Supermicro (NASDAQ: SMCI), one of the most talked-about AI infrastructure stocks of the past year, reports its Q3 FY2025 earnings on May 6, 2025, after market close. But the excitement has turned into anxiety — the company’s April 29 preliminary results sent its stock plunging 20–23%, stunning Wall Street.

In this deep dive, l unpack the numbers, what caused the shortfall, where the opportunities and risks lie, and what investors and traders should watch.

What Happened — and Why the Shock?

On April 29, Supermicro announced preliminary results:

- Revenue → $4.5B–$4.6B

→ Below prior guidance of $5.0B–$6.0B

→ Miss driven by delayed customer orders and platform transitions - Non-GAAP EPS → $0.29–$0.31

→ Far below analyst consensus of $0.46–$0.62 - Gross margin → Down ~220 basis points QoQ

→ Due to inventory write-downs on old-generation products and expedite costs to meet new-generation deliveries

What Caused the Miss?

1️⃣ AI platform transition delay

- Customers are waiting for NVIDIA Blackwell GPU servers, causing paused orders.

- Older-generation inventory is now harder to sell, forcing write-downs.

2️⃣ Customer concentration risk

- Two major customers accounted for ~27% and ~30% of revenue.

- When big customers pause, Supermicro feels it fast.

3️⃣ Margin compression

- Expedite costs to deliver cutting-edge systems

- Higher freight + component costs

- U.S.–China tariffs pressuring costs (5–25% import tariffs on server parts)

4️⃣ AI sector overheating? – Some analysts warn that “AI bubble stocks” like Supermicro are priced for perfection, and any misstep leads to a crash.

Analyst & Market Reactions

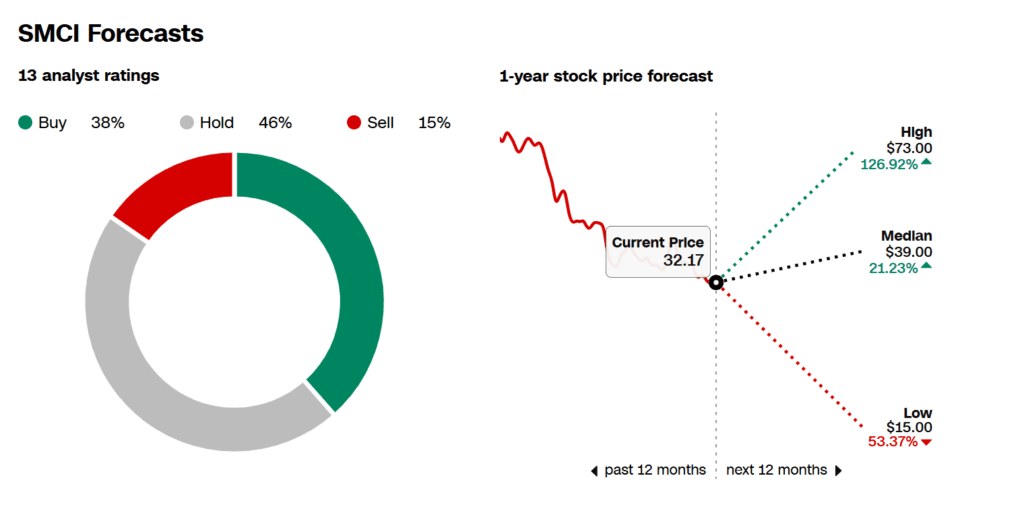

- JPMorgan: Cut price target from $39 → $36; called the preannouncement a “credibility hit.”

- Barclays: Lowered PT from $59 → $34; says expectations were too high during the AI server build-out.

- Northland Capital: Cut EPS estimate from $0.38 → $0.21.

Stock impact:

- Shares collapsed ~23% in one day — wiping out ~$6 billion in market cap.

- Retail and institutional traders sold heavily on margin concerns.

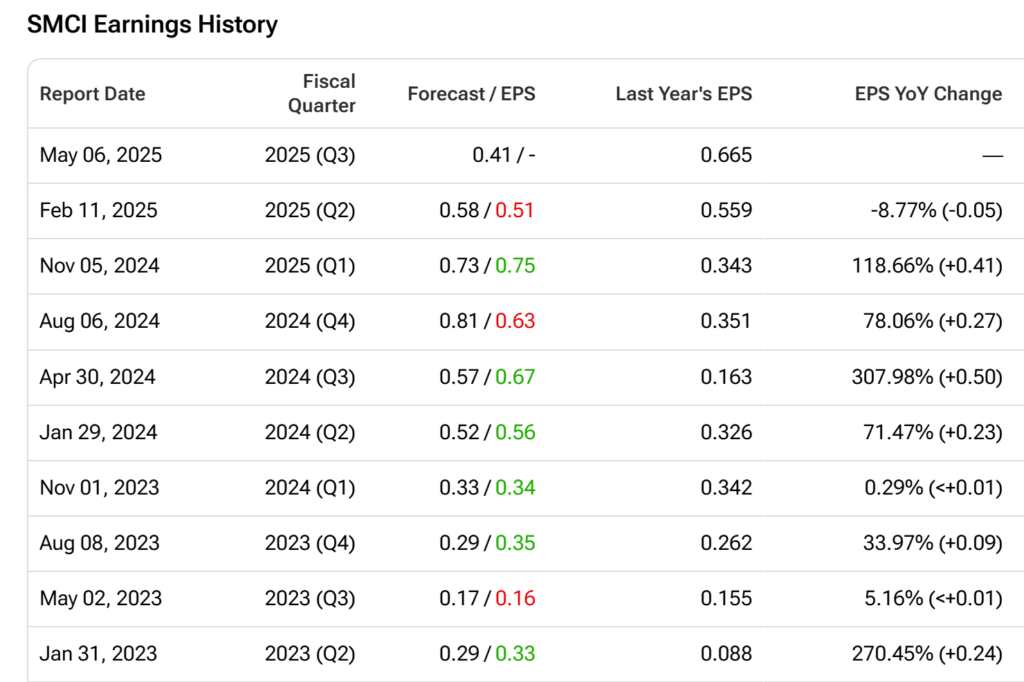

- Super Micro Computer’s earnings beat the Zacks Consensus Estimate twice in the trailing four quarters while missing once and matching the same on the other, delivering an average negative surprise of 1.82%.

Bullish Factors

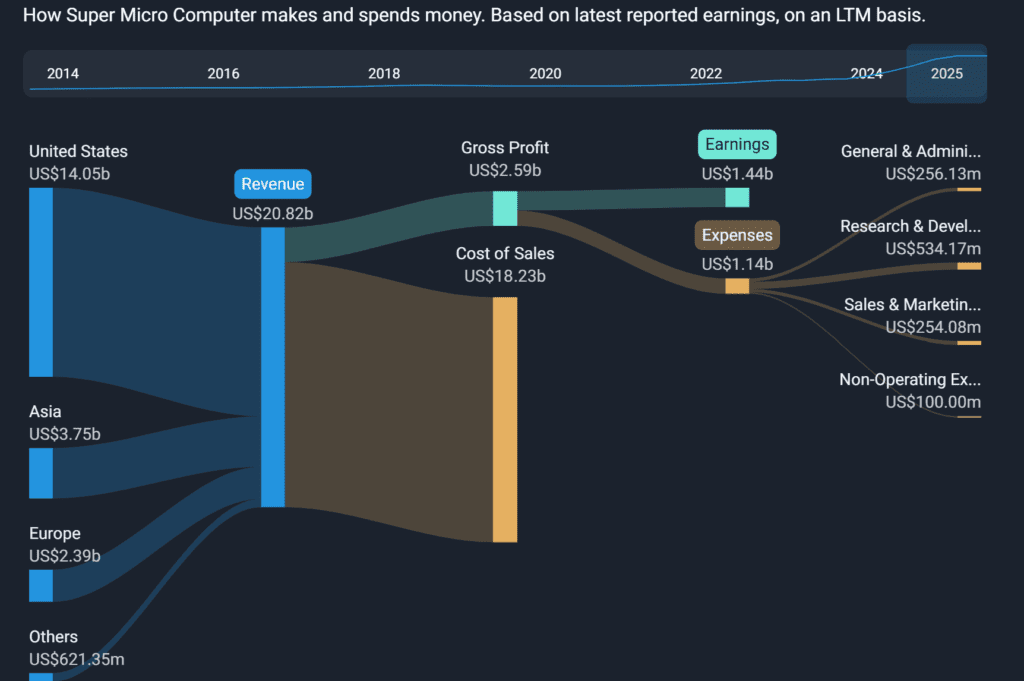

✅ AI server leadership: Supermicro leads in AI-optimized, liquid-cooled servers — core to next-gen datacenters running NVIDIA’s Blackwell GPUs and AMD’s MI300X.

✅ Strong design pipeline: Management reported “record design wins” for new systems, suggesting a robust Q4 and FY2026 pipeline.

✅ Long-term AI boom: Even with short-term delays, AI server demand is projected to surge, with Supermicro as one of the few scaled players in the U.S.

✅ Aggressive manufacturing ramp: The company recently expanded capacity to ~4,000 racks/month, positioning itself as a key supplier to hyperscalers.

Bearish Factors

⚠️ Execution missteps: The surprise earnings warning raises questions about management’s ability to forecast demand and manage inventory transitions.

⚠️ Gross margin squeeze: Margins fell 220 basis points QoQ — a red flag during an “AI boom.” This suggests poor cost controls or aggressive discounting.

⚠️ Customer concentration: Reliance on two mega-customers leaves the company vulnerable to sudden order shifts.

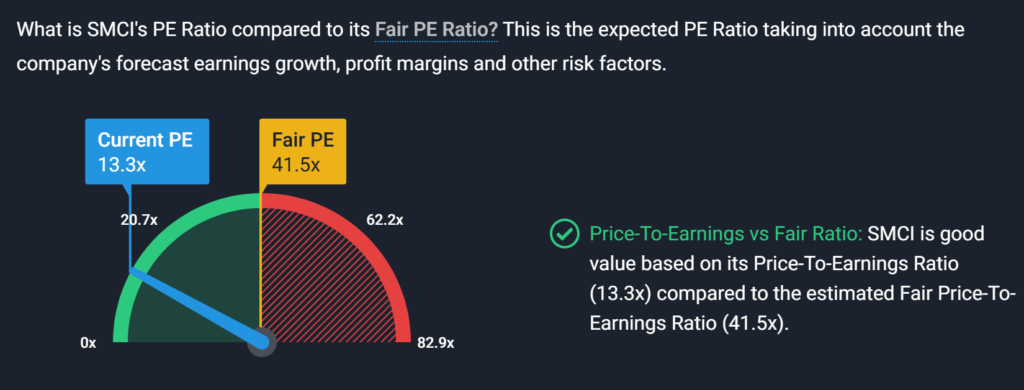

⚠️ Valuation risk: After a +700% rally from early 2023 to early 2025, Supermicro’s valuation baked in massive AI growth, making the stock fragile on any earnings stumble.

Prediction and Guidance

- Revenue (final) → ~$4.5–4.6B

- EPS (final) → ~$0.29–0.31

- Gross margin → Down ~220bps

➤ Q4 outlook will be critical.

Analysts expect a sharp rebound IF Blackwell ramp starts and customer orders accelerate.

➤ Stock reaction potential:

Given the massive selloff, any positive Q4 guidance could trigger a relief rally; but weak commentary may push the stock even lower.

Final Takeaway: What Should Investors Do?

Supermicro’s Q3 earnings preview is a wake-up call about the challenges of riding the AI server boom. The company remains fundamentally well-positioned with cutting-edge hardware and deep partnerships (especially with NVIDIA), but:

- Execution discipline needs to improve.

- Management must regain Wall Street’s trust.

- Margin stabilization and Q4 momentum are now critical.

For long-term investors, this dip may be an opportunity — but only if you believe in management’s turnaround ability.

For traders, the stock will remain highly volatile; focus on Q4 guidance and customer commentary.

For beginners, understand that AI stocks are prone to extreme hype → crash cycles; manage your risk carefully.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: China, Japan and South Korea will jointly respond to US tariffs

Palantir Q1 2025 Earnings Report — Why the Stock Popped (Then Dropped)