Tuesday opens with cautious optimism across global markets, as investors digest record US closes, tariff negotiations, and upcoming rate decisions. With tech earnings and macro data ahead, markets are bracing for a pivotal week.

Global equities are inching higher Tuesday morning after the S&P 500 and Nasdaq Composite closed at record highs on Monday. Sentiment remains cautiously bullish, underpinned by hopes for a continued US-China tariff truce, a dovish stance from the Federal Reserve, and strong tech earnings. However, lingering concerns about trade war consequences, global inflation, and regional CAPEX imbalances temper the rally.

The mood across Asia and Europe is more muted, reflecting the economic drag from rising tariff costs and macro uncertainty. In the UK, sentiment has soured as multinationals redirect investment toward the US, while the eurozone grapples with stagnant growth and policy constraints. In contrast, the US continues attracting global capital, solidifying its dominance in corporate CAPEX.

Today’s Must-Know Market Themes

1. US-China Trade Talks Continue in Stockholm

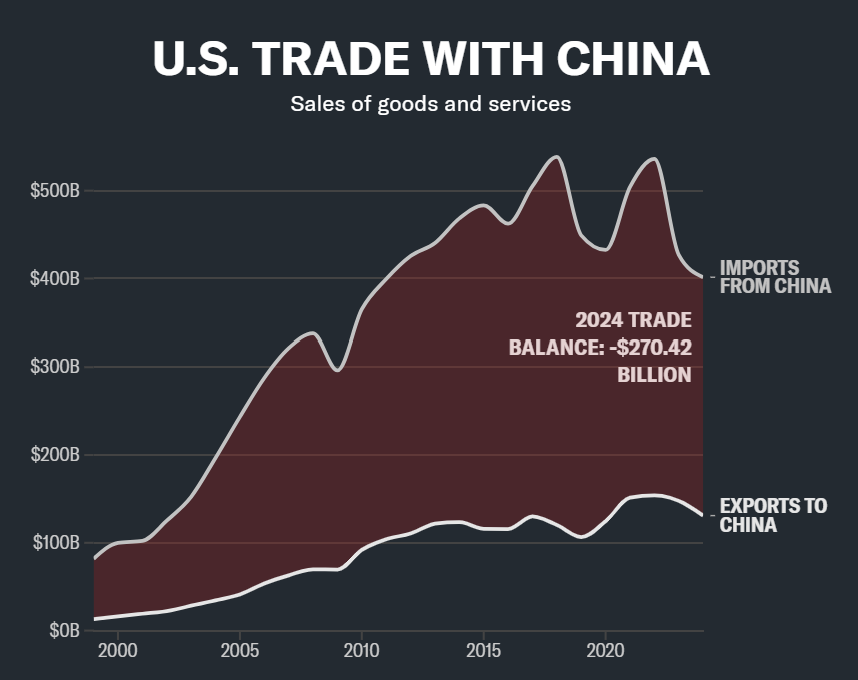

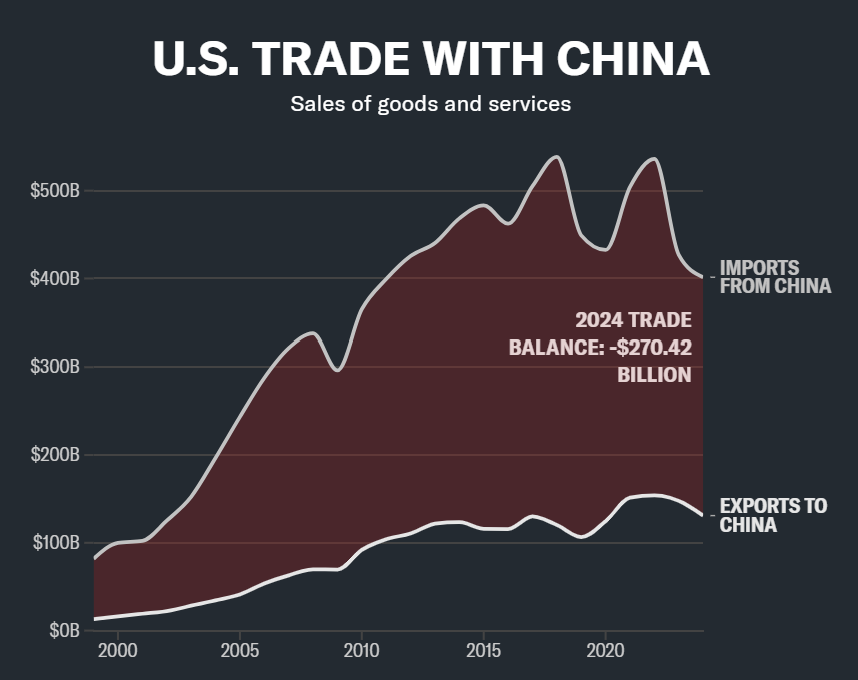

- Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng met in Stockholm to advance a deal before the August 12 tariff deadline.

- Trump’s administration is pushing for market access while China demands removal of key tech curbs.

- Trump said: “I may go to China, but it would only be at the invitation of President Xi, which has been extended.”

2. Taiwan Trip Blocked Amid Xi-Trump Summit Plans

- Taiwanese President Lai’s US stopover was halted, reportedly to avoid upsetting China ahead of the summit.

- Pelosi criticized the move: “This is a victory for Xi… Let us hope it is not indicative of a dangerous change in US policy.”

- Analysts warn Taiwan risks becoming a bargaining chip in Trump’s trade diplomacy.

3. Fed Decision Looms: Rates Likely on Hold

- The Federal Reserve begins its two-day meeting with the rate decision due Wednesday.

- Market consensus expects no change to the 4.25%-4.5% range.

- Investors will focus on Chair Powell’s tone amid persistent inflation and global monetary easing.

4. Record Tech Earnings Week Begins

- More than 150 S&P 500 companies report this week, including Meta, Microsoft, Amazon, and Apple.

- With expectations high, any miss could challenge current valuations.

- Over 83% of companies have beaten estimates so far, per FactSet.

5. Oil Holds Gains as Trump Shortens Russia Deadline

- WTI crude is up 0.8% as Trump threatens secondary sanctions or tariffs unless Russia reaches a deal within 10-12 days.

- China, as a major importer of Russian oil, is closely watching developments.

Global Market Snapshot

Markets in the US are pointing slightly higher, supported by earnings optimism and trade hopes. Asia saw modest declines, especially in Japan and Hong Kong, while Europe opened flat amid concerns about the economic cost of tariffs and weak manufacturing data.

| Region / Asset | Price / Index Level | Daily Change (%) |

|---|---|---|

| S&P 500 | 6,389.77 | +0.15% |

| Nasdaq‑100 Futures | ~18,600 | +0.24% |

| Dow Jones Futures | ~40,900 | +0.17% |

| EURO STOXX 50 Futures | ~4,800 | −0.12% |

| FTSE 100 Futures | ~7,200 | −0.05% |

| DAX Futures (Germany) | ~20,800 | −0.08% |

| CAC 40 Futures (France) | ~6,900 | −0.10% |

| Nikkei 225 (Tokyo) | ~34,500 | −0.45% |

| Hang Seng (Hong Kong) | ~16,800 | −0.61% |

| CSI 300 (China) | ~4,100 | −0.35% |

| WTI Crude Oil | ~$80 | +0.80% |

| Brent Crude Oil | ~$85 | +0.70% |

| Gold | ~$2,050/oz | +0.20% |

| Bitcoin | $118,940 | +1.20% |

Market Outlook and Economic Data Ahead

This week is packed with catalysts:

- Tuesday: JOLTS job openings report.

- Wednesday: Fed decision, ADP private payrolls, Microsoft & Meta earnings.

- Thursday: Amazon & Apple earnings, jobless claims, trade balance.

- Friday: July nonfarm payrolls (expected +100,000), unemployment rate (expected to tick up to 4.2%).

Despite global headwinds, investors remain focused on the strength of the US economy, corporate resilience, and AI-led tech optimism. But macro risks—especially geopolitical shocks, interest rate divergence, and policy uncertainty—remain in play. Watch for volatility spikes tied to earnings misses, Fed surprises, or unexpected turns in US-China diplomacy.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Market Is Euphoric Again — and Everyone Knows It

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion