On Friday, markets rejoiced. The White House had announced that smartphones, laptops, and other electronics would be excluded for 90 days from the sweeping 125% reciprocal tariffs targeting Chinese imports. Apple, Nvidia, and other tech stocks surged, with investors eyeing short-term breathing room.

But that optimism was shattered over the weekend.

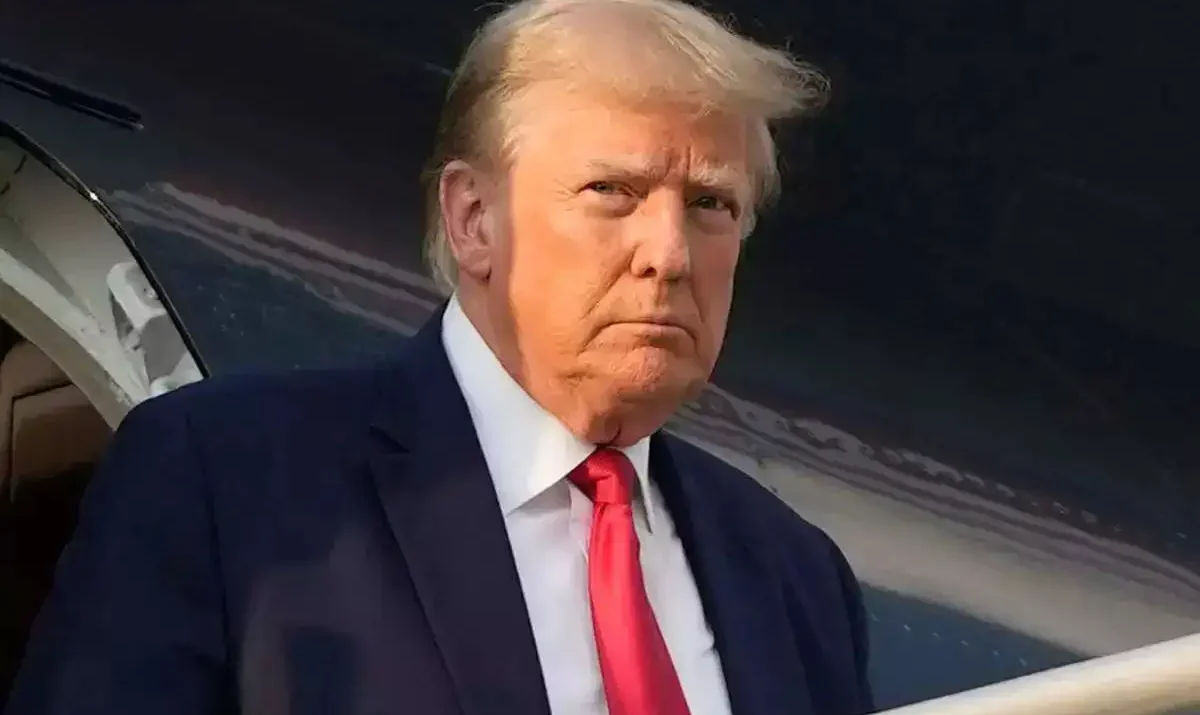

On Sunday, Trump wrote on Truth Social:

“There was no Tariff ‘exception’… These products are subject to the existing 20% Fentanyl Tariffs, and they are just moving to a different Tariff ‘bucket.’”

He added that the administration would launch a national security investigation into the entire electronics supply chain, aimed at curbing U.S. dependence on “hostile trading nations like China.”

Translation? iPhones, laptops, and consumer electronics will likely face semiconductor-related duties within a month or two — and this time, they’re here to stay.

Lutnick’s Message: “These Must Be Made in America”

Commerce Secretary Howard Lutnick, speaking on ABC’s This Week, emphasized that the exemption was never meant to be permanent. Instead, smartphones and computers would fall under a new structure — separate from the reciprocal tariffs, but no less impactful.

“These are things that are national security… We need our medicines and we need semiconductors and our electronics to be built in America.”

He clarified that the new tariffs would be in addition to existing global levies. Tech firms were warned: prepare for a long-term shift.

Markets React — Again

The rebound on Friday was short-lived. The sudden shift triggered one of the wildest weeks on Wall Street since the pandemic, with the S&P 500 down over 10% since Trump took office on January 20.

- Investors dumped U.S. bonds

- The dollar slumped

- Consumer confidence took a dive

Even Sony raised PlayStation 5 prices in Europe, Australia, and New Zealand by 10%, citing inflation and trade-related instability — a move likely to be echoed across the tech sector.

China Fires Back: “No Winners in Trade War”

China’s Ministry of Commerce described the temporary exemption as a “small step,” calling on the U.S. to “cancel the entire tariff regime.”

President Xi Jinping, speaking Monday, stressed that “protectionism leads nowhere” and warned that a trade war will have no winners.

China’s retaliatory duties now stand at 125%, and Beijing warned it will ignore future hikes, claiming U.S. goods are already priced out of the market.

Meanwhile, China is accelerating ties in Southeast Asia, with Xi beginning a visit to Vietnam to strengthen regional partnerships and diversify trade.

Whiplash Policy, Worsening Outlook

Trump’s tariff rollercoaster — from sweeping impositions to sudden pauses and back again — has left businesses, investors, and global markets dizzy.

- The initial U.S. tariffs began at 54% earlier this month

- They surged to 145% in under two weeks

- China’s counter-tariffs followed suit: 34% ➝ 84% ➝ now 125%

Senator Elizabeth Warren criticized the administration’s erratic approach:

“There is no tariff policy – only chaos and corruption.”

Economists echoed the warning, highlighting that the back-and-forth threatens to dampen U.S. economic growth and fuel inflation — especially in consumer electronics and pharma.

Finblog Takeaway:

Trump’s latest tariff maneuver signals an even deeper decoupling from China — not just on trade but on tech sovereignty. The reclassification of smartphones and laptops into national security issues rewrites the rules for global electronics.

Investors should expect:

- More supply chain disruptions

- Higher consumer prices on electronics

- Continued market volatility — especially in tech and retail

The full list of affected products and new levy rates is expected this week. But one thing is clear:

Tariffs are no longer just trade tools — they’re strategic weapons.

And the tech war between the world’s top economies is entering a much more volatile phase.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Tariffs on Phones and Microchips Will Return — Electronics Exemption Only Temporary

90 Deals in 90 Days?: Experts say good luck with that

China strikes back with 125% tariffs on U.S. goods, starting April 12

Tesla stops taking new orders in China

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts

Trump Raises Tariffs On China To 125% After Beijing’s 84% Move