Shares of ICICI Bank (NSE: ICICIBC) jumped 2% to ₹1,456.35 on Monday after the lender reported a 15.5% YoY rise in standalone net profit, reaching ₹12,768 crore for the June 2025 quarter. The solid results came amid broader optimism surrounding Indian financials, with bank earnings widely exceeding analyst expectations.

- Net Interest Income (NII): ₹21,635 crore (+10.6% YoY)

- Net Interest Margin (NIM): 4.34% (down from 4.41% in Q4, aided by tax refunds)

- Core Operating Profit: ₹17,505 crore (+13.6% YoY)

Despite a slight dip in NIM, the bank’s profitability outpaced many of its peers, with core fee income rising approximately 7.5% YoY and pre-provision operating profit surprising to the upside.

Analyst Upgrades Pour In

The strong showing led to a flurry of target price upgrades from top brokerages:

- UBS: Raised price target from ₹1,680 to ₹1,720, maintaining a Buy rating

- CLSA: Increased target to ₹1,700, Outperform rating; cited 8% beat on pre-provision operating profit and 11% beat on PAT

- Goldman Sachs: Lifted target to ₹1,644, noting 6% earnings beat, but flagged loan growth concerns and mortgage market competition

- Axis Capital: Raised target to ₹1,620, Add rating, highlighting strong credit growth in retail and unsecured segments

UBS estimates ICICI Bank’s ROA will remain around 2.2% through FY26–FY27, and sees the stock deserving a premium valuation of ~2.5× September 2026 P/BV, supported by strong financials and capital efficiency.

According to InvestingPro, ICICI Bank’s P/E is currently 20.1x, and shares appear undervalued based on their proprietary fair value model.

Macro Tailwinds Fuel Optimism

Beyond bank-specific performance, macro-level trends are also aligning in India’s favor. Bernstein strategists from Société Générale Group are now bullish on Indian stocks with upward earnings revisions, citing them as the key driver in navigating current high market valuations.

Their thesis: “Earnings revision was the best-performing style of 2024, and valuations are already stretched. The only way forward is through better earnings,” wrote analysts Rupal Agarwal and Cheng Zhang.

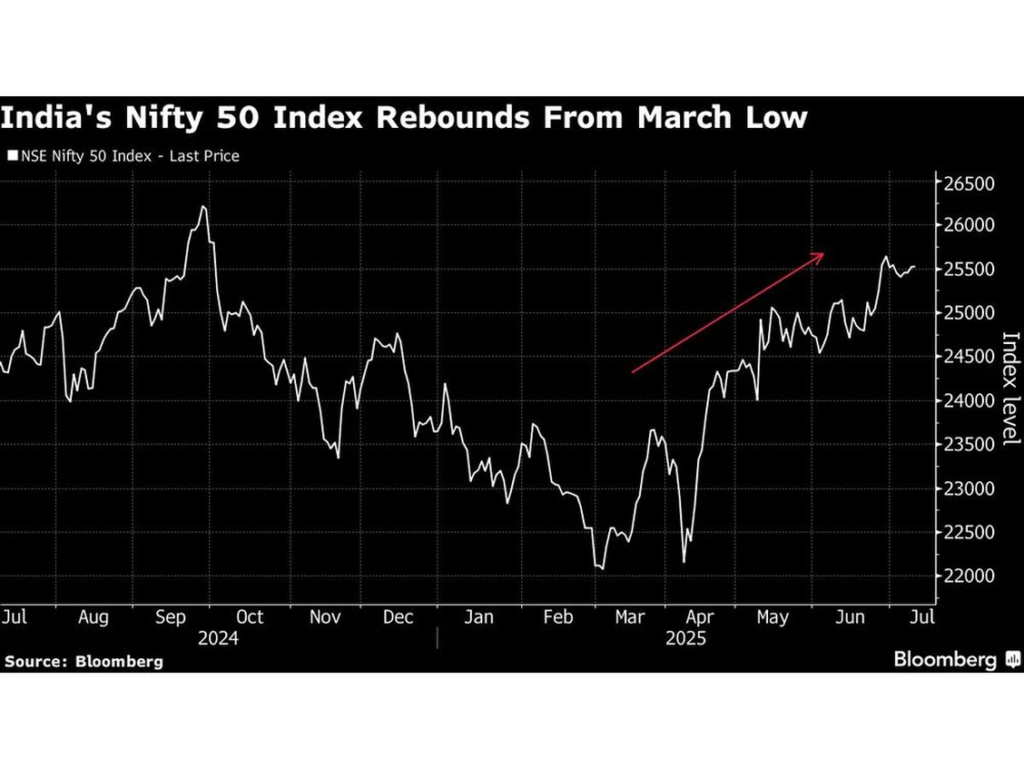

The Nifty 50 has risen over 15% since March, now trading at over 21× forward earnings, above its 10-year average. In this context, financials and select midcaps offer attractive entry points due to rising EPS estimates and supportive macro data.

Midcaps Back in Play: Bernstein Upgrades Outlook

Bernstein has also turned constructive on Indian midcap stocks, upgrading the segment to Neutral from Negative after a year of caution. Several factors contribute to this shift:

- Valuation reset: Midcap premium over largecaps fell from 70% to 35%, now near 5-year average

- Earnings Momentum: Midcap earnings grew ~30% over Q3 and Q4 FY25, totaling 21% YoY for the full fiscal year

- Positive Surprises: 51% of midcap firms beat expectations in Q4—the highest since 2020

- Valuation Compression: Nifty Midcap 150 valuations dropped from 39x FY25 to 28x FY26 earnings

Bernstein now sees midcaps as “not cheap, but not exorbitant either,” favoring a bottom-up stock selection strategy focused on positive earnings revisions.

Market Implication: India’s Earnings Engine Is Back

The combination of ICICI Bank’s strong Q1, broad financial sector beats, and Bernstein’s shift to an earnings-led outlook has rekindled momentum in Indian equities. With banks outperforming, midcaps resetting, and strategists rotating toward growth upgrades, investors are increasingly betting that India’s earnings cycle may outperform global peers in the second half of 2025.

As the earnings season rolls on, all eyes will be on whether this early strength translates into sustained upward revisions—and whether the market’s elevated multiples can be justified through continued performance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches