Meta Platforms (NASDAQ: META) is set to report its Q1 2025 earnings after the market closes on Wednesday, April 30. Analysts anticipate strong year-over-year growth, driven by advancements in AI and robust advertising revenues. However, challenges such as trade tensions and regulatory scrutiny may impact the company’s performance.

Expected Q1 2025 Results

- Revenue: $41.2 billion to $41.4 billion (+13% YoY)

- Earnings Per Share (EPS): $5.21 to $5.29 (+11% to +12% YoY)

- Operating Margin: Expected to decline to 32.5% from 43.1% in Q4 2024

Key Factors to Watch

1. Advertising Revenue Amid Trade Tensions

Advertising remains Meta’s primary revenue source, accounting for approximately 96% of total income. However, recent U.S.-China trade tensions have led to reduced ad spending from Chinese e-commerce companies like Temu and Shein. Analysts estimate this could result in a 3% to 5% revenue impact for Q2 2025.

2. AI Investments and Monetization

Meta’s significant investments in artificial intelligence, particularly its open-source Llama models, are central to its growth strategy. While these initiatives promise long-term benefits, the immediate financial returns remain uncertain. Investors will be keen to hear updates on monetisation plans for AI tools and platforms.

3. Reality Labs Performance

The Reality Labs division, responsible for Meta’s metaverse projects, continues to incur substantial losses, estimated at $15 to $20 billion annually. Analysts suggest that a strategic realignment or cost-cutting measures in this segment could positively influence investor sentiment .

4. Regulatory Challenges

Meta faces ongoing regulatory scrutiny, including a $227.5 million fine from the European Union for Digital Markets Act violations and a pending U.S. antitrust trial. While these issues may not have immediate financial implications, they contribute to the company’s risk profile .

Analyst Sentiment and Stock Performance

Despite a 26% decline from its February 2025 peak, Meta’s stock remains a favorite among analysts. Out of 27 analysts tracked by Visible Alpha, 25 rate the stock as a “buy,” with an average price target of approximately $687, suggesting a potential upside of about 25% from current levels .

Technical analysis indicates key support levels at $482 and $452, with resistance around $588. A breakout above these levels could signal a bullish trend .

Bullish Case for Meta

- AI Leadership: Meta’s advancements in AI, particularly with Llama models, position it as a leader in the space, with more than 700 million monthly actives.

- Analyst Confidence: Major financial institutions like Wells Fargo, JPMorgan, Bank of America, and Goldman Sachs have expressed optimism, citing Meta’s advertising dominance, AI developments, and cost control initiatives .

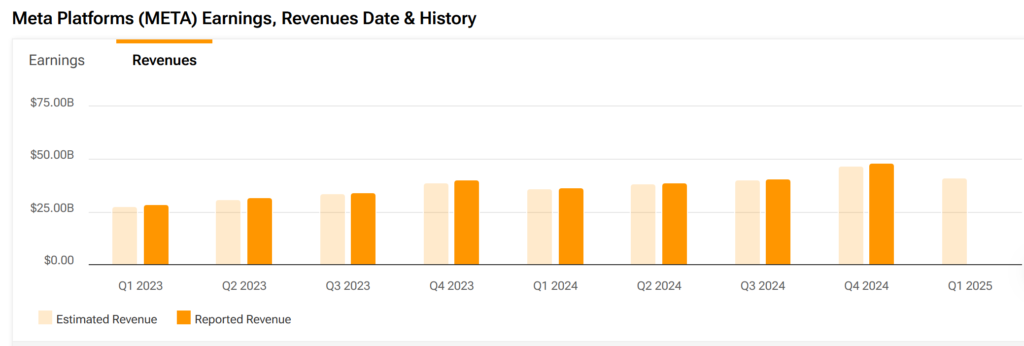

- Strong Revenue Growth: Q4 total revenue was $48.4 billion, up 21% year-over-year on both a reported and constant currency basis.

- Operating Income and Margin: Fourth quarter operating income was $23.4 billion, representing a 48% operating margin.

- Ad Revenue Increase: Q4 Family of Apps ad revenue was $46.8 billion, up 21% year-over-year.

- Threads User Growth: Threads now has more than 320 million monthly actives, adding more than 1 million sign-ups per day.

- Meta AI Glasses Popularity: Ray-Ban Meta AI glasses are a real hit, indicating positive consumer reception.

Bearish Case for Meta

- Reality Labs Losses: Continued losses in the metaverse division may concern investors seeking profitability. Reality Labs operating loss was $5 billion in Q4.

- Market Volatility: Broader economic uncertainties and trade tensions could affect Meta’s revenue streams.

- High Infrastructure Costs: Cost of revenue increased 15%, driven mostly by higher infrastructure costs.

- Regulatory and Legal Headwinds: Monitoring an active regulatory landscape, including legal and regulatory headwinds in the EU and the U.S. that could significantly impact the business.

- High Capital Expenditures: Full-year 2025 capital expenditures are expected to be in the range of $60 billion to $65 billion.

How Will Meta Platforms Stock React To Its Upcoming Earnings?

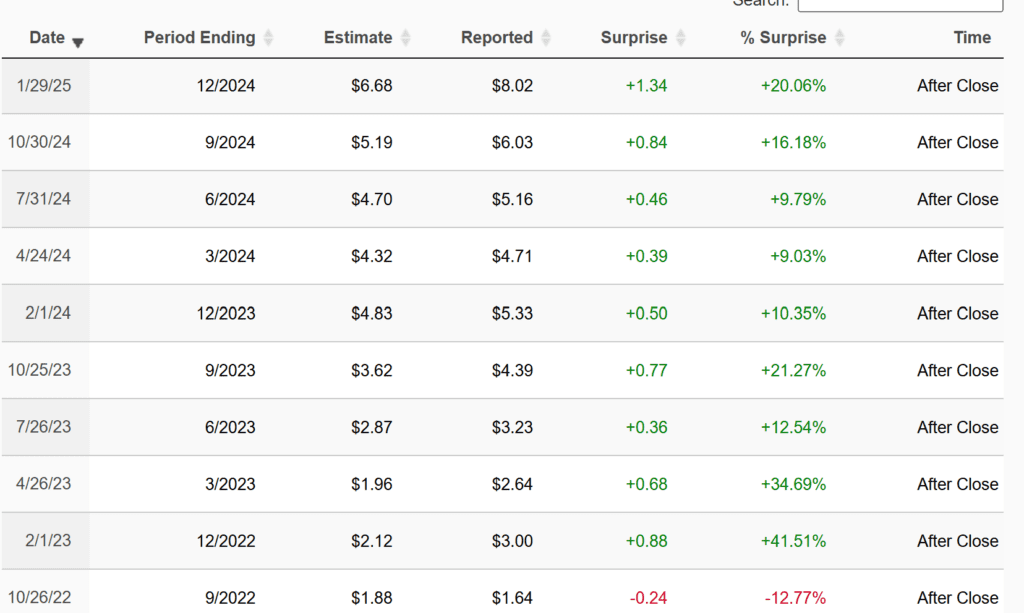

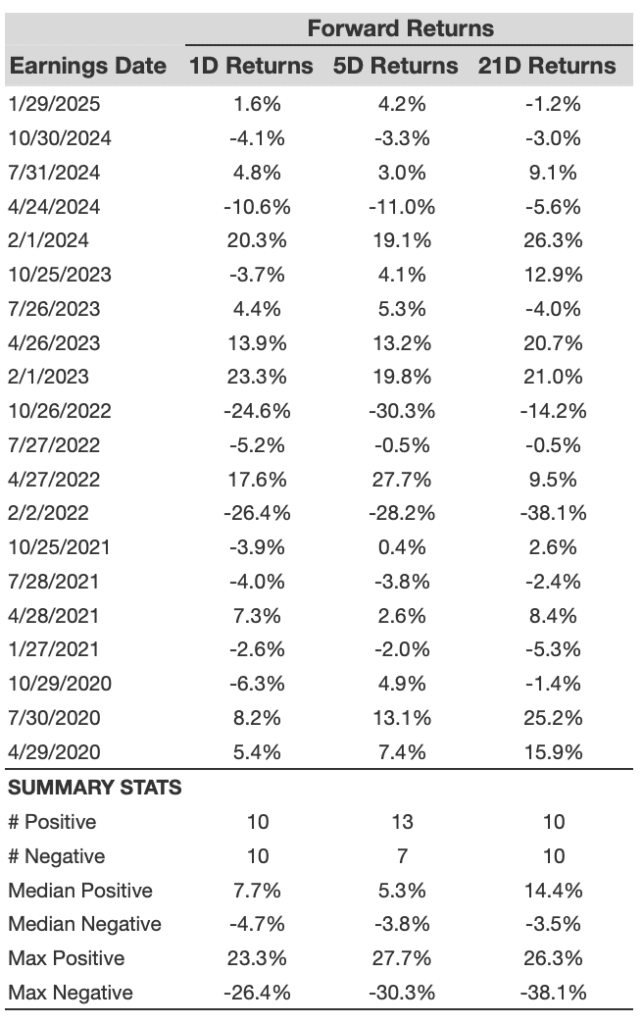

Meta has a 50/50 track record of posting positive or negative one-day returns after earnings, based on the last 20 reports. When the reaction is positive, the median gain is +7.7%; when negative, the median drop is -4.7%.

Short-term and medium-term reactions (1D to 5D or 21D) show mixed correlation, but traders often watch the 1D move to gauge near-term momentum.

Analysts expect Meta to post $5.22 EPS on $41.35B revenue, both showing strong year-over-year growth. If history repeats, a surprise beat could trigger a short-term rally — but volatility is part of the game.

Conclusion

Meta’s Q1 2025 earnings report is poised to showcase the company’s strengths in AI and digital advertising. However, external factors such as trade disputes and regulatory pressures present challenges. Investors will be closely monitoring the company’s guidance and strategic responses to these headwinds.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion

Shein and Temu Hike Prices as Trump’s 120% Tariff Takes Effect Next Week

Buy Now, Pay Later Use Surges — But Trouble May Be Brewing

Trump’s TIME Interview: Key Takeaways on Trade, Foreign & Domestic Policy