Rivian Automotive (NASDAQ: RIVN), one of the most closely watched electric vehicle (EV) startups, is set to report its Q1 2025 earnings on May 6 after market close. With rising competition, high cash burn, and the highly anticipated R2 SUV, this report comes at a critical moment. Here’s everything investors, traders, and beginners need to know.

Key Expectations

- Revenue: ~$1.2 billion (estimated range from analysts)

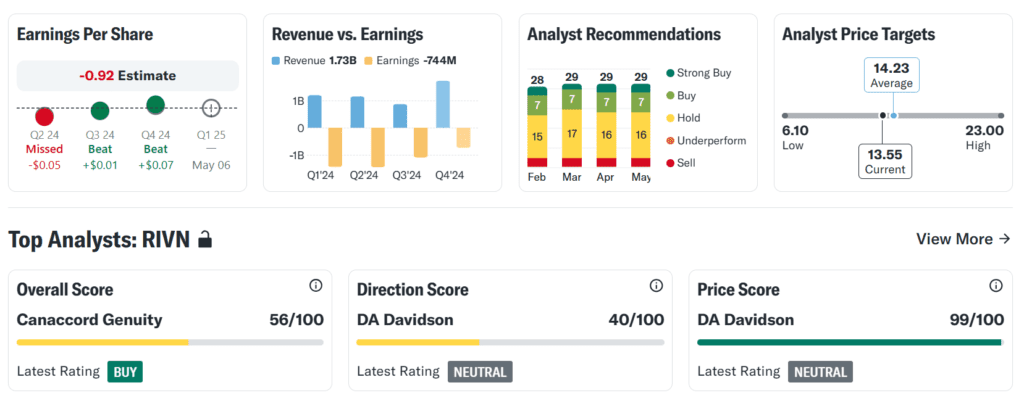

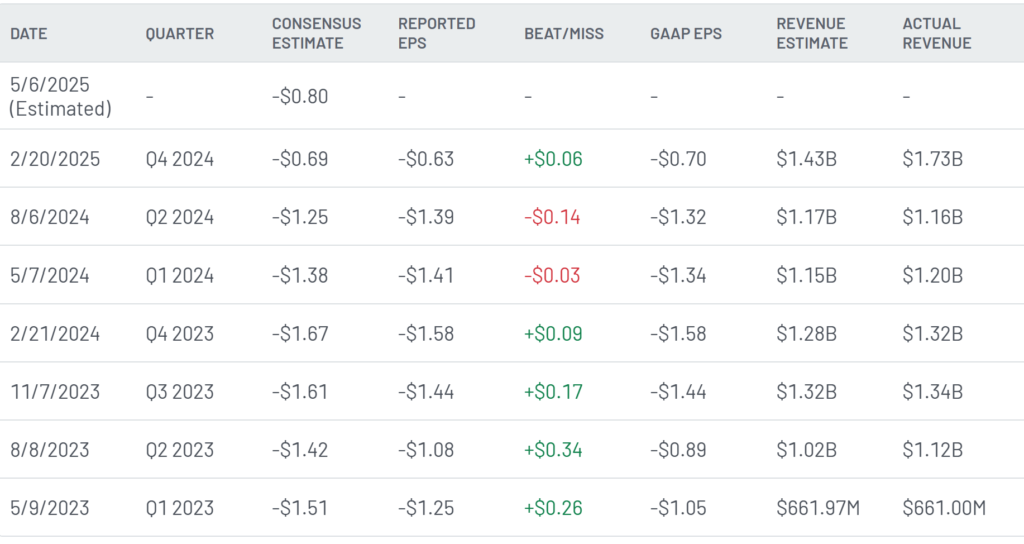

- EPS (Earnings per Share): Expected to report a loss of ~$1.24 per share, reflecting high production costs and investment in scaling.

- Vehicle Deliveries: Rivian has already announced 13,588 vehicles delivered in Q1, up ~7% YoY.

- Gross Margin: Still negative, but analysts expect gradual improvement from ~-36% toward the mid-20% negative range.

What’s Driving Rivian’s Quarter?

✅ Production and Deliveries:

Rivian has been ramping production at its Illinois factory, focusing on its R1T pickup, R1S SUV, and EDV vans for Amazon. Deliveries of 13,588 vehicles slightly beat internal targets, signaling steady demand even amid EV market softness.

✅ R2 SUV Launch:

All eyes are on the R2, a smaller, cheaper SUV crucial to Rivian’s long-term survival. Analysts highlight this as the most important near-term catalyst, though real revenue contribution won’t come until 2026.

✅ Cash Burn + Liquidity:

Rivian had ~$9.4 billion in cash at the end of 2024 but is burning $1 billion+ per quarter. Analysts are closely watching management’s update on liquidity, with no major capital raise expected yet.

✅ Partnerships:

Amazon remains a key partner, having placed a major order for delivery vans. Cox Automotive’s investment and service network is also seen as a competitive edge.

✅ Market Headwinds:

Like other EV makers, Rivian faces slowing demand, price wars led by Tesla, and a cautious consumer backdrop.

Historical Earnings Snapshot

While Rivian has beaten delivery targets, it still struggles to surprise Wall Street on profit metrics, making guidance especially important this quarter.

Bullish Case

- Record production + steady demand → Despite EV slowdowns, Rivian is growing volumes, a clear differentiator.

- R2 hype builds momentum → With ~68,000 reservations, the R2 could unlock a massive new market segment.

- Strong cash balance → ~$9.4B provides enough runway to fund operations through 2026.

- Vertical integration + in-house tech → Helps control costs and defend margins long-term.

Analysts from Benzinga call Rivian one of the few EV startups showing real scaling potential and see the R2 as a game-changer.

Bearish Case

- Cash burn remains alarming → At ~$1B+ per quarter, Rivian needs to show a path to break-even or risk dilutive capital raises.

- No major catalysts in 2025 → As flagged by several analysts, meaningful revenue from the R2 won’t hit until 2026.

- Gross margins deeply negative → Despite scaling, margins remain far below breakeven.

- Broader EV market slowdown → High rates, economic uncertainty, and Tesla-led price cuts weigh on the entire sector.

- Competition intensifying → Ford, GM, Hyundai, and Lucid are all launching new EV trucks and SUVs.

Gurufocus points to “limited catalysts and a cooling EV hype cycle” as key risks holding the stock back.

Final Takeaway

Rivian’s Q1 2025 earnings will tell a nuanced story. While production and delivery growth are strong, profitability remains a challenge, and investors must look past just headline numbers. Analysts are sharply divided: bulls are focused on Rivian’s execution and future R2 upside, while bears are concerned about the company’s cash runway and lack of near-term catalysts.

For investors:

- Long-term bulls may see current weakness as a buying opportunity ahead of the R2 wave.

- Short-term traders should watch guidance closely, especially around cash burn, margins, and production targets.

- Beginners should understand that Rivian is still a high-risk, high-reward EV play, best sized carefully in a portfolio.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: China, Japan and South Korea will jointly respond to US tariffs

Supermicro Q3 Fiscal 2025 Earnings Preview and Prediction: What to Expect

Palantir Q1 2025 Earnings Report — Why the Stock Popped (Then Dropped)