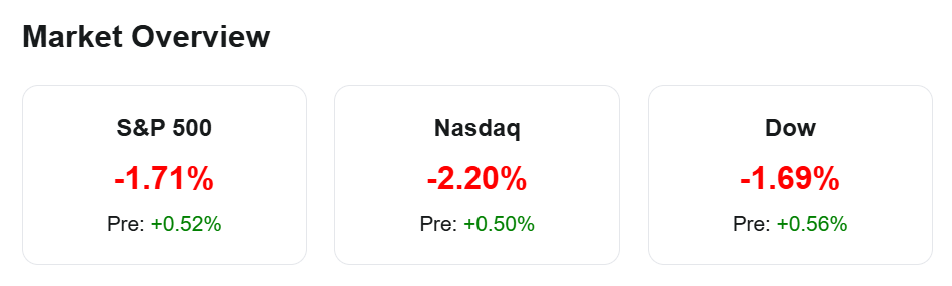

Market recap: The Dow dropped 748 points on Friday in its worst day of 2025, while the S&P 500 and Nasdaq fell 1.71% and 2.2%, respectively. Walmart (WMT), Nvidia (NVDA), and Palantir (PLTR) led losses. Futures this morning rebounded, with the Dow gaining 300 points.

Apple’s U.S. factory investment: Apple (AAPL) announced a $500B investment in U.S. facilities over 4 years, aiming to create 20,000 jobs and mitigate potential tariffs on Chinese imports.

Wegovy, Ozempic shortages over: The FDA declared Novo Nordisk’s (NVO) Wegovy and Ozempic shortages resolved, boosting its stock by 5%. Hims & Hers Health (HIMS) fell over 25% due to expectations for depressed demand for compounded alternatives.

Google-Salesforce deal: Salesforce (CRM) has signed a $2.5B, 7-year cloud deal with Google (GOOGL) to expand its AI and cloud offerings, countering Microsoft’s (MSFT) dominance. The agreement allows Salesforce customers to run AI tools like Agentforce on Google Cloud.

Real estate buyout: Apollo Global Management (APO) will acquire Bridge Investment Group (BRDG) for $1.5B in stock, nearly doubling its real estate assets under management to over $110B.

Alibaba’s AI investment: Alibaba (BABA) will invest $52.4B in AI and cloud computing over the next 3 years, surpassing its spending in the sector over the past decade. The move boosts its position in China’s AI race, with its stock up 68% YTD.

Gene therapy buyout: Private equity firms Carlyle and SK Capital will buy gene therapy company Bluebird Bio (BLUE) for $30M following financial struggles despite its 3 FDA-approved gene therapies. The company’s stock fell 40% on the news.

Streaming bundle’s customer retention: Disney (DIS) and Warner Bros. Discovery’s (WBD) bundle of Disney+, Hulu, and Max has retained 80% of subscribers after 3 months, outperforming Netflix (NFLX) and other standalone services. The $16.99/mo., ad-supported plan has attracted 2.2M subscribers.

SEC shelves Robinhood investigation: The SEC has dropped its investigation into Robinhood’s (HOOD) crypto unit. The company’s shares have surged 38% YTD. S

Massive crypto theft: Crypto firm Bybit suffered a $1.5B crypto theft, potentially the largest ever, after hackers exploited its Ethereum wallet. The firm, which holds $20B in assets, assured users their funds are safe.

Amgen’s India investment: Amgen (AMGN) plans to sink $200M into a new technology center in India, focusing on AI and data science for drug development. The site is expected to employ 2,000 people by year-end.

Pipeline company vs. Greenpeace: Energy Transfer (ET) is going to trial in its $300M lawsuit against Greenpeace, alleging the group’s protests against the Dakota Access Pipeline caused financial harm. Greenpeace calls the lawsuit a strategic effort to silence opposition.

Earnings & Forecasts Highlights

Berkshire Hathaway (BRK.B) reported a 71% YoY surge in Q4 operating earnings to $14.5B, driven by higher Treasury yields and strong insurance profits, particularly from Geico. The company’s cash reserves hit a record $334.2B as it scaled back holdings in Apple (AAPL) and Bank of America (BAC).

Domino’s Pizza (DPZ) missed Q4 same-store sales estimates, reporting a 0.4% U.S. increase versus the expected 1.63%, as fast-food competition intensifies. Shares fell 4% premarket.

IMAX (IMAX) expects a record $1.2B in box office revenue for 2025, driven by a strong movie slate. Growth is partly fueled by China’s “Ne Zha 2,” which has grossed $1.6B globally, with $135M from IMAX screenings.

Recent Earnings & Forecasts Highlights

🔊Coca-Cola FEMSA (KOF) has released its quarterly earnings

- Revenue of $3.76B (-0.08% YoY) beats by $274M.

- EPS of $1.73 (+17.69% YoY) beats by $0.38.

🔊Summit Therapeutics (SMMT) has released its quarterly earnings (

- EPS of -$0.07 beats by $0.01.

🔊Domino’s Pizza (DPZ) has released its quarterly earnings

- Revenue of $1.44B (+2.92% YoY) misses by $26M.

- EPS of $4.89 (+9.15% YoY) misses by $0.01.

🔊Owens Corning (OC) has released its quarterly earnings

- Revenue of $2.84B (+23.26% YoY) beats by $70M.

- EPS of $3.22 (+0.31% YoY) beats by $0.32.

🔊Westlake (WLK) has released its quarterly earnings

- Revenue of $2.84B (+0.60% YoY) misses by $97M.

- EPS of $0.06 (-91.67% YoY) misses by $1.03.

🔊Intra-Cellular Therapies (ITCI) has released its quarterly earnings

- Revenue of $199.22M (+50.81% YoY) beats by $5.26M.

- EPS of -$0.16 misses by $0.04.

🔊H&E Equipment Services (HEES) has released its quarterly earnings

- Revenue of $384.08M (-0.45% YoY) beats by $10.89M.

- EPS of $0.99 (-32.65% YoY) beats by $0.18.

✅Berkshire: Berkshire Hathaway (BRK.B) reported a 71% YoY surge in Q4 operating earnings to $14.5B, driven by higher Treasury yields and strong insurance profits, particularly from Geico. The company’s cash reserves hit a record $334.2B as it scaled back holdings in Apple (AAPL) and Bank of America (BAC).

✅IMAX: IMAX (IMAX) expects a record $1.2B in box office revenue for 2025, driven by a strong movie slate. Growth is partly fueled by China’s “Ne Zha 2,” which has grossed $1.6B globally, with $135M from IMAX screenings.

Economic News

Consumer sentiment: The University of Michigan’s consumer sentiment index fell to a 1-year low in February, with respondents expecting inflation to surge to 3.5% — the highest expectation reading since 1995. Consumers are cutting big-ticket spending, and over half expect higher unemployment this year.

Ultra wealthy fuel consumer spending: The top 10% of U.S. earners now account for nearly 50% of all consumer spending, a record high, as their wealth surges from rising stocks and real estate. Their spending grew 12% YoY, while middle- and lower-income households cut back.

Home sales: U.S. home sales fell 4.9% in January as high prices and mortgage rates pressured buyers, with the median home price hitting a record $396,900. Inventory rose 17% YoY, but affordability remains a challenge.

Singaporean inflation: Singapore’s inflation slowed to 1.2% YoY in January, the lowest since Feb. 2021 and below forecasts of 2.15%. Core inflation fell to 0.8%.

The US signaled sanctions relief for Russia could be on the table as President Donald Trump rushes toward a deal to end the three-year conflict in Ukraine.

European stocks rose, following strong gains across Asian markets as results from China’s Alibaba Group Holding Ltd. fueled a fresh wave of optimism over artificial intelligence. Gold slipped from a record and the dollar ticked higher.

Nissan shares jumped 9.5% after the Financial Times reported a high-level Japanese group has drawn up plans for Tesla to invest in the struggling carmaker. Nissan declined to comment, while Tesla didn’t reply to a request for comment.

Business activity in the euro area hardly grew again in February, reinforcing fears that the bloc remains mired in stagnation. The euro slipped 0.2% to $1.0476 as investors added to bets that the European Central Bank will cut interest rates.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trade War and Market Panic: Are Short-Term Dips Long-Term Opportunities?

The Market Begins a New Trading Trend: Contrarian Trump Trades

Hedge Funds Loaded Up AI Stocks at the Fastest Pace Since 2021

These Stocks Could Skyrocket According to “Trends With No Friends” Strategy!

Market Looks Strong—But Whales Are Quietly Exiting, Should You?

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4

This Week S&P500 ChartStorm – Bad News Damages Investor Sentiment

Warren Buffett Berkshire now hold a record $334 BILLION in cash, What does he know that we don’t?

Key Earnings Takeaways from This Week: AI, E-Commerce, and Travel Stocks Lead Market

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China