Markets are gearing up for an event-packed week, with economic data, Fed decisions, and high-profile earnings taking center stage. While the earnings calendar is lighter than in previous weeks, the economic releases and central bank updates could significantly sway investor sentiment.

Monday, March 17

- Retail Sales (8:30 AM ET): Previous: +0.6% MoM in February (surprised to the upside). Markets typically react strongly; a weak number often sparks recession concerns. Historically, a surprise decline in retail sales in March 2023 led to a 1.2% drop in the S&P 500 that day.

Tuesday, March 18

- Housing Starts & Building Permits: Last Report: Housing Starts fell -14.8% YoY in January. Weakness in this metric previously triggered selloffs in homebuilder stocks like LEN and DHI.

- Nvidia (NVDA) CEO Jensen Huang’s GTC Keynote: In 2024, Huang’s AI announcements drove NVDA stock up 5% the next day. Focus: Rubin AI chip details could be a major market mover. (Nvidia Stock Rises Ahead of GTC Conference as Investors Await Vera Rubin AI Chip Details)

Wednesday, March 19

- FOMC Rate Decision (2:00 PM ET): Market Expectation: Hold rates steady, signal future cuts. Last March Fed meeting led to a 2.5% S&P 500 rally after Powell hinted at easing.

- Fed Press Conference (2:30 PM ET): Powell’s tone is key; dovish comments historically push tech stocks higher.

- Crude Oil Inventories (10:30 AM ET): Past Drawdowns: WTI crude spiked 3% following large inventory declines in January 2025.

- Earnings: General Mills, Williams Sonoma, Ollie’s Bargain Outlet, Five Below: In 2024, FIVE missed revenue guidance, dropping 6% in after-hours.

Thursday, March 20

- Philadelphia Fed Manufacturing Survey (8:30 AM ET): Last Report: Declined to -9.5, signaling contraction.

- Initial Jobless Claims (8:30 AM ET): Continued strength under 220K filings has previously buoyed markets.

- Existing Home Sales (10:00 AM ET): January saw a surprise rebound; stocks like LEN and ZG rallied 4-6% after the release.

- Earnings: Accenture, PDD, Darden, FactSet, Nike, Micron, FedEx, Lennar: Nike earnings last quarter fell short of guidance; stock dropped 4%. Micron has been a barometer for the memory chip market. Q4 2024 EPS beat by 5%, stock rallied 8%.

Friday, March 21

- Earnings: Nio, Carnival, Miniso: Nio’s previous report showed 18% YoY sales decline; stock fell 12%. Carnival exceeded occupancy expectations in Q4 2024, stock jumped 6%.

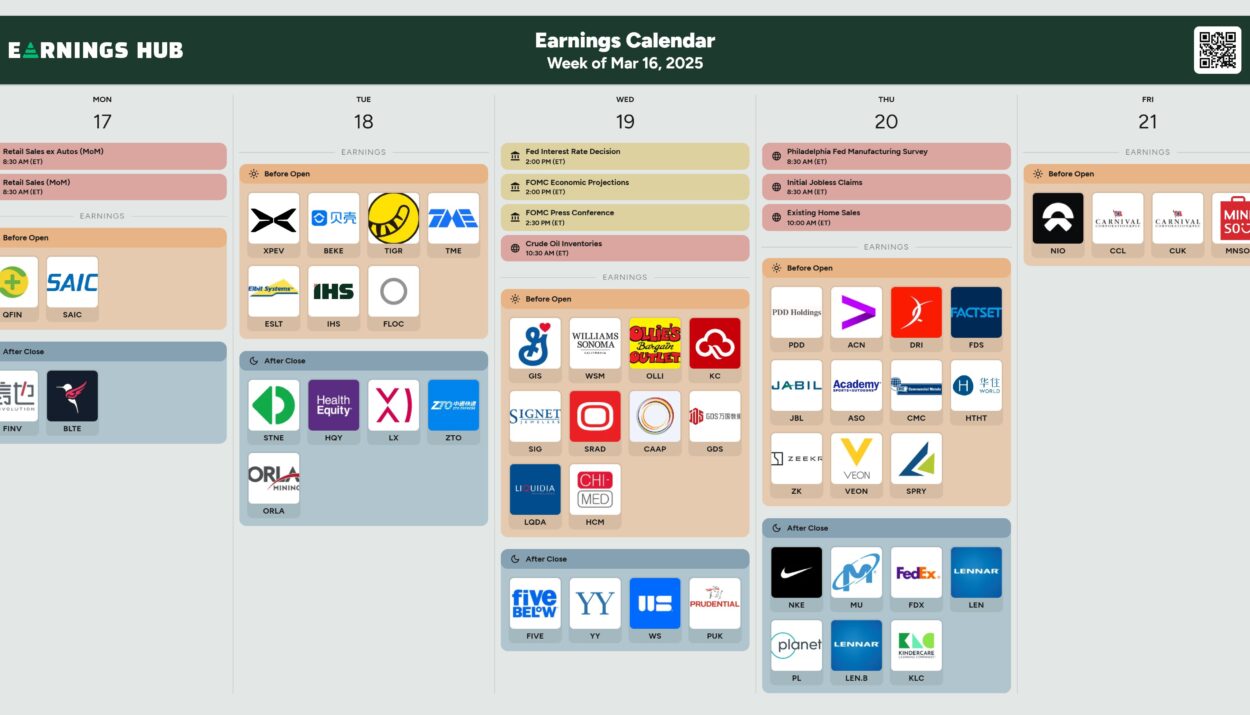

Earnings Calendar:

| Date | Company | Sector | Time | EPS Estimate | Revenue Estimate |

|---|---|---|---|---|---|

| Mon, Mar 17 | QFIN | Finance | Before Open | N/A | N/A |

| Mon, Mar 17 | SAIC | Technology/Defense | Before Open | $1.70 | $1.86B |

| Mon, Mar 17 | FINV | Finance | After Close | N/A | N/A |

| Mon, Mar 17 | BLTE | Healthcare | After Close | -$0.20 | N/A |

| Tue, Mar 18 | XPEV | Automotive/EV | Before Open | -$0.29 | $1.1B |

| Tue, Mar 18 | BEKE | Real Estate/Technology | Before Open | $0.15 | $2.4B |

| Tue, Mar 18 | TME | Entertainment/Streaming | Before Open | $0.11 | $900M |

| Tue, Mar 18 | STNE | Fintech | After Close | $0.29 | $600M |

| Tue, Mar 18 | HGQY | Healthcare | After Close | $0.12 | N/A |

| Tue, Mar 18 | ORLA | Mining | After Close | $0.05 | $56M |

| Wed, Mar 19 | GIS | Consumer Staples | Before Open | $1.05 | $5.1B |

| Wed, Mar 19 | WSM | Retail | Before Open | $5.46 | $2.2B |

| Wed, Mar 19 | OLLI | Retail/Discount Stores | Before Open | $0.84 | $625M |

| Wed, Mar 19 | FIVE | Retail/Discount Stores | After Close | $3.79 | $1.35B |

| Thu, Mar 20 | ACN | IT Consulting | Before Open | $2.66 | $15.9B |

| Thu, Mar 20 | DRI | Restaurants | Before Open | $2.60 | $2.97B |

| Thu, Mar 20 | FDS | Financial Services/Analytics | Before Open | $4.18 | $540M |

| Thu, Mar 20 | NKE | Apparel/Footwear | After Close | $0.76 | $12.2B |

| Thu, Mar 20 | MU | Semiconductors | After Close | $0.39 | $4.99B |

| Thu, Mar 20 | FDX | Logistics | After Close | $3.47 | $22.05B |

| Thu, Mar 20 | LEN | Home Construction | After Close | $3.12 | $8.03B |

| Fri, Mar 21 | NIO | Automotive/EV | Before Open | -$0.25 | $2.05B |

| Fri, Mar 21 | CCL | Cruise Lines | Before Open | $0.15 | $5.79B |

| Fri, Mar 21 | MNSO | Retail/Consumer Discretionary | Before Open | $0.24 | $500M |

With FOMC decisions, major economic data, and high-profile earnings, markets face a volatile week

- Fed dovishness often triggers rallies.

- Nvidia’s GTC announcements have historically boosted both NVDA and the broader AI sector.

- Consumer data surprises can heavily influence sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Quantum computing leader reveals historic breakthrough

Russia Turns to Cryptocurrencies to Bypass Sanctions and Sustain Oil Trade

Bitcoin panic selling costs new investors $100M in 6 weeks — Research

Oracle: How Project Stargate and OCI will fuel growth

Why China Isn’t Worried About Trump’s New Trade War Like It Was in 2018

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory