A high-stakes geopolitical gamble is unfolding in global financial markets. Investors are quietly positioning for a potential reopening of Russia’s economy, betting that former President Donald Trump’s backchannel efforts to end the war in Ukraine could lead to the lifting of sanctions and Russia’s reintegration into global financial markets.

According to a Bloomberg Big Take report, traders at a prominent London brokerage have recently been scouring the globe for Russian debt, including dollar-denominated bonds issued by energy giant Gazprom. These bonds have been nearly untradeable since Western sanctions hit Russia in the wake of its 2022 invasion of Ukraine.

Now, there is renewed interest from Middle Eastern family offices and other high-net-worth investors looking to acquire these heavily discounted securities, wagering they could surge in value if a peace deal emerges and sanctions are relaxed.

“There’s an aggressive search for securities of Russian issuers around the world,” said Evgeny Kogan, a Moscow-based investment banker. “Investors are asking how quickly they can enter the Russian market.”

Trump’s Role in the Speculation

Reports suggest that Trump allies are quietly engaging with Moscow, exploring options for a ceasefire or peace deal to end the ongoing conflict in Ukraine. Any such resolution could unlock Russia’s $40 billion in frozen sovereign assets, normalize trade relations, and pave the way for Russia’s re-entry into global capital markets.

While official channels remain silent, rumors of Trump’s geopolitical maneuvering are already influencing investor behavior.

Ruble Bets on the Rise

Beyond bonds, non-deliverable forwards (NDFs) tied to the Russian ruble are gaining attention. These derivatives allow investors to bet on ruble movements without directly transacting in Russian assets, sidestepping sanctions risks.

Money managers report that sales teams are actively gauging interest in such trades, suggesting growing speculative activity in currency markets as well.

Risks Remain High

Despite growing interest, investing in Russian assets remains high-risk.

- Sanctions are still in place, and premature moves to re-engage with Russia could lead to reputational damage.

- Even if a peace deal is struck, sanctions relief is far from guaranteed, as European and U.S. policymakers remain cautious.

- There’s also the moral question for institutions that may be perceived as backing a country responsible for Europe’s largest conflict since World War II.

Final Thoughts

For now, these speculative plays remain confined to a niche group of investors. But the mere existence of such activity highlights how geopolitical developments, particularly those involving Donald Trump’s potential diplomatic moves, are reshaping market sentiment about Russia’s long-term economic prospects.

For investors: This is a high-risk, high-reward scenario. While the potential for significant gains exists if Russia reopens to global finance, the risks of premature re-entry remain considerable.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

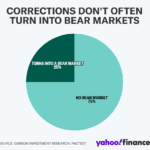

Stock market today: S&P 500 enters correction, Dow sinks

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app