Imagine this: waking up one morning and seeing Dogecoin, Solana, or XRP available for purchase as ETFs, just like stocks. No crypto wallets, no exchanges, no complicated sign-ups. That future might be closer than you think.

Why? Because the SEC (Securities and Exchange Commission) could soon approve a new rule to fast-track crypto ETFs—simplifying how investment products based on altcoins get listed and sold. Let’s take a deep dive into what this means, who stands to benefit, and what’s at stake for investors like you.

Let’s dive in. First things first, what exactly are Crypto ETFs?

What Are Crypto ETFs and How Do They Work?

A crypto ETF (exchange-traded fund) is an investment product that lets you buy exposure to cryptocurrencies without directly holding the coins yourself. Think of it like a basket that tracks the price of a crypto asset—whether it’s Bitcoin, Solana, XRP, or Dogecoin—and trades on the stock market just like Apple or Tesla shares.

Here’s how it works:

- Structure: An ETF provider (like BlackRock or Grayscale) creates a fund that holds crypto assets, futures contracts, or derivatives tied to the price of those assets.

- Trading: Shares of this fund are listed on regular stock exchanges (like Nasdaq or NYSE), so you can buy and sell them through your brokerage account.

- Tracking: The ETF’s value moves up or down based on the price of the underlying crypto. If Solana rises 10%, the Solana ETF should rise by roughly the same amount.

- Simplicity: No need to open a crypto wallet, manage private keys, or worry about losing access—ETFs fit into the existing stock market system.

Why They Matter: Crypto ETFs solve two big problems: accessibility and trust. They make it easy for everyday investors to enter the crypto space using familiar tools, and they add a layer of regulation and transparency that direct crypto exchanges often lack.

Quick Example:

- If you want exposure to Solana today, you’d need to sign up on a crypto exchange, transfer funds, and store tokens in a wallet.

- With a Solana ETF, you just log into your brokerage app (Robinhood, Fidelity, Schwab), search the ticker, and hit “buy”—just like buying $AAPL or $TSLA.

The Big Question: Are Crypto ETFs About to Explode?

So, the crypto market is buzzing again, but this time not because of wild meme-coin rallies or a surprise Elon Musk tweet. The focus has shifted to something far more structural: crypto ETFs. If the SEC signs off on new rules in the coming weeks, we could see a flood of altcoin ETFs—everything from Solana to Dogecoin—hit mainstream brokerages.

This moment matters because it’s not just about trading coins anymore. It’s about how crypto gets integrated into the everyday financial system, shaping portfolios for retail investors, institutions, and even pension funds. Let’s break it all down in a way that’s easy to understand.

1. What’s Happening—and Why It’s Different This Time

For years, launching a crypto ETF in the U.S. meant a painfully slow, case-by-case approval process. Bitcoin ETFs finally got approved in 2024 after a decade of rejection, but altcoins were left waiting.

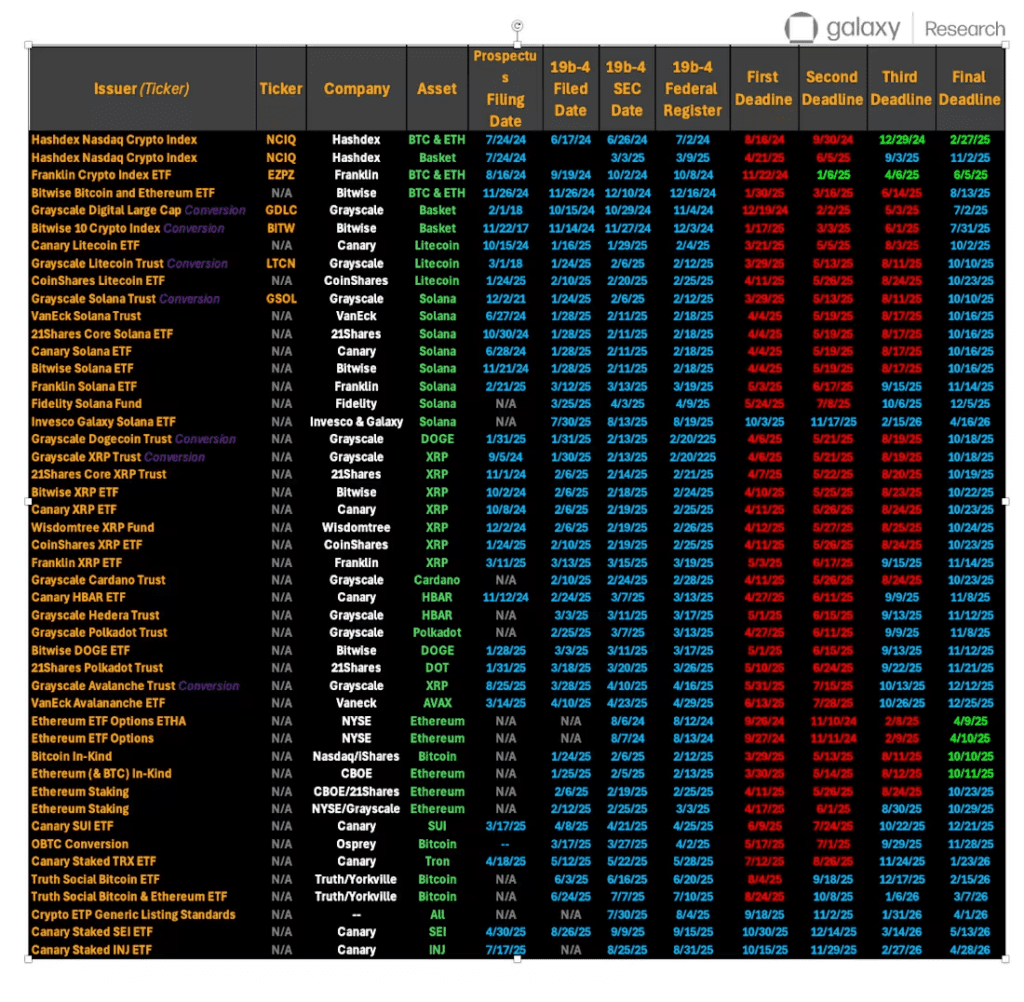

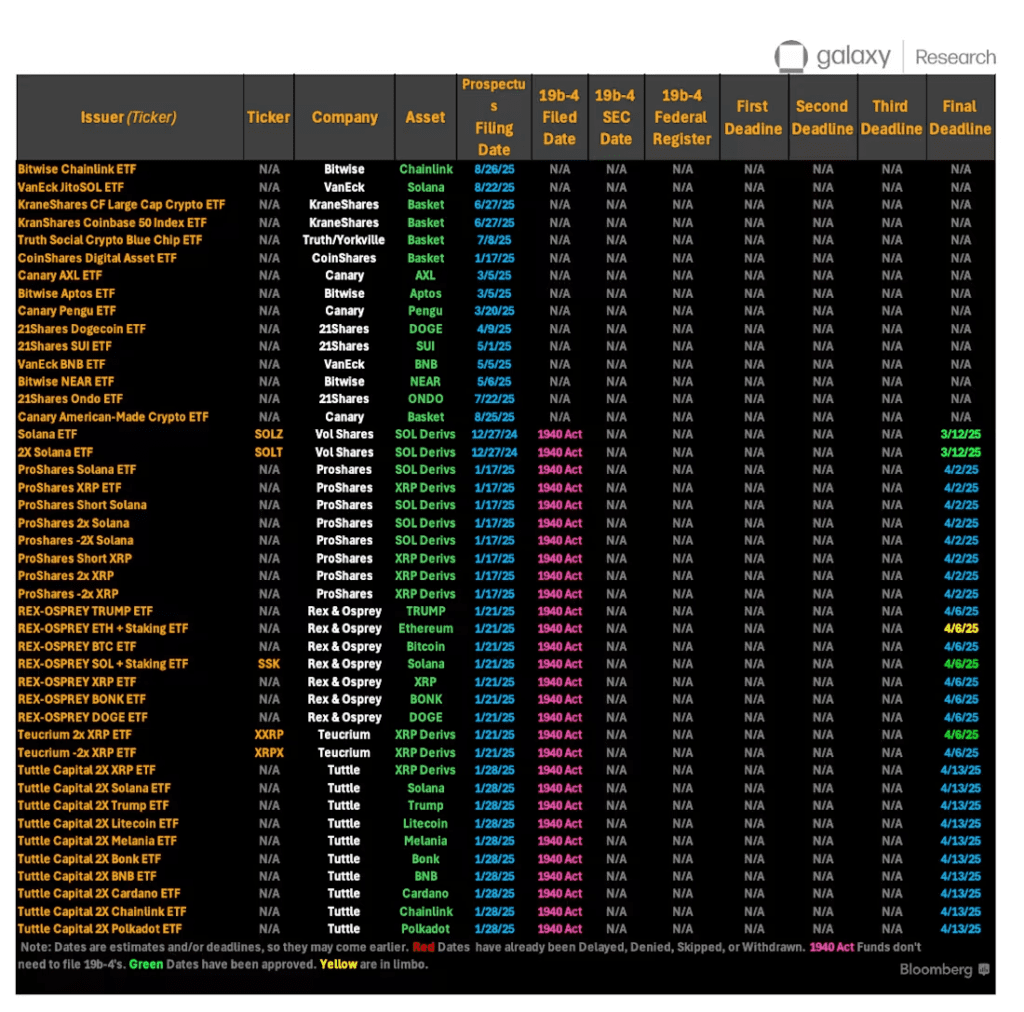

Now, three major U.S. exchanges—Cboe BZX, Nasdaq, and NYSE Arca—are asking the SEC to approve generic listing standards for crypto ETFs. If the SEC agrees, the process would become automatic for qualifying coins, the same way it works for traditional ETFs.

This could be a game changer. Instead of waiting months (or years) for approvals, altcoin ETFs could go live much faster. That means easier access for investors and faster growth for the crypto market.

Key points:

- Decision window: Late September 2025 (first deadline) to March 2026 (final deadline).

- First batch could include Solana (SOL), XRP, Dogecoin (DOGE), Litecoin (LTC), and more.

- Institutional money would finally have a regulated, easy way to buy into altcoins.

2. The Pipeline: Which Crypto ETFs Are Waiting?

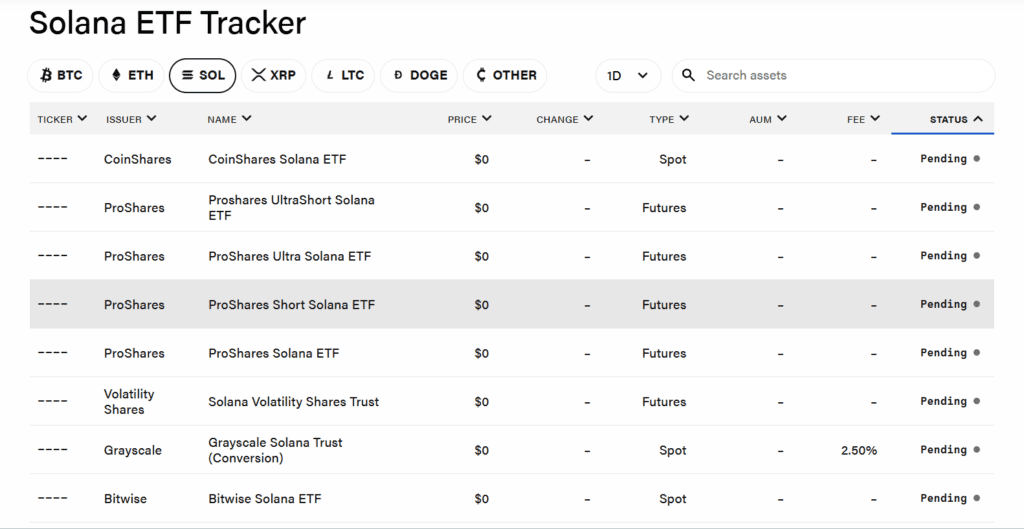

The ETF backlog is huge—92 crypto ETF applications are currently pending SEC review. That’s a record, and the list is growing every week.

The stars of the lineup are Solana and XRP, both of which already have strong institutional support and liquidity. But meme coins like Dogecoin aren’t far behind, thanks to their cultural staying power.

Here’s the current leaderboard:

| Token | Pending ETF Applications | Market Significance |

|---|---|---|

| Solana (SOL) | 8 | Fast transactions, strong DeFi ecosystem, institutional adoption |

| XRP | 7 | Known for payments and banking partnerships |

| Dogecoin (DOGE) | Multiple | Meme coin with staying power; now eyed by ETF issuers |

| Litecoin (LTC) | Several | One of the oldest and most established cryptos |

| Others (ADA, AVAX, DOT, SHIB, HBAR, LINK) | Dozens combined | Strong networks, liquidity, and user bases |

Big names like Grayscale and 21Shares are leading the charge. They want to convert their existing trusts (SOL, XRP, DOGE, LTC, AVAX) into ETFs, while also filing new applications for emerging coins.

3. Analysts’ Expectations: Optimism Is High

Market analysts and ETF watchers are almost unanimous: approval is likely. The reason? The SEC is overwhelmed by the sheer number of filings and has already shifted its stance on crypto regulation.

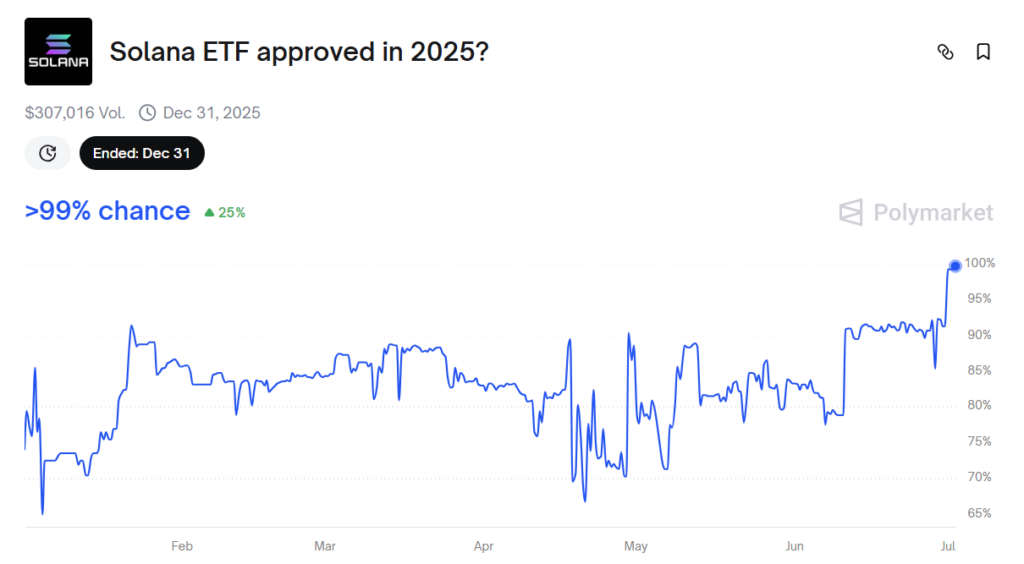

Prediction markets mirror this optimism. According to Polymarket:

- Solana ETF odds: 99% by end of 2025 (up from 72% in May).

- XRP ETF odds: 87% (up from 64% in August).

- Dogecoin ETF odds: 82% (nearly double the 44% in June).

Analysts’ takeaways:

- Bloomberg Intelligence: There may soon be more crypto ETF filings than U.S. stock ETFs.

- 21Shares’ Andrew Jacobson: “First to file isn’t enough anymore. Product innovation will win long term.”

- Ray Youssef (NoOnes CEO): Only tokens with real utility will survive this ETF wave; speculative tokens will fade.

4. If the SEC Approves: What to Expect

If the SEC says yes, the crypto landscape could change overnight. ETFs would open the floodgates for both retail and institutional investors, creating new demand and liquidity.

Impacts of approval:

- Altcoin ETFs launch in late 2025 and early 2026.

- Institutional investors gain regulated access—think pension funds, wealth managers, and ETFs in retirement accounts.

- Coins like SOL, XRP, and DOGE could see major price rallies due to inflows.

- ETF issuers will innovate with DeFi integrations, staking features, and diversified baskets.

- Global markets—from Europe to Asia—will likely copy U.S. approval and launch similar products.

5. If the SEC Rejects or Delays: Risks to Watch

Rejection is still possible, though analysts see it as unlikely. But if it happens, the consequences will ripple across crypto.

Impacts of rejection:

- 92 ETF applications stall or die on the table.

- Altcoin optimism fades, possibly dragging prices down.

- U.S. risks falling behind as Europe and Asia push forward with their own ETF frameworks.

- Retail investors remain stuck with direct crypto purchases, riskier and less accessible.

- Confidence in SEC’s approach could erode further, reigniting political fights over crypto regulation.

6. Why This Matters for Everyday Investors

For new investors, crypto ETFs offer something they’ve been waiting for: a simple, safe, and familiar way to invest in crypto. No more wallets, private keys, or exchange hacks. Just log into your broker and buy like you would a stock.

But it’s not just about convenience. ETFs also bring transparency and regulation—things the crypto market has often lacked. They could help weed out scams and focus investor attention on strong projects with genuine adoption.

Scenarios for investors:

- If approved: Expect broader adoption, price boosts, and safer access.

- If rejected: Stay patient, but understand the growth story gets delayed.

7. The Global Picture: Beyond the US

What happens in the US doesn’t stay in the U.S. ETF approval would spark a global ripple effect.

- Europe: Already ahead with crypto ETPs, but SEC approval would boost competition and attract more capital.

- Asia: Countries like Japan and South Korea are exploring ETF frameworks, and U.S. approval would accelerate that.

- Emerging markets: Could see adoption through ETF access even if crypto exchanges remain restricted.

This could also cement the U.S. as the global hub for regulated crypto finance—something it has been losing to Europe recently.

8. Bottom Line: A Defining Moment Ahead

We are approaching a make-or-break decision for crypto ETFs. With 92 applications on the line, the SEC’s call will shape the next chapter of crypto investing.

- If approved: Altcoins enter mainstream portfolios, and crypto finally becomes a regular part of retirement accounts and institutional strategies.

- If rejected: Momentum stalls, and the U.S. risks falling behind.

For now, optimism is high, and investors are betting on a green light this fall. If that happens, we may look back on September 2025 as the month crypto truly crossed into the financial mainstream.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)