Uber Technologies Inc. (NYSE: UBER) is set to report its Q1 2025 earnings on May 7. As one of the most closely watched names in mobility and delivery, Uber’s report comes at a time of major expansion moves, competitive pressures, and technological shifts, including autonomous vehicles (AVs) and AI integration. Here’s everything you need to know — whether you’re holding Uber, trading it, or watching from the sidelines.

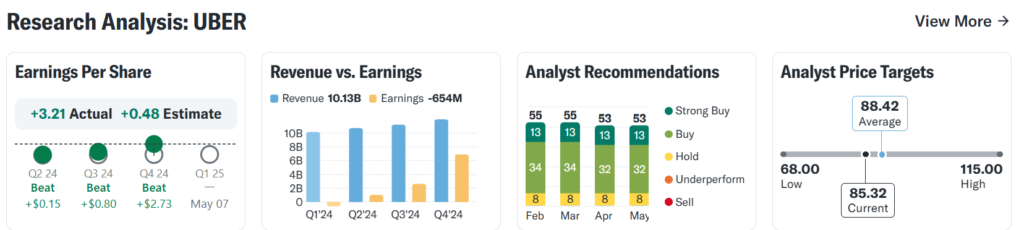

Wall Street Estimates & Core Metrics

- Revenue estimate: ~$10.1–$10.3 billion

→ Up ~18–20% YoY, driven by mobility recovery and delivery strength (Yahoo Finance, MarketBeat) - Adjusted EPS: ~$0.36–$0.38

→ A sharp swing from ~$0.08 last year; profitability continues to improve as Uber narrows GAAP losses - Gross Bookings: ~$37–38 billion

→ Up ~18% YoY, reflecting strong demand in mobility and delivery - Adjusted EBITDA: ~$1.3 billion

→ Up ~50% YoY, signaling continued operational leverage

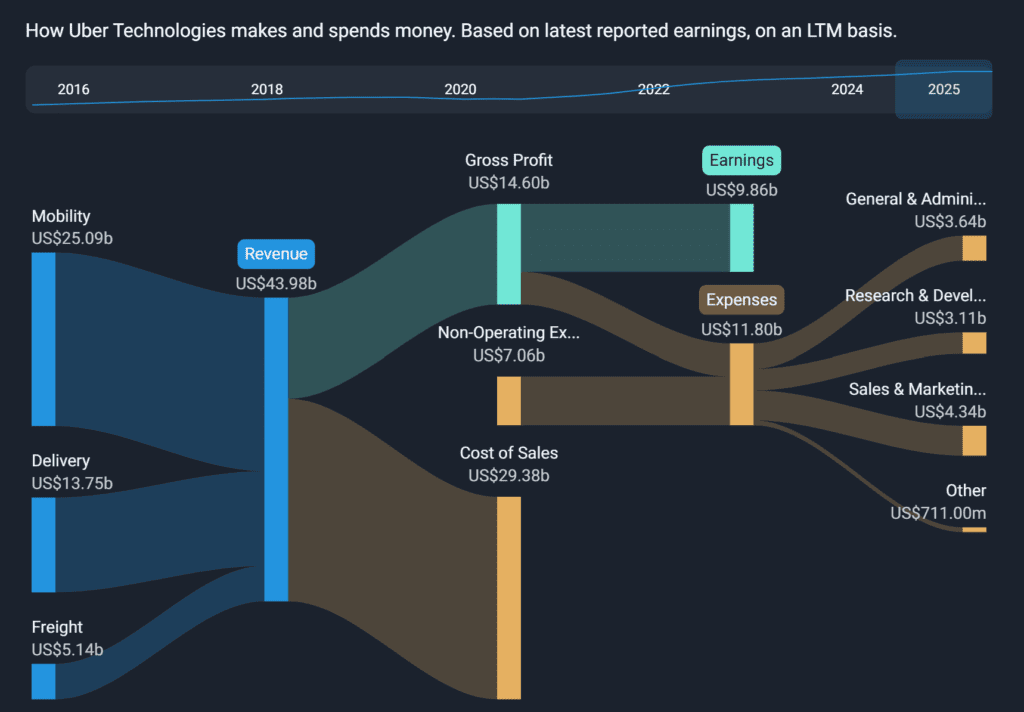

Key Business Drivers

✅ Mobility Segment (Rideshare Rebound)

- Uber’s core rideshare business is seeing strong demand, especially in urban centers where travel patterns have normalized.

- Investors.com reports surge pricing and normalization of driver supply are boosting margins.

- Analysts expect mobility revenue up ~20–25% YoY, fueled by international markets, business travel, and airport rides.

✅ Delivery Segment (Uber Eats)

- Uber Eats is benefiting from both order volume growth and improved unit economics.

- GuruFocus highlights that food delivery’s growth is moderating (~10% YoY), but new verticals like grocery, convenience, and alcohol delivery are helping diversify revenue.

- Uber’s pending $700 million acquisition of Turkey’s Trendyol Go (Investing.com, StartupNews.fyi) shows its commitment to expanding international delivery.

✅ Freight

- Freight continues to lag, with Yahoo Finance projecting flat-to-low single-digit revenue growth.

- High competition and weaker logistics demand are weighing on margins.

✅ Autonomous Vehicles (AVs) and Partnerships

- Uber’s partnerships with AV leaders like Waymo, Aurora, and Motional are in focus.

- Seeking Alpha reports that while AVs won’t meaningfully affect near-term earnings, they are critical for Uber’s long-term cost structure and differentiation.

Key Updates, Announcements & Acquisitions

- Trendyol Go deal: $700M controlling stake gives Uber a stronger foothold in Turkey’s fast-growing food delivery space (Investing.com, StartupNews).

- Robotaxi progress: Uber’s AV partnerships are advancing, but analysts caution these are still in pilot or early stages.

- Tariff concerns: Investors.com notes that possible regulatory headwinds and tariffs on imported vehicles could affect Uber’s cost base, though less directly than automakers.

Historical Performance & Surprise Trends

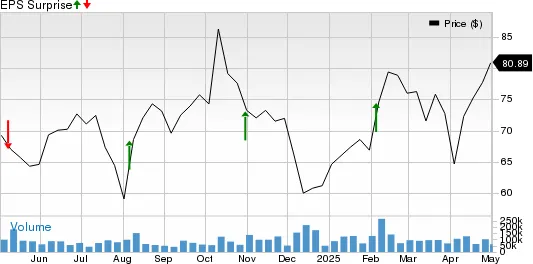

- Uber has beaten EPS estimates for the last four quarters, often by wide margins (MarketBeat, Nasdaq).

- On average, EPS surprises have come in 10–20% above consensus.

- The stock’s one-day post-earnings move has ranged 5–12%, often depending on gross bookings guidance and profitability outlook.

Bullish Arguments

1️⃣ Profitability Inflection Point

- Uber is now generating consistent adjusted EBITDA profits, with $1.3B expected in Q1.

- Bernstein (via Investing.com) reiterates an “Outperform” rating with a $95 price target, citing Uber’s improved margin profile.

2️⃣ Strong Execution in Mobility

- Rideshare demand is booming; surge pricing, fleet expansion, and driver incentives are driving >20% YoY growth.

- Airport rides alone contribute ~15% of mobility bookings and continue to grow faster than overall mobility.

3️⃣ Diversified Revenue Streams

- With Uber Eats, grocery, convenience delivery, and even alcohol, Uber is less dependent on just rideshare.

- The Trendyol Go deal underscores Uber’s international expansion push.

4️⃣ Long-Term AV & Tech Play

- While still early, partnerships with Waymo, Aurora, and Motional position Uber as an AV ecosystem leader.

- Analysts see this as a potential cost reducer over the next 5–10 years.

Bearish Arguments

1️⃣ Freight Drag

- Freight revenue is expected to decline YoY, with heavy competition from Flexport, Convoy, and incumbents.

- This weighs on consolidated margins.

2️⃣ Macro and Regulatory Risks

- Potential tariffs on imported vehicles or e-bikes could affect costs, especially in Europe and Asia (Investors.com).

- Wage regulation or reclassification of gig workers remains an ongoing overhang.

3️⃣ Valuation Risks

- Uber trades at ~35–40x forward EBITDA, a premium multiple. Any slip in bookings or margins could trigger sharp downside.

4️⃣ AV Timelines Are Uncertain

- While partnerships are promising, commercial AV deployment is still years away, and investors may tire of promises without clear monetization.

Prediction and Sentiment

- Revenue: Expected beat (~$10.3–10.4B vs. $10.1B estimate)

- EPS: Modest beat (~$0.39 vs. $0.36–$0.38 consensus). Uber surpassed EPS estimates on three occasions and missed once, with the average earnings surprise being 133.5%.

- Mobility and Delivery Growth: ~20–25% and ~10–12% YoY, respectively

- Freight: Flat or slight miss

Stock reaction: Likely volatile post-earnings (~±7–10%), heavily dependent on forward bookings and margin guidance.

Valuation & Market Setup

- Market Cap: ~$150 billion

- YTD performance: +28%

- Forward P/E: ~35–40x

- Wall Street sentiment:

- ~80% Buy

- ~18% Hold

- ~2% Sell

- Average price target: ~$80–85 (current price ~$72–74)

Final Takeaways for Investors, Beginners & Traders

- Investors: Uber is executing well, expanding internationally, and progressing toward sustained profitability. It’s a long-term bet on urban mobility and delivery, but you must accept the volatility and regulatory risks.

- Beginners: Understand that Uber operates in a high-competition, high-regulation environment. Earnings beats matter less than long-term margin and cash flow improvements.

- Traders: Watch gross bookings, adjusted EBITDA, and mobility trends. Guidance will likely drive post-earnings moves more than headline beats or misses.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

India, UK successfully conclude mutually beneficial Free Trade Agreement

EU Eyes €100 Billion of US Goods With Tariffs If Talks Fail

China, Japan and South Korea will jointly respond to US tariffs

Supermicro Q3 Fiscal 2025 Earnings Preview and Prediction: What to Expect

Palantir Q1 2025 Earnings Report — Why the Stock Popped (Then Dropped)

Rivian (RIVN) Q1 2025 Earnings Preview and Prediction: What to Expect