Markets are entering a high-stakes week, fresh off a sharp pullback driven by rising Treasury yields, growing fiscal concerns, and the latest Trump tariff drama. While US markets were closed Monday for Memorial Day, the rest of the week is packed with major economic data, tech earnings, and new Fed signals.

Investors will focus on three core themes:

- Nvidia’s earnings report (Wednesday)

- PCE inflation data (Friday)

- Fresh fallout from Trump’s trade threats and tax bill

Here’s a full breakdown of what to expect — with a detailed calendar included at the end.

Trump Tariffs Back in the Spotlight

On Friday, President Trump reignited trade war fears by threatening a 25% tariff on Apple products made outside the US, and a sweeping 50% tariff on all EU goods beginning June 1. By Sunday, however, he reversed course — delaying the EU tariffs until July 9 after a call with European Commission President Ursula von der Leyen.

Markets responded quickly:

- Nasdaq and Dow fell ~2.4% last week

- S&P 500 dropped 2.6%

- Treasury yields spiked as fiscal concerns and Trump’s tax plans shook bond markets

Even with the tariff delay, Piper Sandler’s Michael Kantrowitz noted that trade uncertainty remains elevated. “Markets need to see these tariffs retracted AND bond yields not spike again for any material move higher,” he wrote Friday.

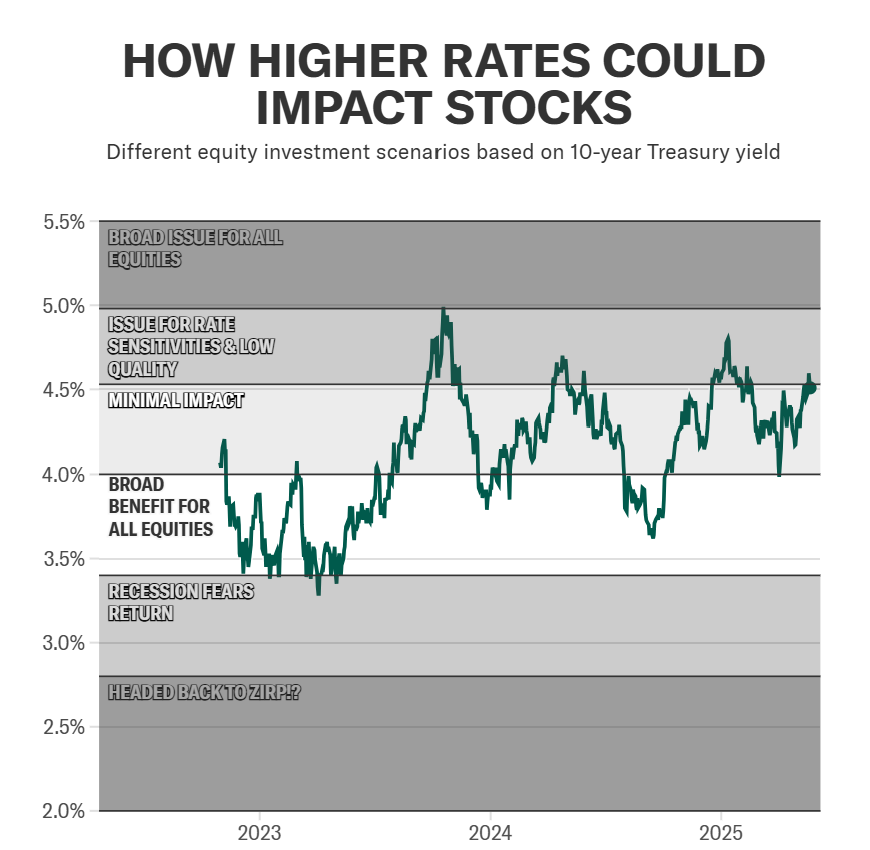

Treasury Yields Surge — Then Pull Back

- The 30-year Treasury yield flirted with 5.1%, its highest since 2007.

- The 10-year yield briefly climbed above 4.6% before retreating under 4.5% Friday.

Rate-sensitive stocks felt the heat: The Russell 2000 fell nearly 4% last week — underperforming the S&P 500’s 2.6% drop — as smaller firms with higher interest rate exposure took a beating.

Nvidia Earnings (Wednesday After the Close)

This week’s highlight is Nvidia’s Q1 earnings. Wall Street expects:

- EPS: $0.88

- Revenue: $43.3 billion

(Last year: $0.61 EPS on $26B revenue)

Why it matters:

- Nvidia is the single biggest driver of S&P 500 gains since ChatGPT’s launch in 2022.

- The stock is roughly flat YTD amid AI chip competition and tariff fears, despite recently returning to a $3T market cap.

Analysts and investors will watch closely for:

- Any signs of slowing AI demand

- Revenue updates from Asia and Europe amid trade tensions

- Commentary on the $25 billion Saudi AI chip deal

PCE Inflation Report (Friday)

The Fed’s favorite inflation gauge drops Friday, with markets laser-focused on:

- Core PCE YoY: 2.5% expected (vs. 2.6% in March)

- Core PCE MoM: 0.1% expected (vs. 0% prior)

BofA economist Aditya Bhave warns May data (out in June) will give the first real read on tariff impacts. So while this week’s PCE data may show improvement, future price spikes could follow if tariffs escalate.

GDP Revision & Fed Outlook (Thursday & Wednesday)

Thursday brings a key GDP update:

- Q1 GDP (2nd rev.): -0.3% expected

- Q1 Personal Consumption: 1.8%

Wednesday: FOMC Minutes from May’s meeting could reveal how close the Fed is to pivoting rates — or tightening if inflation stays sticky.

Fed speakers this week:

- Tuesday: Kashkari

- Wednesday: Waller, Williams

- Thursday: Daly, Goolsbee

- Friday: Bostic, Goolsbee again

Consumer Mood and Spending

Reports on consumer confidence (Tuesday) and sentiment (Friday) will gauge public reaction to Trump’s policies and inflation fears. Retail inventories and trade balance data (Friday) may show early impacts of tariffs on supply chains.

Big Earnings Week

Besides Nvidia, watch for:

- Salesforce (CRM) – AI platform growth

- Marvell Tech (MRVL) – AI chip infrastructure

- Dell (DELL) – Enterprise AI demand, servers

- HP (HPQ) – Hardware spending & margin outlook

- Costco (COST) – Signs of tariff-related early buying

- Dick’s Sporting Goods (DKS) – Post-Foot Locker acquisition update

- AutoZone (AZO) – Used car repairs as new car prices spike

- PDD Holdings (Temu) – China ecommerce amid tariff pressure

- Li Auto – Tesla’s China EV rival

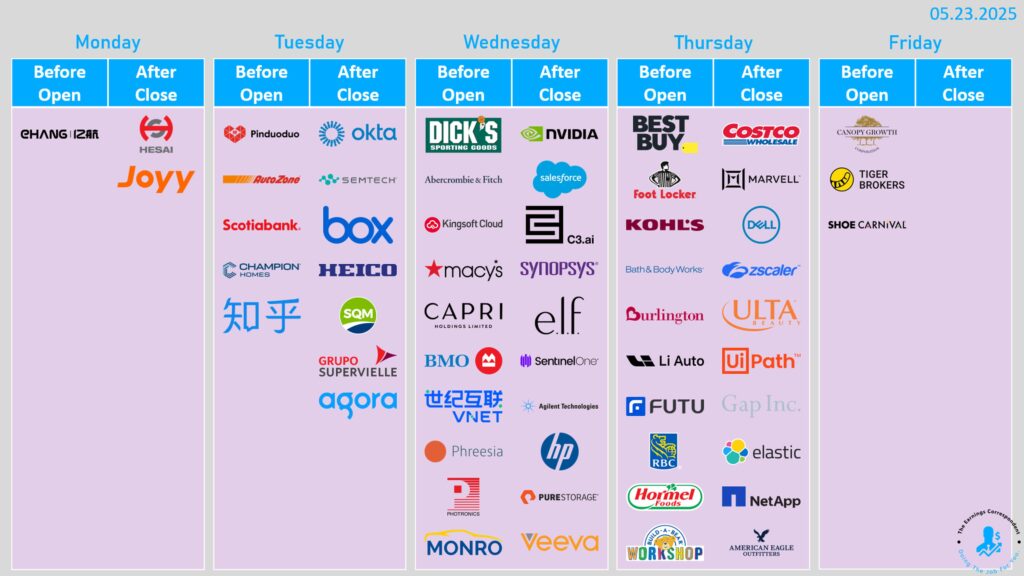

Full Weekly Calendar

Here’s a breakdown of what’s happening each day:

| Day | Events / Data Releases |

|---|---|

| Monday | Markets closed for Memorial Day |

| Tuesday | Durable goods orders, Case-Shiller home prices, Consumer confidence, Minneapolis Fed’s Kashkari, Earnings: AutoZone, Box, Okta, PDD |

| Wednesday | FOMC minutes, Fed speakers Waller and Williams, Earnings: Nvidia, Salesforce, HP, Dick’s Sporting Goods, Bank of Montreal, Synopsys, Agilent |

| Thursday | Initial jobless claims, Q1 GDP 2nd revision, Pending home sales, Fed speakers Daly and Goolsbee, Earnings: Costco, Dell, Marvell, Zscaler, Li Auto |

| Friday | PCE Inflation (Apr), Advance trade balance, Retail & wholesale inventories, Chicago PMI, Consumer sentiment, Fed speakers Bostic, Goolsbee, Shoe Carnival earnings |

This week may define how markets navigate the summer. Nvidia’s results will steer tech sentiment. PCE will set inflation expectations. And Trump’s tariff timeline — now delayed but not forgotten — looms large.

isclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Media Slams $3B Crypto Report as “Fake News”

China has quietly relaxed export restrictions on rare earth elements

Hedge funds are shorting stocks again, boosting leverage to new record

Trump says he’ll delay a threatened 50% tariff on the European Union until July

Angry Elon Is Back — And He’s Betting Big on Driverless Teslas and AI

Elon Musk’s Qatar Meltdown: “NPCs,” Jeffrey Epstein, Tesla Denial, and Prison Promises

Trump Escalates EU Trade Clash With 50% Tariff Threat: “The Deal Is Set”

Most Trump Crypto Dinner VIPs Have Moved or Dumped Their Coins: Inside of Dinner