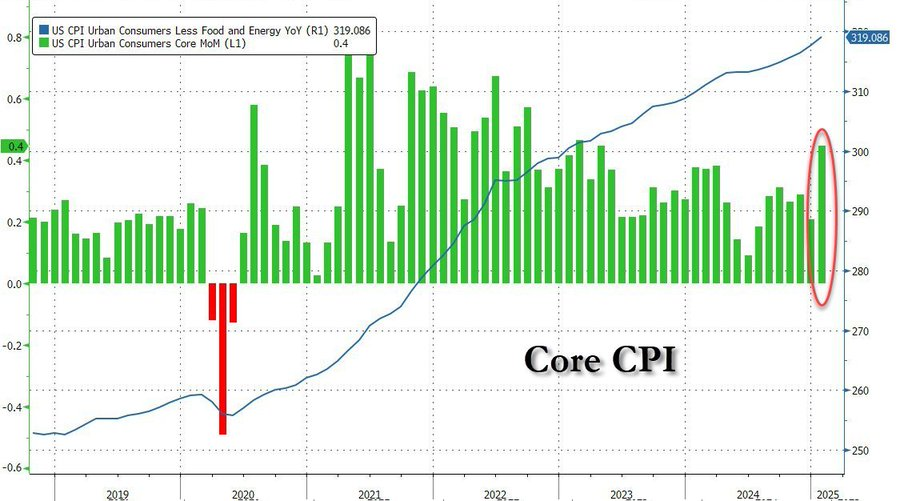

CPI inflation just officially JUMPED +0.5% in one month, the largest increase since August 2023. Core CPI inflation was expected to fall to 3.1% but instead ROSE to 3.3%.

What does this mean? Let TKL explain.

This was the hottest inflation report we have had since 2023. Headline CPI inflation was expected to remain flat, at 2.9%, while Core CPI inflation was expected to fall to 3.1%. Instead, inflation posted a large jump and hit 6+ month highs.

This has HUGE implications.

And, it gets even worse.

Headline CPI rose by +0.5% Month-over-Month, above expectations of +0.3%. This marks the first +0.5% increase since August 2023. Not even the early 2024 rebound in inflation saw CPI jump by this much on one month.

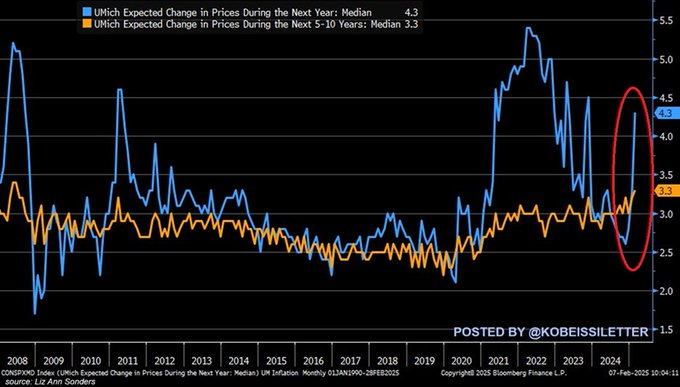

5 days ago, this chart showed SURGING inflation expectations. US consumers’ 12-month inflation expectations are up to 4.3%, the highest since November 2023. This marks a 1.7 percentage point jump over the last 3 months, the largest surge since February 2020.

The month-over-month increase in Core CPI is more concerning, chart via Zerohedge. Not only was +0.4% above expectations of +0.3%, but it DOUBLED from the +0.2% seen in December. This data has yet to reflect the full effects of newly established tariffs on China and others.

The data officially puts the 10-year note yield back above 4.60%. This is +20 basis point above the lows seen just a few days ago. Such a sharp move higher in the bond market emphasizes just how hot the inflation data was.

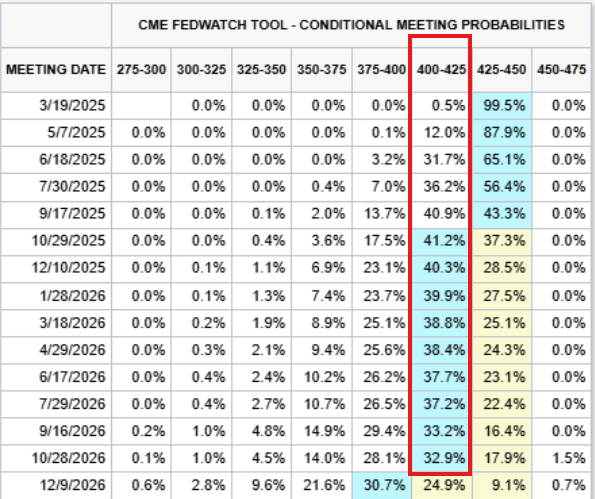

So, what about Fed rate cut expectations?

This chart is wild.

After the data, the market now sees ONE rate cut this year, in October 2025. From there, the market does not see another rate case until DECEMBER 2026. The market effectively sees higher rates for years to come amid the recent data shifts.

And the ultimate wildcard is what tariffs will do to the inflation situation.

As seen below, one-year inflation expectations are skyrocketing since the trade war began. We could see an average tariff rate of 20%+, the highest in 30 years. Inflation just got even hotter.

We are seeing various market disruptions seemingly weekly at this point. Between DeepSeek, trade wars, and inflation, we expect market swings to become larger and more tradable.

To top things off, CPI inflation on used cars and trucks jumped by +2.2% in January.

This marks the largest monthly jump since May 2023.

Consumers will definitely feel the effects of the recent price surges.

Related:

Super Micro (SMCI) Surges After Filing Update—Can It Recover From Its Accounting Scandal?

Rocket Labs (RKLB) vs Intuitive Machines (LUNR): The Likely Winner in 2025?

Physical Gold BUYING Went Apocalyptic: What to Expect

Short positioning in Ethereum is now up +40% in ONE WEEK: What do hedge funds know is coming?

Elon Musk and Coinbase’s CEO proposed putting ALL US spending on blockchain. What does this mean?

Trump’s 25% Tariffs on Steel & Aluminum: What It Means for Stocks

Top Funds Absolutely Adore These 6 Stocks — And Love Tesla, Too

Trump to Announce Reciprocal Tariffs: Is a New Stock Dip Coming?

Key Events to Watch in [Week] & Their Market Impact

Bullish Momentum vs. Financial Reality in Palantir

Here Are 10 Most Polarizing Stocks in Market Right Now & Why Critics Might Be Wrong