The MicroStrategy liquidation:

As MicroStrategy, $MSTR, falls over -55%, many are asking about “forced liquidation.” The company now holds $44 BILLION worth of Bitcoin, could they be forced to sell it?

Is liquidation even possible? Let us explain.

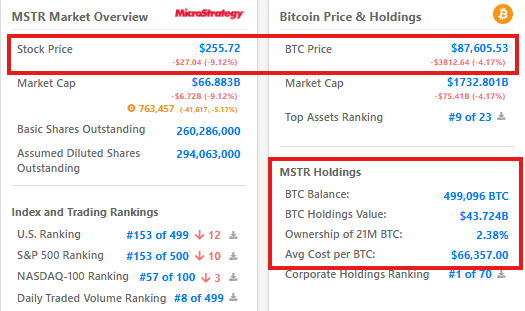

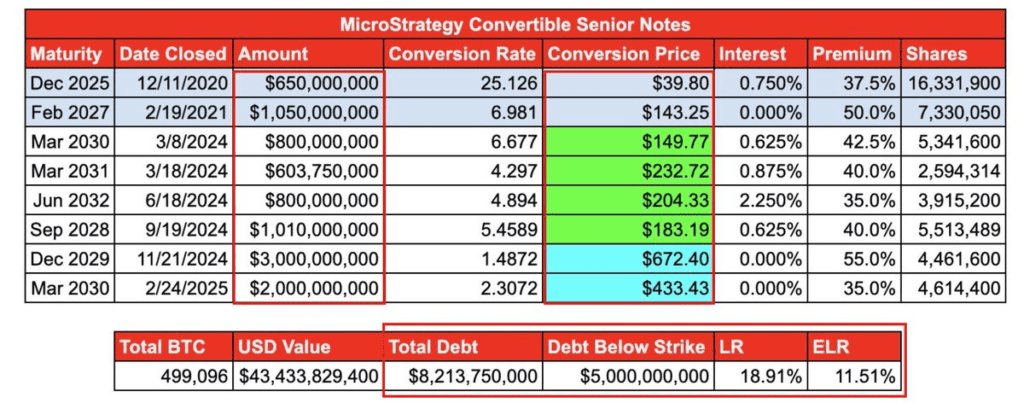

MicroStrategy currently holds ~499,096 Bitcoin worth a total of $43.7 billion. Their average cost to acquire each Bitcoin is around $66,350.

So, here’s a question we are getting a lot: What happens to $MSTR if Bitcoin falls significantly below their average entry price?

Let us begin by stating that this isn’t the first time liquidation is mentioned. $MSTR has been buying Bitcoin for years and there have been MULTIPLE bear markets since then.

This includes the 2022 bear market when Bitcoin fell from ~$70K to ~$15K.

Is this time different?

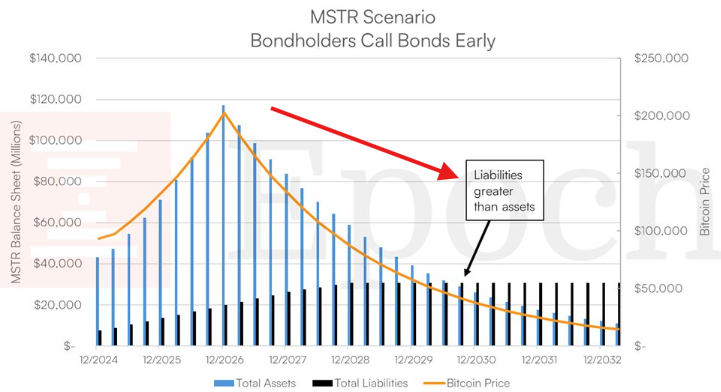

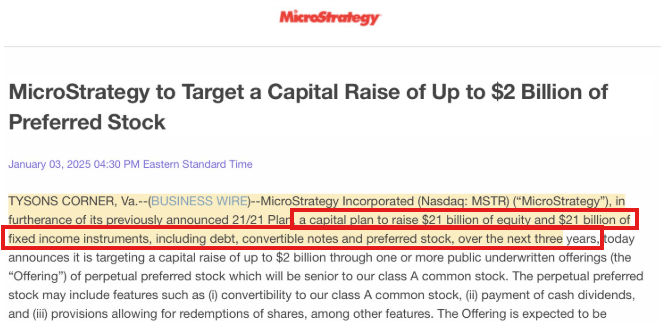

First, $MSTR’s strategy is largely contingent on the ability to raise additional capital. In a situation where their liabilities rise significantly higher than their assets, this ability could deteriorate.

However, this doesn’t necessarily mean “forced liquidation.”

Why do they need the ability to raise capital? Because it’s their entire “business model:”

1. Borrow money through 0% convertible notes

2. Buy Bitcoin and drive price higher

3. Sell new shares at premium and buy more bitcoin

4. Repeat

This is a crucial point. Currently, $MSTR holds ~$8.2 billion of total debt for ~$43.4 billion of Bitcoin. They have a leverage ratio of ~19%.

As seen below, MOST of this debt is held in convertible notes with conversion prices BELOW the current share price.

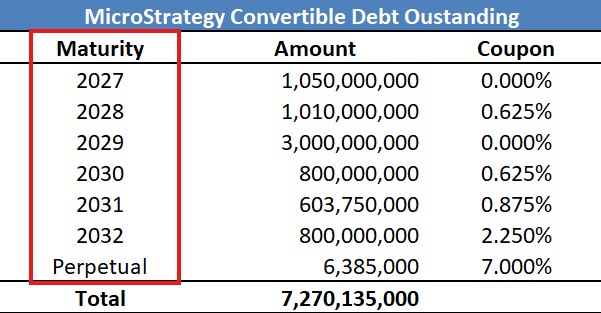

Most of this doesn’t mature until 2028.

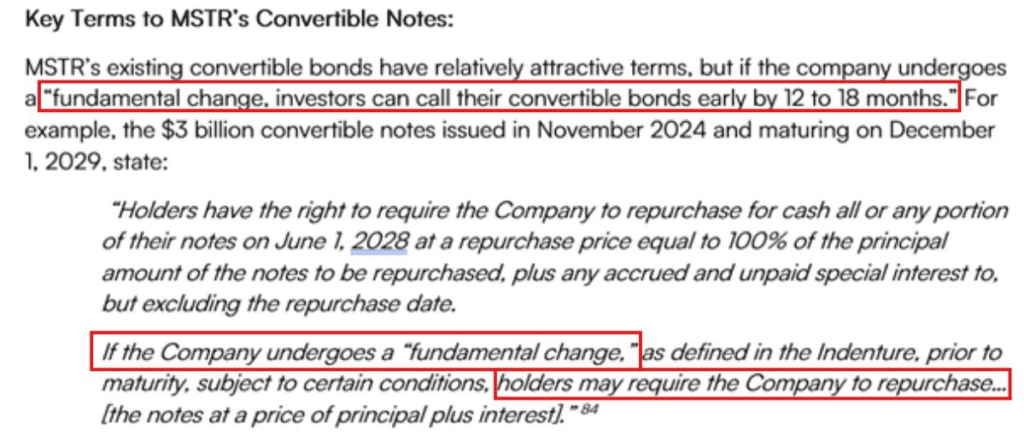

Now, let’s take a look at the credit agreements on this debt.

Just about the only way a “forced liquidation” occurs if there is a “fundamental change” at the company. This COULD require $MSTR to liquidate Bitcoin holdings is an early redemption is called on the notes.

So, what exactly is a “fundamental change?”

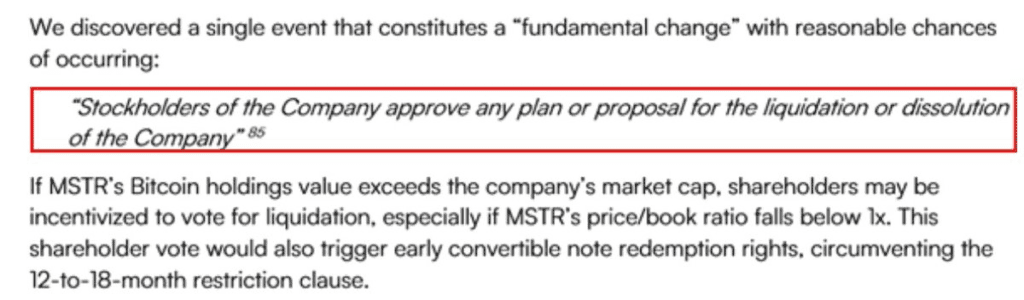

As seen in the below per EpochVC, a shareholder approval is needed for the liquidation or dissolution of the company. Effectively, for liquidation to occur there would first need to be a stockholder vote or a corporate bankruptcy.

The advantage for MicroStrategy here is that they have bought time.

However, what if these convertible bonds remain below the conversion price at maturity, beginning in 2027+? For this to happen, Bitcoin would need to fall well over 50% from current levels and remain there.

Michael Saylor was asked about liquidation recently.

His answer was that even if Bitcoin fell to $1, they still would not get liquidated. They would “just buy all of the Bitcoin.”

While this sounds good in theory, the convertible note holders cannot be forgotten.

Michael Saylor was asked about liquidation recently.

— The Kobeissi Letter (@KobeissiLetter) February 25, 2025

His answer was that even if Bitcoin fell to $1, they still would not get liquidated.

They would "just buy all of the Bitcoin."

While this sounds good in theory, the convertible note holders cannot be forgotten. pic.twitter.com/al2KQFR09A

From a technical viewpoint, forced liquidation of $MSTR is not necessarily impossible.

But, it is highly unlikely. This is particularly due to the way the convertible notes are structured and multiple price variables at play. It would need a “mayday” situation to occur.

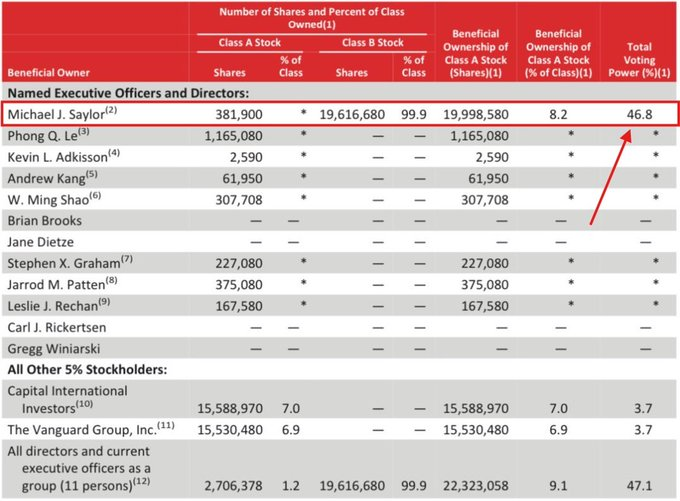

Also, let’s not forget that Michael Saylor himself currently holds 46.8% of the voting power. Therefore, it is almost impossible to pass a shareholder vote without Michael Saylor.

In the case of a “fundamental change” in the company, Saylor could easily vote against it.

With that said, a major drop in $MSTR and/or Bitcoin could certainly hinder their ability to raise capital.

As we mentioned, continuous capital raises, which are then funneled into Bitcoin, are vital to $MSTR’s strategy.

Would investors still fund this in a bear market?

We are now witnessing the first “bear market” in MicroStrategy since it gained popularity in 2024.

The question becomes: will investors continue to buy the dip here? Michael Saylor says “Bitcoin is on sale.”

Source: TKL

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

3 Value Stocks that are Backed by the World’s Largest Activist Hedge Fund

Why Nvidia’s earnings are important to the entire US stock market

Daily Market Brief: Stocks Struggle, Bitcoin Drops & Earnings Highlights

Trade War and Market Panic: Are Short-Term Dips Long-Term Opportunities?

The Market Begins a New Trading Trend: Contrarian Trump Trades

Hedge Funds Loaded Up AI Stocks at the Fastest Pace Since 2021

These Stocks Could Skyrocket According to “Trends With No Friends” Strategy!

Market Looks Strong—But Whales Are Quietly Exiting, Should You?

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4