Exchange-traded funds (ETFs) have transformed investing, but surging growth and speculative flows are raising red flags. With more ETFs in the US than listed stocks for the first time, some experts warn that retail exuberance may be flashing a cautionary signal.

The ETF Explosion

The ETF industry has grown at breakneck pace since its launch in 1993. According to Bloomberg and Morningstar, there are now more than 4,300 ETFs listed in the US, surpassing the roughly 4,200 individual stocks available on exchanges. Globally, ETFs now command $13.8 trillion in assets under management (AUM), with an annualised growth rate of 20% since 2008.

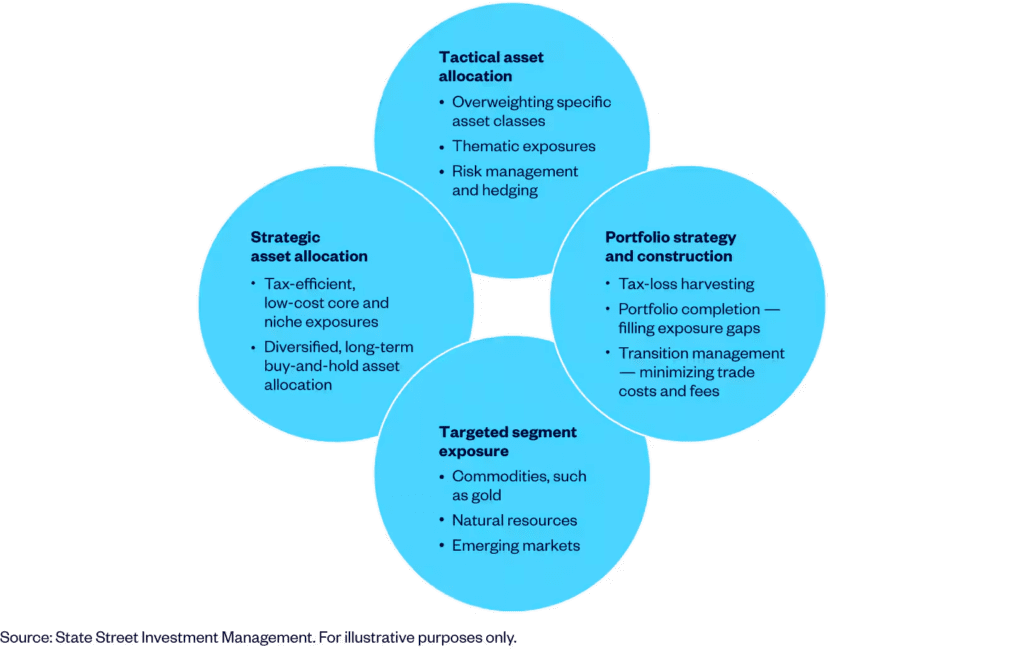

A decade ago, ETFs accounted for just 9% of all investment vehicles; today, they make up nearly a quarter. The variety is staggering: from index-tracking funds and bond ETFs to more exotic single-stock and leveraged products. ETFs have become the building blocks of portfolios for both institutional investors and everyday traders.

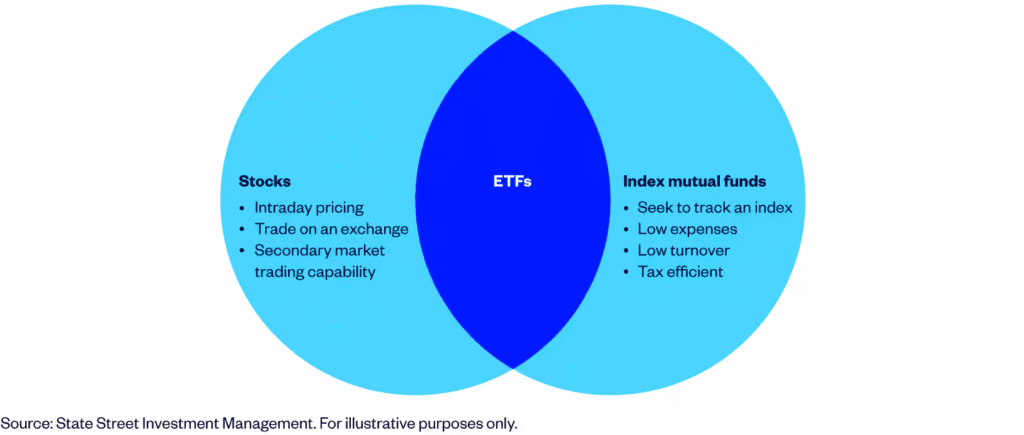

State Street, which launched the first ETF in 1993, describes them as “the great equalizers of financial markets.” Their appeal lies in offering low-cost, tax-efficient, and diversified exposure—trading like a stock, but with the diversification of a mutual fund.

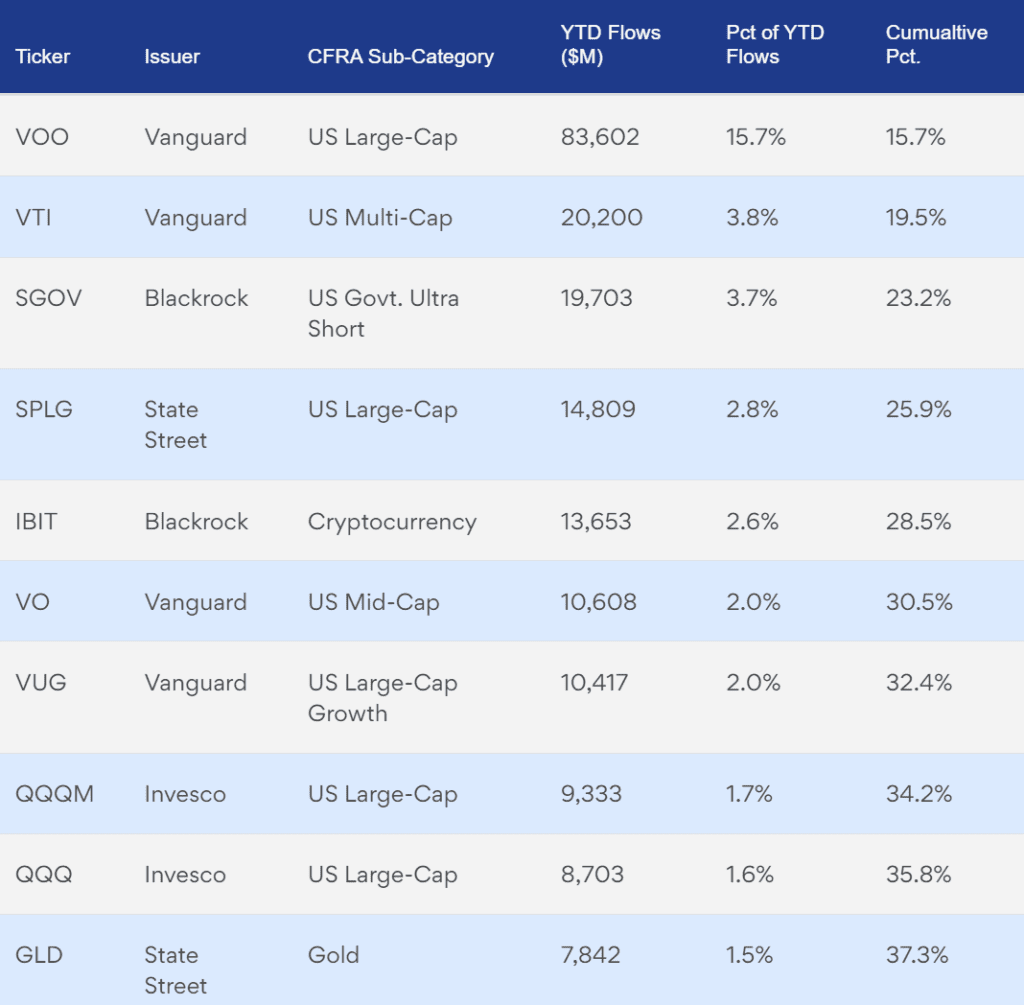

Furthermore, despite trade wars, geopolitical shocks, and Fed uncertainty, retail investors poured over $500 billion into ETFs in the first half of 2025 — putting the market on pace to beat last year’s $1.12 trillion inflow record. Vanguard funds alone account for 37% of net flows, with the Vanguard S&P 500 ETF (VOO) making up 16% of all inflows year-to-date, CFRA Research reported.

Source: CFRA’s ETF database. Data as of June 20, 2025.

What Exactly Is an ETF?

An exchange-traded fund (ETF) is a basket of securities—stocks, bonds, commodities, or other assets—that trades on an exchange throughout the day like a stock. Investors don’t buy shares of each company directly; instead, they buy a slice of the ETF, gaining exposure to the whole basket.

By contrast, stocks represent ownership in a single company. If you buy Apple shares, your performance hinges on Apple. But if you buy an ETF like the S&P 500 ETF (SPY), you get exposure to 500 companies in one trade.

| Aspect | ETFs | Individual Stocks |

|---|---|---|

| Transparency | Fund holdings generally disclosed daily | Investors know exactly which company they own |

| Range of Asset Classes | Offer exposure to stocks, bonds, commodities, currencies, sectors, or themes | Exposure limited to a single company’s performance |

| Transaction Fees/Commissions | Generally subject to brokerage fees (often commission-free now) | Same, depends on broker |

| Pricing & Trading | Exchange traded; buy/sell continuously at market price | Exchange traded; buy/sell continuously at market price |

| Dividends | Yes, if underlying holdings pay dividends | Yes, if the company pays dividends |

| Diversification | High; exposure to many companies/assets in one trade | Low; concentrated bet on one company |

| Research & Management | Professionally managed (passive index or active) | Investor must research, analyze, and trade independently |

| Expense Ratio | Yes (management fee, usually 0.03%–1%) | No annual expense ratio |

| Tax Efficiency | High: in-kind redemption reduces capital gains taxes | Taxable when shares are sold (capital gains triggered) |

| Minimum Investment | No minimums (1 share cost, subject to broker rules) | No minimums (1 share cost, subject to broker rules) |

| Risk Profile | Lower single-stock risk, but may dilute gains if over-diversified | Higher risk/reward depending on company performance |

Retail Frenzy and Warning Signs

While institutions still dominate the ETF market—holding 64% of assets—retail investors have surged into leveraged, inverse, and thematic ETFs, which are 90–99% retail-owned. According to ETF Action, nontraditional ETFs have pulled in more than $60 billion in 2025 alone.

Mike Akins of ETF Action warns this looks like 2020–2021 all over again, when retail-driven flows into speculative thematic ETFs like ARK Innovation (ARKK) coincided with market peaks.

“These strategies are incredibly volatile. They’re 99% owned by retail. There are no institutions allocating these strategies, but there’s billions of dollars coming into them,” Akins told CNBC. He added that covered-call ETFs promising double-digit annual yields could become a “train wreck” if underlying stock prices fall.

The parallels with the pandemic-era meme-stock and thematic ETF frenzy are making some analysts nervous. “When you start seeing the flows into those products take off, generally, that is a contrarian signal that we’re overheating across the market,” Akins warned.

ETFs and the Tax Angle

Another reason ETFs keep growing is tax efficiency. Unlike mutual funds, ETFs rarely trigger taxable capital gains until sold. New products, like the Astoria U.S. Enhanced Core Equity ETF (LCOR) launching in October, even use IRS Section 351 strategies to help investors swap out concentrated stock positions (like Nvidia or Microsoft) without realizing taxable gains.

This makes ETFs especially attractive after a record-setting market run, where investors sitting on massive unrealized gains are seeking ways to reallocate portfolios without hefty tax bills.

A Double-Edged Sword for Brokerages

The ETF boom has been a boon for brokerages and trading firms. Margin-loan books are surging—Robinhood’s grew 90% year-over-year, while Schwab and Interactive Brokers saw double-digit growth. ETFs drive commissions, fees, and interest income.

But if markets reverse, that same margin-fueled growth could unwind violently, just as it supercharged the upside.

The Bigger Picture: Democratization or Overheating?

On the positive side, ETFs have democratized investing, giving millions of retail investors low-cost access to broad markets, commodities, and even niche strategies that used to be limited to hedge funds.

But the sheer proliferation—now more ETFs than stocks—also risks confusing investors with too much choice. Analysts warn that complex, high-yielding, or leveraged ETFs can mask risks, luring inexperienced traders into dangerous products.

At the same time, massive inflows into risky ETFs often coincide with market peaks. That could mean today’s ETF boom is both a testament to the market’s maturity—and a warning of speculative froth.

Key Takeaway

The ETF industry has hit historic milestones: $13.8 trillion in assets, more funds than stocks, and dominant adoption by both institutions and retail. ETFs offer diversification, tax efficiency, and liquidity unmatched by individual stocks.

But with retail piling into leveraged and thematic products, parallels to past bubbles are hard to ignore. For long-term investors, ETFs remain powerful tools. For speculators chasing yield or gimmicky strategies, they could become the very “train wreck” that ETF experts are warning about.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana