According to App Economy Insights, recent earnings reports have revealed key trends shaping AI, cloud computing, consumer tech, and enterprise software. Companies like Berkshire Hathaway ($BRK) and Salesforce ($CRM) are navigating macroeconomic shifts, while Snowflake ($SNOW) and C3 AI ($AI) continue to expand AI-driven offerings. E-commerce players like Coupang ($CPNG) and Instacart ($CART) are leveraging logistics and partnerships to drive growth, whereas HP ($HPQ) and Autodesk ($ADSK) are facing demand slowdowns. Meanwhile, entertainment and travel stocks such as AMC ($AMC) and Domino’s ($DPZ) are seeing post-pandemic consumer spending resilience, but economic uncertainties and cost pressures remain challenges across multiple sectors.

🦎 Berkshire: Equities Remain Priority

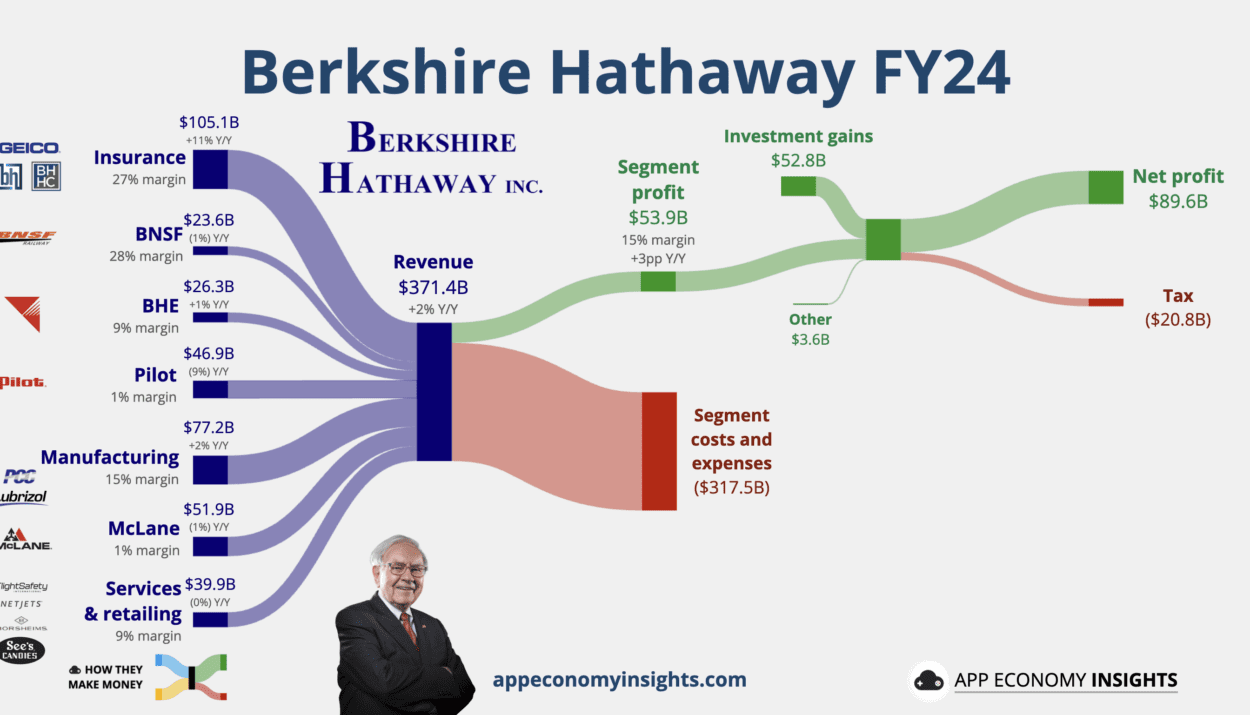

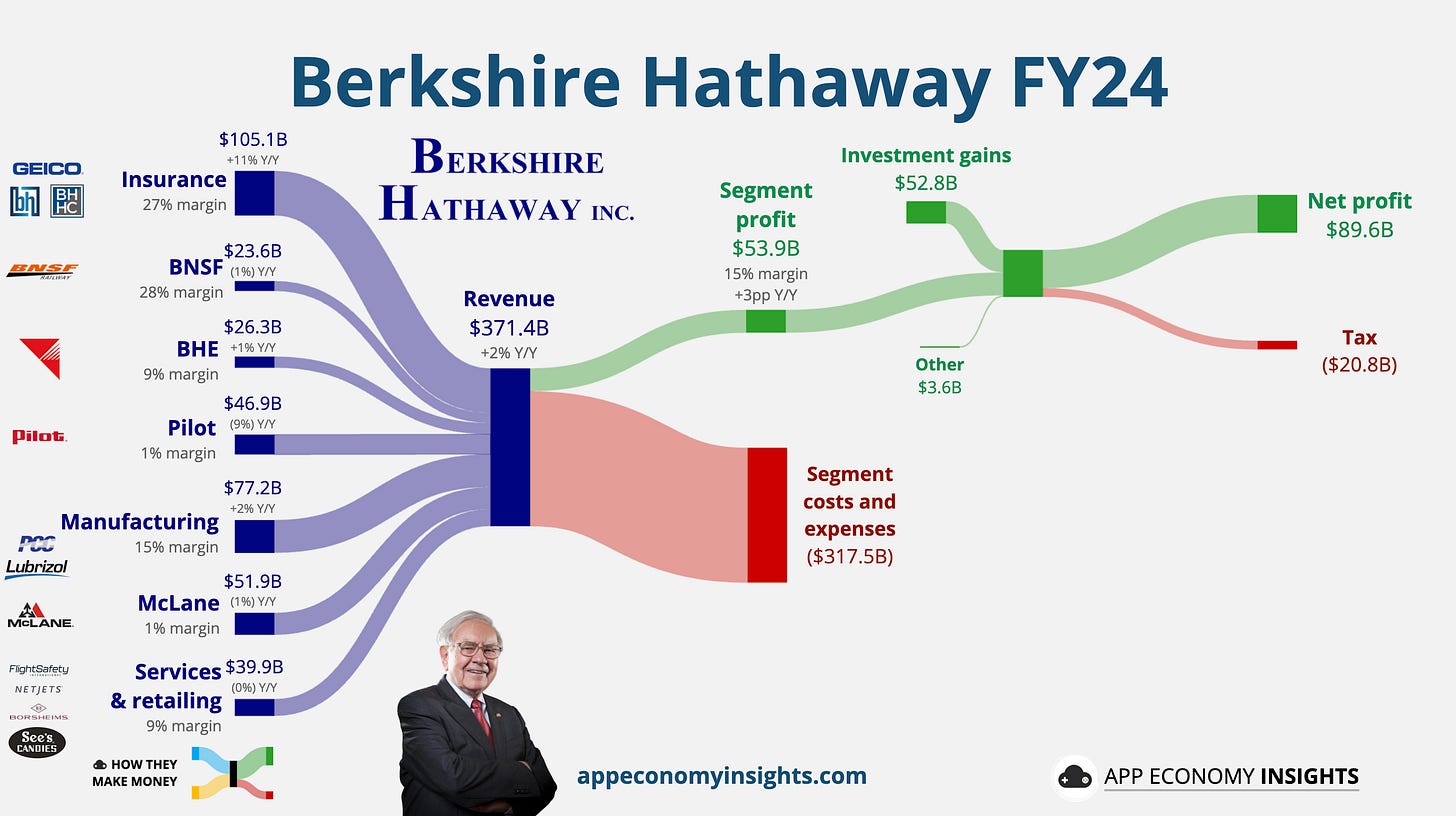

Berkshire Hathaway ended Q4 with a record $334 billion in cash, up from $325 billion in Q3, reflecting Warren Buffett’s patient approach amid limited acquisition opportunities. A large portion of the cash pile is driven by Berkshire’s property-casualty insurance business. Despite accumulating cash for the 10th straight quarter, Buffett reaffirmed that Berkshire will always prioritize equities over cash—with his stock portfolio reaching $272 billion—led by holdings in Apple, American Express, and Bank of America.

In his annual letter, Buffett reiterated confidence in the US economy, highlighting Berkshire’s role as America’s largest corporate taxpayer, contributing $20.8 billion in income tax in 2024. He also hinted at potentially increasing stakes in Japan’s five largest trading houses, signaling continued global investment expansion. Despite its massive cash reserves, Berkshire remained a net seller of stocks, trimming its equity portfolio by 23% Y/Y. The conglomerate also paused buybacks for the second consecutive quarter, suggesting Buffett doesn’t find the stock attractive. While Berkshire’s core businesses remain healthy, analysts noted Buffett’s cautious stance could reflect concerns about a softer US economy ahead.

☁️ Salesforce: AI Potential, Tepid Outlook

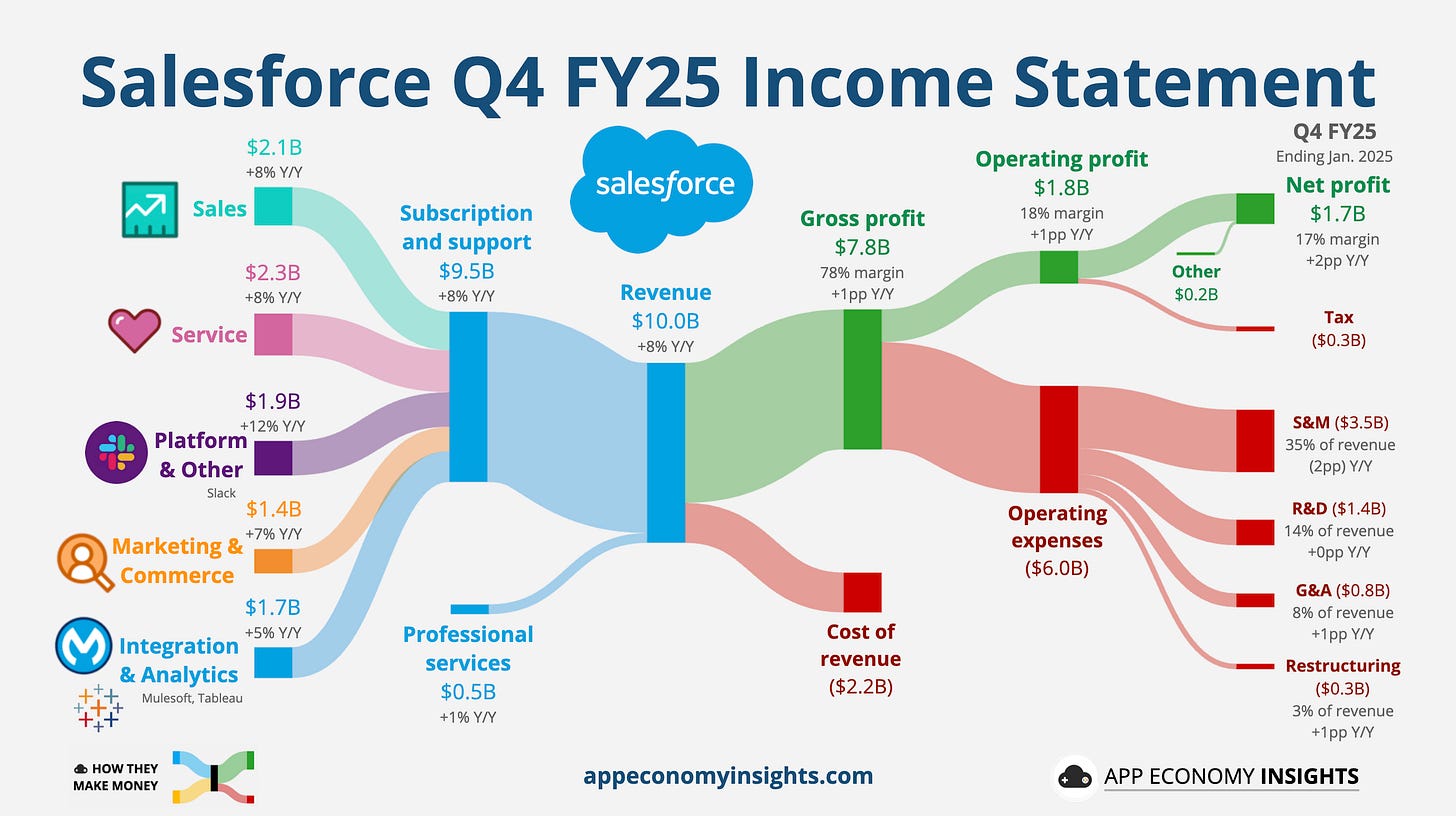

Salesforce posted mixed Q4 results, with EPS of $2.78 ($0.17 beat) and revenue growing 8% Y/Y to $10.0 billion ($50 million miss). The company highlighted strong AI-driven momentum, with Data Cloud and Agentforce reaching $900 million in annual recurring revenue (+120% Y/Y) and 5,000 Agentforce deals signed since October. CEO Marc Benioff emphasized that Salesforce is uniquely positioned to lead the AI-driven “digital labor revolution.” Current RPO rose 11% Y/Y—the best forward-looking growth indicator. However, Q4 marked Salesforce’s third straight quarter of single-digit revenue growth.

FY26 revenue outlook was ~$40.7 billion (+8% Y/Y), below the $41.4 billion consensus. While analysts remain optimistic about Agentforce and long-term AI monetization, they expressed concerns about near-term revenue softness and macro headwinds. Meanwhile, Salesforce is navigating leadership transitions, including a new CFO and Chief Revenue Officer. With AI adoption growing but not yet materially impacting revenue, investors will watch RPO to evaluate Salesforce’s ability to return to double-digit growth.

✅ Intuit ($INTU): Small Business Momentum – Strong demand for QuickBooks Online (+28% Y/Y) and TurboTax Live (+30% Y/Y) fueled growth. AI-driven automation continues to drive efficiency gains for small businesses.

💻 Dell Technologies ($DELL): Lower-Margin AI Deployments – AI-driven server demand surged, but profitability weakened due to lower-margin enterprise contracts. Stock dropped 4.7% post-earnings on cautious forward guidance.

👔 Workday ($WDAY): Reassuring Investors – Workday’s subscription revenue rose +22% Y/Y to $1.23B, driven by strong enterprise adoption in financial management solutions.

🏗️ Autodesk ($ADSK): Workforce Reduction – Autodesk announced a 9% workforce cut, sparking a 2.9% stock decline, as the company navigates slowing demand in construction & engineering software.

❄️ Snowflake ($SNOW): AI-Powered Momentum – Snowflake’s product revenue jumped +54% Y/Y to $345M, fueled by demand for AI-driven analytics. Customer base grew past 6,000, with a 178% net revenue retention rate.

🇰🇷 Coupang ($CPNG): Farfetch Integration – Coupang’s revenue surged +34% Y/Y to $5.1B, benefiting from logistics efficiency and its expansion into luxury goods via Farfetch.

🖨️ HP Inc. ($HPQ): Navigating Headwinds – HP stock fell 6.9% post-earnings due to soft PC and printer demand, leading to further workforce reductions.

🖥️ Zoom ($ZM): AI-First Expansion – Zoom is investing heavily in AI-driven collaboration tools, as enterprise adoption grows despite fierce competition.

☁️ Nutanix ($NTNX): VMware Shift Tailwinds – Nutanix benefited from the shift away from VMware ($VMW), with rising cloud adoption driving long-term growth.

🦉 Duolingo ($DUOL): Record Growth Continues – Despite strong user growth and revenue, the stock fell 17% post-earnings, as valuation concerns linger.

🍕 Domino’s ($DPZ): Aggregator Expansion – Domino’s same-store sales grew +1%, with partnerships expanding third-party delivery (Uber Eats, DoorDash).

⛷️ Amer Sports ($AS): Sales Surge in Asia – Amer Sports’ revenue rose +25% in Asia, with e-commerce sales climbing +30% Y/Y, reflecting strong demand for premium outdoor brands.

🥕 Instacart ($CART): Soft Guidance – Instacart’s order volume grew +15% Y/Y, but cautious consumer spending dampened its forward outlook.

🔍 Elastic ($ESTC): Cloud Acceleration – Elastic posted +30% Y/Y revenue growth, driven by AI-powered search and analytics adoption.

💊 Hims & Hers ($HIMS): Weight-Loss Market Uncertainty – While telehealth demand remains strong, supply constraints in weight-loss drugs (GLP-1s) created uncertainty.

🧠 C3 AI ($AI): Expanding AI Partnerships – C3 AI is growing enterprise AI deployments, positioning itself as a key AI software provider.

🌊 DigitalOcean ($DOCN): High-Value Customers Drive Growth – DigitalOcean is focusing on scaling its premium cloud services for SMBs and startups.

🌎 dLocal ($DLO): Take Rate Compression – dLocal’s growth slowed due to declining transaction margins, raising profitability concerns.

🎓 Docebo ($DCBO): AI-First Pivot in Learning Management – Docebo is shifting towards AI-powered corporate training, as enterprises seek personalized education solutions.

🍿 AMC ($AMC): Box Office Rebound – Theatrical attendance improved, fueling stronger revenue growth for AMC.

🍽️ Olo ($OLO): Expanding Personalization for Restaurants – Olo is leveraging AI to enhance customer engagement and optimize restaurant efficiency.

Related:

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US