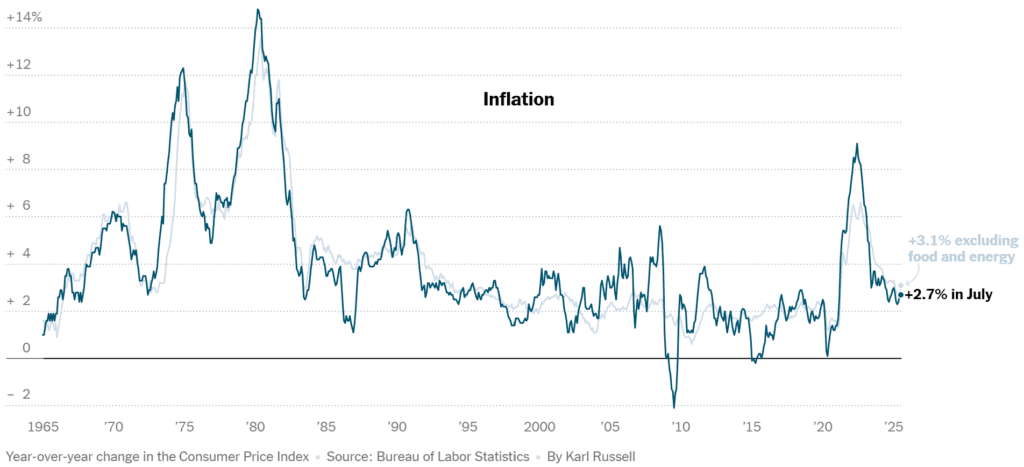

US stocks gained on Tuesday after inflation data showed headline consumer prices holding steady at 2.7% in July, slightly below expectations, easing fears of runaway tariff-driven price spikes, though underlying inflation picked up to its fastest pace since January.

The CPI Numbers

The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.2% month-over-month in July, matching consensus forecasts, while the annual rate stayed at 2.7%, a notch below the 2.8% economists had expected.

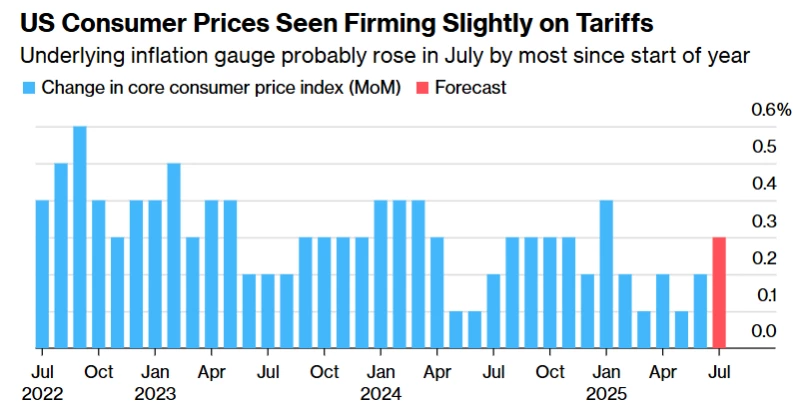

Core CPI, which strips out food and energy and is closely watched by the Federal Reserve, increased 0.3% MoM and 3.1% YoY — its highest annual pace in six months and above June’s 2.9%.

The acceleration in core inflation was driven largely by services and select goods categories tied to tariffs, including:

- Household furnishings & supplies (+0.7%)

- Transportation services (+0.8%)

- Medical care services (+0.8%)

- Used cars & trucks (+0.5%)

Gasoline prices fell 1.1%, keeping the headline CPI in check, while food prices were flat. New vehicle prices were unchanged despite heavy tariff exposure, as automakers continued absorbing costs to protect sales.

Tariffs’ Growing Footprint

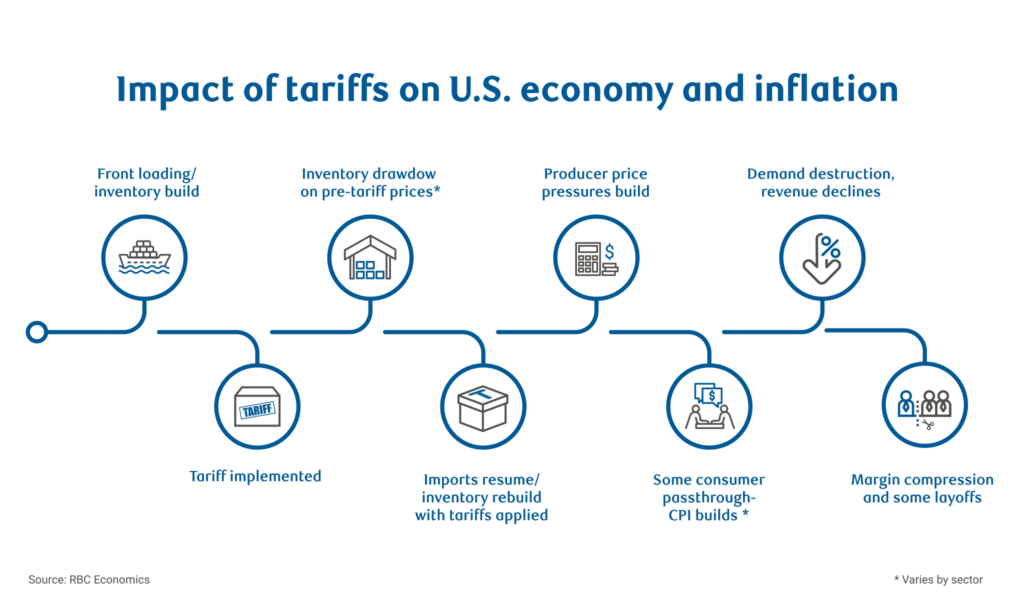

July’s report provided clearer evidence that President Trump’s sweeping tariffs — a 10% baseline on all imports since April, plus targeted higher duties on key goods — are now filtering into consumer prices after months of stockpiling and cost absorption by businesses.

Price pressures were notable in tariff-heavy sectors such as:

- Furniture and appliances

- Apparel (up modestly at +0.1%)

- Recreation goods and footwear

Economists warn that as inventories run down and higher duties from early August kick in — including new levies on China, India, and Japan — inflationary pressures could broaden into late 2025.

Market Reaction

Equities rallied on the data as investors focused on the cooler-than-expected headline CPI and the idea that the Fed remains on track for a September rate cut:

- Dow Jones Industrial Average futures: +0.4% premarket

- S&P 500 futures: +0.3%

- Nasdaq 100 futures: +0.5%

- Intel (INTC) led chip stocks higher, up over 3% in premarket after Trump’s meeting with CEO Lip-Bu Tan signaled thawing tensions.

In bonds, Treasury yields fell as traders priced in a greater likelihood of rate cuts. The 10-year yield eased to around 4.27%.

Fed funds futures now imply nearly 100% odds of a September cut and ~67% odds of another move in October, up sharply from the day before.

Why It Matters for the Market

For equities, the CPI release struck a “Goldilocks” balance — inflation is firm enough to signal the economy hasn’t stalled, but not so hot as to derail the Fed’s easing path.

Headline takeaway for investors:

- A stable headline CPI supports risk assets by reinforcing the case for lower rates.

- A higher core CPI is a reminder that tariffs are a slow-burn inflationary force, meaning rate cuts could be gradual rather than aggressive.

Implications for the Economy

Economists see the current inflation profile as a policy puzzle:

- Positive: Energy declines and flat food prices are cushioning consumers.

- Negative: Sticky core inflation, particularly in services, keeps the Fed cautious.

Tariffs are the wildcard — if passed through quickly and broadly, they could lift inflation above 3% on a sustained basis, forcing the Fed to slow or pause rate cuts.

Goldman Sachs estimates that by October, consumers will be paying about two-thirds of the tariff costs directly, up from just 22% earlier this year. That pass-through could peak just as the holiday shopping season approaches.

The Fed’s Position

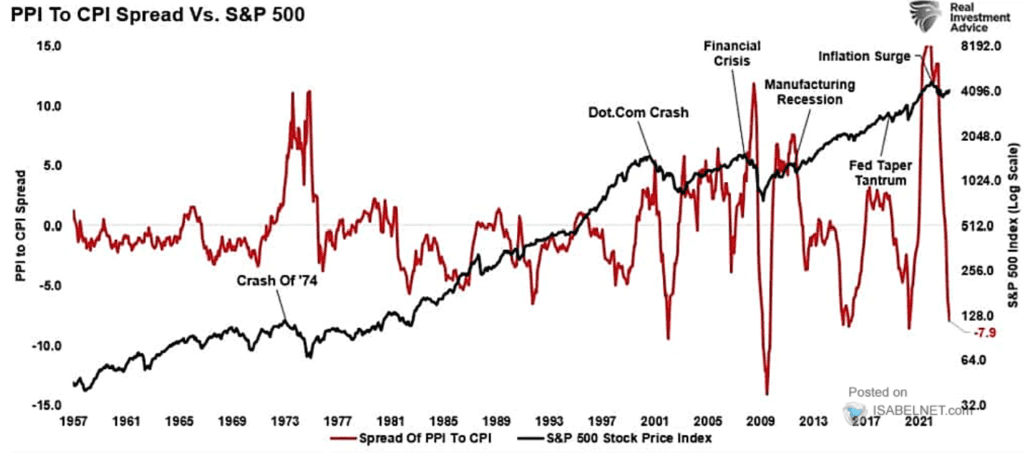

Fed Chair Jerome Powell and policymakers have kept rates unchanged all year, citing uncertainty over the full impact of Trump’s trade policies. The latest CPI data keeps September rate cuts in play, but officials will be watching:

- PPI data due Thursday

- August jobs report next month

- Consumer spending trends amid rising goods prices

If tariffs trigger a one-off price jump, the Fed is likely to cut rates in September and again later in the year. But if they create persistent inflation, rate cuts could slow or stop — a scenario that would pressure stocks and risk assets.

July CPI reassured markets that inflation isn’t running away despite tariffs, but the firming in core prices is a flashing yellow light. For now, investors are betting the Fed will choose growth support over inflation fears — but the next two months of data will be critical.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?