Nvidia CEO Jensen Huang delivered two high-profile interviews this week following the company’s blockbuster earnings report, offering bold visions for AI, defending against China-related concerns, and backing Donald Trump’s reindustrialisation plans.

Speaking to CNBC’s Jim Cramer and Bloomberg’s Ed Ludlow, Huang painted a picture of exponential AI growth, a restructured computing industry, and a reshaped geopolitical tech race.

A $1 Trillion AI Future

In his CNBC interview with Jim Cramer, Huang declared that global computing capital expenditures are headed toward $1 trillion annually by the end of this decade — and most of that, he said, will go to AI.

“We’re fairly sure now that the world’s computing CapEx is on its way to $1 trillion annually… and the vast majority of that will be used for AI,” Huang said.

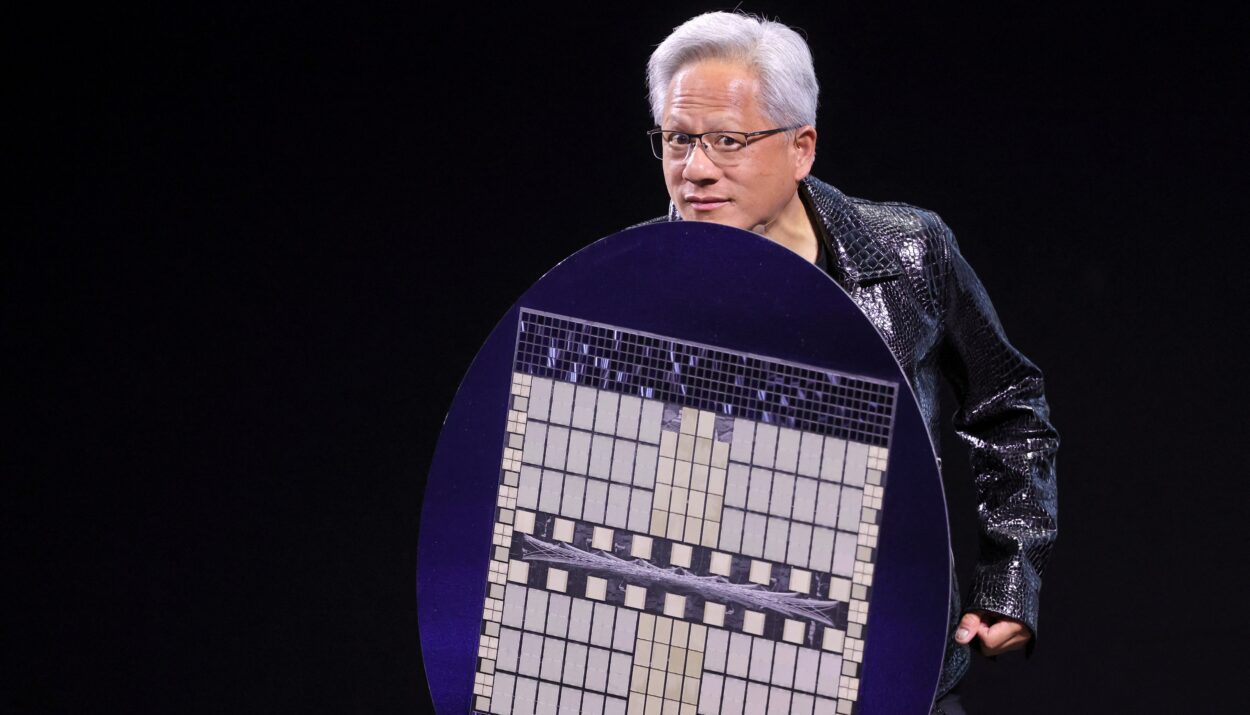

He added that Nvidia’s share of that spend is “quite large,” and emphasized how the company has reinvented the structure of the modern computer, saying each Nvidia system now contains over 600,000 parts and weighs 3,000 pounds.

“We reinvented how the computer is structured… All of those components have to come in to build one computer — and we’re building them in volume.”

Growth Over Margins — For Now

Addressing investor concerns over gross margins, Huang dismissed short-term worries:

“If our company wasn’t growing, then margins would be a focus. But we’re growing incredibly fast. And in a few quarters, we’ll be incredibly good at building these [Blackwell-based] computers.”

Largest Business Opportunity in History”

Huang repeatedly emphasized the historic scale of the AI boom:

“This is the largest business opportunity in history. Bigger than planes, canals, the loom — even bigger than energy.”

He outlined a roadmap for AI infrastructure development spanning three years and said it was a deliberate move to guide billions of dollars in upcoming investments.

“I gave the world a roadmap… That roadmap is also a super high bar.”

China: A Major Loss — But a Larger Message

In his Bloomberg interview, Huang addressed Nvidia’s $8 billion revenue hit due to US-China chip restrictions but said demand elsewhere, particularly for its new Blackwell chips, offset the losses.

“We’ve got a whole bunch of engines firing… Blackwell is a home run.”

Still, he cautioned against underestimating China:

“The Chinese market is very important. It’s the second-largest AI market and home to the world’s largest population of AI researchers.”

Despite the hurdles, Huang revealed that Nvidia is still weighing whether it can develop a custom chip architecture for China, but the technical and regulatory constraints are intense:

“We don’t know how to make it [Hopper] even less… Whatever we offer has to at least be competitive.”

Huawei: Catching Up Fast

Huang openly acknowledged that Chinese giant Huawei now has data center systems that rival Nvidia’s best chips:

“Huawei’s technology is probably comparable to an H200. They’ve moved quite fast… They’re formidable.”

On Trump: A “Visionary” Plan

Huang had strong praise for Donald Trump’s economic strategy, saying he supports both the tariff-driven reindustrialization agenda and the rollback of restrictions on US tech exports.

“Tariffs as a pillar of a bold vision to reindustrialize the U.S.? It’s an incredible vision… transformative for the next century.”

He also backed Trump’s goal to ensure global AI development runs on “American stacks”:

“It’s about accelerating American stacks around the world… before it’s too late.”

On Immigration, Talent & Chinese Student Visas

Responding to news that the US would revoke some Chinese student visas, Huang called for immigration policies that attract global talent:

“I’m an immigrant… Many of us have contributed greatly to the U.S. tech industry. We want the brightest to come here. That has to continue.”

Tesla, Grok, and Human Robots

Huang emphasized the company’s deepening collaboration with Elon Musk’s ventures, particularly Tesla and xAI, signaling that their joint efforts are just getting started.

“We do a lot of business with Tesla and xAI. Elon is an extraordinary engineer,” Huang said. “We’re going to build many more computers together. His self-driving car, his Optimus robot — every single one of them world-class and revolutionary. The Optimus opportunity is just around the corner.”

Huang went even further, describing a future shaped by humanoid robots — a vision that could reshape entire industries.

“It’s very likely that humanoid robots are going to be robots we can deploy into the world relatively easily,” he explained. “And this is the first robot that has a chance to achieve the high volume and technology scale to advance technology.”

“I think this is likely the next multi-trillion dollar industry.”

His comments directly reference Musk’s Optimus project — a humanoid robot that recently made headlines with a new demonstration video showcasing fluid, dance-like movements. While some hailed the tech as groundbreaking, others noted that the robot’s ability to mimic movement doesn’t necessarily translate into real-world utility.

Despite mixed public reactions, Huang clearly sees the long-term potential — not just for Nvidia’s hardware, but for the emergence of a new AI-powered robotics economy.

“We’ve built some amazing computers together,” he added. “I think the Optimus opportunity is just around the corner… It could be the next multi-trillion-dollar industry.”

Europe Trip & Global AI Infrastructure

Looking ahead, Huang announced plans to visit heads of state in France, the UK, Germany, and Belgium, highlighting Europe’s growing commitment to AI infrastructure.

“There’s an awakening… every country now sees AI like electricity or the Internet — part of national infrastructure.”

He confirmed that several AI factory projects are in discussion across the continent.

Market Impact: Despite export challenges and shrinking China access, Nvidia posted a 69% YoY revenue jump to $44.1 billion in Q1, with Q2 guidance of $45 billion. Gaming and automotive segments both beat estimates.

Nvidia stock closed at $134.81 on Wednesday and rose about 4% in after-hours trading following earnings.

Jensen Huang made it clear this week: Nvidia is not just chasing a market — it’s defining the infrastructure of the future.

Whether navigating China’s chip curbs, reshaping AI architectures, or partnering with world leaders, Nvidia’s strategy remains singular: go big, stay ahead, and make AI the next industrial revolution.

“No society can do without intelligence. We’re not just building chips — we’re building the future.”

Meanwhile, Jensen Huang is set to sell up to $800 million worth of NVDA shares, marking his first sale under a pre-scheduled plan adopted in March. Other top executives, including CFO Colette Kress and director Brooke Seawell, have also disclosed similar sales. Despite the insider moves, investor confidence remains high, with analysts forecasting a 12-month price target of $165–$200 as Nvidia rides a wave of record AI chip demand and surging revenues.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Taps Palantir to Build Massive Government Spy Network

Germany Considers 10% Digital Tax on Google, Meta – Risks New Clash With Trump

Appeals Court Reinstates Trump’s Tariffs – Legal Battle Heats Up

JD Vance: Bitcoin Is America’s Strategic Weapon Against China

US trade court blocks Trump’s sweeping tariffs. What happens now?

Trump orders US chip designers to stop selling to China

US Consumer Confidence Soars in May Amid Hopes for Trade Peace