Nasdaq has proposed tougher rules for small-cap listings—especially those tied to China—following a spate of investor losses linked to suspected pump-and-dump schemes. The exchange’s new recommendations include:

- A $25 million minimum IPO raise for companies mainly operating in China (including Hong Kong and Macau),

- Increasing the unrestricted public float requirement to $15 million, and

- Speeding up delisting processes for companies with sub-$5 million market caps that show trading or compliance issues.

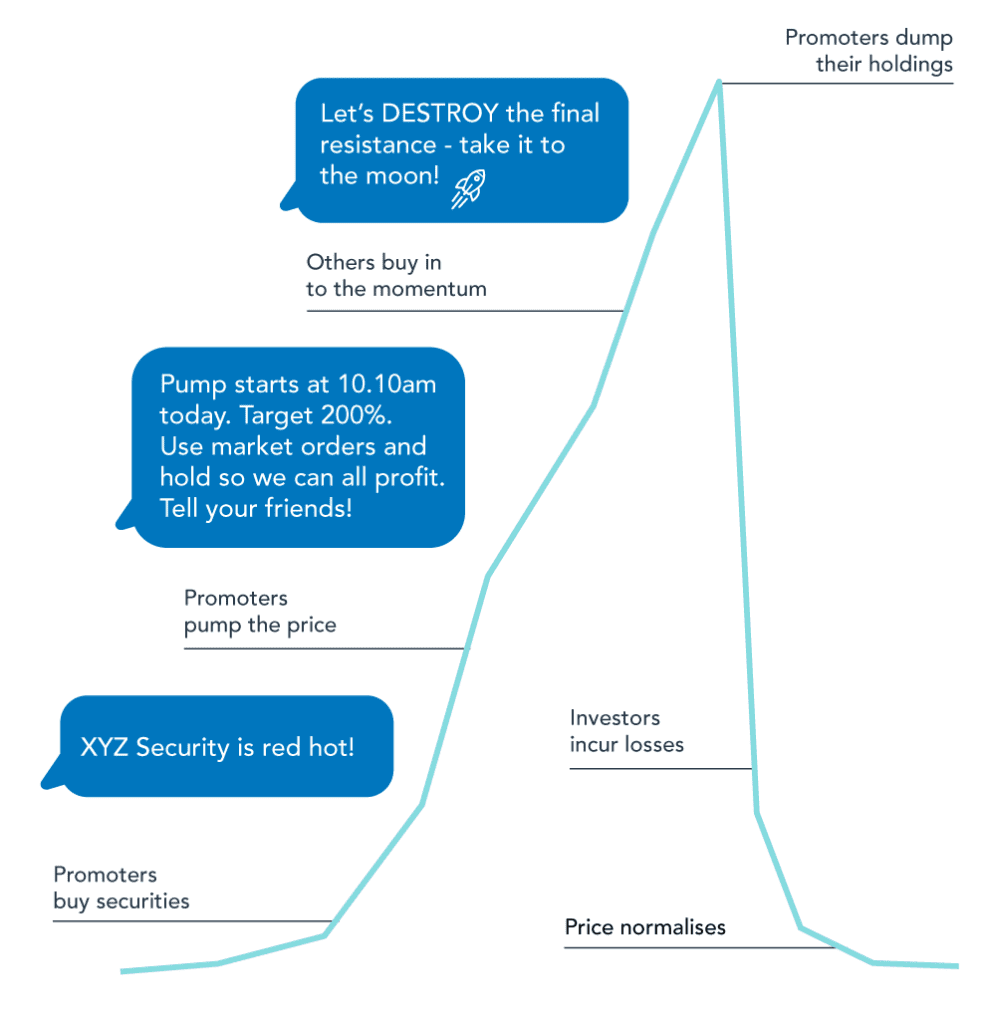

These measures follow a painful summer where several micro-cap Chinese stocks lost staggering value—costing investors $3.7 billion—after being aggressively promoted via social media. Nasdaq disclosed that nearly 70% of its regulatory referrals since August 2022 involved Chinese listings, though they comprise a small fraction of its overall listings.

Chinese Equities Retreat After Tech Rally

Across the Pacific, Chinese markets faced a sharp pullback, with some indices suffering their largest one-day slides in months:

- The CSI 300 slid about 2.1%,

- STAR 50, China’s tech-focused benchmark, plunged 6.2%, and

- Hong Kong’s Hang Seng fell around 1%.

This decline followed a robust August rally—driven by hype around AI chipmaker Cambricon—that pushed margin borrowing to record highs. Concerns of regulatory intervention and a reset after the grandeur of a major military parade in Beijing triggered widespread profit-taking. Analysts suggest this is likely a short-term correction, not a full-blown reversal in momentum.

Why This Matters

| Topic | Implication |

|---|---|

| Market Integrity | Nasdaq’s initiative signals growing scrutiny on speculative listings, offering more protection for retail investors. |

| China Exposure | With tighter scrutiny from both US and Chinese regulators, capital access for small Chinese firms may shift toward Hong Kong. |

| Investor Caution | The sharp pullbacks in Chinese tech emphasize how quickly speculative rallies can reverse—especially without policy catalysts. |

Nasdaq is responding to investor pain by raising the bar on risky IPOs, especially those tied to China, but must remain vigilant as scammers can adapt tactics. Meanwhile, Chinese tech stocks are undergoing a reality check after a blistering rally—highlighting how quickly sentiment can shift. Investors should stay sharp and monitor regulatory developments closely.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)

Tesla Europe Sales Slump 40% as BYD Triples Registrations