A major appeals court decision has thrown Donald Trump’s flagship tariff policies into legal jeopardy, setting up a likely Supreme Court showdown that could reshape US trade and market dynamics.

What the court decided

On Friday, the US Court of Appeals for the Federal Circuit ruled 7–4 that most of Trump’s tariffs were illegal. The judges found that the International Emergency Economic Powers Act (IEEPA) — the law Trump used to justify his sweeping “reciprocal tariffs” — does not grant presidents the authority to impose taxes or tariffs.

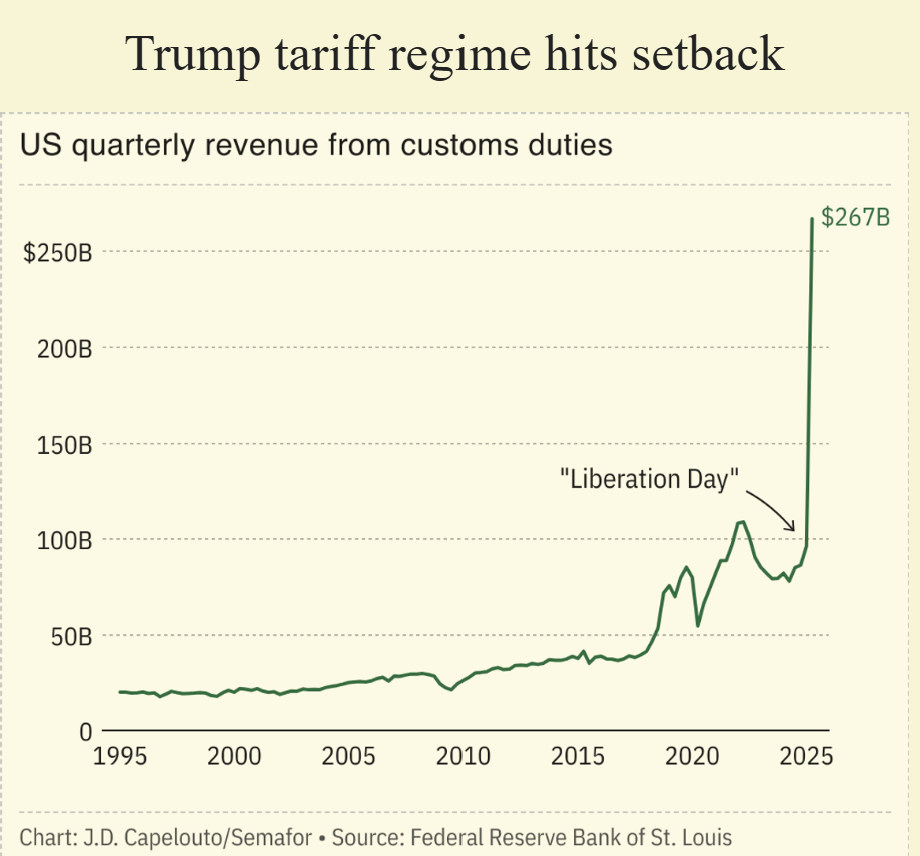

The decision applies to Trump’s April 2 “Liberation Day” tariffs, which placed a baseline 10% duty on nearly all imports, alongside higher levies on specific countries. The court delayed the ruling’s effect until October 14, giving the Trump administration time to appeal to the Supreme Court.

Tariffs imposed under other laws, such as those on steel and aluminum, remain unaffected.

Furthermore, Trump has made import duties a cornerstone of his second term, but Friday’s ruling found that Trump didn’t have the authority to enact them under emergency powers. The levies have been left in place for now while the White House appeals to the Supreme Court, where Trump’s success is “far from assured,” The Washington Post wrote. There are workarounds should Trump gets an unfavourable ruling there, but cancelling the tariffs would pose its own problems, with businesses and industry groups likely to seek repayment for the duties they’ve paid, Politico noted.

Why it matters

The ruling is one of the sharpest legal rebukes yet to Trump’s economic agenda. It underscores the limits of presidential power: Congress, not the president, has constitutional authority over taxes and tariffs.

If the Supreme Court upholds the decision, the government could be forced to refund billions of dollars collected from import duties, and Trump would lose his main economic lever in trade disputes.

What if the tariffs are ruled illegal?

The federal appeals court was divided 7-4 in its decision that Trump’s nearly universal tariffs are illegal. It has now given the US administration until mid-October to appeal to the US Supreme Court on a case with implications for both the US economy and its trade relationship with the rest of the world.

If the Supreme Court affirms the decision, it could trigger uncertainty in financial markets.

There will be questions over whether the US will have to repay billions of dollars that have been collected through import taxes on products.

It could also throw into question whether major economies – including the UK, Japan and South Korea – are locked into the individual trade deals they secured with the US ahead of the August deadline. Other trade deals currently being negotiated could also be thrown into chaos.

If allowed to stand, the appeals court decision would also be a tremendous blow to Trump’s political authority and reputation as a dealmaker. But if it were overturned by the Supreme Court, it would have the opposite effect.

Market reaction

Markets took the news in stride, with little immediate reaction in after-hours trading. Still, analysts warn that the decision introduces fresh uncertainty for businesses and investors:

- Short term: Volatility may remain muted until October, as tariffs stay in place during the appeal window.

- Medium term: If the Supreme Court affirms the ruling, companies with global supply chains could benefit from lower costs, potentially boosting margins in sectors like retail, autos, and tech hardware.

- Long term: A full rollback could strengthen US allies’ confidence in trade predictability but remove Trump’s favored tool for leverage, reducing his bargaining power in future deals.

Art Hogan, chief market strategist at B. Riley Wealth, noted: “The last thing the market or corporate America needs is more uncertainty on trade.”

What happens next

- Supreme Court appeal: The Trump administration is expected to appeal quickly, with a conservative-leaning Court likely to hear the case.

- Plan B: Experts believe Trump may try to reimpose tariffs under the Trade Act of 1974, but that law caps tariffs at 15% and only for 150 days — far weaker than his sweeping measures.

- Global implications: Countries like India, Japan, and Mexico — all recently caught in tariff crossfire — will closely watch whether existing trade deals hold or unravel.

Political fallout

Trump blasted the ruling as the work of a “highly partisan” court and warned that removing tariffs would be a “total disaster” for the US. Still, the case highlights the extraordinary collision between Trump’s trade agenda and constitutional checks on presidential power.

As Josh Lipsky of the Atlantic Council put it: “It puts Trump’s entire economic agenda on a potential collision course with the Supreme Court. It’s unlike anything we’ve seen ever.”

For now, Trump’s tariffs stay in place, but their future hinges on the Supreme Court. Markets may remain cautious, with investors balancing the possibility of tariff refunds (a boost for import-heavy industries) against the political risk of continued trade turbulence.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)