Coinbase (NASDAQ: COIN), the largest U.S.-based cryptocurrency exchange, will release its Q1 2025 earnings on May 8, after market close. This report comes amid a shifting crypto market landscape, with regulatory battles, retail pullbacks, and rising institutional adoption shaping sentiment. Investors, traders, and beginners alike are watching closely — not just for numbers, but for clues about the platform’s long-term future.

Here’s the full picture.

What Wall Street Expects

According to Yahoo Finance, Nasdaq, and MarketBeat, consensus forecasts for Q1 2025 are:

- Revenue: ~$1.36–1.4 billion → up ~35–40% YoY (vs. $1.02B last year)

- EPS: ~$2.05–2.15 per share → sharply up from ~$0.80 YoY

- Monthly Transacting Users (MTUs): ~7.8–8 million → slightly down sequentially (vs. ~9M last quarter)

- Total trading volume: ~$200–210 billion → driven mainly by institutional flow

These numbers reflect a recovery in the crypto market (Bitcoin up ~50% YTD), but also softer retail activity.

Key Business Drivers

✅ Institutional Growth

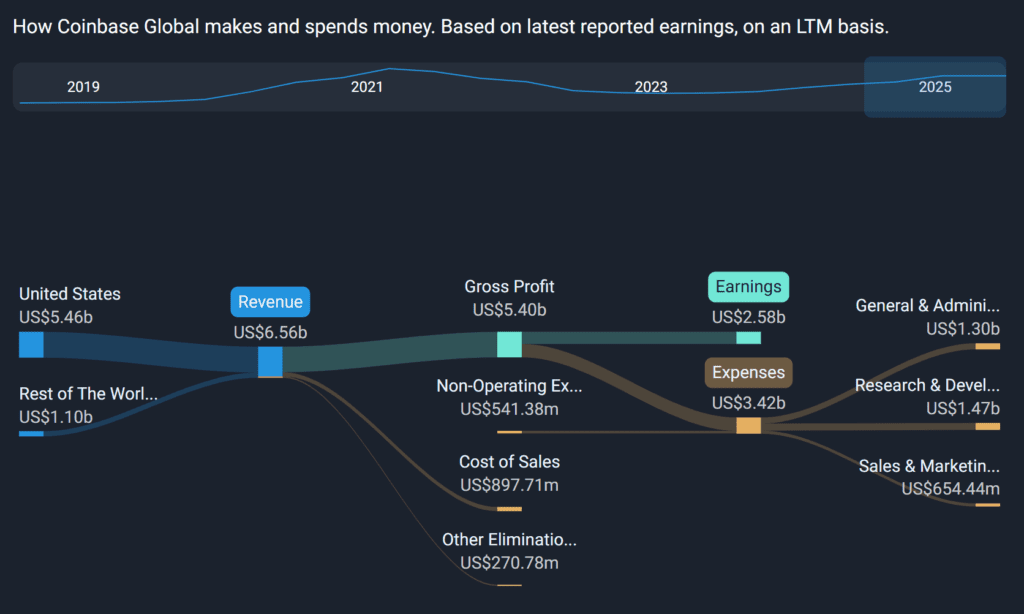

Coinbase’s institutional segment is a major revenue driver. According to Nasdaq and Moomoo, ~70–75% of trading volume now comes from institutional clients — hedge funds, family offices, and asset managers.

- Custody and Prime services saw a big boost, with BlackRock, Ark Invest, and Fidelity using Coinbase infrastructure.

- Coinbase’s international expansion, including Coinbase International Exchange and derivatives trading in Europe and Asia, adds to institutional growth.

✅ Retail Weakness

Coindesk warns that retail trading activity has softened significantly in Q1, with fewer high-fee transactions. Messari reports that while overall platform volumes are healthy, the mix has shifted toward low-margin institutional business.

This is critical because retail fees typically account for ~70–80% of total transaction revenue.

✅ Subscription and Services Revenue

Coinbase has been actively diversifying away from trading fees. TipRanks and Alphastreet highlight that staking, custodial fees, and blockchain rewards (including ETH staking) are growing fast, potentially hitting ~$350M this quarter — up ~25% YoY.

✅ Regulatory Uncertainty

One of Coinbase’s biggest overhangs remains U.S. regulatory pressure. Ongoing litigation with the SEC over staking, token listings, and stablecoins weighs on investor sentiment.

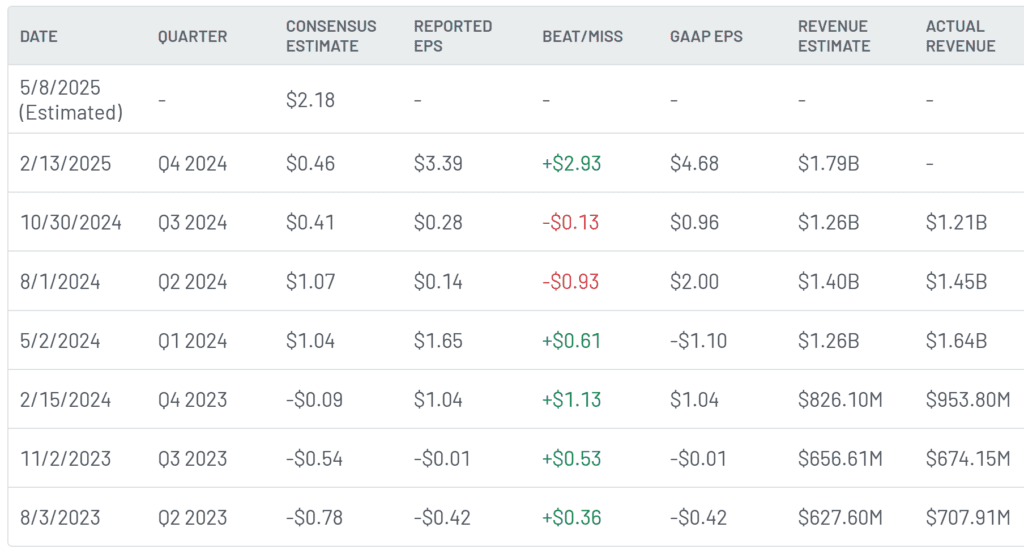

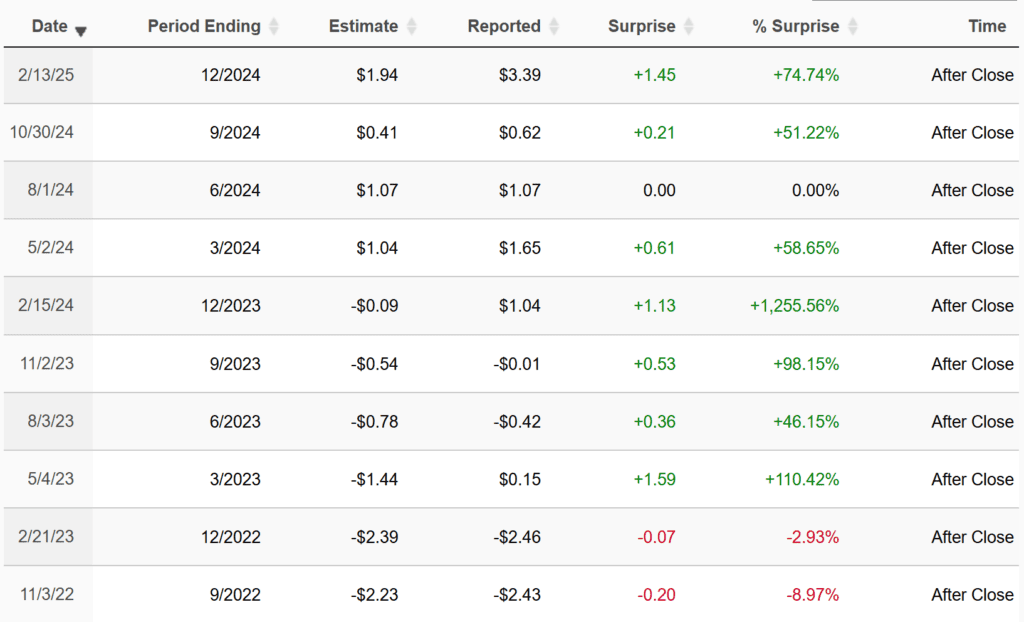

Historical Performance and Surprise Record

- Coinbase has beaten EPS estimates in 4 of the last 6 quarters.

- Last quarter, Coinbase reported EPS of $1.04 vs. $0.89 expected, but the stock fell ~7% after management flagged slowing retail activity.

- Shares often swing 8–12% post-earnings, making it a trader favourite on earnings day.

Bullish Case

Crypto Market Rebound: Bitcoin (BTC) and Ethereum (ETH) prices are up ~50–60% YTD, according to Coindesk, driving overall platform volumes. Historically, Coinbase’s revenue correlates closely with BTC price trends.

Institutional Strength: Per Nasdaq, Coinbase has cemented its role as the “institutional on-ramp” for crypto, with Prime, derivatives, and custodial businesses expanding rapidly. Institutional clients generate steady, predictable revenue.

Diversified Revenue Streams: Subscription and services revenue (staking, custodial fees, USDC interest) now accounts for ~25% of total revenue providing a buffer against trading volatility.

Global Expansion: Coinbase International Exchange is gaining traction in non-U.S. markets. This is critical as regulatory clarity in Europe (MiCA framework) gives Coinbase a chance to grow overseas while U.S. rules remain murky.

Bearish Case

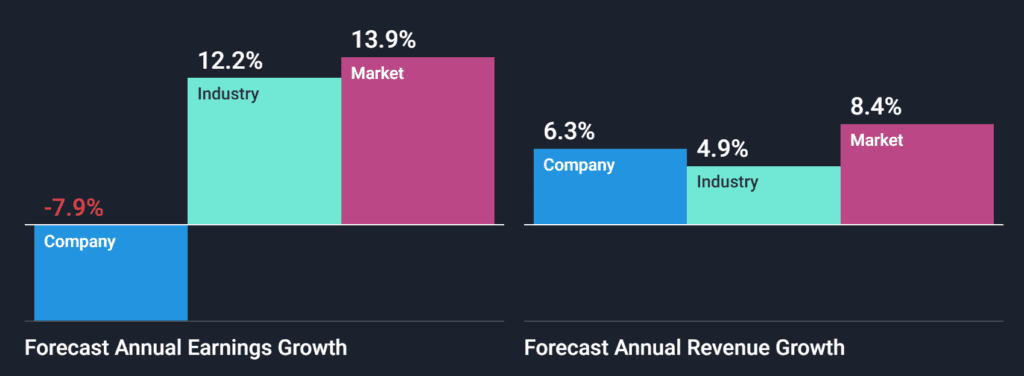

Retail Weakness: Retail fee revenue has declined sharply, down ~15–20% YoY. Coinbase’s profitability relies heavily on these high-fee transactions.

Regulatory Risk: Ongoing SEC lawsuits over staking, token classifications, and stablecoins create existential risks. As Alphastreet notes, “a negative legal outcome could impair core operations.”

Valuation Concerns: Coinbase trades at ~35x forward earnings, according to GuruFocus, which assumes sustained crypto market strength. Any Bitcoin price pullback or trading volume slowdown could lead to a sharp valuation reset.

Rising Competition: Rivals like Binance (international) and Kraken (U.S.) are eating into Coinbase’s share. TipRanks reports that even mainstream firms like Fidelity and Robinhood are ramping crypto offerings.

Prediction and Market Sentiment

Wall Street expects Coinbase to post:

- Strong headline revenue and EPS beats due to institutional flow.

- Muted retail metrics, which could disappoint investors.

- Guidance highly dependent on crypto market outlook and regulatory commentary.

If Coinbase delivers clear progress on international expansion and regulatory defenses, the stock could rally. But if management issues cautious guidance, expect a “sell-the-news” reaction.

Valuation, Sentiment, and Stock Setup

- YTD stock performance: +82% (massive crypto recovery)

- Market cap: ~$42 billion

- Forward P/E: ~35x (premium for a crypto platform)

- Wall Street analyst ratings: 12 Buy, 8 Hold, 4 Sell

- Average price target: ~$250 vs. ~$230 current → modest upside

Final Takeaways

For long-term investors: Coinbase offers a rare, regulated, U.S.-based crypto platform with strong institutional foundations. But regulatory risk looms large, and heavy reliance on crypto market cycles makes this a volatile holding.

For traders: Expect high post-earnings volatility (±8–12%). Watch for clues in guidance, retail trends, and management’s tone on international markets.

For beginners: Understand that Coinbase’s business is tied to crypto cycles. When BTC and ETH rally, Coinbase shines — but when crypto markets cool, earnings and the stock can fall sharply.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump expected to announce trade agreement with United Kingdom

What Jerome Powell said after Fed leaves key interest rate unchanged

US-China Trade Talks to Start This Week as Tariffs Start to Bite

India, UK successfully conclude mutually beneficial Free Trade Agreement

EU Eyes €100 Billion of US Goods With Tariffs If Talks Fail

China, Japan and South Korea will jointly respond to US tariffs

Supermicro Q3 Fiscal 2025 Earnings Preview and Prediction: What to Expect

Palantir Q1 2025 Earnings Report — Why the Stock Popped (Then Dropped)