Amazon is set to report its Q1 2025 earnings on Thursday, May 2, after market close — one of the most anticipated moments this season. As an e-commerce titan, cloud powerhouse, and emerging AI leader, Amazon’s report will offer critical insights into the health of the consumer, the evolution of enterprise tech, and the trajectory of one of the world’s largest companies.

Here’s a deep dive into what to expect, what’s driving results, where the risks lie, and how Wall Street is positioned.

Expected Q1 2025 Results

What’s at stake: Analysts are looking for Amazon to deliver solid growth across its segments, while watching for signals on AI monetization, cloud momentum, and margin trends.

- Revenue: ~$142.5B

- EPS: $0.83 per share

- Previous Year Revenue: $127.4B

- Previous Year EPS: $0.64

Why it matters: Amazon is expected to post ~12% revenue growth YoY — a return to double-digit expansion, driven by strength in AWS and advertising. EPS growth is key, reflecting improved cost discipline.

Key Focus Areas

Let’s break down the critical engines of the quarter.

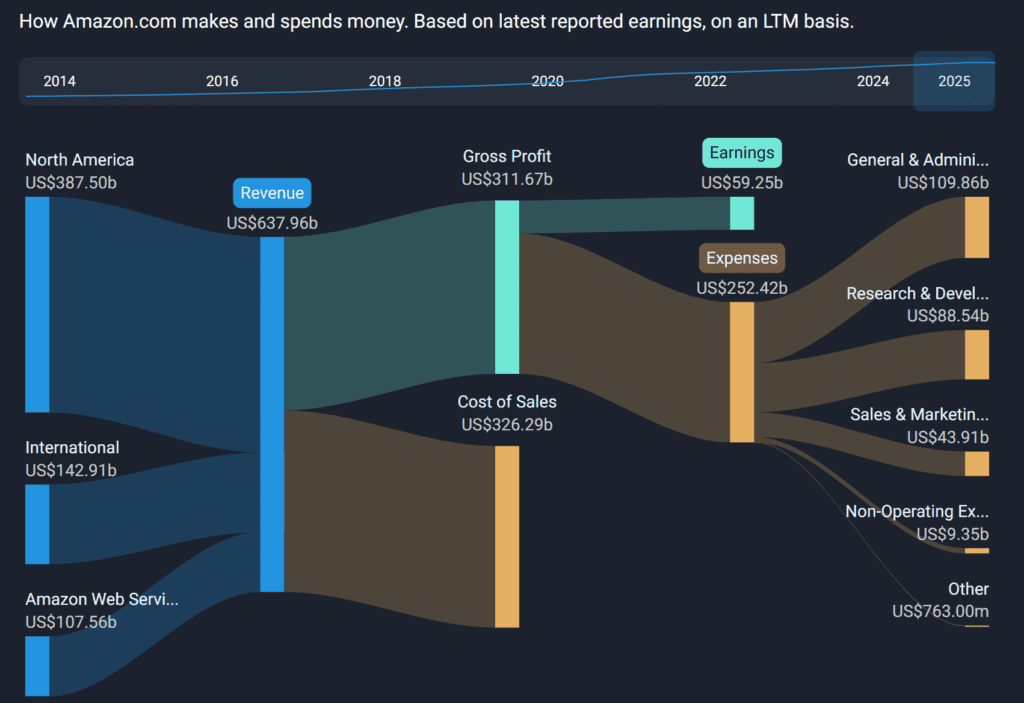

✅ AWS (Amazon Web Services) AWS is Amazon’s profit machine, contributing ~60% of operating income despite representing ~15% of revenue.

- Analysts expect AWS growth of ~15% YoY, rebounding from a recent slowdown (Investors.com, GeekWire)

- Key drivers: AI workloads, cloud migration, new enterprise deals

- AWS faces tough competition from Microsoft Azure and Google Cloud but is still viewed as the #1 market leader

Why it matters: AWS performance is the single most important factor in Amazon’s margin story — and investors want proof that AI is fueling a new phase of cloud growth.

✅ E-Commerce and Retail

- North America and International e-commerce sales expected to grow ~11–12% YoY (CNBC, Yahoo Finance)

- U.S. consumer strength is a tailwind, but international markets are mixed, with macro challenges in Europe and Asia

Key areas to watch:

- Prime membership retention

- Same-day and one-day delivery adoption

- Inventory efficiency and automation improvements

Why it matters: Amazon’s e-commerce segment is still its largest by revenue — but profits are thin. Investors want to see margin improvements from logistics investments.

✅ Advertising: Amazon’s advertising business is a quiet juggernaut, now delivering ~$14B+ per quarter.

- Expected growth: ~25% YoY (Barchart, Business Insider)

- Drivers: Sponsored product ads, streaming (Twitch, Freevee), and new AI-driven targeting tools

Why it matters: Advertising is Amazon’s highest-margin non-cloud business, helping offset retail’s thin profits.

✅ AI and GenAI Strategy: Wall Street is eager for updates on:

- Amazon Bedrock (GenAI platform)

- Custom AI chips (Trainium, Inferentia)

- Alexa AI upgrades

Why it matters: Amazon is seen as a sleeping giant in AI — strong signals here could reset the stock’s narrative and valuation.

✅ Margins, Costs, and Tariff Risks

- Operating margin expected at ~6% (vs. ~3.7% YoY), reflecting better fulfillment, automation, and cost cuts

- Watch for commentary on tariffs: Trump-era policies and new tariff tensions could raise input costs, especially in electronics and private-label goods (Yahoo Finance, Investors.com)

Why it matters: Amazon’s 2024 cost-cutting efforts paid off. Investors want reassurance that margins will continue to expand.

Challenges and Headwinds

- Macro risks: Softness in Europe and parts of Asia

- Cloud competition: AWS faces fierce pressure from Microsoft, Google, and Oracle

- E-commerce price wars: Temu, Shein, and Walmart are gunning for share

- Tariff uncertainties: White House trade policies could disrupt supply chains

- Labor pressures: Ongoing wage hikes and union activity in U.S. warehouses

Bullish Drivers

✅ AWS (Amazon Web Services) Reaccelerating

- Analysts expect AWS to grow ~15% YoY in Q1, signaling a turnaround from the mid-teens slowdown seen in 2023–2024. (GeekWire, Investors.com)

- The enterprise shift to cloud and surging demand for AI workloads (like training large language models) is driving stronger AWS bookings.

- Recent deals with big customers like Salesforce, BMW, and Expedia show AWS remains the #1 cloud provider by market share.

✅ AI Monetization Opportunity

- Amazon’s AI push is intensifying, with products like Bedrock (GenAI platform), Trainium/Inferentia chips, and Alexa upgrades.

- Analysts see Amazon as a “sleeping giant in AI”: its ability to integrate AI across e-commerce, cloud, and logistics could unlock multi-billion-dollar opportunities.

- Example: personalized recommendations, logistics optimization, and AI ad targeting all boost efficiency and engagement.

✅ Advertising Growth Is Surging

- Amazon’s ad business, largely from sponsored search and product ads, is growing ~25% YoY, hitting ~$14B per quarter. (Barchart, Business Insider)

- This segment delivers >70% gross margins, making it a key profit driver alongside AWS.

- Analysts expect continued ad innovation, like AI-driven targeting and video ad expansion on Twitch and Prime Video.

✅ Improving Profit Margins

- Operating margins have improved from ~3.7% in Q1 2024 to ~6% expected this quarter (CNBC, Yahoo Finance).

- Drivers include:

- Automation in fulfillment centers

- Faster delivery at lower costs

- Regionalized shipping networks

- Better inventory optimization

- Investors see these margin gains as a sign Amazon is maturing into a more disciplined, profit-focused giant.

✅ Prime Ecosystem Strength

- Prime membership growth remains steady, with improvements in same-day delivery, digital content, and grocery perks.

- Prime Video, with its big bets on sports and entertainment, helps anchor loyalty.

- Amazon’s broad ecosystem creates sticky customer relationships that competitors struggle to match.

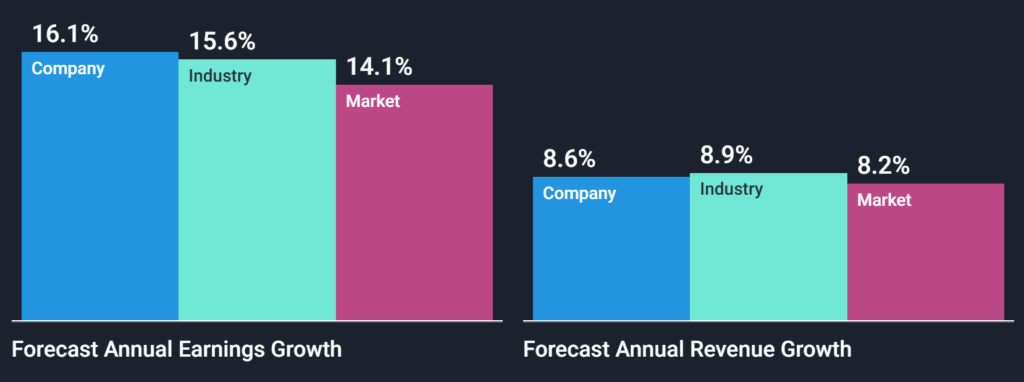

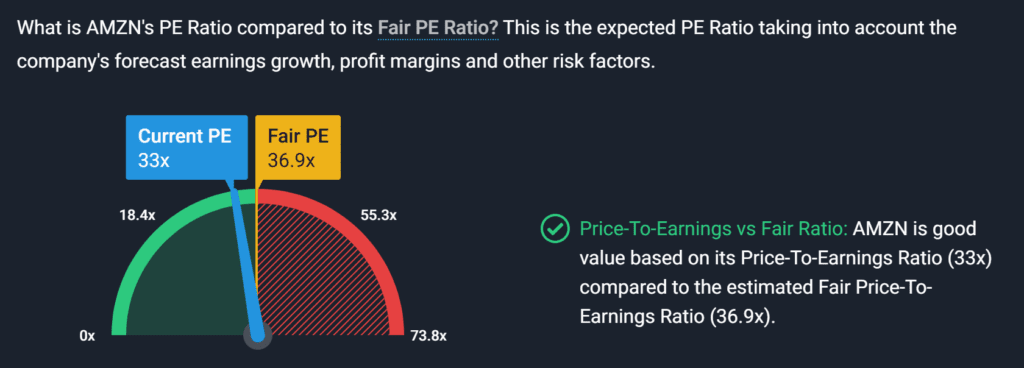

✅ Valuation Still Attractive

- Despite a ~60% rally off 2023 lows, Amazon trades at ~32x forward earnings — below its historical average (~50x) and cheaper than fast-growing AI peers. (Investopedia, MarketBeat)

- Many analysts maintain Buy ratings with price targets ~10–15% above current levels.

Bearish Case for Amazon (AMZN)

❌ AWS Faces Fierce Competition

- Microsoft Azure, Google Cloud, and Oracle are all gaining share and undercutting on price.

- Some enterprise customers are splitting cloud contracts to reduce vendor risk.

- If AWS misses growth targets, Amazon’s profits could take a big hit, since AWS generates ~60% of total operating income. (Investors.com, GeekWire)

❌ E-Commerce Profitability Is Thin

- Despite revenue growth, Amazon’s core e-commerce margins are razor-thin or negative in many regions.

- International markets (especially Europe and Asia) are under pressure from economic slowdowns, FX headwinds, and aggressive local competitors (like Temu, Shein, Flipkart).

- Delivery and logistics costs remain a constant balancing act, especially as Amazon pushes for ultrafast delivery.

❌ Tariff and Regulatory Risks

- The White House’s evolving tariff policies on Chinese goods threaten to raise costs on Amazon’s electronics, third-party seller goods, and private-label products. (Yahoo Finance, Investors.com)

- Antitrust pressure is growing in the U.S. and Europe, with regulators probing Amazon’s marketplace practices and data use.

❌ AI Lag Perception

- Compared to Microsoft (OpenAI), Google (Gemini), and Meta (LLMs), Amazon is perceived as slower to commercialize generative AI.

- Investors are waiting for a clearer AI roadmap and meaningful revenue impact — not just tech announcements.

❌ Macroeconomic and Consumer Risks

- E-commerce growth may slow if U.S. and European consumers pull back on spending.

- Inflation and wage growth pressures could reduce discretionary purchases.

- Amazon’s grocery and physical retail bets (Whole Foods, Amazon Fresh) are still struggling to scale profitably.

❌ High Expectations and Valuation Pressure

- Amazon shares are up ~28% YTD — any stumble in AWS, margins, or guidance could trigger a sharp sell-off.

- Bulls argue it’s cheap on earnings; bears warn it’s priced for perfection in a volatile macro backdrop.

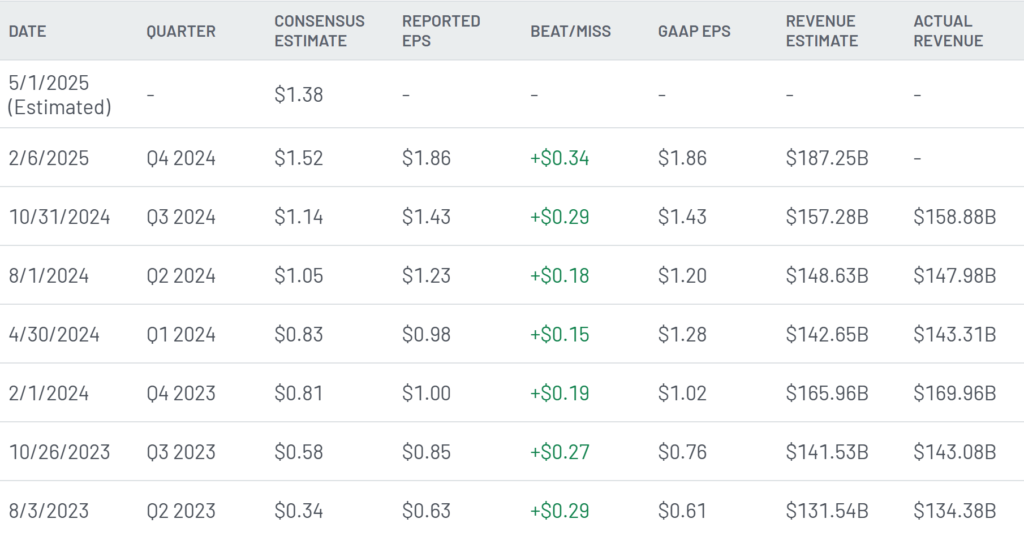

Earnings Surprise History

- Beat EPS in 10 of last 12 quarters (MarketBeat, Investopedia)

- Average surprise: ~8–10%

- Current setup: Analysts leaning bullish, but cloud commentary will make or break sentiment

Why it matters: Amazon has a solid beat record — but this time, it’s the outlook on AI, cloud, and margins that matters most.

Stock and Valuation Snapshot

- YTD performance: ~+28% (CNBC, Business Insider)

- Market cap: ~$1.8 trillion

- P/E ratio: ~32x forward

- Wall Street sentiment: 53 Buy, 5 Hold, 1 Sell

- Average price target: ~$205–215 (vs. ~$185 current) — ~10–15% upside

Why it matters: Amazon remains a top megacap pick on Wall Street, but needs to deliver across all engines to justify its premium.

Conclusion

Amazon’s Q1 2025 earnings report is shaping up as a litmus test for the company’s next chapter.

E-commerce and cloud are stabilizing, AI and advertising are booming, and cost discipline is improving margins — but tariffs, competition, and macro risks loom large. For long-term investors, this is about whether Amazon can turn the corner from a post-pandemic reset into its next era of profitable growth.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

What Analysts Think of Amazon Stock Ahead of Earnings?

Apple Q2 2025 Earnings Preview and Prediction: What to Expect

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion