Bitcoin ($BTC) has plunged 28% from its record high of $109,000 on January 20, the day Donald Trump was inaugurated as U.S. president. The sharp decline has rattled crypto investors, with market analysts pointing to multiple catalysts driving the selloff.

1. Macroeconomic Concerns & Market Volatility

Bitcoin isn’t alone in its downturn—U.S. stocks have also fallen, with the Nasdaq 100 Index down 7% from its February 19 high.

- Investors are reacting to Trump’s tariff policies, which could slow economic growth.

- A bond market rally suggests a flight to safety, indicating concerns about riskier assets like crypto.

“This tanking can be viewed as a response to macro fears on Trump’s tariffs and geopolitical uncertainty,” said Caroline Bowler, CEO of BTC Markets.

2. The $1.5 Billion Crypto Hack Shakes Confidence

The Bybit exchange suffered the largest crypto hack in history on February 21, losing $1.5 billion, reportedly to North Korea’s Lazarus Group.

- This was a major blow to investor confidence, as hackers breached a “cold wallet” system once considered highly secure.

- Market participants fear that increased cyber risks could deter institutional adoption of crypto.

“Confidence got shaken after the hack of $1.5 billion. I’m sure some investors are thinking: ‘Maybe I should wait it out,’” said Zaheer Ebtikar, co-founder of Split Capital.

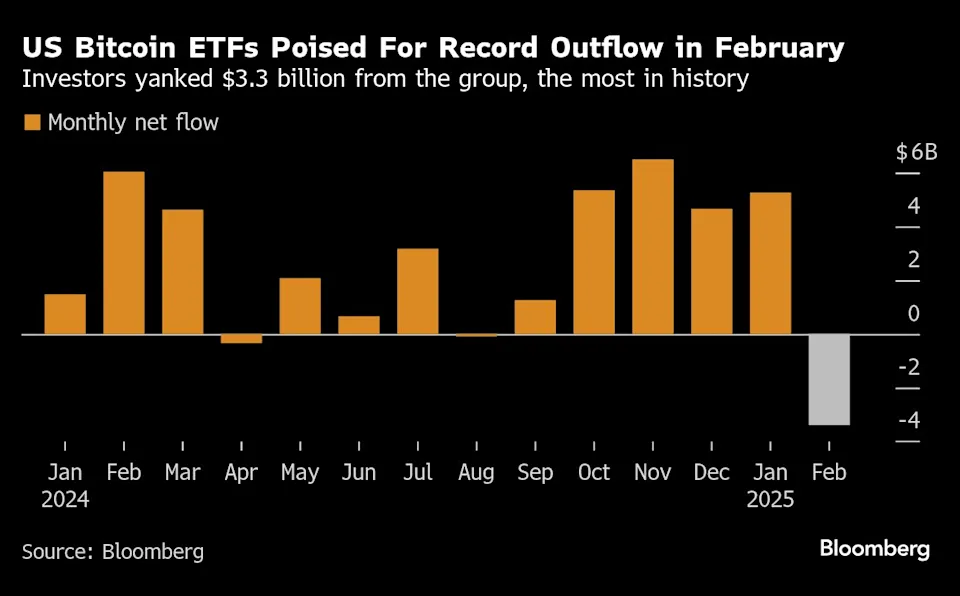

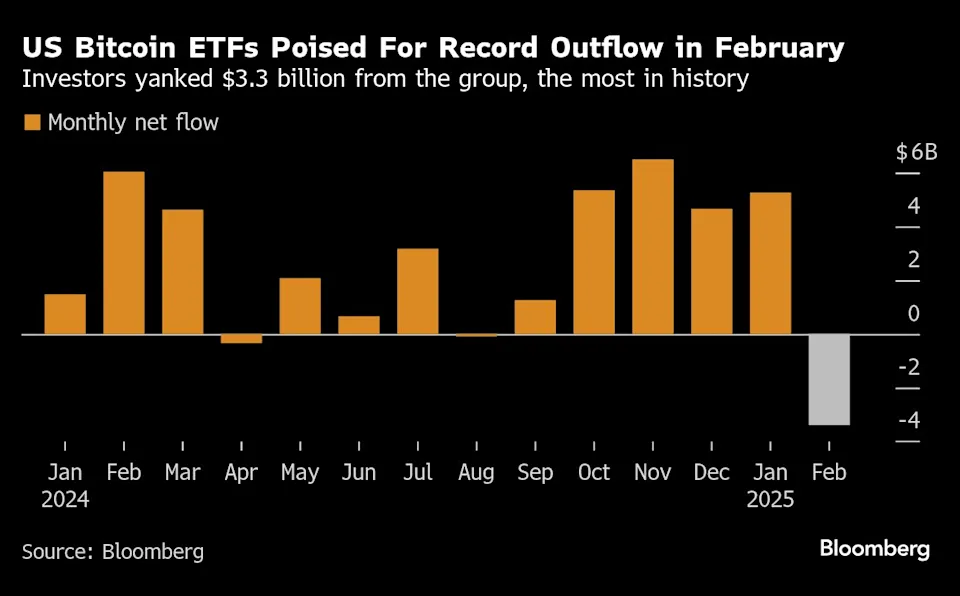

3. Spot Bitcoin ETF Outflows Accelerate the Decline

The recent selloff coincided with $3.3 billion in net outflows from Bitcoin ETFs in February—the largest monthly withdrawal since spot Bitcoin ETFs launched in January 2024.

- As Bitcoin’s price drops, investors withdraw funds, triggering further selling pressure.

- This feedback loop has amplified Bitcoin’s downside volatility.

“Hot money that chases Bitcoin, or any speculative trade, flows out as fast as it entered when prices start falling,” said Michael Rosen, CIO at Angeles Investments.

4. The Unwinding of ‘Cash and Carry’ Basis Trades

A key driver of Bitcoin’s rally was the “cash and carry” arbitrage trade, where investors profited from the gap between spot and futures prices.

- As futures market premiums collapsed to 5.7% (lowest since July 2024), traders unwound their positions, putting additional downward pressure on Bitcoin.

- Hedge funds that had leveraged these trades are now exiting, further increasing selling momentum.

“Most ETF outflows were from arbitrage players unwinding basis trades,” said Mark Connors, founder of Risk Dimensions.

5. rump Trade Unwind – Slow Progress on Bitcoin Policies

Many traders had bet on Bitcoin benefiting from Trump’s presidency, given his pro-crypto stance during the campaign.

- However, despite initial optimism, progress on crypto-friendly policies has been slow.

- Trump’s executive order on digital assets only called for a “study” of a Bitcoin stockpile rather than committing to one.

- Senator Cynthia Lummis’s proposal for the U.S. to accumulate 1 million BTC over five years has failed to gain traction in Congress.

“What’s driving this is the lack of positive executive-order news some pundits were expecting,” said Paul Howard, senior director at Wincent.

Adding to concerns, multiple U.S. states—including Montana, North Dakota, South Dakota, and Wyoming—have rejected state-level Bitcoin reserves, citing volatility risks.

Conclusion: What’s Next for Bitcoin?

Bitcoin’s sharp drop has been driven by a combination of macro fears, ETF outflows, arbitrage trade unwinds, and slow regulatory progress.

- Short-term risks: If tariff concerns persist, institutional outflows continue, and regulatory clarity remains uncertain, Bitcoin could face further downside.

- Long-term outlook: Bitcoin still benefits from growing adoption and potential policy shifts, but investors are waiting for stronger catalysts before stepping back in.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US