Markets opened with a cautiously optimistic tone on Wednesday, lifted by tariff relief news and political shifts in Japan, but tempered by looming uncertainty around corporate earnings and central bank direction.

Key Drivers Behind the Mood:

Tariffs & Trade Relief:

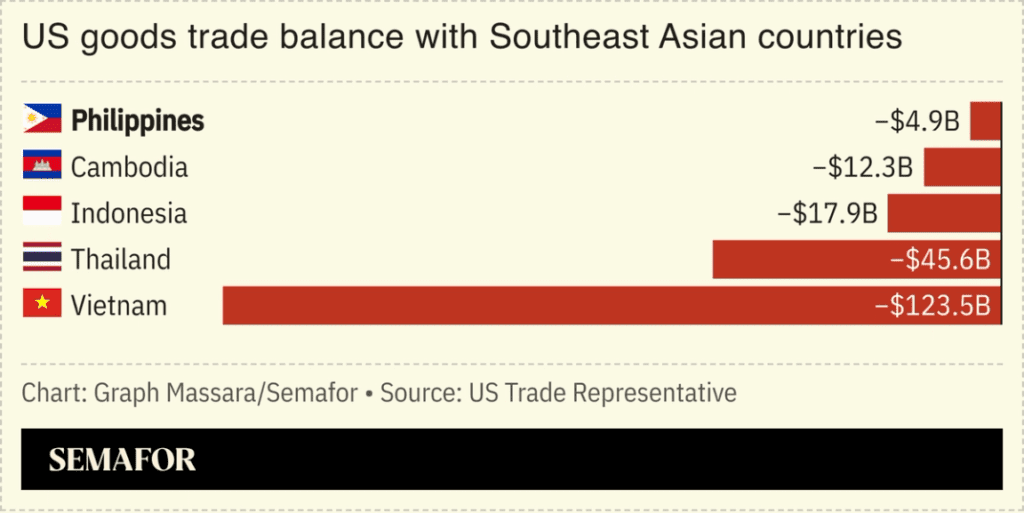

President Trump’s announcement of a revised trade deal with Japan, lowering proposed auto tariffs from 25% to 15%, offered a rare moment of relief for global trade watchers. The agreement also included a 19% tariff deal with the Philippines, seen as a softening of the administration’s broader protectionist stance. The news triggered a strong rally in export-heavy Japanese equities, reviving hopes that similar de-escalations could emerge with Europe and South Korea next.

More about: Trump Strikes Major Trade Deals With Japan, Philippines, and Indonesia

Additionally, following his party’s election defeat and mounting internal pressure, Japanese Prime Minister Shigeru Ishiba is expected to officially announce his resignation later this month, clearing the way for a leadership transition more aligned with market and US trade priorities.

Markets also welcomed the shift in tone toward US–EU negotiations, with Eurozone equity futures jumping 1% on signals that Brussels will send representatives for fresh trade talks today.

Macroeconomic Underpinnings:

Despite the trade tailwinds, investors remain cautious due to uncertainty around upcoming earnings from Tesla and Alphabet, two of the most influential names in the Mag 7. Additionally, a critical Fed meeting next week and signs of fragility in consumer and housing data are keeping risk sentiment in check. The US-China dynamic is also back in focus, with Treasury Secretary Scott Bessent confirming high-level meetings in Stockholm next week aimed at extending the August 12 trade deadline.

Spotlight: Tesla & Alphabet Earnings

Tesla and Alphabet take center stage today amid heightened expectations and scrutiny:

Tesla ($TSLA): Q2 Sales Estimate: ~$22.1 B (down YoY)

EPS Forecast: ~$0.49, slightly below last year’s $0.52

Challenge: Investors will focus intensely on forward guidance, especially delivery projections and margin outlook. A weak outlook could significantly weigh on the stock.

Alphabet ($GOOGL): Q2 Revenue Forecast: ~$93.98 B; EPS: ~$2.20

Key Metric: Forward-looking guidance is crucial amid evolving AI dynamics and ad-market health. Analysts expect ~$95.7 B in Q3 revenue — any miss could dent confidence.

Global Market Snapshot

| Asset | Level / Price | Change |

|---|---|---|

| Nikkei 225 | ~41,070.9 | +3.3% (1‑year peak) |

| Euro Stoxx 50 Futures | ~5,369 EUR | +1.24% |

| S&P 500 Futures | ~6,346.5 | Slightly positive |

| WTI Crude Oil | ~$65.64 /barrel | +0.5% |

| Brent Crude | ~$68.90 /barrel | +0.4% (previous data) |

| Gold | $3,423–3,429 /oz | –0.2% to $3,422.95 |

| Bitcoin (BTC) | ~$118,754 | –0.5% (24h) to flat |

Summary Highlights:

- Japan’s Nikkei rallied to its highest in over a year (+3.3%) on the US-Japan tariff deal

- European equities surged on renewed trade optimism (+1.24% Euro Stoxx futures)

- US futures show moderate gains ahead of key data and Big Tech earnings

- Oil prices are up ~0.5%, lifted by easing trade fears

- Gold eased slightly (-0.2%) as risk appetite improved, though a softer dollar offers support

- Bitcoin stays in mid-$118K range, down ~0.5% amid consolidation after recent rally

What to Watch Today

- Big Tech earnings & forward guidance – particularly Tesla’s delivery commentary and Alphabet’s AI & ads signals.

- Trade/Tariff updates – especially from the EU and China’s engagement in Stockholm.

- US June Home Sales & bond auction results – will guide sentiment on consumer strength and bond yield direction.

- Japan’s BOJ reaction – the trade deal’s side effect is rising yields; watch whether this nudges rate expectations.

| Time (ET) | Release/Event |

|---|---|

| 10:00 AM | Existing Home Sales (June) |

| 1:00 PM | 20‑Year Treasury Bond Auction |

| Pre‑Market | Earnings from AT&T, Freeport‑McMoRan, NextEra, General Dynamics |

| After‑Hours | Tesla, Alphabet, IBM, ServiceNow, T-Mobile, Chipotle, QuantumScape, Las Vegas Sands, Alaska Air, Viking Therapeutics |

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Wall Street Is Stubbornly Bullish on Downtrodden Energy Stocks

As the Dollar Slides, the Euro Is Picking Up Speed

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead