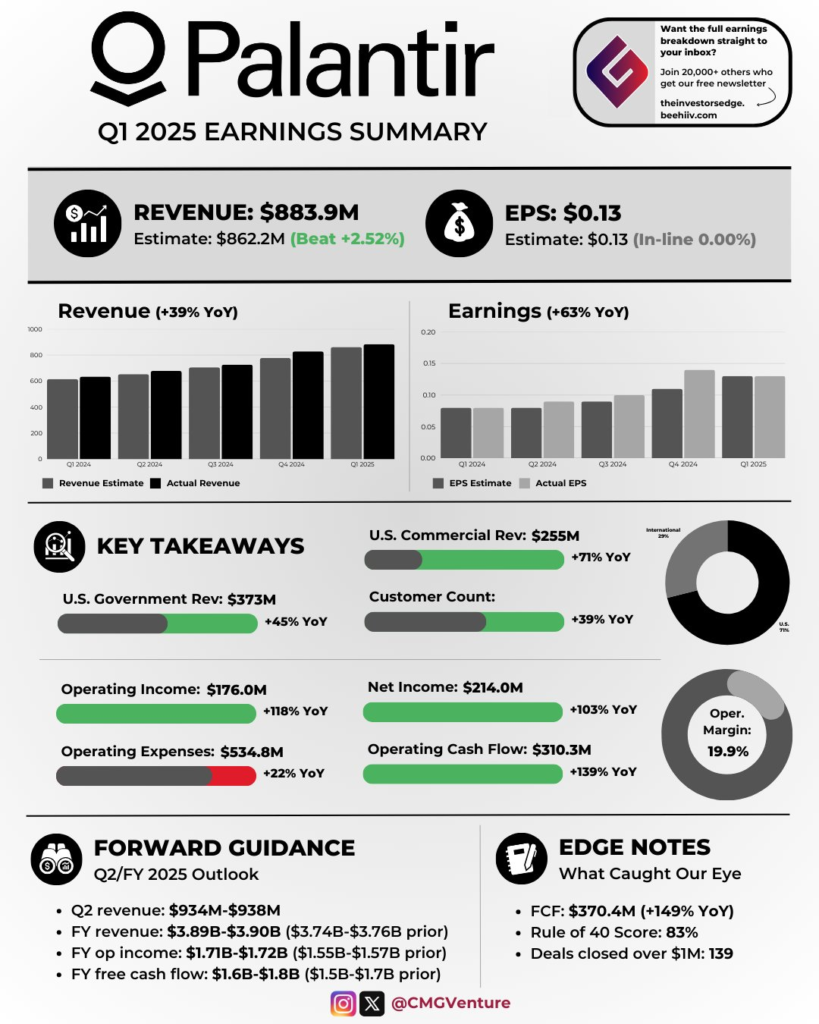

Palantir ($PLTR) just delivered one of the most anticipated earnings reports of the AI era — and it didn’t disappoint on paper. Yet, despite crushing estimates and raising guidance, the stock initially surged and then slipped back.

What’s going on? Let’s break it down in detail.

What Went Right?

- Revenue up 39% YoY → U.S. sales especially strong, with commercial deals up 71%.

- Raised 2025 guidance → signaling even bigger expectations ahead.

- Strong profitability → Palantir is one of the rare AI companies making real cash.

- AI demand boom → U.S. military, defense, and commercial sectors are all ramping up.

On paper, this was one of Palantir’s best quarters ever. Yet the stock popped and then quickly sold off. What happened?

1. The Numbers Were Already Priced In

Palantir shares were up ~50% YTD before the report. Wall Street was already expecting big AI momentum.

→ When a stock is that extended, even great results can trigger profit-taking.

2. The Shareholder Letter Spooked Investors

CEO Alex Karp’s shareholder letter was unusual for a public company.

Instead of focusing purely on numbers, execution, and market share, Karp delivered a philosophical, ideological essay on:

- Palantir’s role defending U.S. national security

- The company’s “heretic” status in Silicon Valley

- A mission-driven, anti-establishment identity

- Loyalty to U.S. government and military contracts

- Critiques of elites, cultural decay, and political collapse

Key quotes that stood out:

“Our results are not and will never be the ultimate measure of the value… of our business. We have grander and more idiosyncratic aims.”

“Our commitment to building software for the U.S. military remains steadfast, when such a commitment is fashionable and convenient and when it is not.”

“We admittedly are not always the most pleasant of partners.”

Why did this trigger selling?

- Institutions want clarity, not ideology.

Big investors want to hear about product, customers, competitive edge, and capital allocation — not sweeping political and cultural manifestos. - Defense-heavy narrative raises risks.

U.S. government spending is cyclical, political, and unpredictable.

The more Palantir leans into this identity, the more investors worry about its reliance on military + intelligence budgets. - Tone of the letter signaled they know competition is rising.

While Palantir’s numbers are excellent, the company hinted it’s preparing for more competitive battles in AI, defense tech, and commercial software.

3. Short-Term Traders Dumped the Pop

After the hype and the initial earnings beat, hedge funds and fast money players sold into strength. This is classic post-earnings behavior, especially in stocks that have rallied hard into a report.

Final Takeaway

Palantir’s Q1 was fundamentally excellent — but the market is a forward-looking machine.

- Traders read the letter as a warning that the company’s unique position may face more tests.

- Institutions dislike mixing ideology with quarterly performance.

- Valuation was already rich → any “imperfection” was a reason to lock in profits.

For long-term believers, this pullback may be a buying opportunity. For traders, it’s a reminder: narrative matters as much as numbers in AI stocks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Palantir Q1 2025 Earnings Preview and Prediction: What to Expect