U.S. stocks have recently experienced a shift from a strong uptrend to a notable decline, with the S&P 500 down 5% and the Nasdaq down more than 7% since reaching all-time highs. This decline is consistent with a surge in pessimism in market sentiment, driven by economic concerns, including Walmart’s weak business forecast, falling consumer confidence, an unexpected increase in initial unemployment claims, and renewed tariff concerns.

In addition to the factors mentioned, several other negative influences are weighing on the U.S. stock market:

- Stagflation risk: The economy shows signs of slowing while expectations of long-term inflation rise. This combination threatens to stagnate economic growth and prolong the duration of high prices.

- · High Valuations Currently, US stock valuations, especially in the information technology and financial sectors, have reached historical highs. This has raised concerns about sustainability and potential overvaluation.

- · Weakened capital support: Market fund inflows have weakened significantly, indicating fatigue. In addition, as the tax filing season approaches, demand from retail customers has clearly declined.These factors have combined to increase investors’ caution about the short-term outlook for the U.S. stock market.

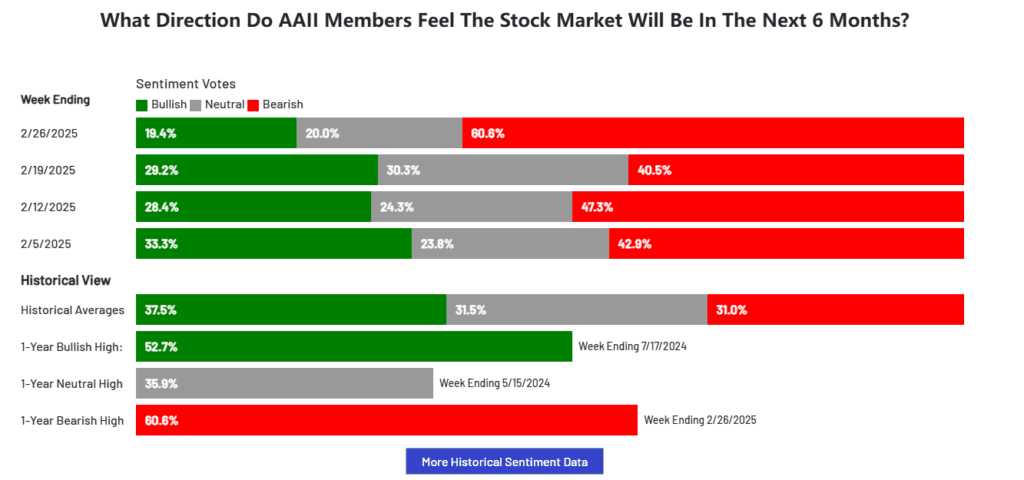

Pessimism peaks in US stock market

Investor confidence appears to have taken a hit, with more than 60% now expecting U.S. stocks to fall further over the next six months – a sentiment not seen in the past year. The negative outlook contrasts with the optimism that prevailed when President Trump was elected, despite concerns about tariffs and economic pressures.

Nvidia Sets Record Revenue, But Is the Market Worried?

Against this backdrop, Nvidia’s (NVDA) financial results stood out. Despite reporting record fourth-quarter operating revenue of $39.3 billion (up 78% year-over-year) and net income of $22.1 billion (up 80% year-over-year), Nvidia’s stock has experienced volatility. Market sentiment was affected by concerns about its first-quarter gross margin forecast that was lower than expected, and rising production costs for its Blackwell chips. In addition, the emergence of low-cost AI models like DeepSeek poses a challenge to Nvidia’s high-priced chip strategy.

However, Morgan Stanley remains optimistic about Nvidia’s prospects, highlighting the continued strong demand for Blackwell chips and predicting a recovery in AI spending in the next 6-9 months. They believe that the pressure on Nvidia’s gross margin is temporary and that the company is about to reach the point where it can fully unleash Blackwell’s potential. As Nvidia’s stock price continues to adjust amid market volatility, the artificial intelligence leader’s valuation is seen as moving to more rational levels, reflecting the struggle between the market’s bulls and bears.

US stocks slide: Is now the time to buy tech giants?

Amid recent volatility in the U.S. stock market, the focus has turned sharply to whether now is the best buying opportunity for the equity of the eight largest U.S. technology giants. In this context, Barron’s analysis highlights that Nvidia’s forward price-to-earnings ratio shows that its stock is relatively undervalued compared to historical data. Among the U.S. technology elite, often referred to as the “Big Seven”, Nvidia appears particularly attractive in terms of price.

The perceived underestimation stems from several factors:

- Highly crowded trade in its stocks

- Ongoing debate about the long-term sustainability of its business model

- Various short-term market disturbances

These issues, while often viewed as negative, fit well with the strategy of a long-term value investor. Concerns about crowded positions, doubts about the long-term prospects of the business, and fast-moving market disruptions may indeed present a compelling entry point for those focused on long-term gains.

Patience is required amid ongoing market volatility.

The market landscape still lacks positive momentum, and a slew of economic data will be released that could confirm concerns about slowing economic growth. Factors such as DOGE and ongoing tariff issues have added uncertainty and complicated the market outlook. In the short term, the market is expected to be volatile, and investors need to remain patient and hold their nerve until volatility subsides.

Check this: Covid and a Reminder about Long Term Investing

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Defense Stocks Soar as Europe Seeks Own Peace Plan for Ukraine

Trump, Chip Maker TSMC Expected to Announce $100 Billion Investment in U.S.

After Trump announced the US Strategic Crypto Reserve, What’s coming next?

Market Debate: Economic Slowdown or Sector Rotation?

Methods for More Consistent Gains in Penny Stocks

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors