BigBear.ai is set to report its Q1 2025 earnings on Wednesday, May 1, after market close — and Wall Street is watching closely. As one of the most volatile names in the AI space, BBAI sits at the intersection of AI enthusiasm, government contracts, and retail trader attention.

With shares battered after a 15% drop and a pending lawsuit, Q1 could make or break sentiment for this under-the-radar Russell 2000 name.

Expected Q1 2025 Results

What’s at stake: Expectations are muted — and that may be BBAI’s opportunity.

- Revenue estimate: ~$48.3M (MarketBeat, Nasdaq)

- EPS estimate: -$0.04 per share (MarketWatch, MarketBeat)

- Previous Year Revenue: $42.2M

- Previous Year EPS: -$0.06

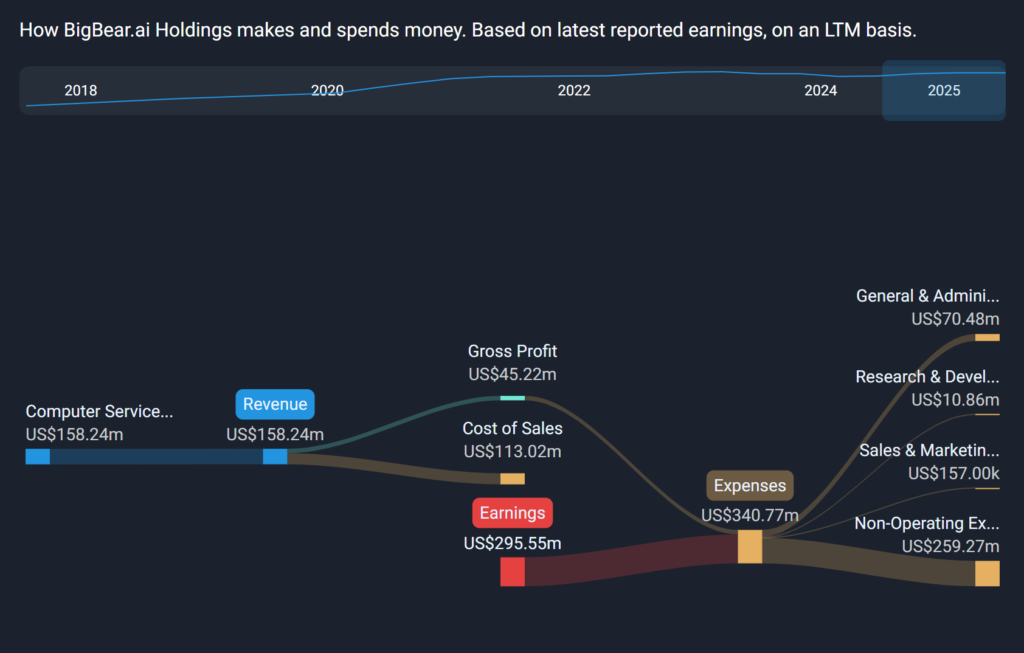

Why it matters: BigBear.ai is not yet profitable, but investors want to see evidence of scaling revenues, narrowing losses, and sustainable backlog growth.

Key Focus Areas

Here’s what will drive the quarter’s reaction.

✅ Government and Defense Contracts: BigBear.ai’s lifeblood is U.S. government, defense, and intelligence contracts.

- Recent deals with the U.S. Army and Air Force are expected to contribute to Q1 numbers

- The company’s artificial intelligence analytics are used in defense, cybersecurity, logistics, and intelligence

Why it matters:

In an AI sector dominated by consumer hype (think ChatGPT), BBAI’s defense focus is a differentiated — and potentially resilient — revenue stream.

✅ Commercial Expansion: BigBear.ai has been expanding into commercial markets, including healthcare, manufacturing, and supply chain.

- Investors are looking for signs that the company is diversifying beyond federal contracts

- Partnerships with private sector players will be key catalysts to watch

Why it matters: Relying too heavily on government spending is risky; commercial diversification is essential for long-term revaluation.

✅ Profitability Path:

- Analysts expect BBAI to post another quarterly loss

- But narrowing losses, improving gross margins, and cost discipline will be critical markers

Why it matters: With the stock under pressure, even small signs of operational improvement could spark a rebound.

✅ Backlog and Bookings

- Current backlog and future bookings are a top priority for analysts

- Orders from existing military clients and new sectors will signal future growth visibility

Why it matters: BBAI needs to prove it’s building a sustainable business, not just riding the AI hype wave.

✅ Stock Volatility and Short Interest

- Shares have been highly volatile, with short interest estimated near 20-25% of float (Finviz)

- There is chatter of a possible short squeeze, though risks of a sharp drop remain if earnings disappoint

Why it matters: Retail traders are closely watching — earnings could set up a big post-report move in either direction.

Bullish Drivers

1️⃣ Strong government and defense customer base: BigBear.ai’s core revenue comes from long-term contracts with U.S. defense, intelligence, and government agencies — including the Army, Air Force, and Department of Defense. These customers value BigBear.ai’s data analytics and AI modeling tools to improve military logistics, cybersecurity, and battlefield decision-making.

- According to Nasdaq and Globe and Mail, these government contracts provide a stable baseline of revenue that buffers BBAI against pure commercial-cycle volatility.

- The U.S. defense budget remains robust, with AI and data analytics as top spending priorities.

2️⃣ Expanding into commercial sectors: BBAI is broadening its reach into healthcare, supply chain, and manufacturing, which could significantly expand its total addressable market.

- Partnerships are underway to apply AI to hospital staffing, factory operations, and logistics route optimization.

- This diversification reduces dependence on government work and increases potential scalability.

3️⃣ Revenue growth trajectory: Analyst estimates show Q1 2025 revenue rising ~14% YoY to $48.3M vs. $42.2M last year (MarketBeat, Nasdaq). If BBAI can maintain this pace while improving margins, it may transition from a speculative bet to a legitimate AI growth story.

4️⃣ AI sector tailwinds

BigBear.ai operates in the hottest macro theme in tech — artificial intelligence. As the demand for AI analytics spreads across sectors, BBAI has opportunities to expand contracts, win new customers, and benefit from rising investor interest.

5️⃣ Potential short squeeze setup

Per Finviz and Globe and Mail, short interest on BBAI is estimated between 20–25% of float — a very high level.

- If earnings deliver even a modest beat or spark a bullish outlook, a short-covering rally could drive sharp upside moves in the near term.

- Retail traders on platforms like Stocktwits have been eyeing BBAI as a possible “gamma squeeze” play.

6️⃣ Russell 2000 inclusion + small-cap potential: As a member of the Russell 2000 index, BBAI benefits from ETF buying flows and institutional small-cap allocations, amplifying volatility and upside potential when sentiment turns positive.

Bearish Case for BigBear.ai

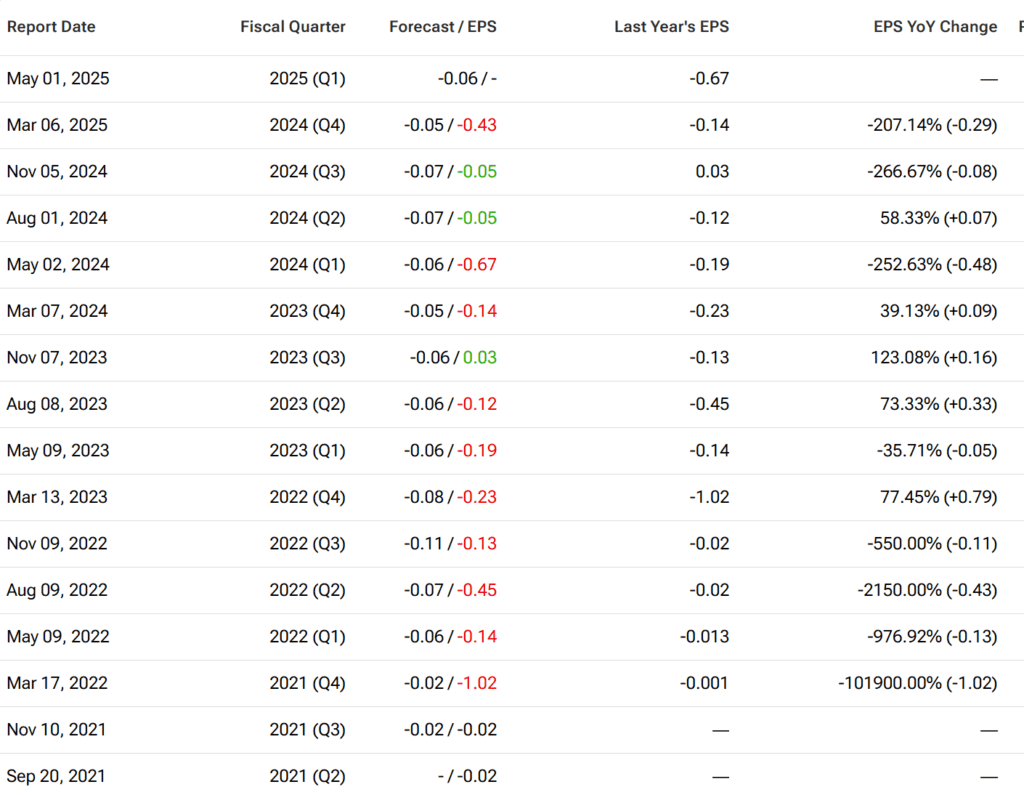

1️⃣ Still unprofitable with negative cash flow: BBAI’s Q1 EPS estimate is -0.04 per share, adding to a multi-year streak of losses (MarketBeat, MarketWatch).

- Without profitability or free cash flow, the company remains heavily reliant on capital raises or debt to fund operations.

- The risk of shareholder dilution or liquidity shortfalls is high if losses persist.

2️⃣ Heavy reliance on government contracts: While defense revenues are a strength, they are also a concentration risk.

- BBAI’s fate is tied to the federal budget cycle — any change in defense spending, contract competition, or regulatory delays could hit revenues.

- Unlike giants like Palantir, BBAI’s diversification into commercial verticals is early-stage and unproven.

3️⃣ Lawsuit and governance risks: Per GlobeNewswire, BBAI faces a pending class-action lawsuit for fraud, following a 15% stock price drop on disappointing results. Lawsuits increase legal costs, distract management, and create headline risk that can keep institutional investors on the sidelines.

4️⃣ Competitive and execution risks: The AI analytics sector is crowded with well-funded competitors like Palantir, C3.ai, and defence integrators like Raytheon and Booz Allen. BBAI needs to prove it can scale revenues, expand margins, and win new contracts before it gets credit as a serious competitor.

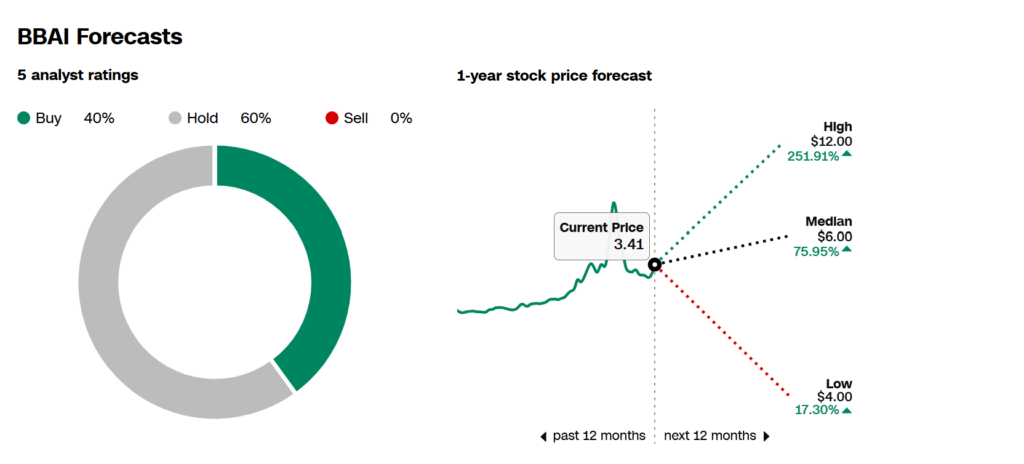

5️⃣ High volatility and retail speculation risk: BBAI’s stock has traded between $1.16 and $6.77 in the past year (Yahoo Finance), making it a magnet for traders but a nightmare for long-term investors. Heavy short interest cuts both ways — while it enables squeeze potential, it also signals deep scepticism from institutional investors.

6️⃣ Valuation disconnect from fundamentals: Despite its small size (~$260M market cap), BBAI trades at speculative multiples based on hype rather than earnings or cash flow. If earnings disappoint or the AI market cools, BBAI’s valuation could reset sharply lower.

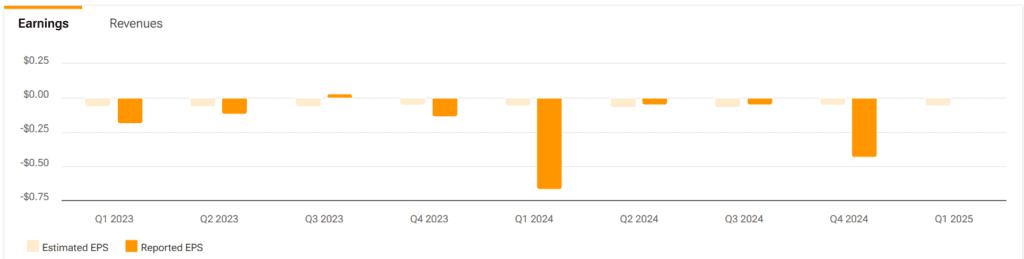

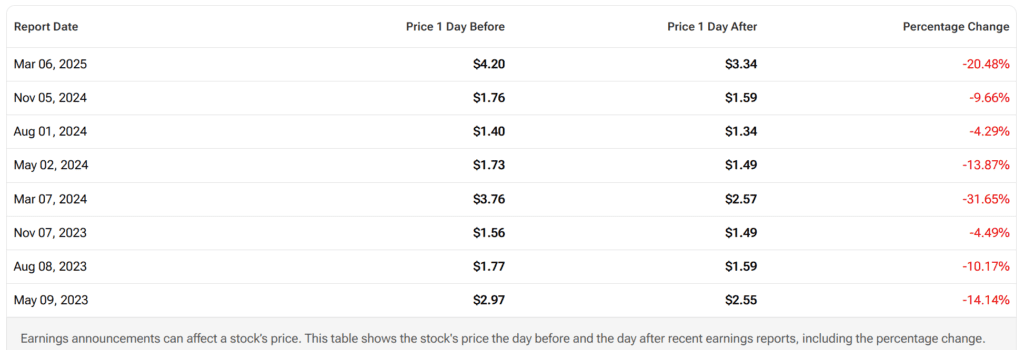

Earnings Surprise History

- BBAI has delivered mixed surprises, sometimes beating on revenue but missing on EPS

- The market has reacted sharply to both beats and misses, often swinging 10-20% post-earnings

Why it matters: With high short interest and low expectations, even a small beat could trigger major price action.

Stock and Valuation Snapshot

- Current price: ~$1.75 (MarketWatch, Yahoo Finance)

- 52-week range: $1.16 – $6.77

- Market cap: ~$260M

- P/E ratio: Negative (unprofitable)

- Wall Street sentiment: Mixed; no major institutional coverage, but retail trader focus is intense

- Price target chatter: Some small-cap analysts eye potential 50% upside if execution improves (Globe and Mail)

Why it matters: BBAI is a high-risk, high-reward microcap where sentiment can shift overnight.

Conclusion

BigBear.ai’s Q1 2025 earnings are a major test for this AI underdog.

The company needs to show progress on revenue growth, margin improvement, and contract wins — or risk losing what’s left of Wall Street and retail trader confidence. While short-squeeze chatter makes the setup exciting, the fundamentals must start to deliver.

For long-term investors, the big question is: Can BigBear.ai go from “AI hype stock” to a real AI business? We’re about to find out.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of MicroStrategy Stock Ahead of Earnings?

What Analysts Think of Amazon Stock Ahead of Earnings?

Apple Q2 2025 Earnings Preview and Prediction: What to Expect

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion