Why Is Trump Imposing Tariffs Again?

Since returning to the White House in January 2025, President Donald Trump has reintroduced his signature economic strategy: aggressive tariffs on imports. He argues that decades of free trade deals have hollowed out American industry, sent jobs overseas, and left the US vulnerable to economic manipulation, by imposing tariffs—taxes on imported goods—Trump the US trade deficit.

But the strategy isn’t just economic—it’s geopolitical. Trump has tied tariffs to immigration enforcement, drug control, and even foreign policy issues like the Ukraine war. Critics say this weaponization of trade undermines long-standing alliances and injects uncertainty into global markets.

What Exactly Are Tariffs?

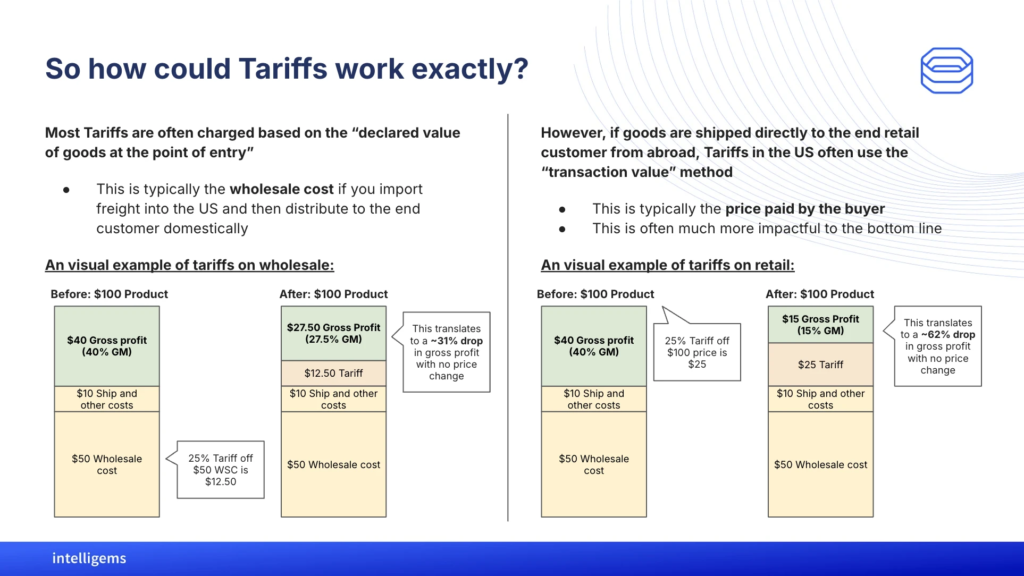

A tariff is a tax levied by a country on goods imported from abroad. It typically applies as a percentage of the product’s value. For example, a 10% tariff on a $100 item adds $10 in taxes, making the final cost to the importer $110. While the tax is paid by the importing company, the cost is usually passed down to consumers through higher retail prices.

Tariffs are intended to discourage reliance on foreign goods and give domestic producers a competitive edge. But they also disrupt global supply chains, invite retaliatory measures from trade partners, and often raise prices on basic goods like cars, electronics, and clothing.

Tariffs on Specific Goods

Trump has issued a series of product-focused tariffs aimed at reviving US heavy industry and reducing dependence on foreign manufacturing. These measures primarily hit materials and industries that form the backbone of the American economy—like metals, cars, and pharmaceuticals.

Critics say these taxes will hurt US manufacturers that rely on imported raw materials and components. For example, a car assembled in Michigan may include engines from Mexico, aluminum from Canada, and electronics from China—each subject to a different duty. The cumulative effect is a rising cost base for US-made products, potentially making them less competitive globally.

Current Product-Specific Tariffs:

- 50% tariff on steel and aluminum imports

- 50% tariff on semi-finished copper imports (effective August 1; excludes copper scrap and some input materials)

- 25% tariff on foreign-made cars and imported engines and components

- 200% proposed tariff on pharmaceutical imports (still unconfirmed)

- Revocation of “de minimis” rule (effective August 29), applying tariffs to all low-cost imports under $800, targeting online retailers like Shein and Temu

Country-Specific Tariffs

Beyond individual products, Trump’s strategy includes reciprocal tariffs against countries he accuses of unfair trade practices, currency manipulation, or geopolitical hostility. These country-specific tariffs are meant to pressure foreign governments into signing bilateral trade deals with more favorable terms for the US.

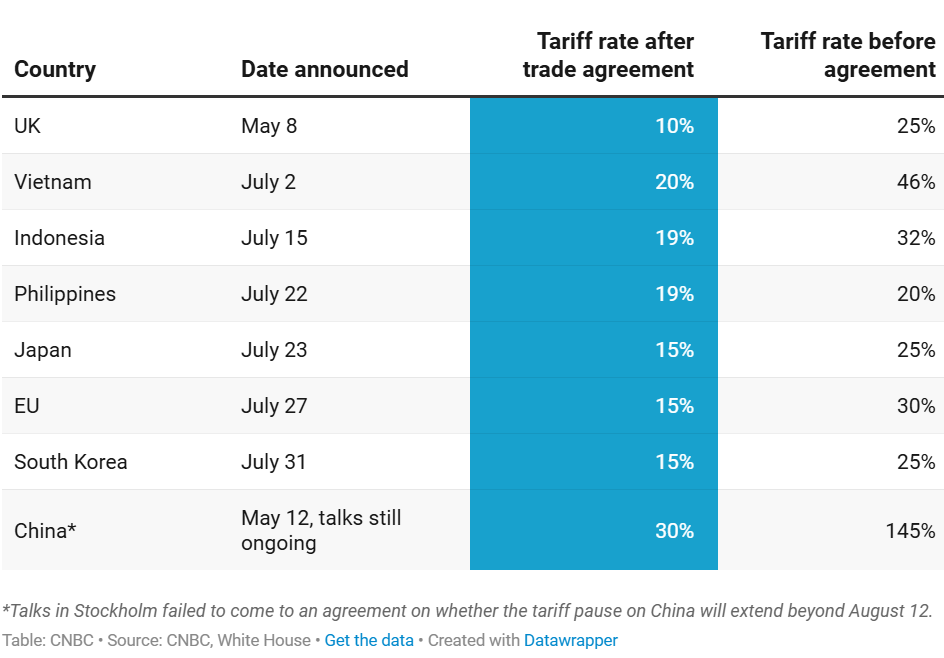

Trump has introduced a “tariff floor” of 15%, with rates going as high as 50% depending on the country. Nations that do not finalize trade agreements before the August 1 deadline will automatically face these new tariffs. Some countries have struck last-minute deals, while others remain at odds with Washington.

Key Country Tariff Updates:

| Country | Tariff Rate | Notes |

|---|---|---|

| Brazil | 50% | Exempts orange juice, aircraft parts |

| India | 25% + penalties | Targeted for ties with Russia; penalties may increase |

| Vietnam | 20% | Lowered from earlier threat of 46% after talks |

| Indonesia | 19% | Affects clothing and consumer electronics |

| Philippines | 19% | Similar to Vietnam and Indonesia |

| Japan | 15% | Down from 25% after final deal |

| South Korea | 15% | Mirrors Japan deal, includes LNG purchases |

| Canada | 35% (pending) | Excludes NAFTA goods; strained after Canada supported Palestine |

| Mexico | 30% minimum | Tariff could rise if Mexico retaliates |

| EU | 15% | Deal reached, but details remain disputed |

| UK | 10% | Most favorable deal, capped at 100,000 cars per year |

Legal Challenges & “Liberation Day” Fallout

Trump’s tariffs haven’t just sparked global backlash—they’ve landed him in court. Several small business importers and US states have sued, arguing that the president overstepped his authority by using national emergency powers to impose sweeping tariffs without Congressional approval.

On April 2 (Liberation Day), Trump announced these tariffs under the International Emergency Economic Powers Act (IEEPA), citing threats like fentanyl smuggling and illegal immigration. A lower court ruled against the tariffs in May, but that decision was put on hold. Now, an appeals court in D.C. is weighing the legality just hours before the August 1 deadline. Most experts believe the case will ultimately land at the Supreme Court.

Even if Trump loses, legal analysts say he could pivot to other statutes, like Section 301 (unfair trade practices) or Section 232 (national security threats), to continue the tariff policy.

Tariff Deals in Progress

Amid looming deadlines, several countries have rushed to negotiate last-minute trade pacts. These deals usually secure lower tariffs in exchange for promises of increased US investment or favorable treatment of American exports.

However, many of these “agreements” are informal or lacking legally binding text. The White House has touted hundreds of billions in promised investments, while foreign governments—including the EU—have published more cautious interpretations.

Latest Trade Deals:

- EU: 15% tariff deal; US claims $600B in investment; EU calls it “non-binding”

- UK: 10% car tariff cap on 100K vehicles; beef and ethanol tariff cuts; steel tariffs remain at 25%

- Japan: Tariffs capped at 15%; includes energy and tech investments

- Vietnam, South Korea: Tariff reductions in exchange for market access and US imports

- Thailand, Cambodia: In talks following a ceasefire; tentative deals in place

- Mexico, Canada: Ongoing discussions; Canada criticized after Palestine support

US–EU Trade Deal: One Agreement, Two Stories

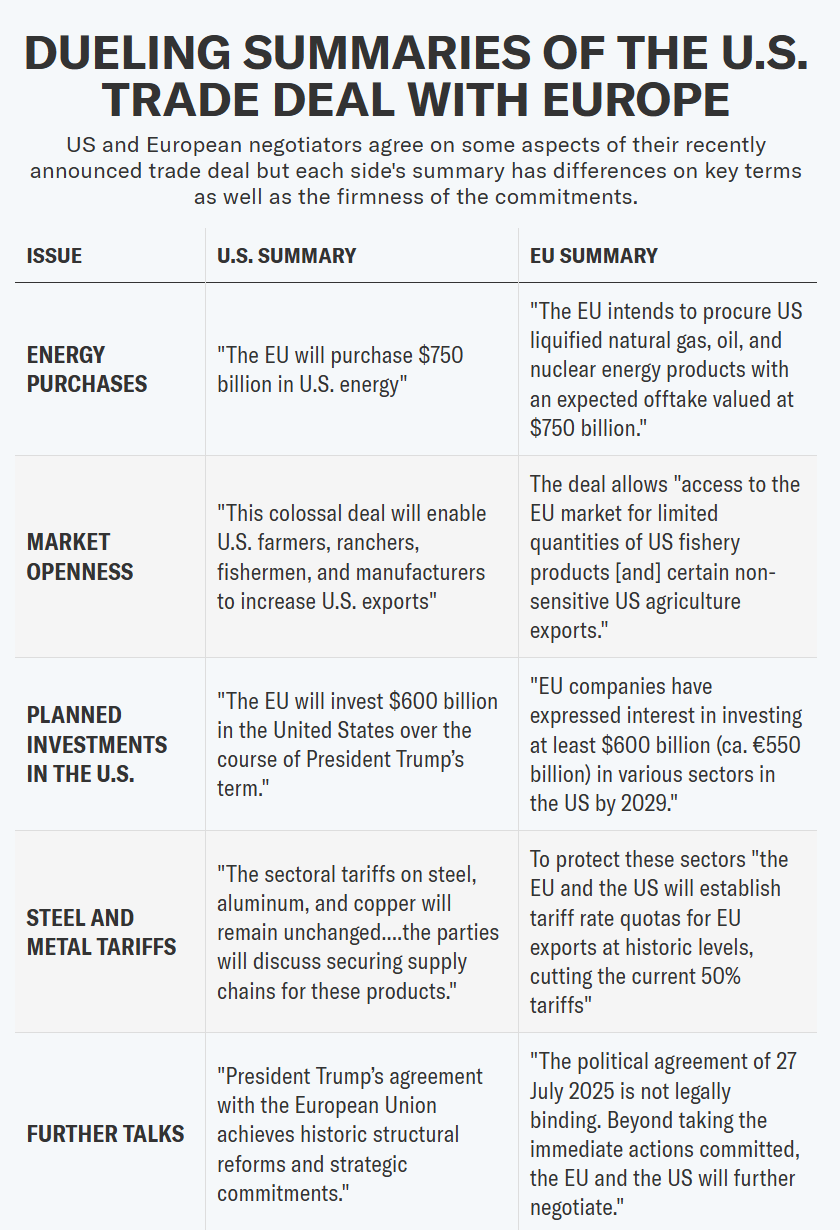

President Trump and European Commission President Ursula von der Leyen publicly shook hands on what was framed as a landmark US–EU trade agreement, but conflicting details from both sides raise doubts about its scope and solidity. The White House summary calls it a breakthrough with “historic structural reforms”, including a 15% tariff on most EU goods like cars, semiconductors, and pharmaceuticals, plus $750 billion in European energy investment and $600 billion in corporate deals.

However, the EU’s version tells a more cautious story, describing the deal as “not legally binding”, with investment plans framed as intentions rather than guarantees. Brussels also limits market access for certain goods—like agriculture and fish—to “non-sensitive categories in limited quantities”, clashing with Trump’s claim that European markets are now “totally open.”

One major discrepancy: Trump touted massive European purchases of US military equipment, calling it a “hundreds of billions” commitment. But this element is entirely absent from the European summary. Even US Commerce Secretary Howard Lutnick admitted there’s “plenty of horse trading still to do,” signaling that key parts of the deal are still under negotiation despite the public handshake.

Economic and Market Impact

The new tariffs have sent ripples across the global economy, affecting consumer prices, business costs, and investor sentiment. The IMF and OECD have downgraded their 2025 global growth forecasts, citing tariffs as a key risk. US inflation rose to 2.7% in June, partly driven by higher import costs.

Companies like Nike, Adidas, and Mattel have already confirmed price hikes, citing increased costs from Vietnam, Indonesia, and other affected countries. Meanwhile, industries like automobiles and electronics face rising manufacturing costs due to component tariffs.

Even US-made goods are affected—many depend on parts that cross NAFTA borders multiple times before final assembly. Stricter customs checks are also causing delays at ports and borders, exacerbating the supply chain squeeze.

Trump’s Message: “America First—Or Pay the Price”

Trump remains unapologetic. He insists tariffs are working, that they’re bringing factories back, generating revenue, and giving the US unmatched leverage. His supporters praise the tough stance, while critics warn it risks a return to 1970s-style stagflation—slowing growth combined with rising prices.

With court challenges ongoing, new deals emerging daily, and countries scrambling to respond, the global trade order appears to be reshuffling in real time. Trump has made it clear: you’re either on his trade terms, or you’re paying the price.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Trade War Reshaped: US–EU Deal Finalized, China Truce Extension Likely

Global Markets Kick Off Tuesday With Cautious Optimism: Market Wrap

Market Is Euphoric Again — and Everyone Knows It

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion