Wall Street opened on softer footing Monday as investors digested Jerome Powell’s Jackson Hole pivot and shifted focus to Nvidia’s looming earnings test.

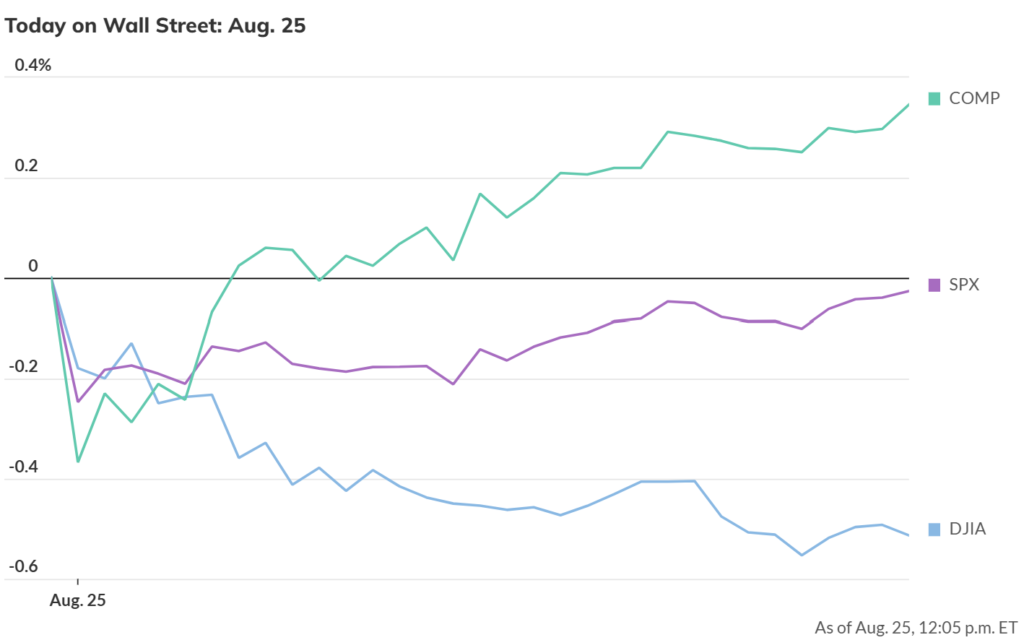

US stocks pulled back after last week’s surge, with the S&P 500 slipping 0.1% and the Dow Jones Industrial Average down 242 points (-0.5%). The Nasdaq Composite bucked the trend, reversing early losses to gain 0.3%, lifted by strength in semiconductor names.

Tech in focus

Nvidia (NVDA) rose about 2% ahead of Wednesday’s earnings, bolstered by fresh analyst upgrades. With expectations set at $45.9B in revenue and EPS up 48% YoY, the AI leader faces a high bar — options pricing implies a 6% swing in either direction post-results.

Intel (INTC) climbed 1%+ and 22% this month., extending its rally after the Trump administration confirmed a 10% government stake in the chipmaker. NEC Director Kevin Hassett hinted Monday that this could mark the start of a broader sovereign wealth-style strategy. Trump doubled down, saying he would make such deals “all day long.”

Speaking on CNBC, Hassett also said, “The president has made it clear all the way back to the campaign, he thinks that in the end, it would be great if the U.S. could start to build up a sovereign wealth fund. So I’m sure that at some point there’ll be more transactions, if not in this industry then other industries.”

Intel, on the other hand, warned of “adverse reactions, immediately or over time,” from investors and employees over the deal in an SEC filing.

The macro backdrop

Friday’s rally came after Fed Chair Powell signaled rate cuts could begin in September, sending odds of a 25bps move up to 86%. But markets cooled as traders questioned whether tariff-driven inflation could complicate the Fed’s path. US Treasuries eased, with the 10-year yield back at ~4.28%, while the dollar stabilized after Friday’s drop.

Europe and Asia

European equities slipped, with the Stoxx 600 down 0.2%, pressured by sharp losses in renewable stocks after the US blocked an Ørsted wind project. In Asia, China blue chips hit their highest since 2022, and Japan’s Nikkei added 0.4%, supported by Powell’s dovish tone and continued liquidity inflows.

Other moves

- Gold steadied near $3,368/oz as the dollar regained ground.

- Brent crude edged up to $68.16/barrel, supported by the ongoing Russia–Ukraine stalemate and sanctions.

- Furniture retailers including Wayfair (W), RH, and Williams-Sonoma (WSM) slumped after Trump launched a tariff investigation into imports, while US manufacturers like La-Z-Boy (LZB) gained.

Corporate drama

Adding to the day’s headlines, Elon Musk’s xAI and X filed suit against Apple and OpenAI, alleging an “anticompetitive scheme” to dominate generative AI and suppress rival apps. The legal fight could intensify scrutiny on Apple’s App Store practices just as regulators globally ramp up oversight of big tech.

Markets are entering the week with more restraint after Powell’s Jackson Hole lift, keeping one eye on Nvidia’s results and another on the Fed’s September meeting. For now, optimism is tempered by tariffs, inflation risks, and Washington’s growing hand in corporate boardrooms.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana