Nvidia delivered another big quarter and a $60B buyback, but the stock fell because the beat wasn’t explosive where it mattered most (data center), growth is normalizing, and the outlook still excludes China.

NVIDIA’s stock fell 4% after hours following the report’s release. Going into the report, options showed traders had priced in a swing of roughly 6%, or about $260 billion, in Nvidia shares after results were posted.

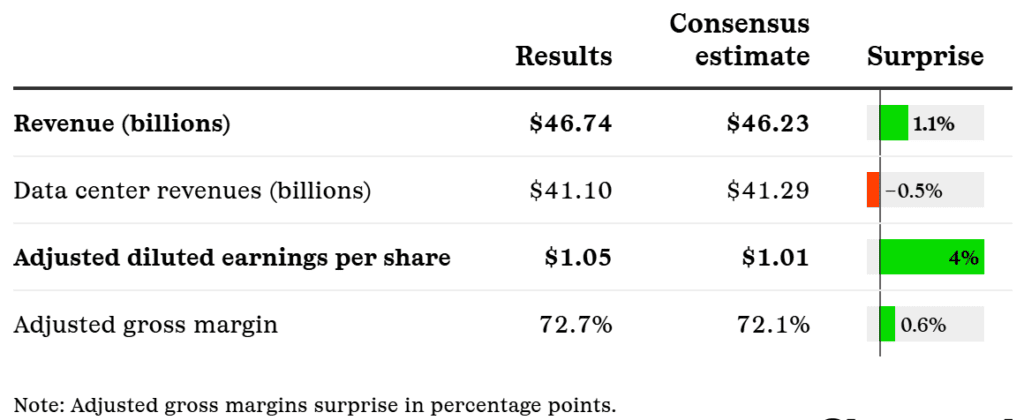

The results (Q2 FY26)

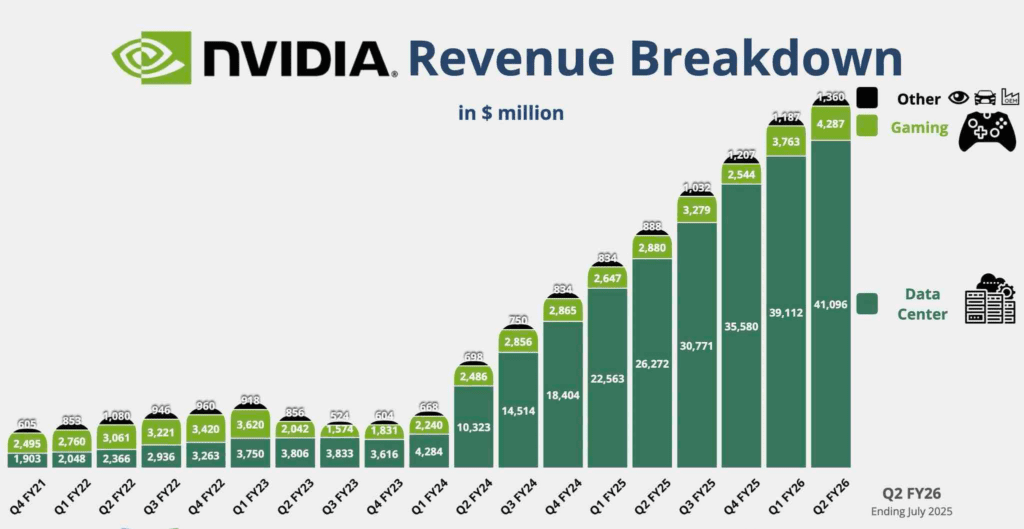

- Revenue: $46.74B vs $46.23B est. (+56% YoY)

- Adj. EPS: $1.05 vs $1.01 est. (+54% YoY)

- Adj. gross margin: 72.7% (ahead of est.)

- Data Center: $41.1B vs ~$41.2–$41.3B est. (+56% YoY) — slight miss

- Gaming: $4.3B (+49% YoY)

- Pro Viz: $601M (+32% YoY); Auto: $586M (slight miss), +69% YoY

- Adj. OpEx: $3.80B (better than est.) | EBIT: $28.44B (a touch light)

- Free cash flow: mid-$20Bs

- Capital return: Buyback authorization +$60B; $24.3B returned in 1H

Why did $NVDA drop even though it beat?

The numbers were good, but not good enough in the places that matter most, and the stock was priced for fireworks.

- The bar was higher than “estimates.”

Street consensus was $46.2B / $1.01, but many traders were leaning to whisper numbers above that. A small beat on the headline won’t lift a $4T stock when people expected a big beat. - Slight miss in the key line (Data Center).

Data Center is the engine. It printed $41.1B vs ~$41.2–$41.3B expected — basically a hair light. When the core segment isn’t the source of upside, bulls take profits. - Growth is normalizing.

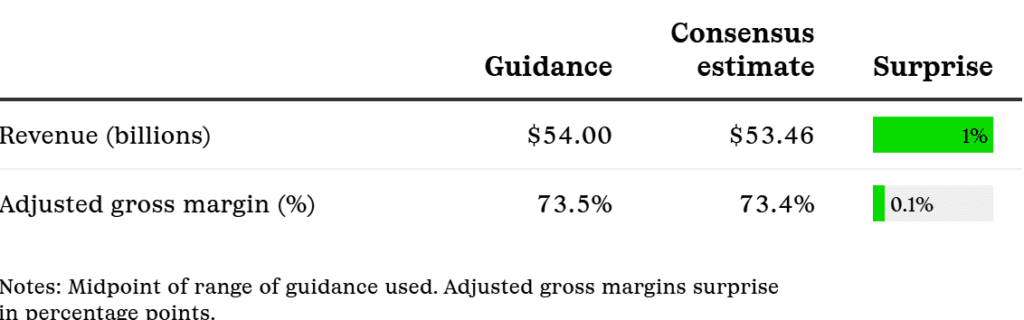

YoY is still huge (Revenue +56%, EPS +54%), but last year you had triple-digit growth. The market is adjusting from “shock & awe” to “very strong but slowing,” which pressures the multiple. - Guidance is good, not jaw-dropping.

Q3 rev $54B (±2%) is above the Street (~$52.5B) and margins guided to ~73.5%, but some hoped for an even bigger “Blackwell surge.” Good ≠ multiple expansion when expectations are extreme. - China is still a ‘later’ story.

Management said the Q3 outlook assumes no H20 shipments to China. That keeps a chunk of potential demand out of the base case. Investors want timing and scale, not just promise. - Nitpicks in the details.

EBIT $28.44B was a touch below models; FCF sits mid-$20Bs. Small things, but enough to justify “sell the news” after a big run. - Positioning/flow (IV crush).

Options priced a ~6.1% move. After earnings, implied vol falls, dealers unwind hedges, call buyers take profits — flows that can push shares down even on a beat. - Valuation reality.

At ~8% of the S&P 500 and a $4T+ cap, “priced for perfection” means anything short of spectacular can trade lower on the day.

What to watch next

- Can they hit the Q3 guide? – Revenue $54B ±2% and adj. GM ~73.5%. If they deliver or raise, the stock gets support; if not, multiple compresses.

- Blackwell ramp details: Shipments, lead times, yields, and which customers get priority. If Blackwell ramps smoothly (and quickly), it can flip sentiment back to bullish.

- Data Center momentum vs. supply: Is the slight miss a timing/supply issue or demand issue? Watch backlog, delivery cadence, and any comment about ODM rack builds.

- China path & mix: Status of export licenses, any H20 or China-specific Blackwell timing, and how the 15% China fee affects margins. When China moves from “optionality” to “in the guide,” that’s upside.

- Hyperscaler capex signals: Fresh commentary from MSFT/AMZN/GOOGL/META on AI spend. If capex stays hot into 2H/2026, demand support remains.

- Margin bridge: How they get from 72.7% → ~73.5%: pricing, mix (compute vs networking), software attach, and any China drag.

- Networking + systems: Infiniband/Ethernet growth and full-rack deliveries. Bottlenecks here can cap revenue conversion even if demand is strong.

- Software & recurring (NIM, CUDA stack, enterprise AI): Any traction here lifts quality of revenue and margin durability.

- Cash returns vs. investment: Pace of the $60B buyback, share-count trend, and whether capex/supply commitments expand alongside it.

- Competition watch: Any signs of price pressure or share shifts vs. rivals’ next-gen accelerators. If competitors catch up, investors will look harder at NVDA’s pricing power.

Guidance (Q3 FY26)

- Revenue: $54.0B ±2% (above Street; ~+15% QoQ)

- Adj. gross margin: ~73.5% (±50 bps)

- Adj. OpEx: ~$4.2B

- Important: Guidance assumes no H20 shipments to China.

“Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary,” said Jensen Huang, founder and CEO of NVIDIA. “NVIDIA NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center.”

During the first half of fiscal 2026, NVIDIA returned $24.3 billion to shareholders in the form of shares repurchased and cash dividends. As of the end of the second quarter, the company had $14.7 billion remaining under its share repurchase authorisation. On August 26, 2025, the Board of Directors approved an additional $60.0 billion to the Company’s share repurchase authorisation, without expiration.

NVIDIA will pay its next quarterly cash dividend of $0.01 per share on October 2, 2025, to all shareholders of record on September 11, 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Nvidia Q2 2026 Earnings Preview and Prediction: What to expect