Black Friday deals can be tempting, but planning ahead can help you save money and avoid overspending. Here’s how:

1. Set a Budget

- Decide on an overall spending cap (e.g., $500) or allocate specific amounts for gifts and personal buys.

- Use last year’s spending as a reference to fine-tune your budget.

2. Plan Ahead

- Research deals and compare prices early. Use retailer ads and online roundups to create a shopping list.

- Stick to your list to avoid impulse purchases.

3. Use 0% APR Cards Wisely

- Consider credit cards with 0% APR offers if you need time to pay off your balance.

- Ensure you pay off the balance before the introductory period ends to avoid interest.

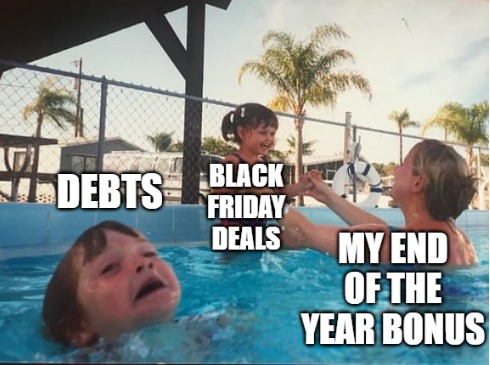

4. Avoid Credit Cards if You Have Debt

- Focus on paying down existing balances.

- Try cash-only shopping to limit spending and avoid adding to debt.

5. Leverage Credit Card Rewards

- Use rewards cards for extra savings or sign-up bonuses.

- Examples:

- Capital One Venture Rewards: Earn 75,000 miles with $4,000 spending in 3 months.

- Prime Visa: Get a $200 Amazon Gift Card instantly (for Prime members).

6. Hunt for Additional Discounts

- Use browser extensions for coupons and cash-back offers.

- Watch for price-matching policies and set price alerts for big-ticket items.

7. Use Credit Card Protections

- Look for cards offering purchase protection, extended warranties, or return protection for added peace of mind on big purchases.

8. Maximize Welcome Bonuses

- Align holiday spending with cards offering welcome bonuses:

- Chase Sapphire Preferred: 60,000 points after $4,000 spending (worth $750 via Chase Travel).

- Amex Gold: 60,000 Membership Rewards points after $6,000 spending in 6 months.

9. Add Shopping Offers

- Check your card’s online account for special offers like discounts or extra cash back at specific retailers (e.g., 10% back at DoorDash).

Stick to a plan, take advantage of rewards, and avoid overspending this Black Friday. A little preparation can keep your finances intact while you snag great deals!

Related articles: