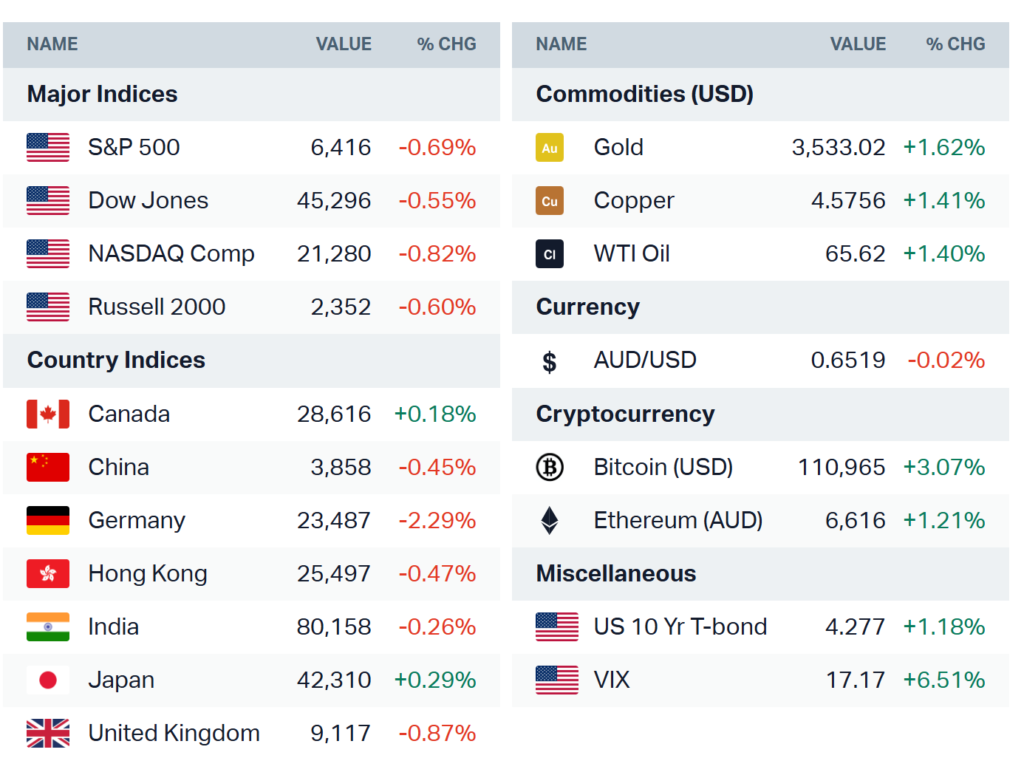

Global markets slumped on Tuesday as a renewed bond selloff rattled investors, pushing US and European equities lower while safe-haven gold surged past $3,500. Wednesday opened on a mixed note, with futures reflecting both relief from a major antitrust ruling and caution ahead of key economic data.

Wall Street Struggles Under Yield Pressure

U.S. stocks closed firmly in the red on Tuesday, September 2, weighed down by rising long-term bond yields and lingering policy uncertainty. The S&P 500 fell 0.7%, the Dow Jones lost 0.6%, and the Nasdaq slid 0.8%.

Tech stocks bore the brunt of the selloff. Nvidia extended its longest losing streak since March, tumbling nearly 5% at one stage, while Alphabet finished the session lower but staged a sharp rebound after hours. A favourable ruling allowed Google to retain its Chrome browser, removing the threat of a forced breakup but imposing restrictions on contracts and data sharing that could reshape its dominance in search. Apple also rallied in after-hours trade, as the decision preserved its lucrative deal to feature Google Search in Safari and Siri. (More about: Google Ordered to Share Search Data, Avoids Chrome Breakup)

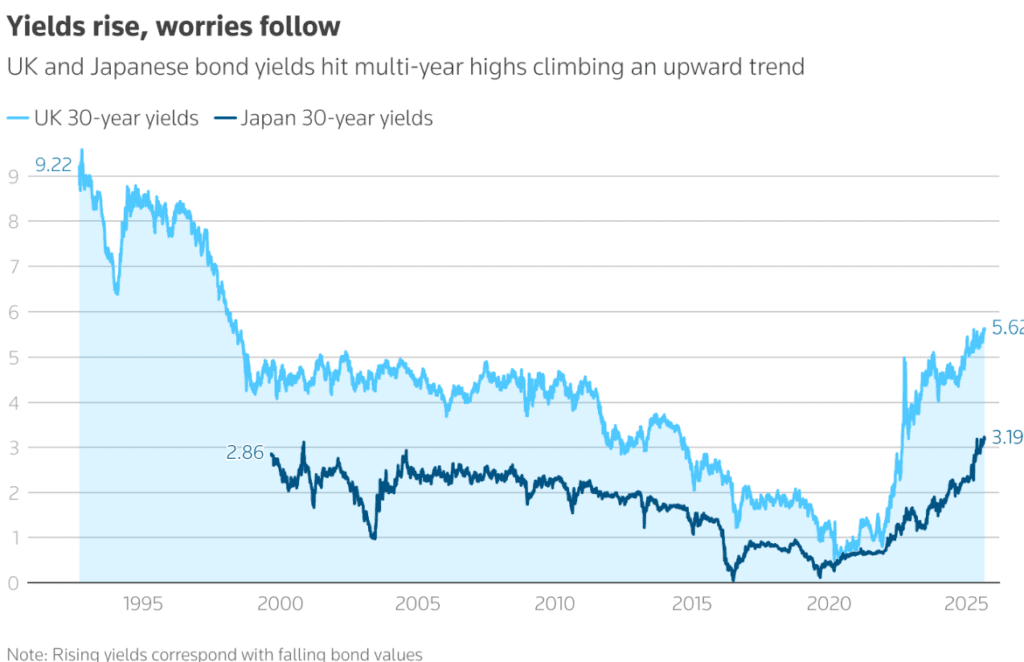

Driving Tuesday’s weakness was a renewed surge in yields: the 10-year Treasury rose to 4.28%, while the 30-year approached the 5% mark, a level not seen in years. Investors worried that higher borrowing costs would choke corporate investment and consumer demand, especially in rate-sensitive sectors like housing and technology.

Europe Faces Debt and Currency Woes

Across the Atlantic, the selloff was even starker. The Stoxx 600 fell 1.5%, with losses concentrated in real estate, financials, and technology. U.K. markets were hit hardest: the 30-year gilt yield surged to its highest since 1998, sending sterling to fresh lows. Political uncertainty over fiscal policy further dented investor sentiment.

Not all was bleak. Luxury names LVMH and Kering rose after analyst upgrades tied to expectations of stronger Chinese demand, while Nestlé found support on news of a leadership change. Still, the broader tone was one of caution, with traders steering clear of riskier assets.

Safe Havens Shine as Gold Hits Record

With equities and bonds both flashing warning signs, investors turned to gold. The precious metal hit a new all-time high of $3,546.99 per ounce in Asian trading, underscoring the depth of market unease. Copper, by contrast, pulled back from a five-month high as traders weighed China’s uncertain economic outlook.

This Morning: Futures Signal Mixed Mood

U.S. futures opened Wednesday with a more mixed tone: Dow futures slipped 0.3%, S&P 500 contracts edged up 0.1%, and Nasdaq 100 futures gained 0.3%. The after-hours tech rally helped lift sentiment, though bond market jitters continued to cast a long shadow.

In Europe, futures pointed cautiously higher, with Euro Stoxx 50 contracts up 0.34% and the DAX gaining 0.3%, while FTSE futures added 0.1%.

More about: Trump Vows Tariff Fight, China Counters With ‘Peace or War’ Choice

What to Watch Today

Attention now turns to economic data and central bank commentary:

- JOLTS job openings will provide fresh insight into the U.S. labor market ahead of Friday’s nonfarm payrolls. July data showed cracks in hiring, and further weakness could push the Fed toward a deeper rate cut.

- PMIs from Britain and the eurozone will set the tone for Europe’s growth outlook.

- ECB President Christine Lagarde and Bank of England officials Sarah Breeden and Catherine Mann are scheduled to speak.

- Major sovereign debt auctions across Germany, France, and the U.K. could test investor appetite after this week’s bond rout.

- On the earnings front, Macy’s, Salesforce, and Dollar Tree are set to report.

Markets are currently pricing in an 89% chance of a Fed rate cut this month, but any signs of labor market resilience could challenge those expectations.

| Time (EST) | Event / Company | Detail / Ticker |

|---|---|---|

| 07:00 | MBA Mortgage Applications | Weekly data |

| 08:55 | Redbook YoY | Retail sales |

| 09:00 | Fed’s Musalem | Speech |

| 10:00 | JOLTS Job Openings; Factory Orders | Labor & economic data |

| 13:30 | Fed’s Kashkari | Speech |

| 14:00 | Fed Beige Book | Fed survey |

| — | Wards Vehicle Sales | Aug data |

| — Before Open — | ||

| 06:30 | Dollar Tree | $DLTR |

| 06:45 | J.Jill | $JILL |

| 06:55 | Macy’s | $M |

| 07:00 | REV Group | $REVG |

| 07:15 | Campbell Soup | $CPB |

| 07:30 | Sprinklr | $CXM |

| — After Close — | ||

| 16:00 | Salesforce | $CRM |

| 16:05 | Credo Tech, American Eagle, GitLab, Hewlett Packard Enterprise, PagerDuty, ChargePoint, Methode Electronics, Tilly’s | $CRDO, $AEO, $GTLB, $HPE, $PD, $CHPT, $MEI, $TLYS |

| 16:10 | C3.ai | $AI |

| — | Figma | $FIG (time unconfirmed) |

Tuesday’s selloff underscored how fragile sentiment has become. With bond yields at multi-decade highs and political uncertainty clouding the outlook for trade and fiscal policy, equities face continued headwinds. Relief from the Google ruling and a resilient tech sector could provide short-term support, but traders are bracing for volatility as fresh labor data and central bank guidance emerge in the days ahead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)