The White House just hit pause on one of the most important deadlines in global trade.

After weeks of pressure, Press Secretary Karoline Leavitt said Thursday that President Trump’s July 9 trade deadline isn’t set in stone. The same goes for the July 8 expiration of the 90-day tariff reprieve — both of which had raised fears of a fresh wave of reciprocal tariffs hitting US allies.

“The president can simply provide these countries with a deal if they refuse to make us one by the deadline,” Leavitt said, adding that Trump could still select tariff rates “advantageous for the United States and for the American worker.”

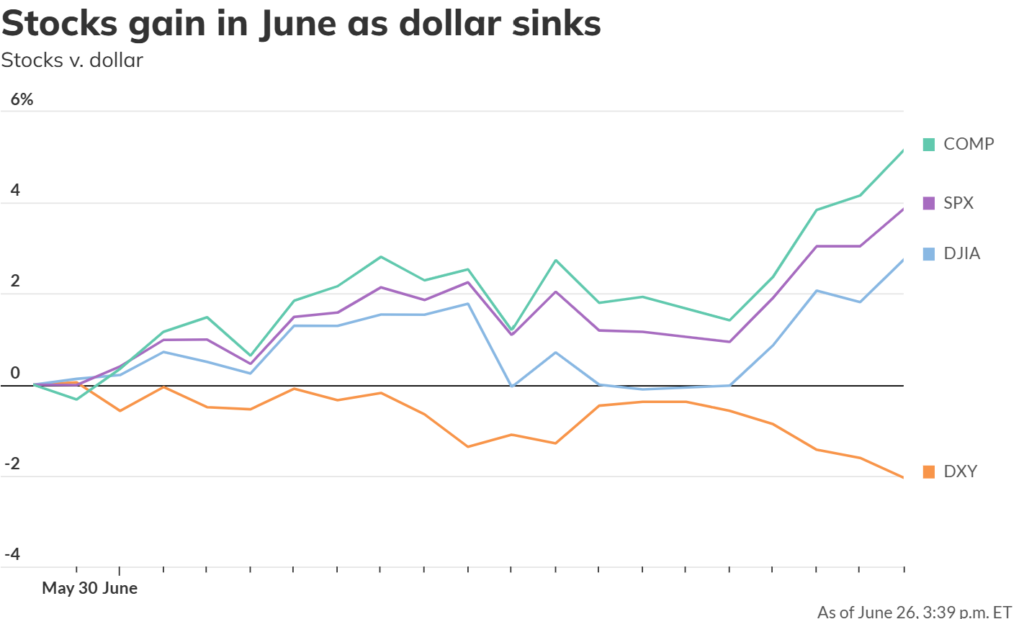

Stocks surged on the news, with traders relieved that Trump may delay the return of steep tariffs — especially the 50% duty threatened on the EU, which was originally slated for June 1 before being pushed to July 9.

Two deals done. Dozens stalled.

Trump officials had floated a bold goal: 90 trade deals in 90 days. But so far, only two agreements have been reached — one with China and another with the UK. Neither is finalised, and both are still described as “frameworks.”

Talks with India are reportedly close, but no deal has been announced.

White House officials insist the president is still committed to getting deals done. National Economic Council Director Kevin Hassett said this week: “We know that we’re very, very close to a few countries,” hinting that a batch of trade announcements could follow passage of Trump’s tax-and-spending bill by July 4.

Treasury Secretary Scott Bessent also told Congress this month that it’s “highly likely” the administration will extend the deadlines for countries negotiating in “good faith.”

Market Reaction: Stocks Rally as Deadline Uncertainty Eases

Markets responded swiftly to the White House’s softened tone on Trump’s July 9 tariff deadline. The S&P 500 jumped 0.8%, nearing its first record close since February at 6,144, while the Nasdaq rose over 1%, boosted by gains in tech and energy stocks. The Dow climbed nearly 400 points, as easing trade fears and renewed optimism over interest rate cuts fueled the rally.

Investors viewed Karoline Leavitt’s comment — that the tariff deadline is “not critical” — as a signal that an extension is likely, especially for countries negotiating “in good faith.” The dollar weakened to its lowest since April 2022, and Treasury yields fell, with the 10-year dipping to 4.25%, reflecting growing expectations for Fed policy easing.

Market takeaway

This is the clearest sign yet that Trump is willing to be flexible — and investors are paying attention. With geopolitical tension rising and the market on edge, even a temporary reprieve is enough to rally risk sentiment.

The real question? Whether any of these deals actually land before the election.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nike Reports After the Bell: Here’s Why Wall Street Expects a Weak Quarter

US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors

Kalshi Hits $2 Billion Valuation as Prediction Markets Go Mainstream

S&P 500 Nears All-Time High After Stunning Rebound from April Lows

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates