After Trump’s latest tariffs and economic threats, we’re seeing a big sell-off in both the stock market and crypto.

But there’s a popular theory flying around on X right now explaining what’s really going on behind the scenes… and it makes a lot of sense. Let’s break it down.

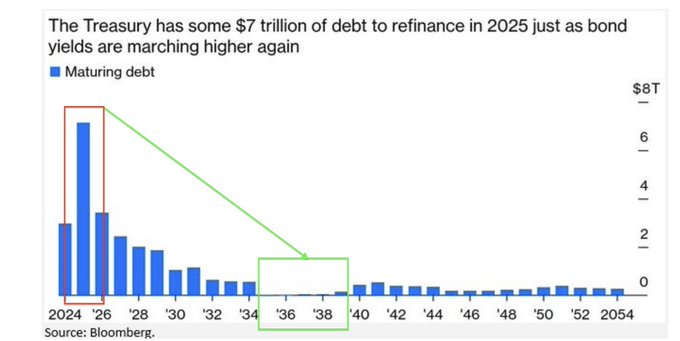

The Big Picture: $7 Trillion Problem

The U.S. government has a serious issue on its hands. There’s $7 TRILLION in debt that needs to be refinanced over the next six months.

At today’s high interest rates, rolling over that debt would be a financial disaster. The cost to refinance would skyrocket, putting huge strain on the budget.

The administration needs interest rates much lower to avoid a debt crisis.

What Was the Easy Fix?

The simple solution was for the Federal Reserve to cut rates early this year.

But Jerome Powell didn’t move. Despite public pressure from Trump and his team last year, Powell stood firm and refused to lower rates.

Now, with time running out, Trump’s team is taking matters into their own hands.

The Plan: Crash the Markets to Force Powell’s Hand

Here’s the theory:

They’re intentionally crashing asset prices to create fear and uncertainty. This panic drives investors out of stocks and crypto, and into bonds.

Why? Because when money flows into bonds, yields drop.

And lower yields make it cheaper for the government to borrow money—exactly what they need to refinance that massive pile of debt.

Step-by-Step: How It Works

- Uncertainty and fear shake markets. Investors sell off risk assets like stocks and crypto.

- That money floods into safe-haven bonds.

- Bond yields drop, making it cheaper to borrow.

- Lower yields could also fuel mortgage demand and support economic activity, giving the economy a boost later.

And here’s the thing—it’s already starting to work.

📉 10-Year Treasury Yields:

- In January, they were 4.8%.

- Now, they’re down to 4.25%.

- The goal? Drive them even lower, so refinancing debt becomes affordable.

This is why we’re seeing tariffs ramp up and economic uncertainty dialed to 10. It’s all designed to scare investors into dumping risky assets and rushing into bonds.

What Does This Mean for Crypto and Stocks?

In the short term, it’s rough.

- Expect high volatility to continue.

- Liquidity is tightening as money shifts from risk assets into bonds.

- Crypto and stocks will stay under pressure until there’s a clear move from the Fed.

But if this strategy works—if Powell caves and cuts rates—there could be a massive rally ahead. Lower rates could kick-start the housing market, drive more spending, and eventually fuel another bull run in risk assets like crypto and tech stocks.

So, What Can We Do Right Now?

This is a time for patience and smart strategy.

- Watch bond yields closely. If they keep dropping, we’re getting closer to a Fed pivot.

- Look for strong support levels in your favorite stocks and crypto. Build positions slowly and carefully.

- Don’t chase short-term rallies or panic on dips. This is a trader’s market, not a time for FOMO.

- Keep an eye on recession indicators. If the economy avoids a hard landing, there’s big upside later. If not, staying cautious will pay off.

The Bottom Line

The administration is playing a high-stakes game. They’re crushing the markets on purpose to get the rates they need.

If it works, we could see huge opportunities when the Fed finally moves.

Until then, stay patient, stay sharp, and get ready to take advantage when the time is right.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?